Mobile Banking App Development Services

In banking IT since 2005, ScienceSoft creates reliable and stylish mobile banking apps that introduce excellent customer experience and help banks achieve up to 10x reduction in servicing costs.

Mobile Banking App Development: Summary

Mobile banking app development services aim to create reliable and secure applications that enable banking customers to make payments, check account balances, and perform other financial operations via mobile devices.

Well-designed mobile banking applications help financial institutions win the leadership in client service and drive up to 300% ROI via a smooth launch of trending digital banking products and convenient customer self-service options.

How to develop a mobile banking app in 6 steps

- Define functional and non-functional requirements for the banking app.

- Design the app’s features, architecture, UX and UI, and tech stack.

- Plan project deliverables, schedule, and budget.

- Develop back end and role-specific interfaces.

- Establish integrations and run the necessary QA procedures.

- Configure the infrastructure and set the app live.

Our Mobile Banking Development Service Scope

In banking software engineering since 2005, ScienceSoft provides full-cycle mobile banking development services to help banks design and build secure mobile banking apps.

Mobile banking app consulting

We introduce an optimal design for your unique app and provide expert advice on security and compliance. You also receive a detailed project plan for risk-free app implementation.

Mobile banking app development

We develop your mobile banking app, integrate it with the required systems, and run all necessary QA procedures. You get a sleek, stable, and secure app promptly and at an optimal cost.

Mobile banking app modernization

Already have a mobile banking app that requires upgrading to bring more value? Our experts can revamp the app's tech design and codebase and evolve it with the required features.

Our awards, certifications, and partnerships

Named among America’s Fastest-Growing Companies by Financial Times, 4 years in a row

Named Best in Class in Web and Mobile Banking Software Development by FinTech Futures

Listed among Highly Commended tech partners at the Global FinTech Awards 2025

Awarded for measurable results in insurance digital transformation by The Global Insurer

Listed in IAOP’s 2025 Global Outsourcing 100 for the 4th year running

Microsoft Partner since 2008

AWS Partner since 2017

ISO 9001-certified quality management system

ISO 27001-certified security management system

Mobile Banking Applications We Develop

Our mobile banking app development company is here to create an app of any type and complexity to meet your business requirements and the expectations of your target audience.

Below, we composed a list of basic mobile banking features commonly requested by our clients from the banking industry:

Account management

to check account balances and transaction history.

Digital payments

to domestic and foreign counterparties for purchased products and services.

Money transfer

to another person and between the owner’s accounts at different banks, with the option of an instant transfer.

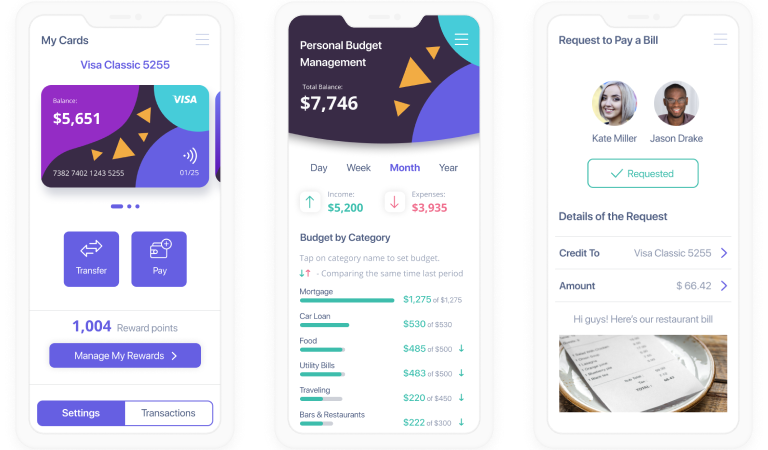

Card management

to control card balances, temporarily lock the cards, set and change PIN, and more.

GPS-navigation

to find the nearest service point or ATM.

Customizable alerts

to receive email and push notifications.

In our projects, we power mobile banking apps with the following value-adding features to drive higher ROI from app implementation:

Value-adding banking products

- QR-code-based payments and cardless ATM withdrawals to improve client convenience.

- Creating and managing multi-currency virtual cards to enable convenient online payments in a client’s preferred currency.

- Crypto banking to enable customers to transact crypto assets via a mobile banking application.

- Buy Now Pay Later support to provide app users with affordable everyday purchases and drive customer loyalty.

- Robo advisors for automated investment management, technical analysis, and trade execution.

Top-notch self-service experience

- A currency converter to access up-to-date exchange rates and automatically recalculate account balances in another currency.

- Personal finance management to control spending, set budget goals, forecast expenses by category, and more.

- Voice navigation to enable app users to perform mobile banking operations on the go.

- Automated billing for business customers to streamline invoicing and payment tracking workflows.

- Mobile RDC to scan checks remotely and transmit the check images to a bank for deposit.

Excellent customer support

- AI-powered chatbots to assist mobile banking users on any arising issues, process natural language queries and provide accurate responses.

- Appointment scheduling to help customers save time during live visits and improve bank operations planning.

- A live chat to enable instant messaging between customers, support specialists, and bank personnel.

- An emergency call option to allow for prompt notification about identity fraud, stolen funds and cards.

Advanced security

- Geography-based KYC/AML verification for new app users to prevent illegitimate access to mobile banking services.

- Biometric authentication (e.g., facial or fingerprint recognition) to minimize the risk of identity fraud.

- AI-based fraud detection to prevent suspicious access attempts and transactions and protect customers’ funds and sensitive data.

- Blockchain-based recordkeeping of transactional data to enable full traceability of user activities and funds movements.

Our experienced mobile banking app developers can also assist you in creating niche funds management and payment solutions to expand the functionality of your core e-banking platform:

Major Opportunities Mobile Banking Unlocks

|

|

|

|

|

The global number of mobile internet users is expected to increase by 30.6% (or 1.5B+ users) and exceed 6.4 billion users worldwide by 2029, expanding the potential mobile banking clientele. Recent stats show that over 70% of Americans prefer digital banking channels to in-person servicing. Mobile apps are the most popular method of banking, and its popularity only increases. Today, over 48% of individuals use mobile banking as a primary servicing method. |

|

|

|

As an appetite for mobile banking grows, financial organizations realize that introducing seamless mobile customer experiences is a key to winning the competition and driving tangible gains. ScienceSoft delivers high-performing and user-friendly mobile apps that help banks reap the following benefits:

Up to 10x lower servicing costs

due to cheaper mobile transactions, minimized servicing teams' efforts, and eliminated the need for physical offices.

Selling up to 70% more to existing clients

thanks to new value-centered financial products and services and facilitated cross- and upselling.

Improved customer satisfaction

due to personalized banking experience and convenient access to self-service banking options on the go.

Attracting small businesses

by combining individual and business banking in one application and offering robust finance automation features.

Enhanced service accessibility

achieved via offering lower service prices for depositors from rural areas and distant locations.

Facilitated client outreach

thanks to easy in-app distribution of personalized offerings and information about new products.

How to Build a Mobile Banking App: ScienceSoft’s Roadmap

Mobile banking app development is a way for banks to introduce a sleek, user-friendly application that provides convenient and secure access to banking operations, enabling customers to manage their finances from anywhere.

The banking app development process at ScienceSoft usually covers the following steps:

Step 1.

Discovery

We analyze your business needs and audience expectations, research the mobile banking market trends, and compose a detailed list of requirements for the banking app. Our experts define the development project scope, devise tailored sets of KPIs, provide high-level time and cost estimates, and outline potential software risks (security, adoption, compliance, etc.) and pragmatic ways to mitigate them.

Step 2.

Technical design

We introduce an optimal feature set for your banking app (including cybersecurity features) and suggest the functional scope for an MVP. Our mobile experts architect your app for high scalability and 99.9% availability and compose a cost-effective development tech stack. We use the final technical design to create a detailed plan of project tasks and resources.

Mobile app design involves choosing between native (iOS, Android) and cross-platform development approaches. In our projects, we analyze the economic feasibility of both options and suggest the optimal choice based on our client’s priorities in speed, budget, and development scope.

Step 3.

UX and UI design

Our UX/UI designers create a convenient UX and an appealing visual style for your banking app to streamline user adoption and drive high customer satisfaction. We tailor the app’s appearance to the brand book of our client and leave room for end-user customization of the app’s look, including accessibility features.

Step 4.

Development and QA

Our financial app developers code the back end of your mobile banking application, build APIs to enable the required integrations, and create role-specific user interfaces. We run full-scale functional, performance, and security testing of the app in parallel with coding to quickly identify and fix any potential issues.

Starting with an MVP of a mobile banking app helps launch the app faster, start collecting early user feedback, and introduce targeted improvements in the consequent software iterations. We can deliver an MVP of your app in 3–5 months and gradually upgrade it to a fully-featured solution with major releases every 2–3 weeks.

Step 5.

Integration

We integrate the mobile banking app with your core banking systems and the required third-party services (e.g., authentication, GPS navigation). Our QA experts perform extensive integration testing to ensure uninterrupted and safe data flow between the solutions.

Step 6.

Release

ScienceSoft’s engineers set the ready-to-use mobile banking application live, transfer knowledge to the app admins, and assist in uploading the solution to the required mobile app stores. Our teams are also ready to take charge of continuous app maintenance to ensure its smooth performance in the long run and quickly make your emerging products and services available to mobile banking users.

ScienceSoft’s Tech Stack for Mobile Banking Application Development

Our mobile developers usually rely on the following tools and technologies to streamline development and ensure superior app quality:

Mobile Banking App Development Cost

From ScienceSoft’s experience, building a custom mobile banking application of average complexity costs around $150,000–$180,000+, depending on the scope and complexity of app features, requirements for UX/UI design, security mechanisms, and integrations.

Learn the Cost of Your Mobile Banking App

Please answer a few simple questions prepared by ScienceSoft's consultants.

Within 24 hours, our team will carefully review your project details and prepare a tailored estimate. We'll send it to your email free of charge.

Discover our mobile banking app development services in detail.

Thank you for your request!

We will analyze your case and get back to you within a business day to share a ballpark estimate.

In the meantime, would you like to learn more about ScienceSoft?

- Project success no matter what: learn how we make good on our mission.

- Since 2005 in banking IT services: check what we do.

- 4,200+ successful projects: explore our portfolio.

- 1,400+ incredible clients: read what they say.

Our Practices to Drive Mobile Banking App Development Success

ScienceSoft’s teams ensure a predictable app development process and guarantee that project goals are met within the expected budget and timeframe. You are welcome to explore the details of our PM and development practices below.

If you are wondering how our approach will benefit your case, want to see relevant mobile banking case studies, or have any other questions, feel free to contact our consultants.

Project planning

Discover the best practices driving our Agile scope management, adequate resource assignment, and accurate development cost estimation. We also describe major project risks and our approach to risk mitigation.

Development flow

Learn the tactical collaboration forms ScienceSoft relies on and understand the KPIs we use to measure cooperation success. We also describe our process for handling change requests.

Get an idea of the quality controls we run at each project stage and understand the standards behind our ISO 9001-certified management system. You can also check the sample quality reports we deliver.

Check the scope of protective measures we apply during app development and discover our ISO 27001-certified security management system.

Understand ScienceSoft’s compliance-centered development process and check the banking industry standards and regulations we help adhere to.

Discover our systemic knowledge management practices and check the samples of documentation we deliver throughout the SDLC.

Learn the coverage and terms of our after-launch application warranty and explore our practices to increase app longevity.