We engineer robust solutions tailored to your needs and deliver a detailed project plan for predictable implementation.

- Full-cycle engineering of insurance software

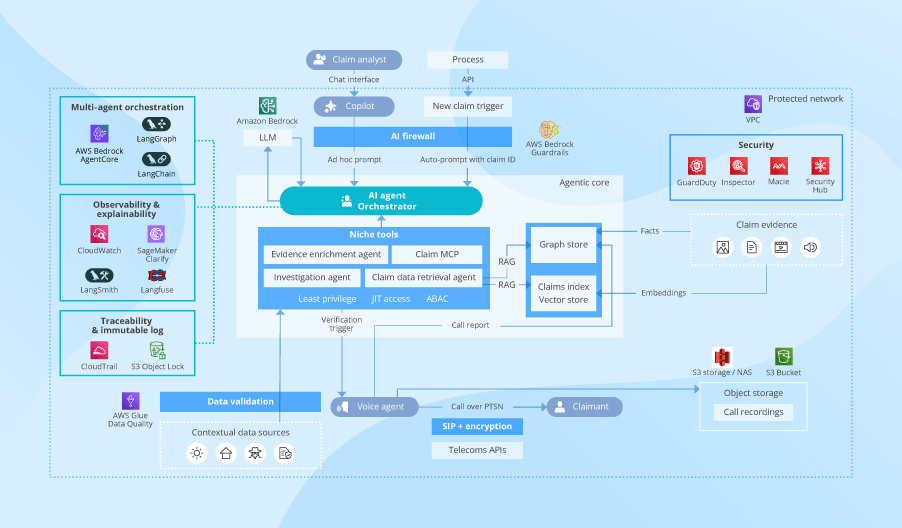

- Architecture design for core insurance solutions and enterprise software

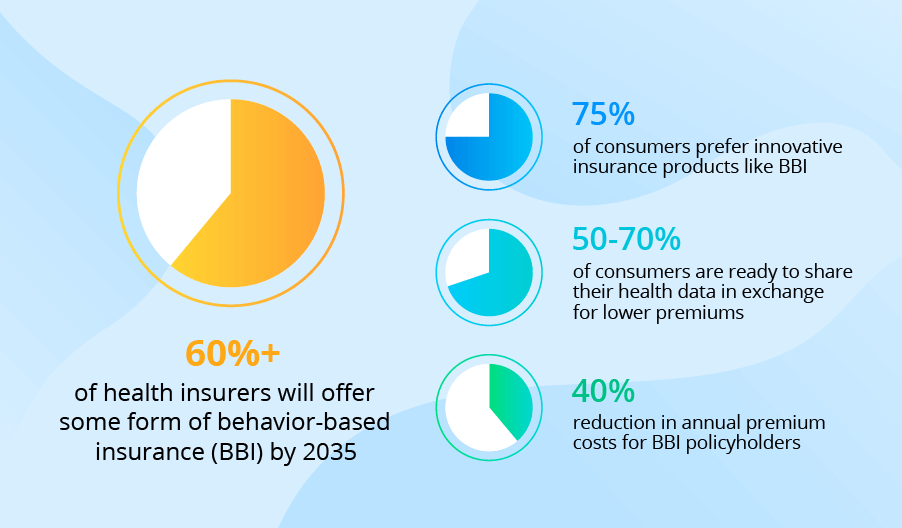

- LLM and GenAI implementation

- Proof-of-concept and MVP delivery

- Software integration, including API development

- Testing and QA for insurance solutions under development

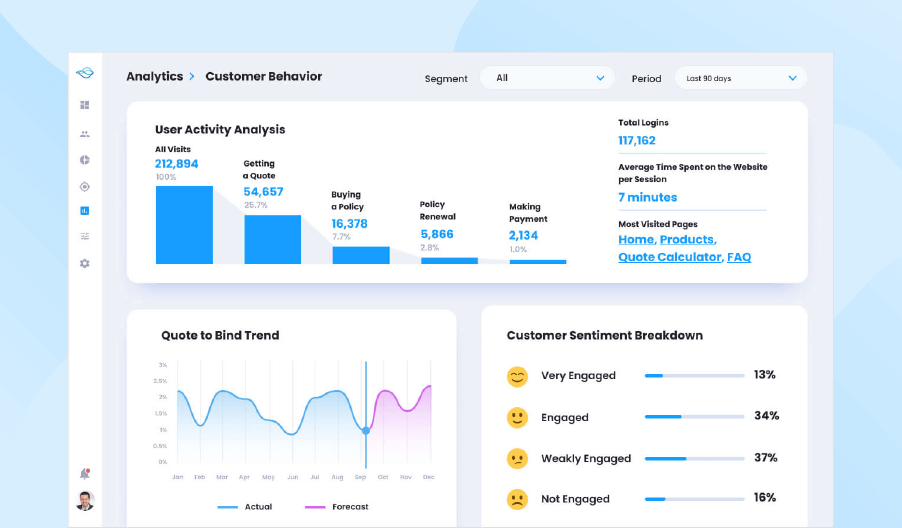

- UX and UI design for insurance apps

- DevOps services for ongoing development projects

- Team augmentation (with software engineers, architects, testers, consultants, PMs, etc.)