Lending Software Development Services

In lending IT since 2005, ScienceSoft provides full-cycle consulting and engineering services to help lenders and lending software product companies create reliable loan management solutions.

We deliver secure, compliant software that enables flawless automation of lending operations, offers comprehensive analytics, and ensures smooth user experiences.

Lending software development services are a way for credit providers to get efficient, secure solutions tailored to their exact workflows across loan management, risk assessment, debt collection, customer service, and beyond.

Unlike ready-made lending tools, custom solutions offer full alignment with the lender’s business processes, smooth integration with existing systems, and the flexibility to adapt to evolving regulatory and market demands.

Why Develop Lending Software With ScienceSoft

-

Since 2005 in engineering custom solutions for the lending industry.

- Practice-proven expertise in building lending software with complex financial logic that smoothly handles the most complicated and specific lending operations and ensures the accuracy of loan-related calculations.

- Principal architects with hands-on experience in designing complex lending solutions and driving secure implementation of advanced techs (AI/ML, blockchain, big data).

- IT consultants and project managers with experience in long-term digitalization projects for Fortune 500 companies.

- In-house compliance experts with 5–20 years of experience to guarantee lending software compliance with CCPA, CECL, CCAR, FCRA, FCBA, ECOA, FDCPA, GDPR, other required global and region-specific regulations.

- Since 2003 in cybersecurity to ensure world-class protection of lending software.

Our awards, certifications, and partnerships

Lending Software Use Cases ScienceSoft Specializes In

Consumer lending

- Instant processing of consumer loan applications.

- Fast, analytics-based loan decision-making.

- Facilitated payment collection and debt recovery enabled by robust process automation.

- Convenient omnichannel communications with borrowers.

Commercial lending

- Streamlined origination and servicing of various business loans, including syndicated and multi-entity loans.

- Intelligent assessment of business credit risks.

- Full traceability of commercial lending operations.

- Simplified compliance with the required regulations.

- Fast generation, secure sharing, and scalable storage of large-volume mortgage documents.

- Automated calculation of mortgage-associated fees.

- Streamlined collateral management, mortgage close, servicing, and foreclosure processes.

- Automated mortgage loan trading.

Alternative lending

- Highly accessible and cost-effective peer-to-peer loans with no middleman services.

- Fast access to funds for borrowers and attractive investment opportunities for lenders.

- Automated microlending and microfinance.

- Support for DeFi loans to reach the global audience, ensure lending transparency, and simplify repayments.

Lending Solutions ScienceSoft Delivers

We provide full-cycle consulting and engineering services to help companies build specialized lending solutions for automating particular operations or implement fully-featured loan management systems to transform the entire lending process.

- Automated borrower onboarding and pre-qualification.

- Automated processing of loan applications and borrower documents using robotic process automation (RPA), intelligent image analysis, and large language models (LLMs).

- AI-powered assessment of borrower credit risks.

- Configurable loan terms (max amount, duration, interest rate, collateral type, etc.) for various borrower segments.

- Automated loan limit and collateral management workflows.

- Intelligent recommendations on loan approval or decline.

- Automated generation of loan agreements.

- E-signing of the lending documents.

- Automated transfer of the approved funds to borrowers.

Business impact: over 2–25x faster loan origination, 15–20% increase in the loan origination volume with no additional staff, 20% decrease in operational costs, improved accuracy of loan-related decisions.

Credit scoring software

- Automated data aggregation from credit bureaus and alternative data sources.

- Borrower creditworthiness assessment using traditional and alternative scoring models.

- AI-powered predictive risk analytics.

- Real-time credit score calculation and updating.

- Detailed credit score reports with insights on key influencing factors.

- Regulatory compliance checks for scoring processes.

- Automated detection of credit scoring fraud.

Business impact: 10–30% improvement in credit decisioning accuracy, an up to 15% increase in loan approvals without taking additional risks, 40–70% manual scoring processes eliminated.

- Template-based creation of loan amortization schedules.

- Automated calculation of monthly principal and interest amounts and other loan-associated fees.

- Scheduled generation of invoices on due loan repayments and sending them to borrowers.

- Real-time tracking of loan repayments by status (received, due, past due).

- AI-supported assessment of loan portfolio risks.

- Automated workflows for loan extension, restructuring, refactoring, etc., upon the request from a borrower.

- Automated loan reporting to the required regulators in the compliant format (e.g., Metro2 format).

Business impact: Up to 300% increase in the productivity of loan servicing teams, 30%+ shorter loan cycle, minimized credit risks, compliant loan reporting.

- AI-based suggestions on the optimal collection strategies for particular debtors and debtor segments.

- Scheduled and ad hoc omnichannel reminders on due loan repayments.

- Rule-based assignment of debt collection tasks to the debt recovery team members.

- Monitoring the debt collectors’ performance and debt recovery progress in real time.

- Forecasting cash inflow and delinquency rate based on the analysis of borrower performance.

- (for mortgage providers) Automated forbearance and foreclosure workflows in case of a mortgagee’s inability to repay debts for a particular period.

Business impact: Up to 65% reduction in debt collection costs, 8x faster debt collection processes, 40%+ cut in DSO, 20% decrease in bad debt.

- Scenario modeling and what-if analysis for various loan pricing strategies.

- Real-time monitoring of competitors’ loan prices across relevant public sources.

- AI-powered analysis and optimization of loan prices.

- Automated calculation of prices for various types of loans based on a user-defined pricing strategy.

- User-defined rules for loan price segmentation.

- Scheduled and ad hoc updates of loan prices across the customer-facing platforms.

Business impact: 1–8% increase in profitability, more than 3x faster loan repricing, enhanced visibility of the loan price performance.

Lending CRM

- Centralized borrower profiles showcasing customer interactions and loan history.

- Automated lead capture and borrower potential scoring.

- Borrower data and document management.

- AI-powered suggestions on cross-selling and upselling opportunities.

- Rule-based borrower segmentation for targeted marketing campaigns.

- Automated borrower follow-ups and reminders.

- Real-time performance dashboards and reporting for loan officers.

Business impact: up to 30% improvement in operational efficiency, 20–25% higher lead conversion rates, enhanced borrower engagement.

- Criteria-based search of the best-fitting loan offerings for borrowers and investment opportunities for lenders.

- A comprehensive loan calculator for borrowers.

- Automated loan underwriting and servicing processes.

- Instant processing of loan-related payments, including payments for the platform services.

- End-to-end traceability of P2P lending activities.

- Trend-based forecasting of P2P lending demand and financial gains from the platform operations.

- (for blockchain-based P2P lending software) Immutable record and full traceability of lending transactions.

Business impact: An opportunity for P2P lending companies to achieve prompt and high ROI with a highly demanded lending solution.

- Automated generation and submission of loan applications.

- Automated loan repayments via the selected payment method.

- End-to-end audit trail of the user account activities.

- Geography-based KYC/AML verification for the app users.

- Multi-factor authentication, including biometric authentication (e.g., facial or fingerprint recognition).

- AI-powered fraud detection.

- Instant messaging.

- An AI-powered chatbot to help users solve technical, transactional, and security issues.

Business impact: Increased customer satisfaction and the opportunity to expand the client base, which results in higher financial gains from lending activities.

Loan marketplaces

- Criteria-based search of the fitting loan offers for borrowers.

- Dynamic comparison of loan terms across multiple lenders.

- AI-powered analysis of borrower profiles and personalized advice on the best-fitting loan options.

- Automated loan application submission and tracking.

- Lead management and loan processing features for lenders.

- Lender-side demand analytics to track offer performance.

- Borrower and lender ratings.

Business impact: an opportunity for the marketplace owner to achieve rapid and high ROI by launching and monetizing a popular lending solution.

Early adopters of AI-powered lending software report up to 70% reduction in operational expenses, a more than 80% improvement in credit risk assessment accuracy, and an up to 35% increase in loan origination volume. To help our clients reap comparable benefits, we can power lending solutions by advanced analytics, natural language processing, generative intelligence, image analysis, and other AI-fueled technologies — without trading off security and compliance.

Benefits of Lending Software Engineering With ScienceSoft

Accurate software logic

Through close collaboration with domain experts, we translate lending rules into precise, reliable software logic. Our QA engineers rigorously test the solution to make sure it runs exactly as intended. We never use obsolete components that may put lending software precision at risk.

Software longevity

We rely on flexible modular architectures (SOA, microservices) and prioritize maintainable techs that enable easy lending software evolution and provide scalability to process growing transaction volumes. You get an adaptable, future-ready solution your business won’t outgrow.

User-centric UI/UX

We prioritize intuitive interfaces and frictionless user journeys to ensure smooth experiences for lending employees and borrowers. Every application screen is optimized to prevent errors, boost productivity, and drive user adoption.

High ROI with advanced techs

With a broad track record in cloud, AI/ML, big data, blockchain, we can assist in selecting and implementing value-adding technologies that can further drive the software's ROI for your specific lending management processes.

Focus on security

We implement intelligent fraud detection, multi-factor authentication, authorization controls for APIs, and other powerful cybersecurity mechanisms to ensure the protection of your lending solution and the sensitive data it stores.

Rapid development

We can provide an MVP of lending software in 3+ months and consistently grow it to a fully-featured solution with major releases every 2–4 weeks. We guarantee project start in 1–2 weeks and apply our established Agile and DevOps practices to ensure fast implementation.

Optimal cooperation model

You can choose the cooperation model that suits your needs best: full outsourcing of lending software development, a dedicated team to take over a part of your development project, or team augmentation with our best talents.

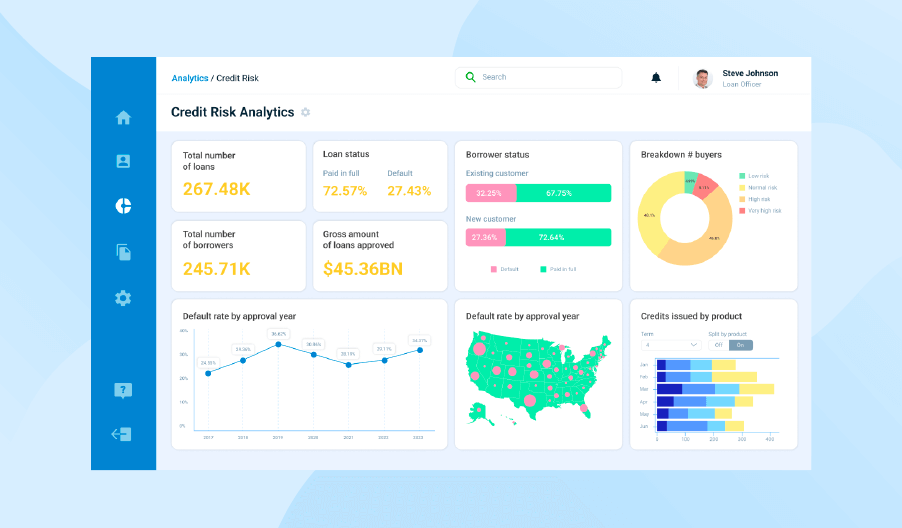

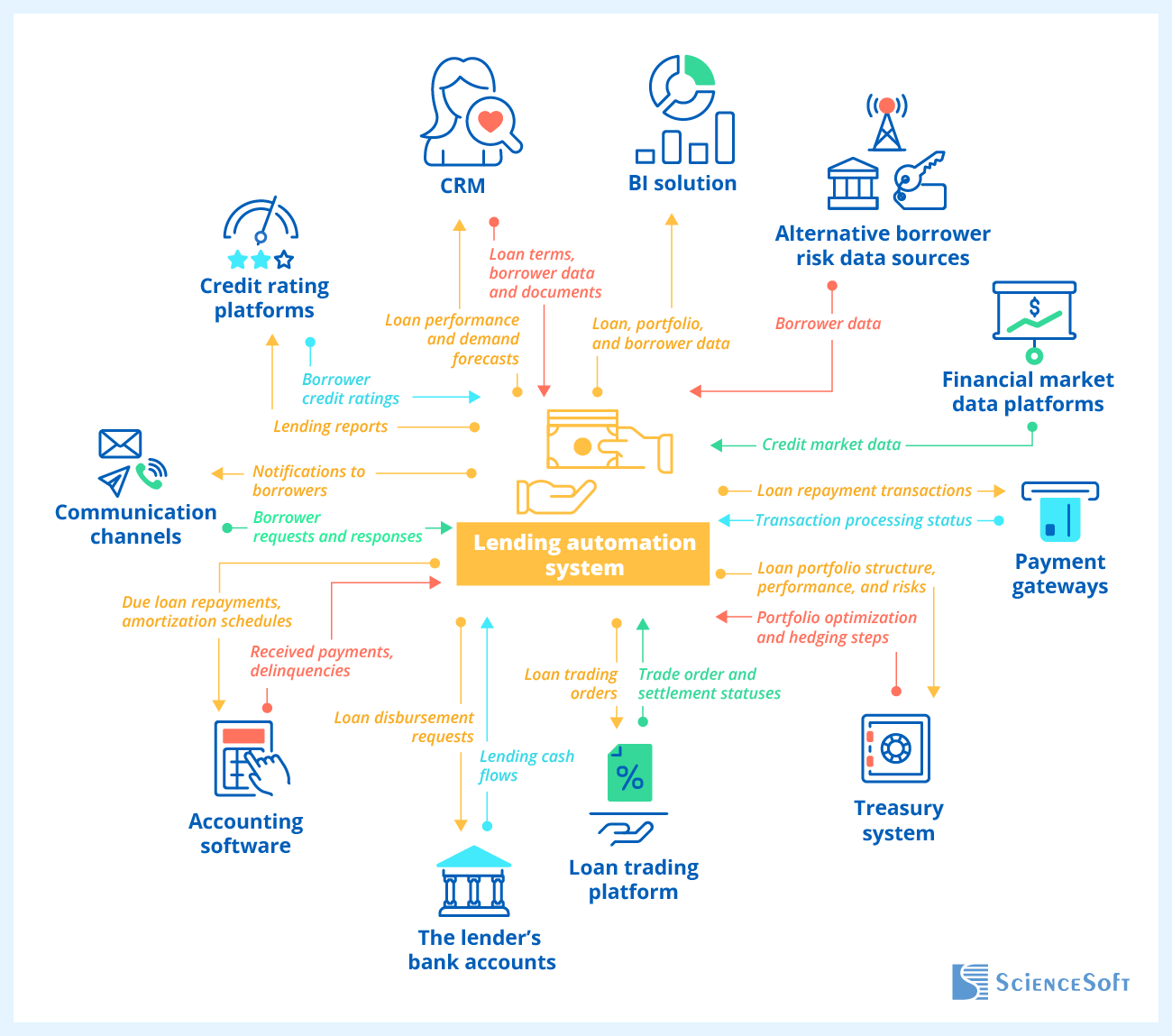

Lending Software Integrations ScienceSoft Helps Establish

Corporate systems

- CRM.

- Accounting software.

- Customer-facing apps (e.g., a customer portal, a company website).

- Business Intelligence (BI) solutions.

- Case-specific systems like treasury software or a core banking system.

External data sources

- Credit rating platforms of credit bureaus (e.g., Experian, Equifax, or TransUnion for the US).

- The lender's bank accounts.

- Financial data marketplaces.

- Loan trading platforms.

- Alternative borrower data sources, e.g., open banking aggregator platforms.

Third-party services

- Payment gateways of banks or independent payment service providers (e.g., PayPal, Stripe).

- Authentication services (e.g., OneLogin, Auth0).

- Messaging, mail, and VoIP, services.

- Employee productivity tools (Slack, Zoom, Trello, etc.).

Advancing Lending Workflows With Broader Data Connectivity

We can connect lenders’ apps and LMS platforms to trusted open banking providers (e.g., Plaid, Envestnet | Yodlee, Mastercard Open Banking/Finicity, MX) to enable instant account verification, cash-flow-based income checks, pay-by-bank payments, and real-time transaction intelligence. These capabilities consistently improve risk scoring accuracy, accelerate approvals, streamline funding flows, and reduce default risk.

We can also build ready-to-use APIs that let lenders and software vendors integrate their products with the internal systems of their clients and partners.

Our Practices to Drive Lending Software Projects to Success

With 45+ certified PMs and project management practices shaped through 36 years in software engineering, ScienceSoft ensures achieving lending project goals despite time and budget constraints and changing requirements. You’re welcome to check the descriptions of our practices backed by examples from our success stories.

If you want to know how our approach will work for your particular case, don’t hesitate to turn to our consultants for the required information.

Project planning

Explore our approach to requirements-based scope mapping, creating a detailed WBS, and planning collaboration flow. We also share our practices to arrange an optimal development team and pick the best-fitting talents.

Get an idea of the variables we factor in to accurately estimate project timelines and costs. The page features our sample cost estimates using various techniques and outlines ScienceSoft’s cost optimization best practices.

Collaborative controls

Check our criteria to measure development success and learn how we organize transparent progress controls in Agile projects. You can also see our sample project health and software quality reports.

Discover the main stages and principles of our structured change request management process, which aims to avoid artificial scope limitation, ensure high-value changes, and prevent scope creep.

Starting from project inception and throughout the entire development journey, we constantly recognize and monitor potential risks. Visit the page to learn our specific risk control and mitigation procedures at each SDLC stage.

Understand ScienceSoft’s intuitive knowledge management process and check the techniques and tools our teams employ for consistent knowledge sharing. You can also explore examples of software documents our clients receive.

Lending Software Development Process

Lending software development is more than just an engineering routine. It requires a well-defined process that ensures smooth, predictable delivery, high software quality, and proactive risk mitigation throughout the project lifecycle.

At ScienceSoft, lending app development process usually looks as follows:

1

In-depth analysis of a customer's business and end user needs, eliciting requirements for lending software (incl. regulatory compliance requirements).

2

3

Project planning: deliverables, success measures, scope of work, team composition, cost and time estimates, risk management procedures, etc.

4

Lending software development: setting up and configuring IT automation environment, back-end and API coding, creating role-specific user interfaces, implementing data storage.

5

(optional) Designing, training, and tuning ML models for lending data analytics.

6

Quality assurance in parallel with coding.

7

Establishing integrations with the required internal and third-party systems, running integration testing.

8

Configuring lending solution's infrastructure, setting data backup and recovery procedures, establishing app and network security mechanisms, and deploying software to the production environment.

9

Knowledge transfer: delivering comprehensive lending software documentation, drawing user training materials, conducting user training in a preferred format.

10

(optional) Continuous support and evolution of lending software.

Get a Cost Estimate for Your Lending Software

Want to know how much your custom lending solution will cost? Please answer a few questions about your needs to help our experts calculate your quote quicker.

Thank you for your request!

We will analyze your case and get back to you within a business day to share a ballpark estimate.

In the meantime, would you like to learn more about ScienceSoft?

- Project success no matter what: learn how we make good on our mission.

- Since 2005 in financial IT services: check what we do.

- 4,200+ successful projects: explore our portfolio.

- 1,400+ incredible clients: read what they say.

Technologies & Tools We Use

In ScienceSoft's projects, we rely on the following tech stack to create reliable consumer and commercial lending software.

Low-code development

AI

Machine learning platforms and services

Machine learning frameworks and libraries

DevOps

Containerization

Automation

CI/CD tools

Monitoring

Blockchain

Smart contract programming languages

Frameworks and networks

Cloud services

Frequently Asked Questions About Lending Software Development

What loan types does lending software help automate?

Custom lending software helps automate all required types of commercial and consumer loans. Some examples are:

- Commercial loans: business lines of credit, term loans, invoice financing and factoring, merchant cash advances, SBA loans (for the US), and more.

- Personal loans: personal lines of credit, unsecured and secured loans for personal needs (e.g., education), Buy Now Pay Later loans, and more.

- Business and consumer mortgage loans.

- P2P crypto loans.

What is the difference between commercial lending and corporate lending?

Commercial lending refers to granting loans to businesses of various sizes and industries to support their operational needs and capital expenditures. Corporate lending is a subset of commercial lending that focuses on providing credit facilities to large enterprises. It typically deals with financing large-scale projects and involves large loan amounts and complex credit agreements.

What impacts lending software development cost and timelines?

Major factors that affect the budget and duration of lending software engineering are:

- The chosen sourcing model (full outsourcing, partial outsourcing, or all in-house).

- The scope and complexity of software features, including AI-powered functionality.

- Non-functional requirements: performance, scalability, availability, security, regulatory compliance.

- The number and complexity of integrations.

- Role-based requirements for UX and UI.

Use our online calculator to estimate the cost for your case.

What is required from a client’s side?

The short answer is, your willingness to communicate openly and share your challenges and needs. We offer tailored collaboration models for various stages of a lending software development life cycle and welcome individually-paced communication forms to meet our clients’ individual expectations. Visit our dedicated page to learn about ScienceSoft’s mature approach to collaboration in IT projects.

Choose Your Service Option

ScienceSoft’s lending management software engineering services are customized to your business needs and can include:

End-to-end lending software development

We promptly design and engineer your lending software, run the necessary quality assurance procedures, and provide after-launch support. You benefit from the software's smooth integration with the required systems. Also, we can conduct user training in a convenient format.

Lending software modernization

We advance the functional and non-functional capabilities of your existing lending solution to help you generate more value with a legacy tool. Compared to software engineering from scratch, you get a modern lending solution faster and at a lower cost.

Consulting on lending software implementation

We introduce the optimal feature set, architecture, and toolkit for your digital lending software and advise on the project cost optimization opportunities. You also get consulting on security and compliance and a detailed implementation plan to minimize project risks.

Lending product consulting

We define a unique selling proposition for your lending product and deliver a clear solution concept. You get convenient UX and sleek UI design to ensure high product value for end users and an interactive prototype to quickly test technical feasibility and usability of your lending software.