Overview of Insurance Portals

Features, Integrations, Benefits, Pricing

ScienceSoft combines 20 years of practice in web portal development with 13 years of experience in creating software for insurance companies to introduce effective, secure, and visually appealing insurance portals.

An Insurance Portal: Key Aspects

An insurance portal is aimed to introduce seamless digital experiences for insurers’ clients, employees, agent teams, and suppliers. Insurance portals provide end users with vast self-service options, process automation, prompt and secure access to the required data and documents.

For insurers, portals bring significant improvement in operational efficiency and higher satisfaction and retention rates of their customers, vendors, and employees.

Building an insurance portal may cost around $40,000–$400,000+, depending on the solution's complexity and the chosen development approach. You're welcome to use our free calculator to estimate the cost for your case.

The implementation of custom insurance portal software typically takes 3–6 months. An insurance portal can bring around 190% ROI within three years after deployment.

Main Types of Insurance Portals

A customer portal

Provide your clients with a personalized digital experience and self-service options and drive up to 90% increase in customer engagement and an 80+% improvement in retention.

An agent portal

Equip your agents and MGAs with best-in-class workflow automation and collaboration tools and provide them with instant access to the required data. Achieve 40%+ increase in agent productivity and up to 4x faster policy cycle.

A supplier portal

Build close and transparent relationships with suppliers, eliminate redundant efforts, and unlock mutual financial gains. Securely exchange sensitive insurance data and leverage no-touch claim evaluation and settlement.

|

|

|

|

|

|

|

NB! Although a broker portal is sometimes referred to as a separate portal type, its functionality and benefits are basically the same as those of a customer portal. |

|

|

|

|

|

|

|

|

Key Features of an Insurance Customer Portal

With 80%+ of customers trying to solve the issues on their own before asking for help, a customer self-service portal becomes a must rather than a need for insurers looking to provide excellent client experience.

Based on ScienceSoft’s experience in customer portal development projects, we compiled a list of features that lay the foundation for a successful client portal:

Key Features of an Insurance Agent Portal

65%+ of insurance agents state that the availability of proper IT tools affects their employment preferences. ScienceSoft is ready to implement an agent portal with all the required capabilities to help you attract and retain the best talents while driving their max productivity. Below, we list the features that form the core of a comprehensive agent portal:

Key Features of an Insurance Supplier Portal

Insurers have to deal with a complex supplier ecosystem comprising partners like damage inspection and estimation services providers, healthcare institutions, home repair companies, auto repair services providers, etc.

In ScienceSoft’s projects, we create supplier portals with unique functionality bound to each insurer’s specific needs. Below, we list the supplier portal features typically requested by our clients from the insurance domain.

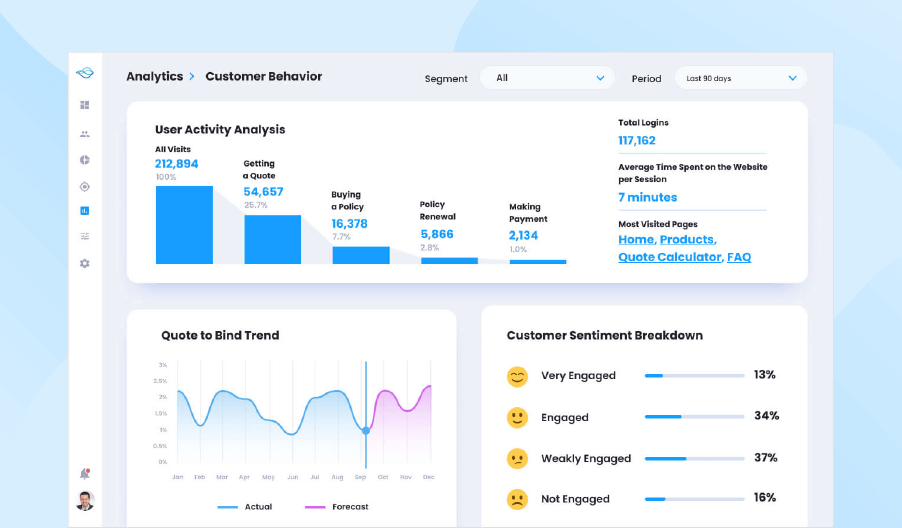

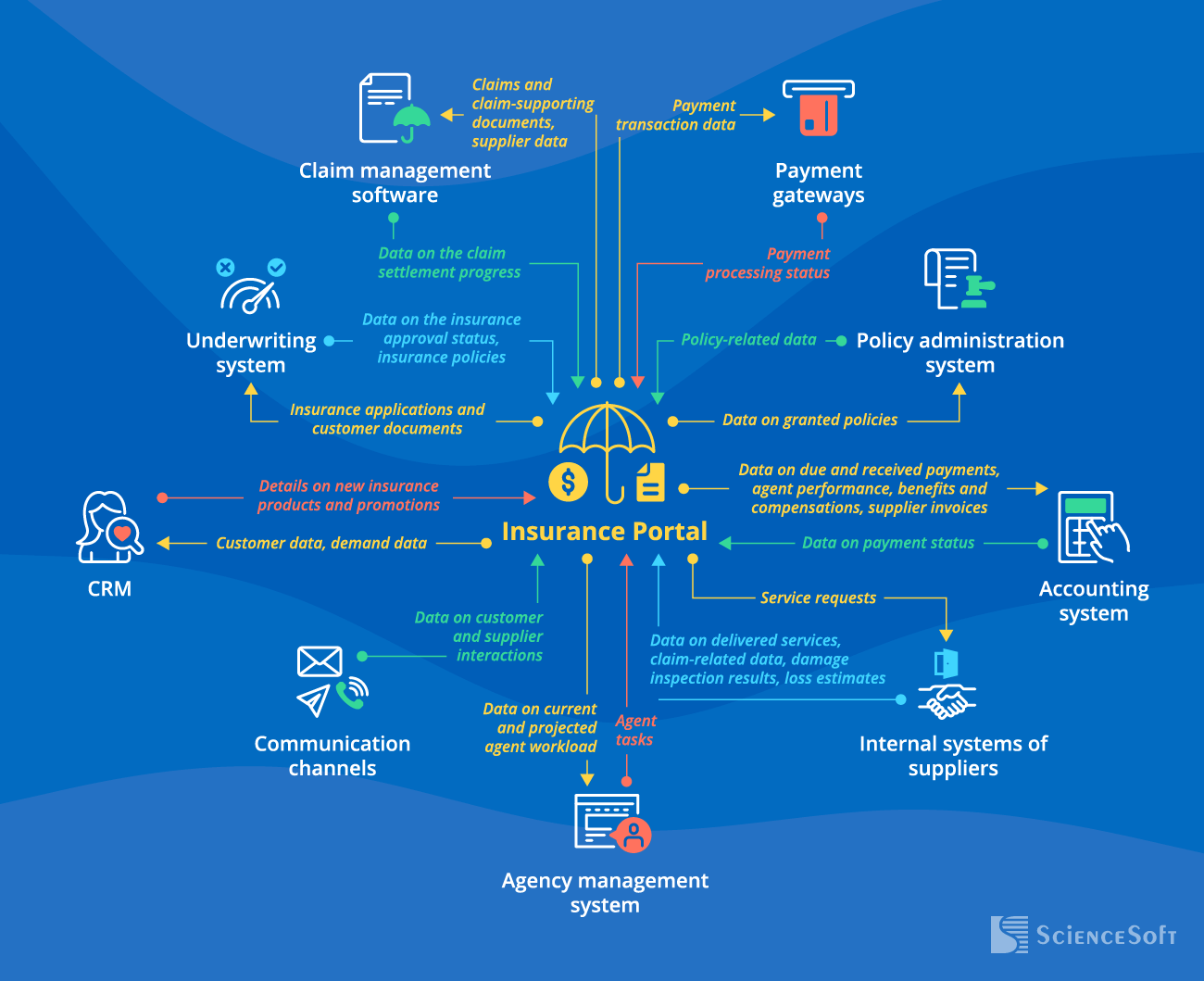

Main Integrations for an Insurance Portal

Below, ScienceSoft shares a sample integration architecture for the insurance portal. A real list of integrations will depend on the portal type you want to implement and the specifics of your software ecosystem.

- For automated recording and centralized storage of customer data: policy-related requests, personal info, etc.

- For data-driven planning of marketing activities.

- To keep the customers and agents updated on the new products and personalized offerings.

- For faster processing of insurance applications.

- To instantly communicate insurance-related decisions to customers and agents and speed up policy submission.

- For instant claim aggregation and facilitated claim status reporting to customers.

- To provide agents with easy access to the customers’ claim histories.

- For accurate assignment of optimal suppliers to particular claim cases and data-driven claim settlement.

- For automated recording of payment transactions in the general ledger.

- For streamlined agent payroll.

- For timely payments to suppliers.

- To enable agents promptly upload, access, and share policy-related data and documents.

Agency management system

- For accurate planning of agent workload and streamlined task assignment to the agents.

Internal systems of suppliers

- For faster processing of service requests.

- To promptly share the available customer data with the insurer.

Communication channels

Mail systems, messaging apps, business phone systems, etc.

- To automatically maintain a full history of customer and supplier interactions.

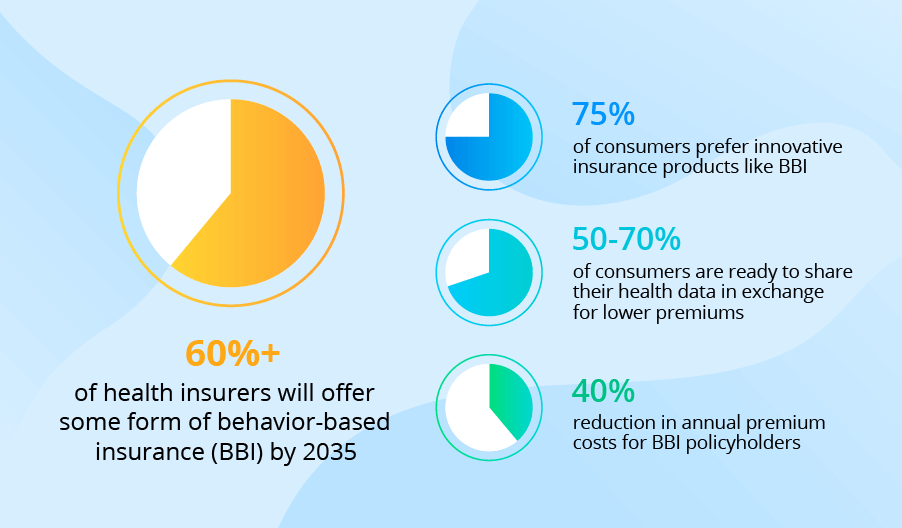

How to Maximize the ROI for Insurance Portal Implementation

Vast self-service options for portal users

To minimize internal teams’ involvement in low-value tasks and increase operational efficiency.

Convenient UX and UI

To provide a seamless digital experience for portal users and streamline its adoption.

A mobile version

To enable portal users to easily access the required documents and track current insurance activities on the go.

Easy-to-use APIs

To ensure fast and smooth portal integration with the required corporate and third-party systems.

Robust security

To protect the insurer’s IT ecosystem by employing AI-powered fraud detection, data encryption, role-based access control, authorization controls for APIs, and other cybersecurity mechanisms.

Regulatory compliance

To guarantee that the portal meets the latest legal standards: KYC/AML requirements, CCPA, CPRA, GLBA, SOC1 and SOC2, IA and SAMA regulations (for the KSA), GDPR (for the EU), HIPAA (for health insurance), and more.

AI-powered virtual assistants can be a strong helping hand for insurance servicing teams. When implemented with an insurance portal, a GenAI assistant can process 70%+ of customer inquiries with no human involvement, driving, on average, a 7% increase in client satisfaction and reducing front-line employee workload by up to 50x.

Insights From ScienceSoft's Insurance IT Experts

Custom vs. Platform-Based Insurance Portals

There are two main approaches to building insurance portals, each having its benefits and limitations. Below, ScienceSoft provides a high-level comparison of the two. Within our insurance portal consulting service, we help define the more feasible approach for your business needs.

Insurance Portal Development Costs

Below, we provide the approximate cost estimations based on ScienceSoft's experience in insurance web portal development.

$40,000–$150,000

An insurance customer or supplier portal of average complexity.

$100,000–$250,000

A custom insurance agent portal with basic functional capabilities.

$250,000–$400,000+

Building a comprehensive insurance agent portal powered with advanced analytics.

Develop Your Insurance Portal With ScienceSoft

In web portal development since 2005 and in insurance software development since 2012, we know how to create a robust insurance portal to meet your unique business needs and address insureds' expectations. We provide: