Insurance Software Development Services

Since 2012, ScienceSoft has been working side by side with insurers to co-create software that streamlines unique insurance workflows and supports innovative business models.

Insurance software development services are a way for insurers to get tailored digital solutions that improve operational efficiency, increase customer loyalty, and help expand a client base while keeping TCO lower than off-the-shelf tools.

ScienceSoft delivers robust insurance software that automates processes like underwriting, claim management, and policy administration and introduces seamless digital experiences for insurers’ customers, employees, and external partners.

What Makes ScienceSoft a Trustworthy Insurance Software Development Company

- Since 2012 in custom insurance software development.

- Proficiency in engineering solutions with accurate business logic that seamlessly automate even the most complex and specific insurance workflows.

- Hands-on experience in creating software with a future-ready architecture that provides smooth integration with all required data sources and scalability to support business growth.

- Compliance experts with 5–20 years of experience to guarantee insurance software compliance with the necessary regulatory frameworks.

- 45+ certified project managers (PMP, PSM I, PSPO I, ICP-APM) with experience in large-scale projects for Fortune 500 companies to manage complex insurance software initiatives.

Our awards, certifications, and partnerships

Choose the Service Option That Best Fits Your Needs

Consulting on insurance software implementation

We help you define the right functionality, architecture, and tech stack for your solution, ensuring compliance and security from the start. Together, we shape a detailed roadmap with realistic time and cost estimates and a pragmatic risk mitigation plan.

Insurance product consulting

We work with you to design engaging interfaces and seamless user journeys, providing an interactive prototype to quickly test the product’s technical feasibility and usability.

End-to-end insurance software development

We handle engineering end to end — from design to QA and integration — while keeping delivery iterative and transparent. Beyond development, we support you with software documentation, employee training, and ongoing support.

Insurance software modernization

We modernize your existing solution with up-to-date technologies, ensuring smooth adoption and cost efficiency. Our approach shortens the learning curve and minimizes disruption for your teams.

Software to Support Your Ambitious Insurance Initiatives

By insurance type

Various types of insurance differ in the potential volume of workflow automation and pose specific requirements for third-party integrations. To maximize payback from going digital, you need a solution that fully meets your unique service scope.

We deliver tailored software solutions for the following insurance types:

By insurance model

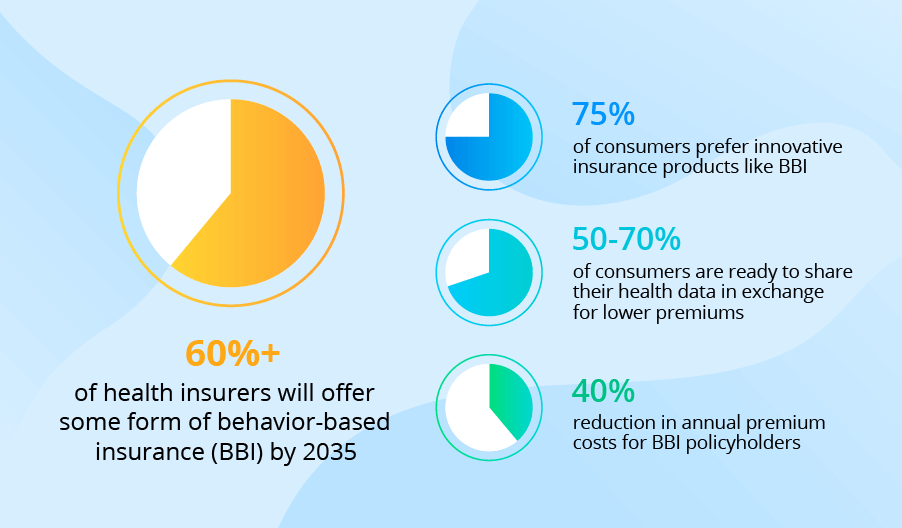

Design your insurance products to meet the rapid pace of cross-industry digital transformation. Those who will be among the first to innovate should expect to win a larger share of younger, tech-savvy audience and see an amazing revenue increase.

We create digital solutions to support innovative insurance models, including:

- P2P insurance

- Microinsurance

- Short-term insurance

- Parametric insurance

- Usage-based insurance

- Pay-as-you-live life and health insurance

The market for embedded insurance solutions evolves rapidly, disrupting traditional policy distribution channels and enabling non-insurance businesses to upscale their products and services with a one-stop insurance offering. Our team can engineer robust embedded insurance software that smoothly integrates insurance flows into the sales process and helps companies introduce innovative customer experiences.

Software That Can Transform All Insurance Processes

Whether you need software to digitalize one specific insurance operation or a multi-functional solution to drive value across the entire insurance ecosystem, we’ve got you covered. The examples of custom insurance software we create include:

All-in-one software that automates the entire insurance cycle for the required product lines. The software offers role-specific interfaces and may include the functionality of a customer portal.

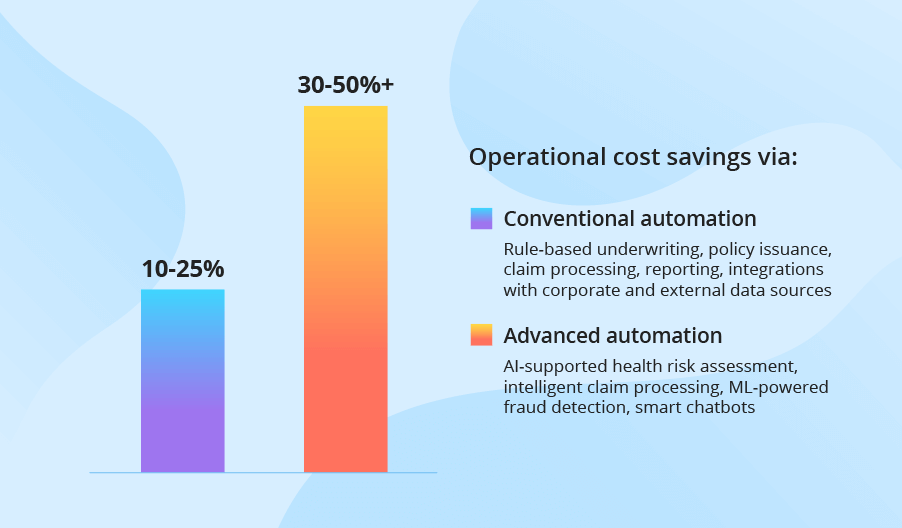

Value: Up to a 50% reduction in employee workload, enhanced team performance, operational cost savings of 10–25%, potentially reaching 30–50% with AI-powered automation.

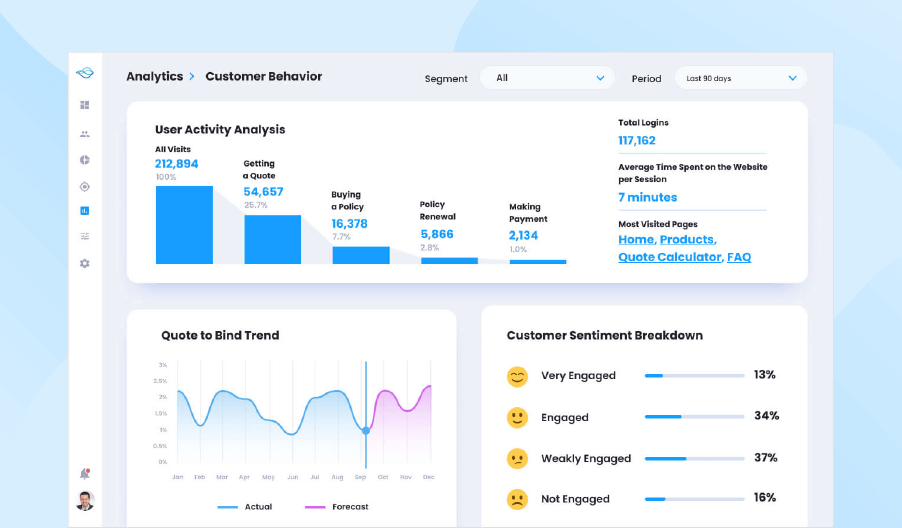

Solutions enabling automated calculation, precise forecasting, and clear visualization of insurance metrics. The software can provide intelligent guidance on optimal insurance-related decisions.

Value: Prompt and accurate identification of inefficiencies and improvement opportunities, 10–20% growth in profitability due to analytics-based decisioning and workflow optimization.

Software that enables automated insurance application processing, risk assessment, and premium calculation. It can provide optimal, analytics-driven insurance pricing.

Value: Up to 40% decrease in underwriting costs, 10–15% increase in revenue due to optimized insurance pricing, and decision-making in minutes rather than days.

Software that automates the entire policy lifecycle, from issuance to termination. It provides rule-based recordkeeping and centralized storage of all policy-related data.

Value: 95% faster policy issuing, updating, and renewal, 40%+ increase in the productivity of the insurance teams, up to 60% reduction in policy administration costs.

Software that offers automated calculation of personalized premiums and customer invoicing. It supports e-signing of invoices and enables real-time processing of multi-currency payments.

Value: Up to 80% decrease in billing-related costs, 2–3x faster billing process.

Software that automates claim management processes end-to-end, from claim data intake to claim settlement and reporting. It enables AI-based claim validation, damage estimation, and fraud detection.

Value: ~30% decrease in claim processing costs, 80%+ faster claim cycle.

Software that introduces seamless digital experiences for insurers’ clients, employees, and suppliers. It automates tedious manual operations, provides secure access to the required data, and offers AI-powered user support.

Value: Improved operational efficiency for the insurance teams, up to 4x faster business processes, higher customer satisfaction.

Web and mobile apps that automate insurance application processing, premium payment, and policy issuance, enable prompt interaction and secure data sharing between the insurers and their clients.

Value: 89% increase in customer engagement and 81% improvement in retention rate, which results in higher revenue.

Software that helps insurance agents easily manage policy sales and marketing campaigns. It automates insurance application processing and policy issuance and provides complete visibility of insurer-customer interactions.

Value: Increased policy sales volume and speed, enhanced customer satisfaction.

Agency management software

Software that enables analytics-based planning and real-time monitoring of agents’ activities. It keeps a full audit trail of agent-customer interactions and provides comprehensive agency performance analytics.

Value: 100% visibility of agency-wide insurance operations, streamlined planning of agents’ workload.

Software that provides a comprehensive toolkit for insurance risk model design and management. It automates actuarial calculations, insurance pricing, and disclosure reporting.

Value: Up to 50x faster actuarial modeling, 1.5–5x increase in the actuaries’ productivity.

Software that streamlines bookkeeping, general ledger management, capital and claim reserve planning, disclosure reporting, and other insurance accounting workflows.

Value: 3x+ improvement in insurance accountants' productivity, up to 12x faster payments, 100% compliant financial reports.

Software that enables real-time evaluation of insurance risks and their impact. Such solutions can be powered with AI to get data-driven guidance on the optimal risk prevention steps.

Value: 360-degree view of company-specific risks, fast and accurate risk mitigation planning.

Insurance compliance management software

Software that enables real-time monitoring of the insurance operations’ compliance with the company’s internal policies and up-to-date regulatory requirements, including local standards.

Value: Enhanced operational transparency, simplified regulatory adherence, minimized compliance risks.

Software that automates insurance-related data validation and enables analytics-based detection of customer fraud and malicious employee activities.

Value: Minimized risks of fraud-associated financial losses.

Insurance marketplaces

Digital platforms that facilitate service promotion for insurers and help customers find the optimal insurance offerings.

Value: An opportunity for the marketplace owner to achieve rapid and high ROI by launching and monetizing a popular insurance solution.

AI-powered copilots used to automate data search and analytics workflows, support insurance teams’ underwriting and claims decisions, and handle routine customer interactions.

Value: 30–110%+ productivity gains for insurance teams, up to 40% reduction in insurers’ operational costs.

Access to the right open finance data lets insurers speed up customer onboarding, improve risk assessment, tailor coverage more precisely, and make real-time claims payouts to customer bank accounts while minimizing fraud exposure and payment failures.

If you want the same benefits, ScienceSoft can connect your quote-to-bind tools, PAS platform, and claims system to trusted data sharing rails like Plaid, Mastercard Open Banking/Finicity, and Yodlee, as well as task-specific APIs, for instance, Canopy Connect for policy verification, PerilPulse for risk scoring, or Middesk for KYC.

Technologies for Custom Insurance Software

Low-code development

AI

Machine learning platforms and services

Machine learning frameworks and libraries

DevOps

Containerization

Automation

CI/CD tools

Monitoring

Blockchain

Smart contract programming languages

Frameworks and networks

Cloud services

Advanced Techs That Can Power Your Insurance Solution

Click on the cards below to explore the advanced technologies ScienceSoft can implement to bring additional value across your insurance workflows.

See How Agentic AI Transforms Insurance Claims

Watch how ScienceSoft’s custom AI agent applies voice intelligence and advanced sentiment analysis to uncover fraud during conversational claim verification. Built on AWS Bedrock AgentCore and powered by OpenAI’s leading LLMs, the agent boosts investigator capacity by over 40% and drives 20%+ higher fraud detection rates through nuanced discrepancy indicators.

Your Benefits From Engineering Insurance Software With ScienceSoft

Follow the links below to explore the descriptions of project management and engineering practices behind our success-driven approach to insurtech software development. If you're wondering how ScienceSoft's practices will work in your case or have any other questions about your endeavor, feel free to contact our consultants.

Cooperation model that fits your needs

- Full outsourcing of insurance software development.

- A dedicated team to take over a part of your project.

- Team augmentation with our best talents (from 0.5 to 150+ FTEs).

- Selecting the best-fitting resources for various cooperation scenarios.

- Mature practices of joint planning, decisioning, and problem-solving.

- KPI-based cooperation.

- Regular reporting.

- Consistent knowledge sharing (check sample software documents we deliver).

Prompt and predictable development

- Quick project start (1–2 weeks).

- Accurate scoping and cost estimation.

- An MVP of insurance software in 3+ months.

- Systematic risk control and mitigation.

- Agile implementation of changes.

- T&M, T&M with a cap for consulting and agile development.

- Fixed price for MVP development.

- Monthly subscription fees for support activities.

achieved by designing a secure architecture for the insurance solution, implementing UBA, multi-factor authentication, authorization controls for APIs, data encryption, and more.

Insurance Software Development Costs

From ScienceSoft’s experience, the cost of insurance software development services may range from $120,000–$180,000 (building a mobile insurance app of average complexity) to $1,000,000–4,000,000+ (creating a large-scale insurance automation system powered with advanced techs).

Want to know how much your insurance software will cost?

Get to Know the Cost of Your Custom Insurance Solution

Please answer a few questions about your business needs to help our consultants estimate the cost of your unique insurance solution faster.

Thank you for your request!

We will analyze your case and get back to you within a business day to share a ballpark estimate.

In the meantime, would you like to learn more about ScienceSoft?

- Project success no matter what: learn how we make good on our mission.

- Since 2012 in insurance IT services: check what we do.

- 4,200+ successful projects: explore our portfolio.

- 1,400+ incredible clients: read what they say.