Insurance Digital Transformation

Upgrade your insurance workflows to succeed in the AI era

Since 2012, ScienceSoft has been helping insurance companies digitally transform their service and business operations to improve employee productivity, elevate customer experience, and foster long-term growth.

Digital Transformation in Insurance: Summary

Digital transformation helps insurance companies improve operational efficiency, refine customer experience, and move beyond traditional business models with the help of robust process automation systems and Insurance 4.0 technologies.

- Key project steps: business analysis and requirements engineering, digital transformation planning, implementation (IT infrastructure modernization, upgrading existing insurance software, engineering new insurance solutions, etc.), gradual adoption and employee training.

- Timelines: 15–30 months on average.

- Cost: $200,000 (one-time)–$500,000/year (spread across 2–3 years) to transform a particular insurance area; $500,000/year–$1,500,000/year (spread across 3–5 years) to transform the core operational areas of a midsize insurance company. To learn the cost for your specific case, you can use our cost calculator.

- Team: a digital transformation consultant, a project manager, a compliance consultant, a solution architect, a DevOps engineer, UX and UI designers, front-end and back-end developers, data scientists, QA engineers.

Main Insurance Areas to Innovate

Explore our dedicated pages to learn about the capabilities and benefits digitalization brings for these insurance areas:

Key Opportunities Digital Transformation in Insurance Unlocks

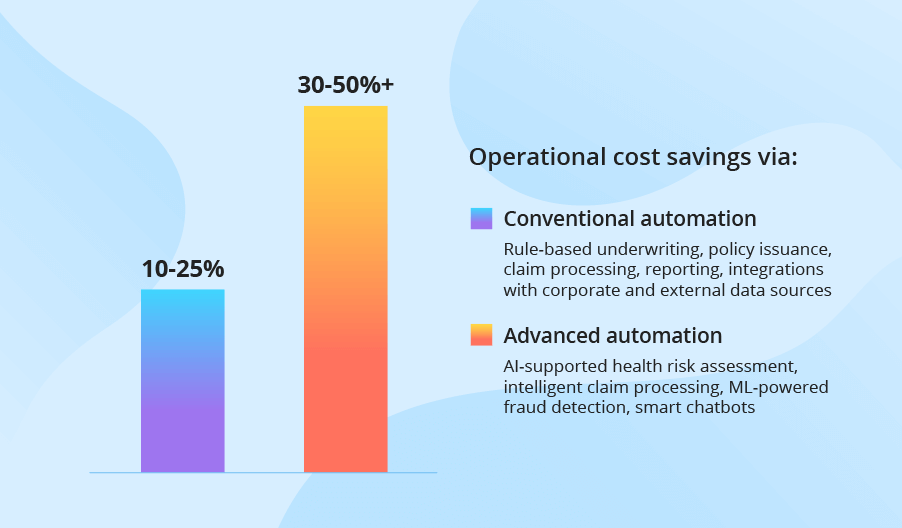

Automation of manual tasks

results in a 30–40% decrease in operational costs, a 2x–20x+ increase in the speed of insurance processes, and a >50% improvement in the productivity of insurance teams.

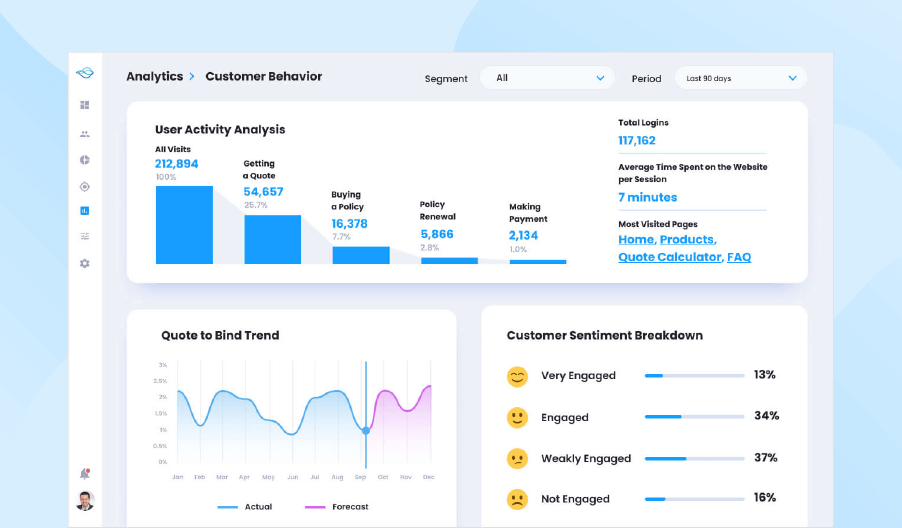

Advanced insurance analytics

enables a 360° view of historical insurance KPIs, allowing for >95% accurate customer behavior and business performance forecasts.

AI-guided insurance decisioning

helps ensure optimal insurance pricing, minimize financial risks, and drive up to a 15% increase in revenue.

Remote provision of insurance services

helps access a larger client base and spurs higher employee and customer satisfaction due to enhanced convenience.

Streamlined collaboration

within the insurance teams and with external partners allows for prompt and secure data sharing, faster underwriting and claim resolution.

Personalized digital customer experiences

drive up to a 90% increase in customer engagement and an >80% improvement in retention.

Roadmap to Digital Transformation in Insurance

Each insurance business is unique, so the DT strategy and plan will vary for different companies. However, each insurance transformation project goes through the same main milestones to consistently drive process innovations. Below, ScienceSoft’s consultants share a sample insurance transformation roadmap for you to get a general idea of how it may look.

Step 1.

Business analysis and requirements engineering

ScienceSoft starts any insurance transformation project with an in-depth analysis of the following aspects:

- The client’s overall business situation, goals, and needs.

- Current insurance processes, their KPIs, bottlenecks, and improvement opportunities.

- IT infrastructure and existing insurance software, their constraints and transformation potential.

- Insurance data flows (within and beyond the organization).

- Regulatory compliance requirements: e.g., KYC/AML requirements, FIO and NICB regulations, IFRS17 standards, CCPA, SAMA and IA (for the KSA), GDPR (for the EU), NYDFS (for New York), HIPAA (for health insurance).

Upon analyzing the collected information, ScienceSoft’s consultants prepare a detailed list of digital transformation requirements, which covers:

- Long-term goals and short-term objectives of the insurance DT process, prioritized according to their expected financial impact.

- The insurance areas that digital transformation should cover: underwriting, claim management, payments, etc.

- All the capabilities that the insurance innovation should provide: process automation, digital customer journeys, support for new business models, etc.

We usually conduct interviews with multiple stakeholders from various insurance teams (policy managers, underwriters, loss adjusters, etc.) to obtain a comprehensive insight into their pains and needs and accurately determine and prioritize the insurance areas subject to transformation.

Step 2.

Designing the insurance digital transformation strategy and plan

At ScienceSoft, this stage covers:

- Creating a custom digital transformation strategy focused on achieving the insurer’s high-priority objectives and building the foundation for long-term evolution.

- Dividing the long-term DT goals into clear short-term objectives and determining a set of time-framed initiatives to achieve these objectives.

- Introducing a step-by-step action plan, which may include:

- Planning the required modifications of the existing IT infrastructure (cloud migration, IT automation, implementation of advanced cybersecurity tools, etc.) and legacy insurance software (rearchitecting, code refactoring, tech stack modernization, implementation of new functional modules).

- Preparing a feature set for the new insurance software, including capabilities powered by advanced techs (AI, big data, blockchain, etc.).

- Designing a secure, scalable, high-performing architecture for the insurance software.

- Creating a plan of integrations with corporate solutions (e.g., CRM, accounting software), external services and tools (mail services, user authentication services, etc.), third-party systems (bank systems, insured asset tracking systems, etc.).

- Designing role-specific UX and UI of insurance applications (e.g., for insurance agents, underwriting professionals, customers, vendors, etc.).

- Selecting a best-fitting tech stack to implement the project.

- (optional) Developing a proof of concept to assess the viability of innovative insurance software (e.g., for usage-based insurance pricing or intelligent claim prevention).

We value our clients’ money and always strive to find opportunities to optimize project costs. For example, we rely on low-code development where feasible — it brings up to a 70% reduction in the development cost. We also employ reliable prebuilt software components (ready-made logic blocks, OOTB UI components, open-source APIs, etc.) to reduce the expenses on custom development and speed up digital transformation.

Step 3.

Project planning

At this stage, ScienceSoft delivers a detailed project plan that comprises:

- Project deliverables, timelines, budget, and ROI estimates (at the level of the entire project and each particular transformation initiative).

- Critical milestones, objectives, and KPIs.

- The project team and collaboration workflows.

- A change management plan for the gradual implementation of DT initiatives, employee training, and smooth transition to the digital servicing workflows.

- A risk mitigation strategy and plan.

Step 4.

Step-by-step digital transformation

At this stage, ScienceSoft’s team implements the planned digital insurance transformation initiatives, which may comprise:

- IT infrastructure modernization: migration to the cloud, tech stack revamp, etc.

- Implementing IT automation: CI/CD pipelines, container orchestration, cloud automation, etc.

- Insurance software development or revamp of the legacy insurance solution(s).

- Quality assurance of the insurance software (functional, usability, performance, security testing, and more).

- Integration with relevant internal and third-party systems (CRM, accounting software, a BI solution, etc.).

- Implementing advanced insurance analytics, incl. designing, training, and fine-tuning AI models.

- Data migration from the previously used insurance tools.

- Automated deployment of insurance software to the production environment.

- (optional) Continuous support and evolution of insurance software.

Step 5.

Employee training

ScienceSoft’s experience shows that user adoption is one of the major factors defining the success of large-scale DT initiatives. To encourage your insurance teams to adopt the digital transformation and help them smoothly shift to the new tech-driven workflows, our experts:

- Conduct employee training in your preferred format (remote, in-person, hybrid).

- Draw up user training materials and user manuals and provide them to your IT team for in-house employee training.

Get Expert Help With Digital Transformation in Insurance

ScienceSoft relies on decades-long experience in digital transformation projects and deep practical knowledge of the insurance IT domain to provide:

Why Trust Your Insurance Innovation Project to ScienceSoft

-

Since 2012 in engineering custom solutions for the insurance industry.

-

IT consultants experienced in large-scale digital transformation projects for Fortune 500 companies.

- Principal architects with hands-on experience in designing complex insurance automation systems.

- Project management office to lead complex transformation projects that involve distributed teams and multiple vendors.

- Compliance experts with 5–20 years of experience to guarantee insurance software compliance with the required standards and regulations.

- Proficiency in advanced technologies: AI/ML (since 1989), big data (since 2013), IoT (since 2011), blockchain (since 2020).

- Since 2003 in cybersecurity to ensure world-class protection of insurance IT systems.

Our awards, certifications, and partnerships

Typical Roles on ScienceSoft’s Insurance Digitalization Teams

Digital Transformation Consultant

Analyzes the insurance business challenges and needs, creates an individual digital transformation strategy and plan, evaluates the feasibility of each DT initiative, and advises on risk mitigation activities.

Project Manager

Plans the insurance innovation project, coordinates the team(s), monitors project progress, reports to the stakeholders, and initiates changes to boost teamwork efficiency, prevent risks, and drive better DT outcomes for the client.

Compliance Consultant

Analyzes the applicable legal requirements, advises on the compliance policies to set up, creates the compliance framework, and participates in the design and QA of the newly implemented or modernized software.

Solution Architect

Designs the insurance IT ecosystem, software, and integration solutions. Rearchitects legacy insurance tools. Suggests the optimal tech stack for insurance DT.

UX Designer

Performs UX research for the employee- and client-facing insurance apps, drafts UX wireframes, and adjusts them during UX testing.

UI Designer

Transforms the final UX wireframes into the insurance app’s UI design mockups, and adjusts the mockups following stakeholder and user feedback.

DevOps Engineer

Designs and configures CI/CD pipelines, sets up and continuously optimizes cloud automation environment, participates in configuring the IT infrastructure.

Front-End Developer

Delivers the interface of insurance software, fixes the issues reported by the QA team.

Back-End Developer

Delivers the server-side code of insurance software, establishes the required integrations, fixes the issues reported by the QA team.

Data Scientist

Designs, trains, and tunes the advanced insurance analytics models. Balances the accuracy of model outputs against the requirements for model explainability to meet regulatory standards.

QA Engineer

Designs and implements a test strategy, a test plan, and test cases to assure the quality of insurance software, reports software defects, and validates fixes.

User Support Specialist

Conducts user training and performs after-launch troubleshooting to ensure the smooth adoption of new digital tools and avoid business disruptions.

|

|

|

NB! Depending on the project specifics, ScienceSoft can involve additional talents, for example, blockchain developers to build smart contracts for insurance. |

Sourcing Models for Digital Transformation of Insurance

Advanced Technologies to Boost the ROI for Digital Insurance Transformation

ScienceSoft’s experts select and implement the best-fitting advanced techs for each particular case to bring additional value across the insurance workflows.

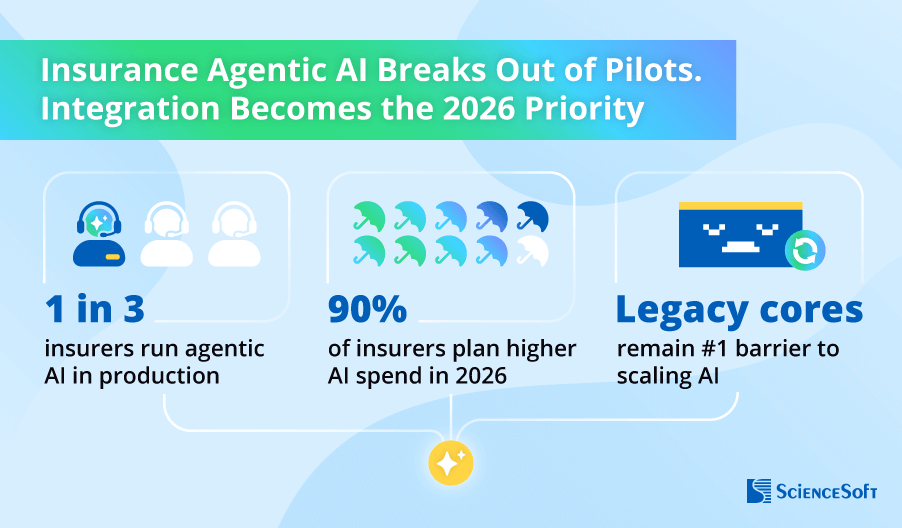

See How Agentic AI Transforms Insurance Claims

Watch how ScienceSoft’s custom AI agent applies voice intelligence and advanced sentiment analysis to uncover fraud during conversational claim verification. Built on AWS Bedrock AgentCore and powered by OpenAI’s leading LLMs, the agent boosts investigator capacity by over 40% and drives 20%+ higher fraud detection rates through nuanced discrepancy indicators.

Costs of Digital Transformation in Insurance

From ScienceSoft’s experience, an insurance digital transformation project for a midsize company may cost around $200,000–$5,000,000+, depending on the scope and complexity of process innovation and the maturity of the company’s existing IT ecosystem.

Major factors that affect the insurance transformation budget and duration are:

- The number and specifics of the insurance areas to transform.

- The possibility to reuse legacy insurance software and IT infrastructure components.

- The functional complexity of new software.

- Performance, availability, scalability, security, and compliance requirements.

- The number and complexity of integrations.

- The number of user roles and role-specific UX and UI requirements.

- The required complexity of insurance analytics.

- The chosen sourcing model and team composition.

Here are sample costs for the digital insurance transformation projects:

$200,000 (one-time)–$500,000/year, spread across 2–3 years

Digital transformation of a particular insurance area, e.g., underwriting or claim management.

$500,000/year–$1,000,000/year, spread across 3–5 years

Digital transformation of the core service operations of a lower midsize insurance business ($50M–$500M in revenue).

$700,000/year–$1,500,000/year, spread across 3–5 years

Digitalization of the core operational areas of an upper midsize insurance company ($500M–$1B+ in revenue).

Learn the Cost of Your DT Project

ScienceSoft’s team is ready to provide a custom quote for your specific case.

Insights From ScienceSoft's Insurance IT Experts

Featured Expert Talk

AI Agents for Insurance Claims Fraud Detection | Presentation at ITS 2025

Presentation by Vadim Belski, Head of AI and Principal Architect at ScienceSoft, from the 2025 Insurance Transformation Summit in Boston. Vadim explores how agentic AI can drive digital transformation in insurance claims and demonstrates how voice AI agents can improve fraud detection through conversational claim verification.

About ScienceSoft

ScienceSoft is a global IT consulting and software engineering company headquartered in McKinney, Texas. We provide end-to-end digital transformation services to help insurance companies innovate their business processes. In our digital transformation projects, we employ mature quality management and data security management systems backed by ISO 9001 and ISO 27001 certifications.