Blockchain for Cross-Border Payments

Features, Challenges, Costs, Tools

In IT since 1989 and in blockchain development since 2020, ScienceSoft helps companies design and build robust blockchain-based solutions for cross-border payments.

Blockchain for Cross-Border Payments: The Essence

Blockchain cross-border payments are money transfer transactions that take place between the parties from different countries and are settled with the help of the blockchain technology.

When used for cross-border payments, blockchain offers payment processing in seconds rather than days, drives an up to 80% reduction in remittance costs, ensures robust security and end-to-end traceability of payment data.

Cross-Border Payments on Blockchain: Market Info

Cross-border payments and settlements are considered the most prominent blockchain use case. According to the IDC Worldwide Blockchain Spending Guide, it accounted for 15.9% of the $4.67-billion blockchain market in 2021. With the expected growth of the global blockchain market from $31.18 billion in 2025 to $393.42 billion by 2032, the segment of blockchain-based cross-border payments is anticipated to show the corresponding increase.

The main driver for the popularity of blockchain solutions for cross-border payments is their ability to provide quick, secure, transparent, and cost-effective processing of cross-border payment transactions. Juniper Research estimates that the use of blockchain for cross-border settlements will help banks unlock 3,300x growth in cost savings – up to $10 billion in 2030.

Why Move Cross-Border Payments to the Blockchain Rails

|

|

Compared to international bank transfers, blockchain offers substantially lower transaction processing costs due to eliminated intermediaries (e.g., commercial banks, clearing houses, etc.). Plus, there are no cut-off times for payment processing, which results in drastically increased processing speed. |

|

|

Compared to the independent e-payment systems such as PayPal or MoneyGram, blockchain provides much more robust security of sensitive data and eliminates the risk of data leakage. Also, blockchain money transfer is fully transparent, which contributes to the mutual trust between payers, payees, and cross-border payment service providers. |

Main use cases

B2B cross-border payments

Key benefits:

- Fast, secure, and cost-effective global B2B payments, including high-value interbank settlements and P2P business payments.

- Eliminated manual errors and payment delays due to cross-border payment automation.

- Compliant financial reporting under different jurisdictions due to immutable records of payment-related data.

Key benefits:

- Prompt and convenient international payments in crypto and fiat for individuals.

- Low payment cost due to no need for third parties, such as governmental entities or financial institutions.

- Minimized risk of security breaches.

- Improved transparency and streamlined control of payment operations due to full visibility of money transfer transactions.

How Blockchain for Cross-Border Payments Works

Architecture

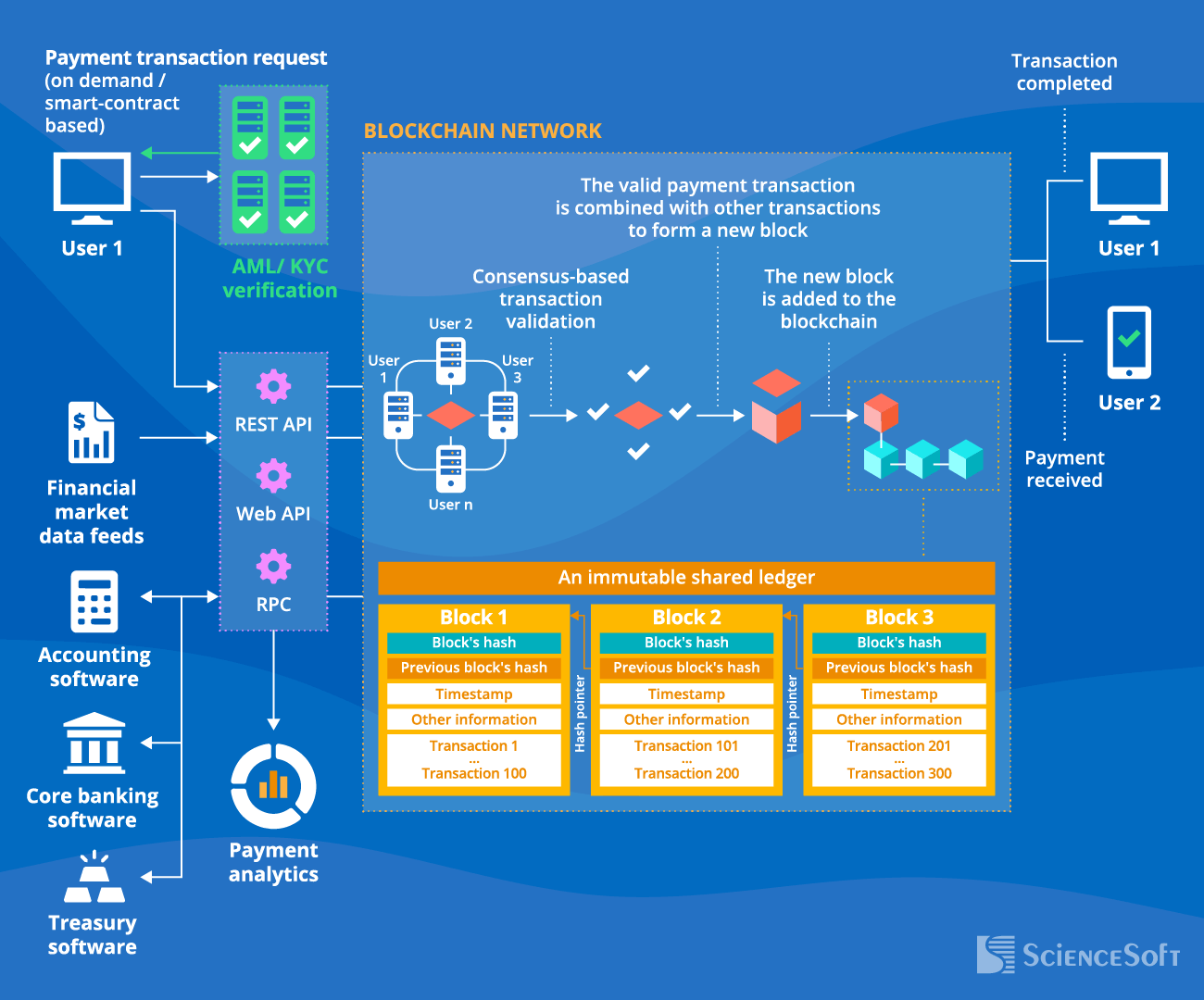

It is blockchain’s innovative architecture that drives the advantages of blockchain-based vs. traditional cross-border payments. A sample architecture of blockchain-based cross-border payment solutions ScienceSoft delivers looks as follows:

Cross-border payment transactions are submitted by the blockchain network members or automatically enforced by smart contracts upon predefined events. The requested transaction is transmitted to the peer-to-peer (P2P) network of nodes that validate the transaction according to the selected consensus protocol. Traditional financial institutions and large businesses dealing with high-value transfers mainly rely on permissioned blockchains. In such networks, only known and trusted users with special rights can access and validate payment events and transactions. Fintech companies and SMEs focused on smaller-value B2B and C2B transactions usually opt for permissionless blockchains to promote financial inclusion and ensure maximized payment transparency.

Upon validation, payment-related data is encrypted with a hash function and stored in timestamped blocks linked chronologically. The blocks form an immutable ledger that provides a single source of truth to trace payment activities. Individuals, businesses, and financial services providers interact with a blockchain to make, receive, and monitor payments using role-specific web and mobile applications. All the participants maintain their own up-to-date copies of the distributed ledger.

A blockchain solution typically requires integration with financial data marketplaces and accounting software. Additionally, the solution may be integrated with:

- Business-specific systems where payment initiation takes place, e.g., core banking software or a treasury system.

- A payment analytics system to share relevant data required to analyze cross-border payment transactions and payers’ behavior.

Key features

ScienceSoft creates blockchain-based cross-border payment software with unique functionality closely bound to the specific payment needs of each client. Here, we share a sample feature set of the blockchain solutions we create:

Real-time processing of cross-border payments

Blockchain offers near-instant processing of cross-border payments on a 24/7 basis with no involvement of intermediaries.

Multi-currency support

Blockchain can support cross-border payments in any cryptocurrency of your choice, including popular crypto coins, CBDCs, and custom cryptocurrency.

Consensus-based validation of payment data

Blockchain provides rule-based validation of cross-border payment transactions and their prioritization for processing and storage. The rules are defined by the selected consensus protocol.

Automated recordkeeping

Upon successful validation, payment transactions and relevant data from the connected systems (e.g., data on currency exchange rates) are automatically timestamped and recorded in the immutable ledger.

Full traceability of cross-border payments

The blockchain ledger enables real-time monitoring and end-to-end traceability of cross-border payments for the blockchain network members.

A comprehensive audit trail of payment-related documents

Blockchain keeps an immutable record of all manipulations across payment-related documents (invoices, receipts, letters of credit, etc.): document creation, editing, sharing between the parties, viewing, and more.

Payment automation enabled by smart contracts

Smart contracts contain the rules for triggering and automated enforcement of particular cross-border payment transactions. For example, they can initiate automated payment to the foreign service provider upon service delivery.

Payment security

Security of the blockchain payments is achieved via payment data hashing, transaction e-signing with a unique digital signature, multi-factor authentication, including biometric authentication (e.g., facial or fingerprint recognition), fraud detection algorithms, and more.

Costs of Blockchain-Based Cross-Border Payment Software

Based on ScienceSoft's experience, developing blockchain software for cross-border payments may cost from $150,000 to $1,500,000.

Major factors that affect the cost and duration of the development are:

- The solution’s functional complexity, including the number and complexity of smart contracts needed to introduce cross-border payment automation.

- The scope and complexity of integrations.

- Performance, scalability, security, and cross-chain interoperability requirements for the solution.

- (for solutions built from scratch) Blockchain network type and a chosen consensus algorithm.

- (for platform-based solutions) The selected blockchain platform.

- Role-specific requirements to the UX and UI of web and mobile payment applications.

Sample estimates

$150,000–$250,000

A cross-border payment app that relies on an existing blockchain network to process payments.

$500,000–$1,500,000

A full-scale custom blockchain solution with a dedicated blockchain network for cross-border payments.

Success Stories of Blockchain for Cross-Border Payments

Banco Santander Benefits from Faster and Cheaper Cross-Border Transactions

In 2018, Banco Santander, a banking giant serving 140M+ customers worldwide, partnered with Ripple to launch One Pay FX, a blockchain mobile app for cross-border payments. The innovative solution offers automated currency conversions, provides real-time processing of cross-border payments, maintains an immutable record of all transactional data.

With the help of blockchain, Banco Santander managed to reduce the processing time for international bank transfers from 3–5 days to seconds and substantially decrease the fees for cross-border transactions. Also, the bank saw enhanced customer satisfaction due to full transparency of FX rates and transactional flow.

One Pay FX currently enables fast, low-cost payments to two dozen countries. The solution has the potential to handle 50% of Banco Santander’s international payment transactions.

A Blockchain Payments Startup Raised $10.5M in 3 Years

A UK-based fintech startup Mercuryo has developed a blockchain payment processing solution that enables businesses and individuals to easily send and receive cross-border payments. The solution supports 50+ cryptocurrencies and fiat currencies, offers fast processing of international payments, and facilitates traceability of cross-border payment transactions. It provides automated AML/KYC compliance checks and offers prebuilt APIs to integrate with the corporate clients’ systems.

Mercuryo raised $10.5 million in funding from 2018 to 2021. Today, the company serves 200+ businesses in 135 countries and partners with a range of global crypto players, including Binance, Bitfinex, Trezor, and Trust Wallet, to deliver additional value with their solution.

Blockchain Consulting and Development by ScienceSoft

In software development since 1989 and in DeFi development since 2020, ScienceSoft provides full-cycle services to help companies create reliable blockchain solutions for cross-border payments. Our top priority is driving the blockchain project to its goals, keeping to the agreed cost and timelines and responding to uncertainties agilely.

Technologies & Tools We Use

The Challenges of Blockchain for Cross-Border Payments

Many business owners and executives still have doubts regarding blockchain’s ability to address certain operational and regulatory aspects of cross-border payments. But having years of expertise in blockchain development, we know how to solve the potential challenges safely and cost-effectively.

Challenge #1: Compliance with anti-money laundering regulations

A blockchain network for cross-border payments needs to provide compliance with global and region-specific AML/CFT regulations, including KYC, CDD, and FATF requirements, to prevent illicit payments and money laundering.

SOLUTION

Solution

ScienceSoft usually develops dedicated smart contracts to run compliant customer identity verification and risk assessment automatically. Smart-contract-based automation can help you eliminate complex, error-prone manual tasks across the initial KYC verification and customer information cross-checking upon changes. It also significantly speeds up further client authentication in the blockchain network.

Hide

Challenge #2: High crypto volatility

Some blockchain solutions rely on the “fiat-crypto-fiat” model of cross-border payments. Under this model, blockchain employs cryptocurrencies as the bridge between the payer’s fiat currency and the payee’s fiat currency. However, continuous – and considerable – fluctuations in cryptocurrency prices pose the risk of losing the crypto funds value during currency conversion and transaction processing. The blockchain solution needs to address this risk.

SOLUTION

Solution

Consider using fiat-backed stablecoins as on- and off-ramps to move from fiat to crypto and vice versa. This step offers a risk-free way to access crypto liquidity while eliminating the conversion losses.

Hide

Coding automated currency conversion rules directly into smart contracts enables real-time exchange rate application at the moment a transaction is executed. This step eliminates manual intervention and reconciliation delays, ensuring accurate, instant cross-border payments. For businesses, it means faster settlement, lower operational costs, and reduced foreign exchange risk.

Challenge #3: Continuous data upload from off-chain sources

Blockchain for payment needs to instantly access the data provided in payment-related documents, as well as up-to-date currency exchange rates for crypto and fiat. These data are essential for accurate processing and recording of cross-border payment transactions. Thus, the solution has to be seamlessly integrated with the relevant external data sources.

SOLUTION

Solution

Easy-to-use integration APIs help ensure fast and smooth blockchain connection to relevant corporate data sources (e.g., an enterprise’s accounting system or core banking software). And blockchain oracles enable real-time import of market-available financial data to blockchain smart contracts.

Hide

About ScienceSoft

ScienceSoft is a global IT consulting and software development company headquartered in McKinney, Texas. We deliver blockchain solutions for secure, prompt, and cost-effective processing of cross-border payments. In our blockchain projects, we rely on robust quality management and data security management systems backed up by ISO 9001 and ISO 27001 certifications.