Blockchain in Insurance

Use Cases, Architecture, Techs

In insurance software engineering since 2012 and in blockchain development since 2020, ScienceSoft designs and builds robust, compliant blockchain solutions for areas like underwriting, claim management, payments, and fraud detection.

Blockchain in Insurance: Market Summary

Blockchain solutions help insurance companies increase the efficiency and transparency of underwriting, reinsurance, and claim management processes, prevent fraud, increase customer trust, and access new markets.

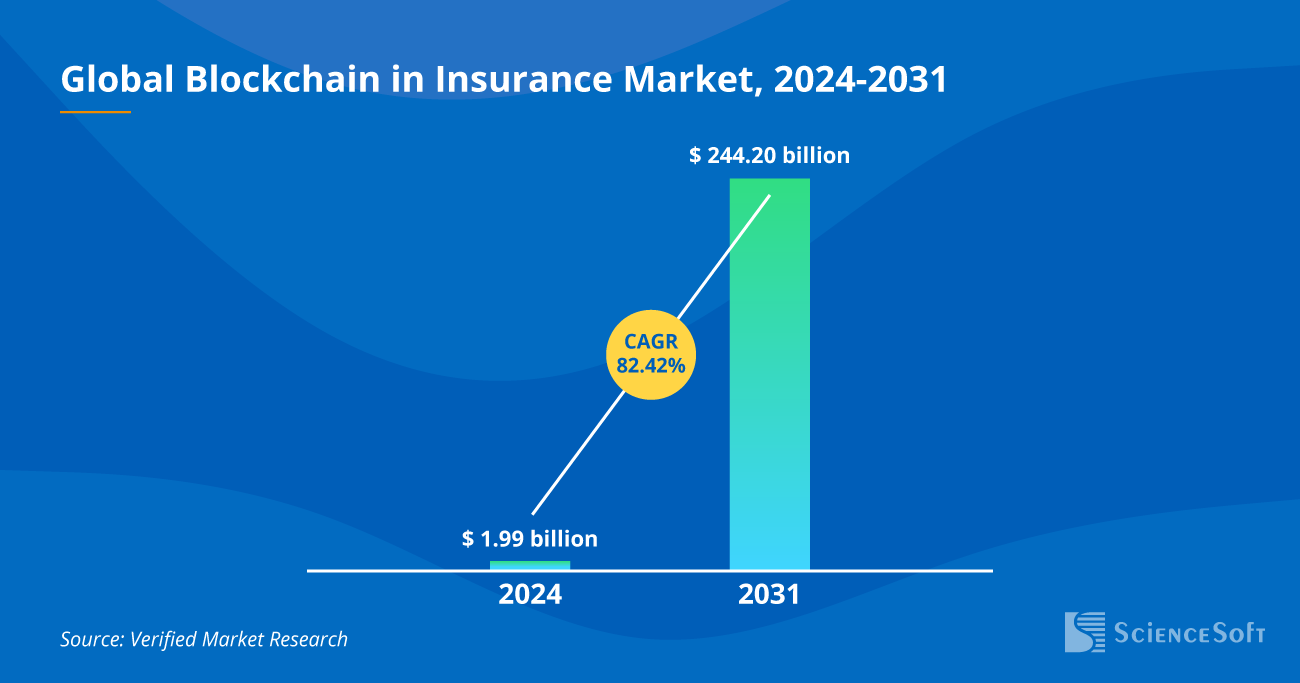

The global insurance blockchain market was valued at $1.99 billion in 2024. It is projected to reach $244.20 billion by 2031, growing at a CAGR of 82.42%.

Blockchain Adoption in Insurance

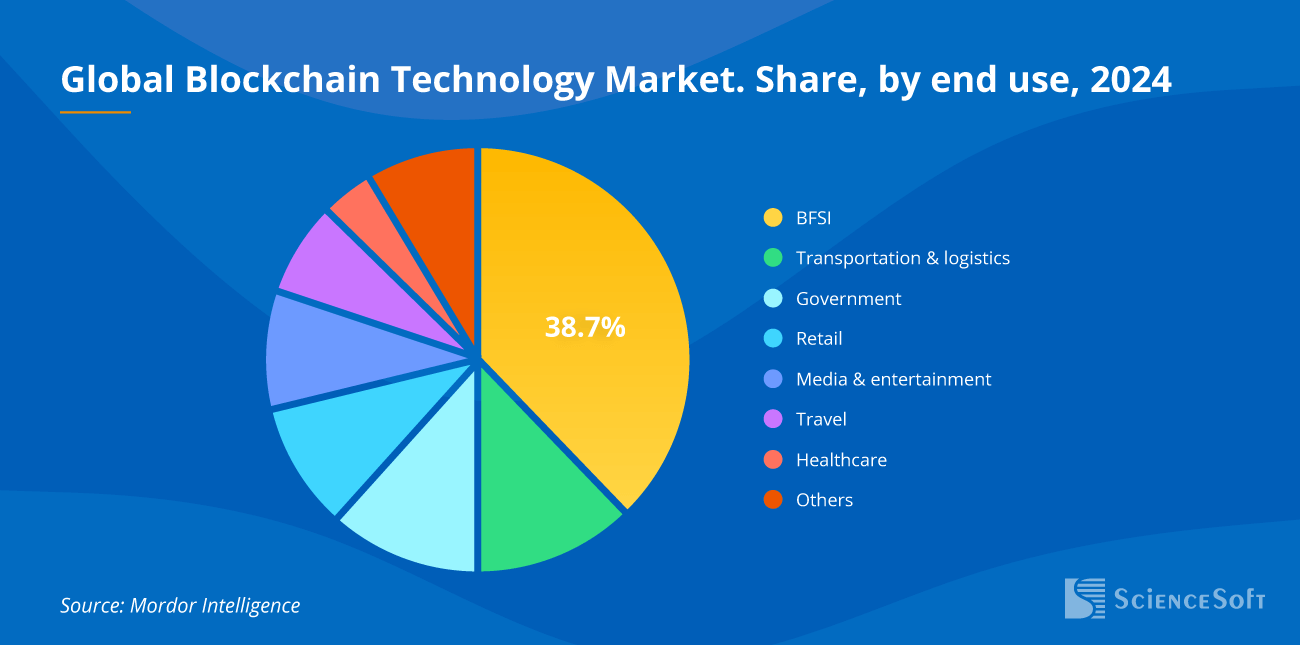

The banking, financial services, and insurance sector accounted for 38.7% of the global blockchain technology market revenue in 2024, with the insurance industry being among the leading blockchain adopters.

According to CoinLaw, 62% of major insurance providers, including AXA and Allianz, have already adopted blockchain for underwriting and claim management. In 2025, blockchain-enabled insurance platforms processed over $3.11 billion in claims.

Key factors that drive the growing popularity of blockchain in insurance are:

- The increase in the volume and costs of insurance fraud.

- The need to improve the efficiency, accuracy, and traceability of insurance operations.

- The high demand for convenient, fast, and secure insurance-related payments.

- The legal pressure to expand access to affordable insurance services in underserved markets.

Blockchain Insurance Software Architecture

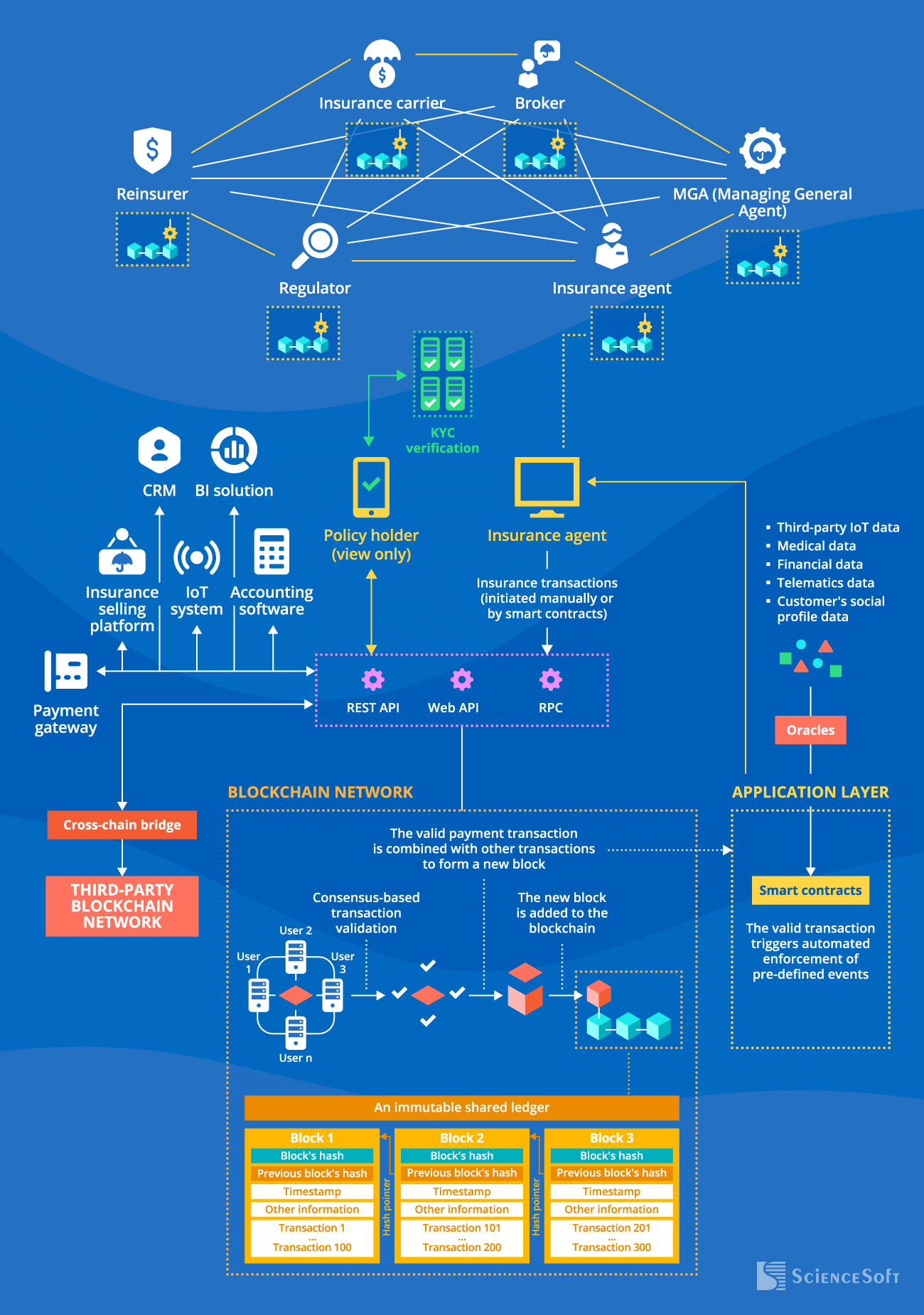

The architecture of blockchain solutions for insurance varies depending on the industry segment, specific functional requirements, and other factors. Still, there are several main components that are usually present in any blockchain solution. Below, ScienceSoft’s architects share a sample architecture of the insurance blockchain software we create.

Blockchain for insurance typically relies on a permissioned blockchain network to provide access to sensitive data only for authorized and trusted parties. Once validated based on a selected consensus mechanism, timestamped, and hashed, insurance transactions (invoked manually or by smart contracts) are recorded in a distributed ledger to be available for the network participants. All network members maintain their own copies of the shared ledger that get auto-updated as new insurance data appears. They interact with the blockchain using role-specific user (node) interfaces.

An insurance blockchain system may require integration with:

- The insurer’s corporate software: CRM, insurance portals, accounting software, an IoT ecosystem, etc. – the integration is established using APIs.

- Third-party data sources: financial data platforms, medical data platforms, telematics providers’ data platforms, etc. – data gets transmitted to the network using blockchain oracles.

- Other blockchain networks – the connection is enabled by cross-chain bridges.

Practical Blockchain Applications by Insurance Area

Relying on a decade of experience in insurance IT and practice-proven blockchain competencies, ScienceSoft’s consultants defined the range of insurance areas where blockchain can bring the most significant value and unique benefits.

Blockchain for fraud detection

Blockchain has the potential to eliminate up to $40 billion in annual fraud costs at the industry level. The technology provides full record of customer and insurance data, enables real-time detection of fraudulent transactions, and helps prevent duplicated claim payments.

How blockchain for fraud detection works:

The distributed ledger serves as an industry-wide record system that stores data on all insurance-related transactions and events. Each authorized insurance company maintains its own copy of the shared ledger to transact data, access the up-to-date customer coverage details and claim history. Transactions are validated only by known and trusted blockchain network members with special rights. Blockchain smart contracts enable automated recordkeeping and rule-based identification of suspicious and duplicate transactions.

Use cases:

- Automated recordkeeping.

- Fraud checks.

- Insurance data tracking and tracing.

Blockchain for underwriting

When used in underwriting, blockchain streamlines aggregation of customer data and documents from disparate sources, provides fast and precise assessment of customer risks. Also, blockchain helps eliminate manual insurance pricing tasks and ensures 100% accurate and transparent premium calculation.

How blockchain for underwriting works:

User-defined rules for customer risk scoring and personalized insurance pricing are coded in smart contracts. They enforce automated risk quantification (based on the data provided in internal and third-party sources) and rule-based premium calculation according to a customer’s risk profile. Blockchain oracles are employed to query, verify, and authenticate external data sources and securely transmit the required customer information to the smart contracts.

Use cases:

- Risk assessment.

- Insurance pricing.

Blockchain for policy administration

Blockchain spurs significant growth in operational efficiency by introducing end-to-end automation of policy management workflows. Plus, a blockchain system enables maintaining a complete log of user manipulations across the insurance contracts and policies and helps instantly detect unauthorized and malicious actions.

How blockchain for policy administration works:

A blockchain ledger stores all policy-related data in a secure and incorruptible manner. It serves as a single source of truth to prove the provenance and authenticity of insurance policies and agreements. The entire policy cycle – from issuance to termination – can be automated using the blockchain smart contracts. Asymmetric encryption ensures secure transfer of insurance documents between the insurance service providers, customers, and external partners.

Use cases:

- Policy issuance, sharing, updating, and renewal.

- Policy data recordkeeping.

Blockchain for claim management

When employed in claim processing, the blockchain technology helps insurance companies streamline claim intake and validation, guarantee fair and transparent claim resolution. Smart-contract-based claim automation alone proved to bring up to 5x cost reduction and around 3x speed increase across the claim management operations.

How blockchain for claim management works:

Smart contracts promptly access the claim-relevant external data using the blockchain oracles and enforce automated claim verification against the policy terms. They also encode the logic for instant notifications to the claim specialists about the fraudulent claims and complicated cases that require manual handling. The insurance teams and policyholders can track the claim resolution progress in the shared ledger.

Use cases:

- Claim validation.

- Claim settlement.

- Claim data management.

Blockchain enables seamless premium payment experience for insurance customers, automates claim-related payments to policyholders and third-party services providers. It handles payment processing in seconds rather than days and guarantees security of payment-related data. Besides, blockchain solutions allow insurers to expand internationally and reach new customer segments (e.g., crypto users).

How blockchain for payments works:

Relying on cryptocurrencies as the means of value transfer, blockchain can smoothly process both domestic and cross-border payment transactions in multiple fiat currencies. Blockchain smart contracts automatically enforce payments to the relevant parties upon the pre-defined events (e.g., claim approval). The data on sent and received payments is instantly hashed, timestamped, and recorded in the shared ledger to be available for the insurance teams and customers.

Use cases:

- Premium payments.

- Claim payments.

- Parametric payouts.

Blockchain for reinsurance

Blockchain streamlines data flow between the insurers and reinsurers, provides an immutable record of transactions, and helps build trust among the involved parties. Real-time monitoring of insurance-related events and automated data reconciliation are estimated to open up a $5–10 billion cost saving opportunity for the reinsurance market.

How blockchain for reinsurance works:

The pre-agreed terms of each reinsurance contract are coded as rules in smart contracts. The latter enforce rule-based direct claim validation, calculation of loss coverage amounts for each party, and payment execution. The blockchain network serves as a shared infrastructure for insurers and reinsurers to transact, track, and trace the available business data. If the parties rely on their own blockchain systems, cross-chain bridges can be employed to provide seamless blockchain-to-blockchain interoperability.

Use cases:

- Insurance data reconciliation.

- Automated claim settlement.

Blockchain for P2P insurance

The blockchain technology serves as a backbone of the innovative P2P insurance model. Here, blockchain offers end-to-end automation and full traceability of multi-party transactions for the participants of the insurance pool. It helps guarantee fair insurance coverage and establish credibility between the members of the self-insurance community with no centralized authority.

How blockchain for P2P insurance works:

The pooled crypto funds are stored on the escrow-type digital account in a multi-signature crypto wallet and can be automatically deducted to pay valid claims. The data on pool contributions, claims, and payouts is recorded and stored in the immutable ledger accessible to all pool members. Smart contracts enforce automated underwriting and claim management procedures according to the business rules pre-defined by the network participants.

Use cases:

- Insurance process automation.

- Collaborative claim decisioning.

- Payment processing.

Blockchain for legal compliance

Blockchain provides a detailed audit trail of all multi-party insurance-related activities and enables automated compliance monitoring. It helps insurers eliminate the manual routine related to compliance maintenance and guarantee data processing and business reporting in accordance with the relevant legal standards.

How blockchain for legal compliance works:

All blockchain entries are recorded in a secure, tamper-resistant distributed ledger. Regulatory requirements are formalized in smart contracts to drive rule-based compliance verification when processing particular insurance transactions. Smart contracts can also enforce scheduled generation of insurance reports and their submission to the regulators. Implementation of proxy contracts helps easily amend smart contract rules when legal requirements change.

Use cases:

- Compliance automation.

- KYC/AML verification.

- Regulatory reporting.

Blockchain Technologies and Tools We Use

Implement Blockchain in Insurance With ScienceSoft

In insurance software development since 2012 and in blockchain development since 2020, ScienceSoft will help accurately plan and smoothly implement your blockchain initiative in insurance.

Blockchain in insurance: consulting

- Business and customer needs analysis.

- Suggesting optimal blockchain architecture design and functionality.

- Introducing a tech stack for blockchain software implementation.

- Preparing a plan of integrations with the required systems.

- Blockchain security consulting.

- Delivering a roadmap for blockchain development, including cost estimates and a risk mitigation plan.

Blockchain in insurance: development

- Business analysis and market research.

- Blockchain software conceptualization.

- Architecture design.

- Blockchain solution development.

- API development to expand the solution’s integration capabilities.

- Quality assurance.

- Preparing the user training guides (if required).

- Blockchain software support and evolution (if required).

Our Clients Say

ScienceSoft demonstrated a deep understanding of our requirements, and their developers needed minimal supervision, keeping us updated on progress and potential hurdles along the way. What stood out was ScienceSoft's proactive suggestions for cost-saving architecture design and tech stack solutions. Their input ensured we stayed within budget without compromising on software quality. The value we derived from partnering with ScienceSoft is definitely worth the investment.

Jen Dalton, Chief Information Security Officer at Brush Claims

About ScienceSoft

ScienceSoft is a global IT consulting and software development company headquartered in McKinney, Texas. We design and implement reliable blockchain solutions to help establish efficient, secure, and transparent insurance processes. In our blockchain projects, we employ robust quality and data security management systems backed up by ISO 9001 and ISO 27001 certifications.