Claims Processing Automation

A way to cut claim handling costs by 30%

ScienceSoft applies 13 years of experience in engineering custom insurance solutions to help insurers establish effective, compliant automation of their claim management processes.

Main Claim Processing Tasks to Automate

Claim validation

Get fast and accurate claim verification with the help of robotic process automation (RPA), machine learning (ML), large language models (LLMs), and agentic AI technologies. Employ advanced analytics to spot fraudulent claims and prevent illegitimate payouts.

Loss estimation

Harness the power of AI/ML, big data, IoT, and image analysis technologies to automatically collect and process contextual data on loss events, enable remote damage inspection in complex environments, and get precise data-driven damage assessment.

Claim settlement

Set custom flows and apply intelligent automation to get accurate claim triaging, straight-through settlement for standard cases, and quick payouts according to pre-agreed schemes.

Customer interaction

Rely on AI-powered virtual assistants to automate claim-related personalized customer interactions via the policyholder’s preferred method of communication.

Did you know?

In its recent research, Capgemini names insurance claim processing among the primary BFSI automation use cases that deliver high value with a short payback. According to Accenture, while only 44% of claims executives say their organizations are mature in the use of automation and AI/ML, 80% believe that techs can power each area of the claims value chain. Unsurprisingly, insurers globally accelerate investments in claim automation, with 65% planning to invest over $10M into cognitive automation by 2025.

How to Automate Claim Processing

|

|

Market-available insurance suite |

Ready-made automated claims processing software |

Custom claim processing system ScienceSoft recommends |

|---|---|---|---|

|

Essence

|

Implementing an all-in-one insurance software product that includes digital claim processing capabilities. |

Implementing an off-the-shelf claims automation tool, which usually features RPA-based processing of claim documents, rule-based claim approvals, scheduled compensation payments, and automated loss reports. |

Engineering custom claims processing automation software to get all necessary capabilities, support all required insurance models, and achieve 100% compliance with all relevant legal frameworks. |

|

Pros

|

Establishing a cohesive insurance automation environment. |

A quick and budget-friendly way to automate claims for insurance SMBs. |

Fully tailored functionality. The ability to leverage value-adding techs. On-demand scalability. Controllable security. Cost-effective integration with all necessary systems, including legacy software and IoT solutions. |

|

Cons

|

High licensing/subscription cost due to a wide scope of covered insurance areas. Chances to obtain a large share of unnecessary features. Limited integration capabilities. Risks of vendor lock-in. |

Pre-defined features and integrations. Customization to support specific insurance types can be costly or impossible. May not provide compliance with your local insurance standards. Security fully depends on the vendor’s cybersecurity practices. |

Custom design requires additional time and investments. |

|

TCO components

|

Setup costs + customization and integration costs + licensing/subscription fees. |

Setup costs + customization and integration costs + ongoing subscription fees that scale with the number of users. |

Upfront investments in software design and development. Lower TCO in the long run. |

Which Claims Automation Option Fits Your Needs Best?

Answer a few simple questions and find out whether you should go for a custom system or a pre-built tool.

Do you need to automate claim processing for specific or innovative insurance types, e.g., mortgage, crop and livestock, professional liability, kidnap and ransom, pay-as-you-live, or usage-based auto insurance?

Do you need to automate specific claim processing tasks, e.g., claims triaging based on custom rules, damage evaluation based on location-specific factors, or claim payment under individual payout schemes?

Do you want AI-assisted claims automation, e.g., to process multi-format claim data (incl. handwritten text, videos, and IoT big data), accurately spot fraud, and get prescriptions on adequate compensation amounts?

Do you want to leverage value-adding insurtech features, e.g., claim filing using augmented reality models, computer-vision-supported damage inspection, or smart-contract-based claim payments?

Do you need claim processing software providing compliance with the latest insurance regulations of the regions you operate in?

Do you need to integrate your automation solution with multiple back-office systems, legacy tools, or IoT-enabled asset tracking software?

Do you need a solution offering advanced cybersecurity mechanisms (e.g., intelligent detection of cyber threats and instant enforcement of protective measures)?

Do you need a claims solution with various interfaces for different roles (e.g., claims specialists, loss adjusters, customers/brokers, damage handling service providers)?

Do you plan to upgrade the automation solution with new functional and non-functional capabilities in order to adjust it to evolving business and legal requirements?

Do you have large teams involved in claim processing and look to avoid the software fees associated with the per-user subscription model?

Please tell us a bit more about your needs

Answer at least 3 questions to get results.

You can go with off-the-shelf automation software

Looks like market-available tools are a viable option to meet your claims automation needs. Turn to ScienceSoft if you need help with picking the optimal tools, their implementation, customization, or integration with your existing systems.

You definitely should consider custom development

A custom claim automation solution will help you reap the unique benefits that market-available software cannot offer. Turn to ScienceSoft to get a detailed assessment of a custom system’s feasibility for your business situation.

Custom claim processing software is your best choice

Looks like market-available automation tools don’t fit your specific requirements and won’t be able to provide the expected operational and economic feasibility. Turn to ScienceSoft to get a free consultation on custom claim processing software and receive cost and ROI estimates.

Key Features of a Claims Processing Automation System

In ScienceSoft's insurance claim automation projects, we create solutions with functionality bound to each client’s unique claim management needs. Below, our consultants list the core features most commonly requested by our clients:

Agentic Claims Automation: The New Frontier for Insurers

AI agents are transforming complex, judgement-heavy claim processes that once required extensive human effort. Watch the presentation by ScienceSoft’s Vadim Belski, Head of AI, from the 2025 Insurance Transformation Summit in Boston to explore the potential of agentic AI for insurance claims automation and see our custom claim validation AI agent in action.

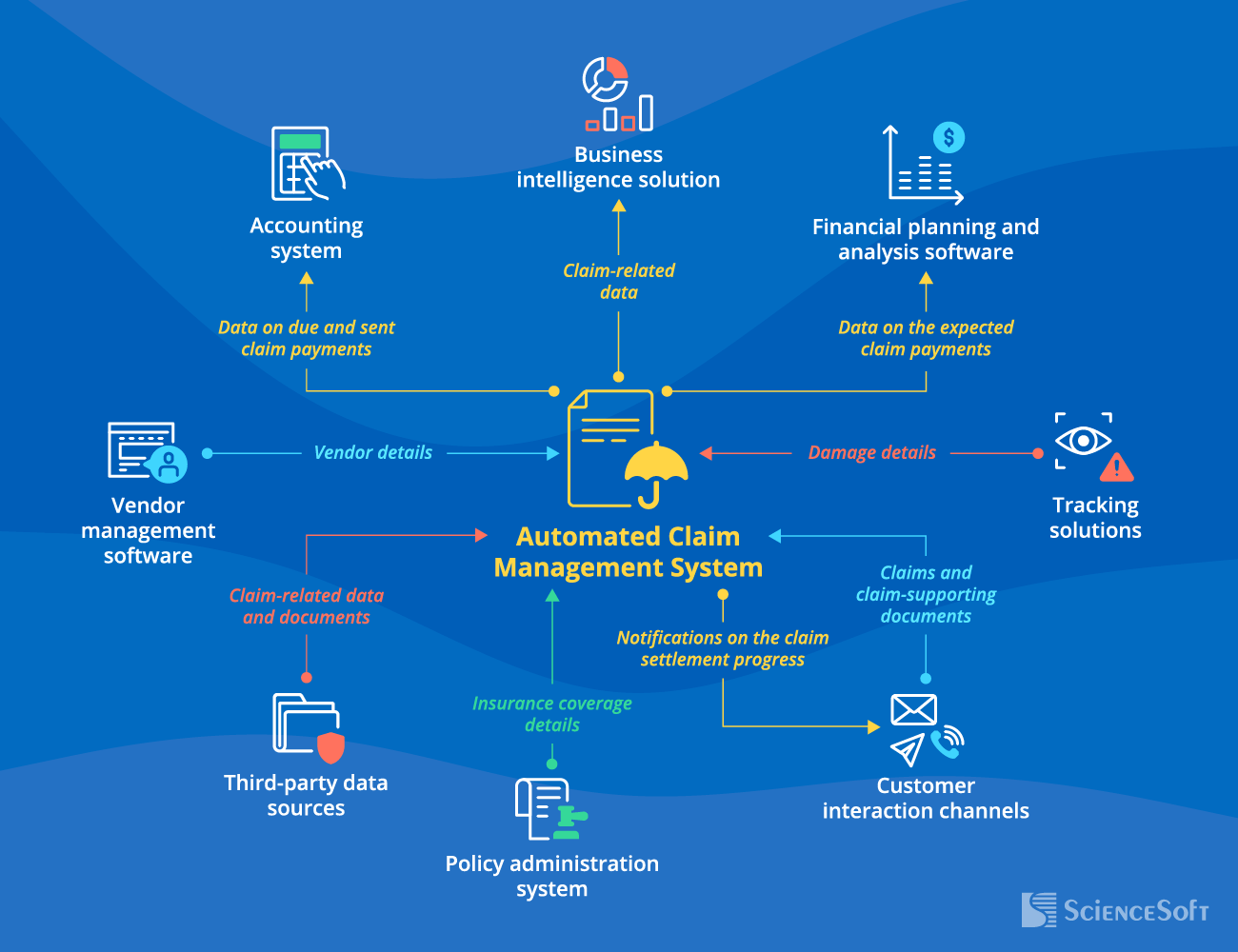

Essential Integrations for an Automated Claims Processing System

Integrating claim processing software with the relevant internal and third-party systems helps elevate the degree of automation and improve the accessibility of claim-related data. ScienceSoft recommends setting up the following integrations:

- Customer interaction channels (a customer portal, email services, messaging services, a business phone system, etc.) — for instant claim aggregation and facilitated claim status reporting to customers.

- Policy administration system — for streamlined claim validation.

- Third-party data sources (internal systems of local medical information bureaus, police administration, etc.; data services of verified providers like Canopy Connect, MeasureOne, Axle, Nearmap, Jumio) — for data-driven claim decisioning and damage assessment.

- Asset tracking solutions (asset monitoring software, including IoT systems and computer vision systems, of commercial customers and maintenance providers; consumer wearable apps) — for fast and precise damage estimation.

- Vendor management software — for prompt selection of optimal health and repair service providers to recommend to policyholders subject to damage.

- Accounting system — for automated recording of claim payment transactions in the general ledger.

- Financial planning and analysis software — for accurate planning of claim handling expenses.

- Business intelligence solution — for comprehensive claim analytics and reporting.

Success Factors for Claim Process Automation

According to McKinsey, RPA-enabled process automation alone can bring up to 200% annual ROI. Additionally, covering the following important factors will help you drive even higher payback from automating your claim management operations.

AI-powered analytics

To leverage automated claim and evidence processing and claim triaging, quickly detect fraudulent claims, and get intelligent claim decision-making support.

Integration with multiple data sources

To verify claims and evaluate damage with full insight into the claim case details, customer behavior, and external conditions.

System scalability

To smoothly process abnormally large volumes of claims caused by external factors (e.g., claim handling during natural disasters or spikes of the COVID-19 pandemic).

Compliance shouldn't be an afterthought

Make sure your automated claim processing system meets all necessary regulatory frameworks by design and can be easily evolved to adapt to frequent changes in regulatory requirements.

Claims Processing Automation Costs

Implementing claims automation for a midsize insurance company may cost around $200,000–$500,000+, depending on the scope and complexity of an automated claim processing system.

Below, we provide the approximate cost estimations based on ScienceSoft's experience in claim management automation projects:

$200,000–$400,000

Development of a custom automated claims processing software of average complexity.

$500,000+

Building a comprehensive custom claim processing system powered with advanced techs.

|

|

|

|

|

|

|

NB! If you don’t have specific requirements for the UX and UI design, ScienceSoft suggests building your claim processing automation system based on a low-code platform (e.g., Microsoft Power Apps). Our experience shows that this option helps reduce the development cost by up to 70%. |

|

|

|

|

Key Benefits of Automated Claims Processing

Faster claims processing

Automation drives around an 80% reduction in claim processing time, enables insurers to cut the turn-around time for claims recovery by over 30%, and helps establish 85%+ faster claim reporting flows.

Accurate fraud detection

According to the FBI, 5–10% of non-health insurance claims are fraudulent, costing more than $40 billion annually for US insurers alone. Employing IA for claims validation can help insurers achieve 95% accurate fraud detection and avoid financial losses.

Higher back-office efficiency

Automated claims solutions offer straight-through processing for more than 50% of claim cases, eliminating lower-value claim specialists’ tasks and bringing a 25–35%+ increase in the team’s productivity.

Reduced operational expenses

By automating claims, insurers benefit from around a 30% decrease in claim processing costs due to removed operational waste and better team performance. Employing an AI-powered solution can bring over a 70% increase in claims process cost efficiency.

Enhanced customer experience

Digital claims systems cater to claimants’ needs more precisely so that customers can get convenient self-service options, 24/7 support, and faster claim resolution. For insurers, this means delivering better customer experiences and achieving a 10–15-point increase in CSAT.

Claims Processing Automation With ScienceSoft

In insurance software development since 2012, ScienceSoft provides comprehensive consulting and engineering services to build robust automated claims processing solutions.

Our awards, certifications, and partnerships

About ScienceSoft

ScienceSoft is a global IT consulting and software engineering company headquartered in McKinney, Texas. Since 2012, we have been helping insurance companies implement effective claim processing automation. Being ISO 9001- and ISO 27001-certified, we apply a mature quality management system and guarantee that cooperation with us does not pose any risks to our clients’ data security.