Artificial Intelligence (AI) in Investments and Wealth Management

ScienceSoft relies on 36 years of expertise in artificial intelligence and 18 years in investment software development to design and build robust AI solutions for wealth management and investments.

Investment and Wealth Management AI: The Essence

Artificial intelligence for investments and wealth management helps domain professionals accurately predict market dynamics, spot profitable investments in seconds, and automatically enforce the optimal trading steps, maximizing portfolio returns and minimizing financial risks.

When used in investments, AI eliminates up to 50% of manual investor prospecting and onboarding tasks and improves investment managers’ productivity by more than 14%. Intelligent automation of portfolio and compliance operations drives a 25–50% reduction in operational costs. AI-powered investment risk analytics help reduce portfolio volatility by 20%.

Organizations applying AI in wealth management can expect an 8%+ rise in assets under management (AUM) and over 7% growth in revenue due to enhanced advisor capacity and sharper financial planning. Automating personalized client interactions with AI helps cut servicing expenses by 30%, raise client retention, and grow the client base by 10–20% without extra engagement steps.

AI in Wealth Management and Investments: Market Info

The global market of AI for asset management was valued at $84.85 billion in 2024. It is projected to grow from $107.7 billion in 2025 to $1,168.33 billion by 2035, exhibiting at a CAGR of 26.92%. Investment and wealth management are among the largest use case segments for AI in asset management.

According to Accenture, 98% of financial advisors believe AI has a transformative impact on the wealth management industry and will reshape the way financial advice is created for, delivered to, and consumed by clients in the near future. The WEF, with reference to Deloitte, predicts that AI-driven investment tools will become the primary source of advice for retail investors by 2028, with usage rates hitting 80%.

The main driver for the popularity of AI-powered investment and wealth solutions is the increasing demand for fast, accurate, and efficient analysis of high-volume investment data, optimized portfolio performance, and improved investor experience.

How AI for Investments and Wealth Management Works

Main use cases

Investor outreach

Demand analytics to identify potential customers and better understand investor needs. Recommendations on winning investment offerings and outreach channels for various target audience segments to attract new clients.

Investor interaction

AI-enabled virtual assistants to handle simple investor communication tasks and provide instant 24/7 support. It helps improve wealth managers’ productivity and drive high customer satisfaction and engagement.

Investor onboarding

Comprehensive analysis of investors’ identity, solvency, and risks to prevent illegitimate access to trading and wealth management services.

Service personalization

Suggestions on the best-performing portfolio structures and investment strategies for each customer to meet investors’ individual opportunities and goals.

Intelligent investment advisory

Real-time prescriptions on the next best actions for wealth managers and investors to maximize financial gains from trading operations.

Trading automation

Intelligent automation of trading activities to instantly respond to emerging market signals and eliminate low-value manual efforts.

Analytics-based portfolio planning, diversification, and optimization to maximize investment profitability and minimize risks.

Investment security

Real-time detection of fraudulent investment patterns to timely take protective measures and prevent financial losses.

|

|

|

|

|

|

|

NB: Wealth management AI can also be helpful for administrative use cases like demand prediction, financial advisor task planning, and service price optimization. |

|

|

|

|

|

|

|

|

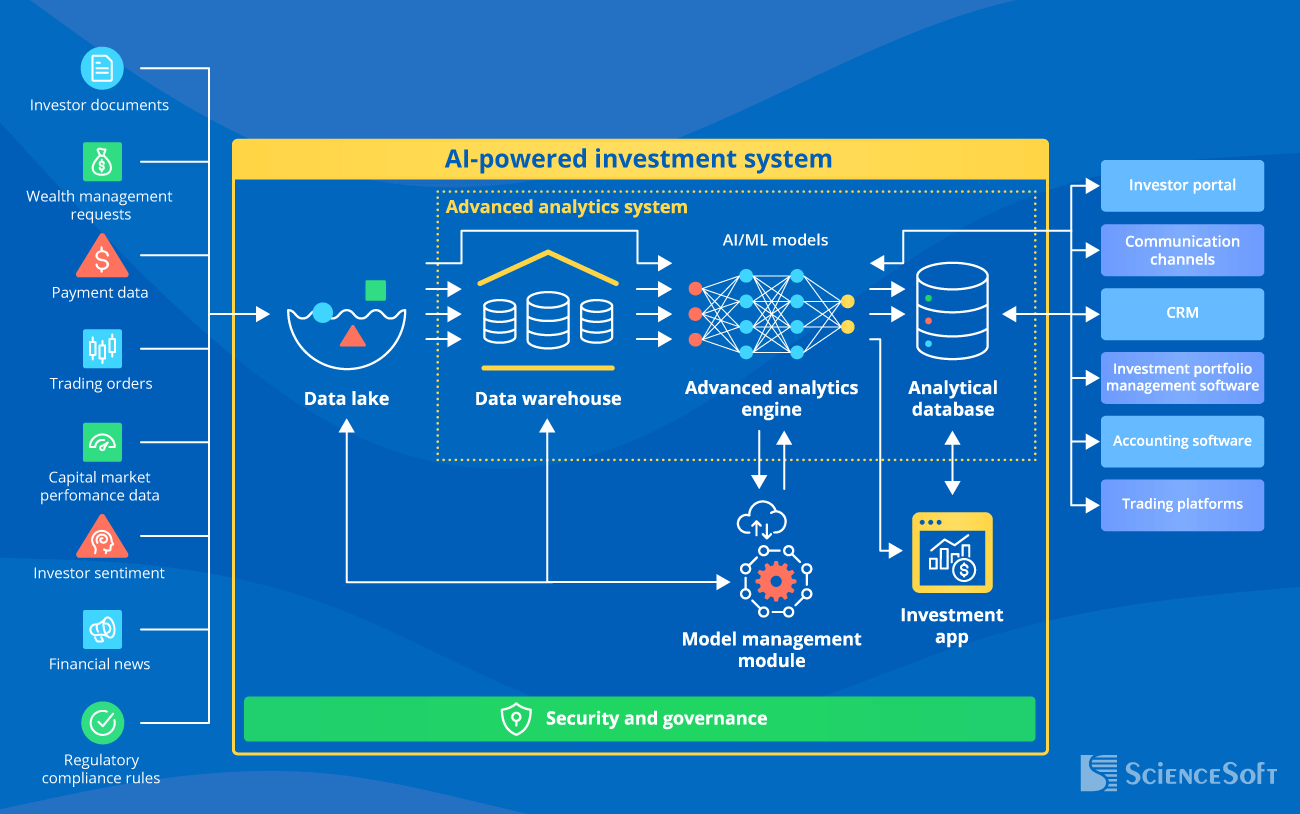

Architecture

ScienceSoft creates AI-powered investment solutions with scalable and secure architecture that enables smooth processing of financial data. Below, our consultants share a sample layered architecture of AI software for wealth management and investment, describing its key components and data flows.

Such an architecture is built around a deep learning analytics engine and can be flexibly extended with LLM-based agents to automate judgement-heavy investment operations end to end.

- Uploading investment-relevant data from the available sources to the data lake for storage and its instant transfer to the advanced analytics system for processing.

- Data preprocessing (sorting, filtering, enrichment, and cleansing) to improve its quality. Storing the structured, ready-to-analyze data in the data warehouse.

- AI model design, training, and tuning in the model management module (operated by data scientists).

- Analyzing investor profiles, portfolio performance, and capital market movements using an ML model. The model forecasts investor behavior and asset prices, prescribes portfolio optimization steps and profitable trading actions.

- Exporting analytical results to the analytical database for storage and to the model management module for model self-training.

- Communicating AI-based insights and AI-prescribed investment decisions to the relevant systems. Wealth managers and investors can access the analytical results via role-specific investment apps.

AI-based software integrates with:

- A wealth management company’s corporate systems (e.g., portfolio management software, CRM, an investor portal, an accounting system) and communication channels (email, messengers, etc.) to import relevant historical information and share investment-related data and decisions.

- Third-party data sources (financial data marketplaces, credit rating bureaus, banking systems, etc.; treasury software of institutional investors) to obtain available investment-relevant information.

- Trading platforms to automate asset trade execution.

Key features

Real-time investment data processing

Together with robotic process automation (RPA), deep learning, image analysis, and natural language processing technologies enable real-time aggregation and processing of multi-format, multi-channel investment-relevant data: investor documents, asset prices, stock indices, financial news, trading order heat maps, regulatory compliance rules, and more.

Predictive capital market analytics

AI continuously monitors the asset price fluctuation patterns, FX, interest, yield, and inflation rates, on-balance volumes, and other capital market performance indicators. It reveals dependencies between the indicators, predicts the market moves, considers investor sentiment, and delivers insights into emerging opportunities.

Investment portfolio planning

AI analyzes investors’ income levels, financial sustainability, risk appetites and tolerances, profitability goals, taxes, and investment histories. It suggests the proper portfolio composition (baseline asset allocation, investment duration, exposure limits, etc.) for each investor to maximize financial gains.

Investment strategy creation

AI drafts go-to investment strategies and plans taking into account user requirements. Based on the AI-generated suggestions, wealth managers can create tailored investment roadmaps for their clients, and investors can self-design trading journeys.

Portfolio optimization

AI enables real-time calculation and forecasting of all necessary performance metrics (total returns, exposures, weighted yields, average daily balances, value at risk, etc.) at the portfolio, investment, and asset class levels. It instantly spots potential risks and prescribes the optimal steps to balance and hedge the portfolio.

AI analyzes live trading events, detects chart patterns and price change directions, and provides personalized investor guidance on the next best actions. AI for trading automation mimics investors’ behavior and can initiate position entering, adjustment, or exit when patterns signal the price trend shifts.

AI-guided customer acquisition

AI identifies the needs and preferences of target customers based on the analysis of the existing clients’ portraits, prospects’ web search histories, social media activities, and more. It suggests the investment products, outreach channels, and promotional messages that will most likely resonate with each target audience segment.

Automated investor communication

AI-enabled virtual assistants (chatbots, digital humans) instantly process investor queries and provide real-time responses in a human-like manner. They can automatically communicate portfolio performance to investors, request missing data and documents, inform clients about new investment products, and more.

Intelligent KYC/AML verification

AI validates the identity, income, and risk data provided by investors against the data from third-party sources (e.g., credit rating platforms, bank systems). It qualifies investors against the geography-based KYC/AML requirements and screens the local sanction lists to avoid serving the blocked individuals and entities.

Fraud and non-compliance detection

AI analyzes real-time activities across investors’ accounts and instantly detects suspicious funds manipulations. It monitors investment compliance with relevant standards (SEC, FINRA, CMA, company-specific policies, etc.) and notifies the responsible parties and regulators about non-compliance cases.

See How Agentic AI Transforms Investment Decision-Making

Watch how ScienceSoft’s AI Agent applies predictive analytics, NLP, and knowledge graph reasoning to uncover market insights and support smarter investment choices. Built on the LangChain framework and powered by OpenAI’s best-in-class LLMs, the agent boosts analyst productivity by over 50% and speeds up research by up to 70% while ensuring high-precision investment suggestions.

Addressing the Challenges of AI in Investments and Wealth Management

While 88%+ of wealth management service providers are pursuing AI initiatives, many still doubt AI’s ability to address certain operational and compliance aspects of investment and wealth management. Having decades-long expertise in AI development and investment digital transformation, ScienceSoft knows how to handle potential issues in a safe and pragmatic way.

Challenge #1: Insufficient trustworthiness of AI predictions

In the wealth management space, poor investment decisions can cause huge financial and reputational losses. It poses extremely high requirements for the accuracy of AI-delivered insights used for investment planning and hedging. The reality is that even ~80% precision of AI predictions can be hard to achieve.

Solution

Make sure you have a scalable and high-performing data management infrastructure. Being the cornerstone for deriving high-quality data from all the required sources and fast (often real-time) processing of this data, a robust data infrastructure lays the groundwork for reliable AI outputs. Our team can advise on the necessary infrastructure improvements and aid in establishing an AI-ready data management framework to ensure the smooth and accurate functioning of your intelligent investment solution.

Challenge #2: Opaque AI's decisioning logic

Wealth managers have a fiduciary responsibility to their clients and are legally obliged to provide a clear rationale behind their investment decisions. In case of AI-prescribed investments, achieving full transparency of decision-making logic may be a challenge, since most intelligent engines rely on highly sophisticated algorithms that are a ‘black box’ even for AI experts.

Solution

Costs of AI-Powered Software for Investments

Based on ScienceSoft’s experience, building a custom artificial intelligence solution for wealth management and investments may cost around $100,000–$650,000+, depending on the solution's complexity.

The major factors that affect the development budget and timelines are:

- The solution’s feature scope.

- The number and complexity of AI models.

- Performance, scalability, security, and compliance requirements for the software.

- The number and complexity of integrations.

- Requirements for the UX and UI of the investment application.

- The required development scope (MVP, a fully-featured solution).

- The sourcing model and team composition.

Here are some examples of ballpark estimates:

$100,000–$250,000

An AI-based investment solution that relies on non-NN ML models to process data from 1–3 internal sources and delivers analytical output in batches.

$250,000–$450,000

AI-based software that employs NN models to process investment data from corporate and third-party sources and deliver intelligent predictions.

$450,000–$650,000+

A complex AI-powered predictive and prescriptive system that uses advanced NN models for real-time processing of investment data from 5–10+ proprietary and third-party sources.

Investment AI Consulting and Implementation by ScienceSoft

In AI implementation since 1989 and in investment software development since 2007, ScienceSoft delivers reliable AI solutions for investment and wealth management.

The value of our investment IT services is confirmed by the world's top 3 asset manager with $5+ trillion in AUM.

About ScienceSoft's AI Practice

ScienceSoft is a global AI software development company headquartered in McKinney, Texas. We deliver tailored AI solutions for efficient wealth management and profitable investments. In our projects, we rely on robust quality management and security management systems backed up by ISO 9001 and ISO 27001 certifications.