Artificial Intelligence (AI) for Insurance Claims

Capabilities, Architecture, Costs

ScienceSoft brings 36 years of experience in AI and 13 years in insurance software development to create effective AI solutions for insurance claims.

Artificial Intelligence in Insurance Claims: Quick Summary

Artificial intelligence for insurance claims helps reduce claim resolution costs by 20–50%, drive an up to 50% increase in claim specialists’ productivity, and achieve 5–10x faster claim cycles due to intelligent process automation.

AI-powered claim management systems can process 70–90% of simple insurance claims in a straight-through manner, with claims decisions delivered in minutes rather than weeks. They enable instant fraud detection, deliver accurate damage estimates, and provide intelligent recommendations on risk mitigation, helping insurers minimize financial losses and elevate customer experience.

Generative AI specifically is estimated to unlock a $100-billion benefit opportunity for insurers in P&C claims through reducing loss-adjusting expenses by another 20–25% and leakage — by 30–50%.

The Market of AI for Insurance Claims

The global market of AI in insurance is projected to grow from $14.99 billion in 2025 to $246.3 billion by 2035, exhibiting a CAGR of 32.3%. Claims processing is considered one of the largest use case segments for AI in insurance.

McKinsey predicts that by 2030, claim processing will turn into the most important insurance function, with AI being the primary driving force of its digital transformation. Key factors spurring the popularity of AI for insurance claims are the increasing demand for fast claim settlement and personalized customer approach. With the help of AI, insurers can eliminate claim fraud and effectively mitigate losses.

How AI for Insurance Claims Works

Architecture

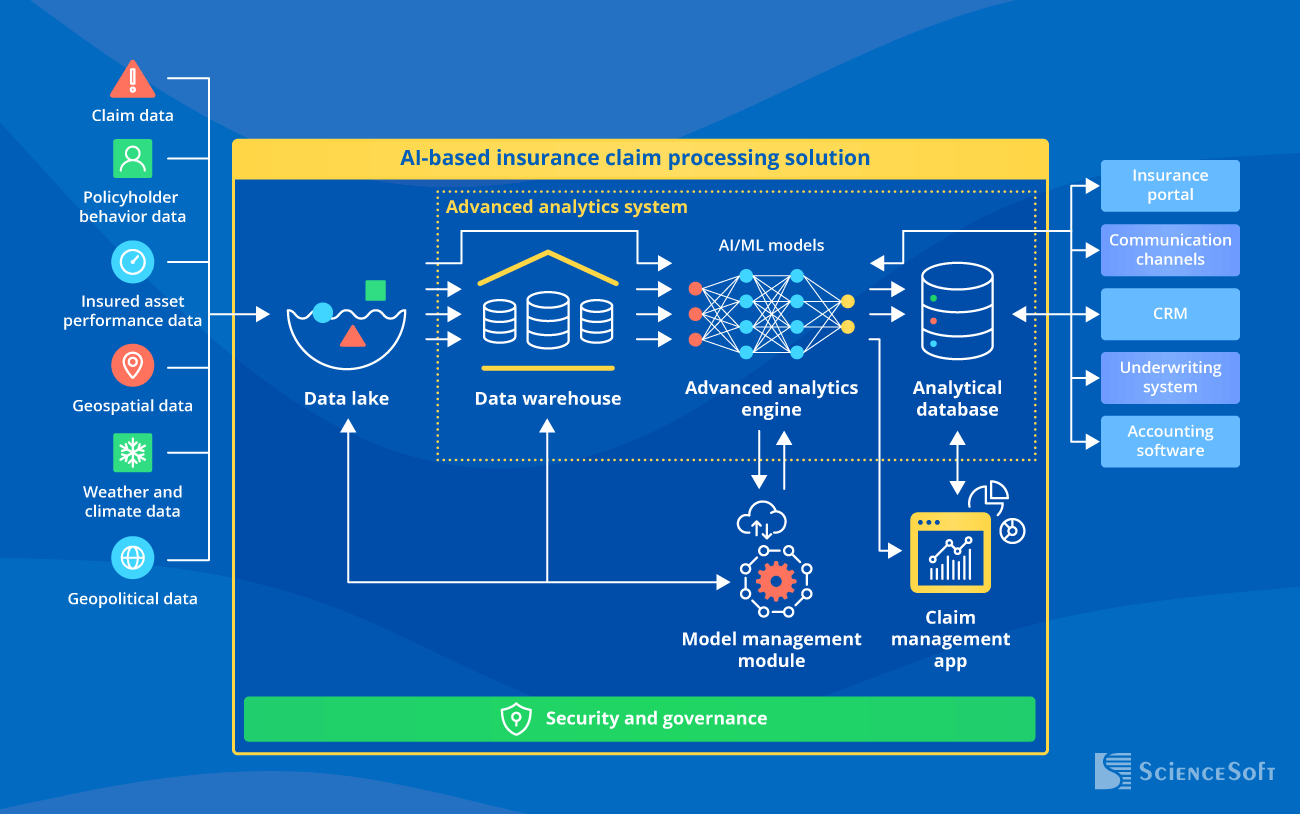

An AI solution for insurance claims integrates with an insurer’s corporate systems, customer-facing apps, and relevant third-party data sources to instantly capture structured and unstructured claim-related data. It moves the collected raw data to the data lake for storage, then directs it to the advanced analytics system for preprocessing (data sorting, filtering, enrichment, cleansing). The preprocessed data is stored in a data warehouse for further analysis.

An analytics engine with a pre-trained machine learning model at its core analyzes the available claim event details to offer intelligent damage estimates and suggestions on whether the claim should be approved or rejected. ScienceSoft’s data scientists suggest using neural network-based models to ensure precise analysis and forecasting of even the most complex claim cases. A dedicated model management module is needed to design, train, and continuously tune the models, improving their accuracy over time.

Finally, the analytical results are stored in the analytical database to be used by claim professionals (via a claim management app) and for further AI model self-learning. The system instantly communicates claim-related decisions to the relevant systems (e.g., an insurance portal, underwriting software, an accounting system) to make them available for claimants and other insurance teams.

|

|

|

|

|

|

|

NB: Such an architecture can be flexibly extended with LLM-based agents to automate end-to-end adjuster workflows across claim investigation, damage assessment, fraud detection, and multi-party settlement. |

|

|

|

|

|

|

|

|

Functionality

While every AI-powered system we build is tailored to our clients’ specific needs, ScienceSoft’s consultants assembled a list of the most popular features usually requested by our clients from the insurance industry.

Automated claim intake

Machine learning (ML) algorithms and large language models (LLMs) enable real-time capture of insurance claims and processing of claim-related documents in various formats: digital and handwritten text, image, audio, video, and more.

Automated claim triaging

AI automatically prioritizes insurance claims for processing based on the analysis of policy terms, claim urgency, injury severity, damage extent, financial and reputational risks associated with non-settlement, etc.

Data-driven claim validation

AI matches the claimants’ loss incident data to the insurance coverage terms and the available data from third-party sources. It instantly identifies fraudulent claim patterns and alerts claim specialists about potential fraud cases.

Intelligent claim decisioning

AI provides analytics-driven suggestions on claim approval or rejection (e.g., rejecting faked, late, wrongly disclosed claims). It flags complex claims that require manual review and automatically routes them to the appropriate claim specialists.

Remote damage inspection

AI-based computer vision techs enable real-time monitoring of insured assets and automated damage inspection even across complex environments like manufacturing lines and offshore drilling rigs.

Analytics-based damage assessment

AI automatically evaluates losses and calculates due compensation amounts based on the analysis of claim-supporting documents and the relevant data from external sources.

Intelligent supplier selection

AI recommends the best-fitting damage-handling service providers (e.g., healthcare providers, repair service companies) to claimants based on the analysis of service suppliers’ capacity, location, availability, pricing, etc.

Claim cost forecasting

AI calculates the expected claim costs (by period, customer, region, etc.) based on the analysis of the claim payment history, customer risks, force majeure risks, and more.

Prescriptive analytics for loss mitigation

AI analyzes real-time data on customer behavior and the insured asset state to assess potential loss risks. It offers intelligent suggestions on the proper course of action for policyholders to prevent claim events.

Automated customer communication

AI-powered virtual assistants can handle diverse customer interaction tasks: requesting the missing claim-related data and documents, communicating decisions on claim approval or rejection, providing 24/7 support, and more.

See How Agentic AI Transforms Claim Validation

Watch how ScienceSoft’s custom AI agent applies voice intelligence and advanced sentiment analysis to uncover fraud during conversational claim verification. Built on AWS Bedrock AgentCore and powered by OpenAI’s leading LLMs, the agent boosts investigator capacity by over 40% and drives 20%+ higher fraud detection rates through nuanced discrepancy indicators.

How Insurance Companies Benefit from AI in Claims Processing: Real-Life Examples

ScienceSoft Creates ML Algorithms to Identify Insurance Fraud with 95% Accuracy

In 2023, ScienceSoft helped a health insurance technology startup deliver an ML-powered software product for automated dental insurance fraud detection.

After the 6-month-long engagement, our senior data scientist introduced ready-to-use ML algorithms for the intelligent analysis of claim-supporting dental X-ray images, instant detection of mismatched oral health data, and automated reporting of fraudulent claims.

The ISO 13485-compliant medical image recognition algorithms demonstrated 95% accurate dental insurance fraud detection. The product is now submitted to the FDA for clearance.

Large Car Insurer Benefits from Fast and Cost-Effective Claim Handling

In 2022, Compensa Poland (a part of Vienna Insurance Group, an insurance giant serving 22M clients in 30+ countries) implemented an AI-based claim processing solution to enhance its car damage claim handling processes.

The solution processes insurance claims and delivers intelligent suggestions on claim approval or rejection. It uses deep learning to analyze vehicle damage photos submitted by claimants and instantly produce accurate damage estimates.

With the help of AI, Compensa Poland cut the claim processing costs by 73%, reduced the claim resolution cycle from days to minutes, and significantly improved customer service quality.

AI Insurtech Startup Raises $119M+ over 8 Years

A UK-based insurtech startup Tractable has developed an innovative AI solution for auto and property claim processing.

The solution automates the entire claim cycle, from FNOL to settlement. It uses deep learning and computer vision to enable remote car and property damage inspection and instant loss assessment. In addition, the software provides analytics-driven recommendations on the required repair operations.

Tractable raised over $119 million in funding from 2014 to 2022. Today, major insurers in the US, UK, Japan, and Europe use Tractable’s product. The solution proved to bring up to a 10x reduction in the claim resolution and damage handling time.

The Challenges of AI for Insurance Claims

AI poses a few unique challenges that complicate its incorporation into claim resolution processes. Below, ScienceSoft’s data scientists, solution engineers, and security officers share their hands-on experience to address the potential risks and maintain the economic feasibility of AI for claim management.

Challenge #1: Achieving high accuracy of analytical results

“Good” AI model accuracy starts at about 70%, but to reliably automate high-risk processes such as insurance claim management, the accuracy needs to be above 95%. To maximize the precision of AI insights, your AI model must be properly designed and trained on the appropriate data sets. Plus, its decisioning logic must be clear and explainable to avoid unintended bias and ensure compliance with the legal claim disclosure standards.

Solution

Solution

Involving professional data scientists to design and train your insurance claim AI model helps ensure prompt model launch and its maximal accuracy. ScienceSoft’s data science experts with 7–20 years of experience will help compose a representative training data set and fine-tune the AI model’s parameters to guarantee that it produces highly accurate results. They will also implement the optimal combination of explainable AI models and black-box deep learning models to balance the accuracy of the output with the system’s transparency.

Hide

Challenge #2: Sensitive data security

When performing claim validation, AI deals with the policyholders’ sensitive data, including personal/business, financial, and health data. It poses strict security and compliance requirements for the AI-based claim processing solution.

Solution

Solution

ScienceSoft augments AI solutions for insurance claims with multi-factor authentication, data encryption, permission-based access control, and other robust cybersecurity mechanisms to prevent the risk of sensitive data leakage. We also recommend performing periodic infrastructure vulnerability scanning to minimize the risk of external cyberattacks. In addition, we help our clients achieve and maintain compliance with the relevant data protection standards, such as SOC 1 and SOC 2, HIPAA, GDPR, NYDFS, and more.

Hide

Security mechanisms we work with

- Data protection: DLP (data leak protection), data discovery and classification, data backup and recovery, data encryption.

- Endpoint protection: antivirus/antimalware, EDR (endpoint detection and response), EPP (an endpoint protection platform).

- Access control: IAM (identity and access management), password management, multi-factor authentication.

- Application security: WAF (web application firewall), SAST, DAST, IAST (security testing).

- Network security: DDoS protection, IDS/IPS, SIEM, XDR, SOAR, email filtering, SWG/web filtering, VPN, network vulnerability scanning.

Costs of Implementing AI for Insurance Claim Processing

From ScienceSoft’s experience, the average cost of building a custom artificial intelligence solution for insurance claim processing may range from $100,000 to $650,000.

Want to understand the cost of your AI-powered software for insurance claim processing?

Below, our consultants provide a list of main factors that may impact the development budget and duration:

- The scope and complexity of the solution’s functional capabilities.

- The number and type of AI models (non-neural network ML models, DNN models, CNN models, etc.) for intelligent process automation.

- Performance, scalability, security, and compliance requirements for the solution.

- The number and complexity of integrations.

- The chosen sourcing model (e.g., outsourced, in-house development) and team composition.

Implement AI for Insurance Claims with ScienceSoft

Since 1989 in AI implementation and since 2012 in engineering custom insurance solutions, ScienceSoft delivers reliable AI solutions for insurance claim processing.

About ScienceSoft's AI Practice

ScienceSoft is a global AI development company headquartered in McKinney, Texas. We build accurate AI solutions for efficient and secure processing of insurance claims. In our AI projects, we rely on robust quality management and data security management systems backed by ISO 9001 and ISO 27001 certifications.