Mortgage Process Automation

A Complete Guide

ScienceSoft combines 20 years of experience in mortgage software development with deep practical knowledge of the real estate domain to help mortgage lenders implement effective mortgage automation.

Mortgage Automation in a Nutshell

Mortgage automation helps digitally transform manual, paper-intensive mortgage processes to accelerate the mortgage loan cycle and free up the teams for high-value, strategic tasks.

Mortgage automation systems enable the automated generation and processing of mortgage documents and facilitate document exchange between the parties involved in a mortgage deal. They provide full visibility of transactions and help maintain compliance with the latest legal regulations.

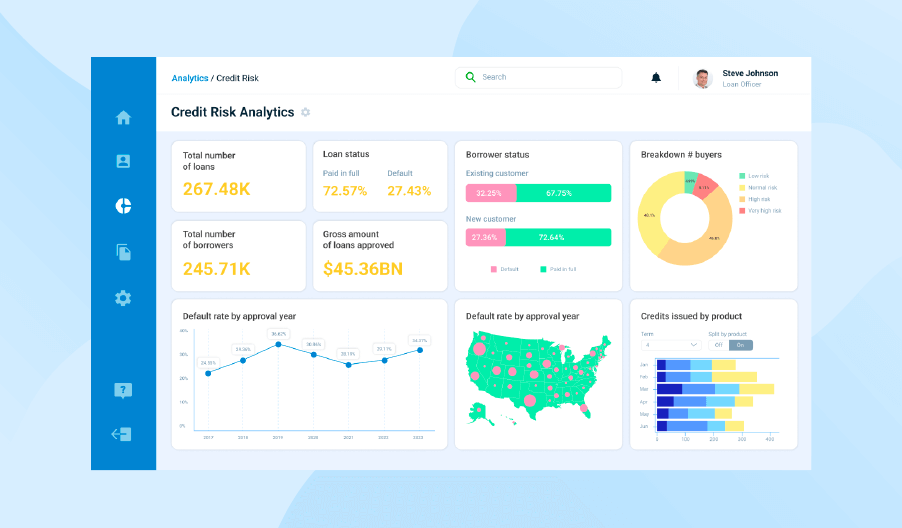

A mortgage automation solution can also provide advanced analytics to ensure accurate mortgage-related decision-making and prevent mortgage fraud.

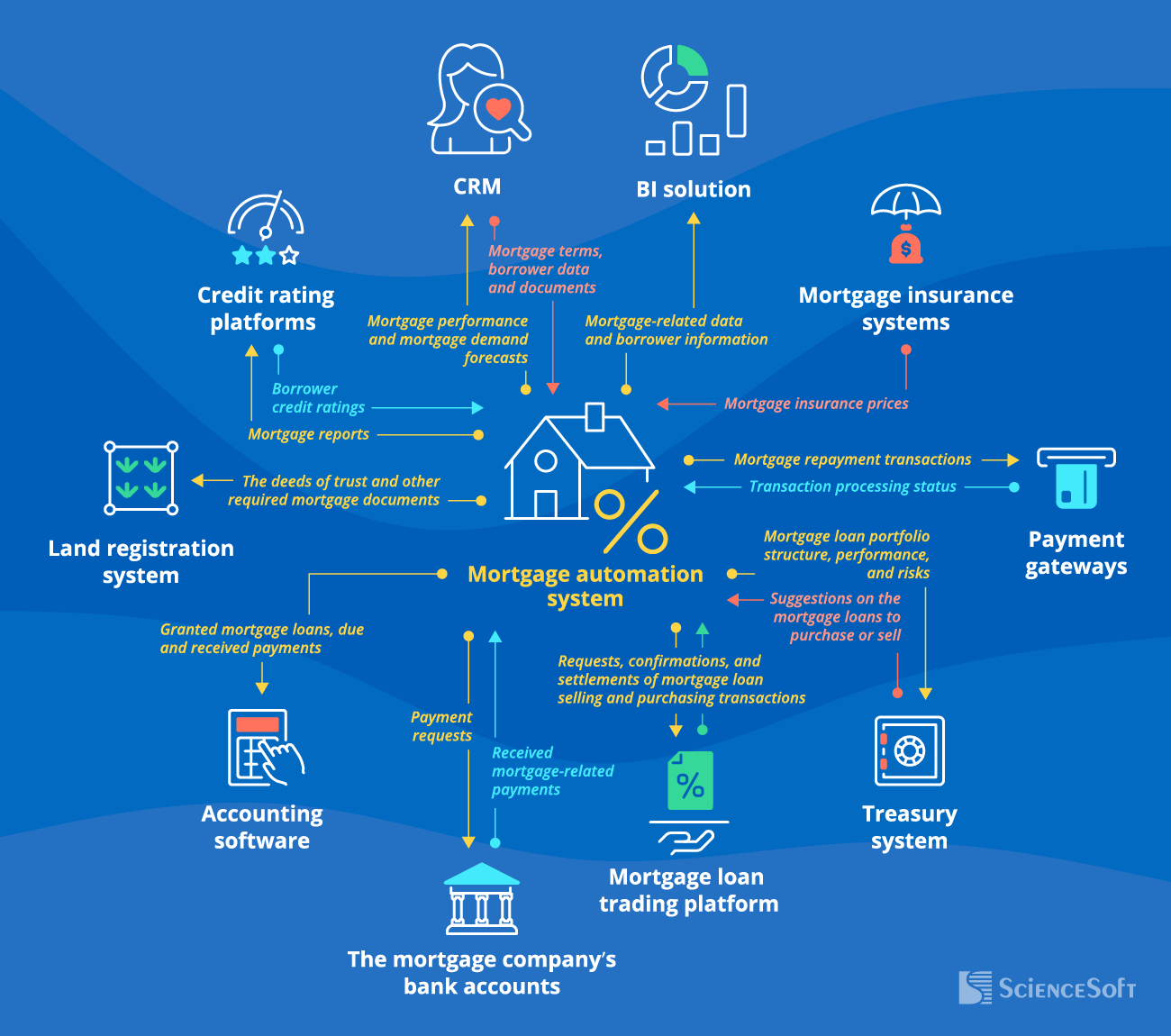

Main integrations: CRM, accounting software, a treasury system, a BI solution, and more.

Implementation time: 10–15+ months for a custom mortgage automation system.

Development costs: $400,000–$2,000,000+, depending on the solution’s complexity. Use our online cost calculator to estimate the cost for your case.

Annual ROI: Up to 840%.

Main Mortgage Processes to Automate

|

|

|

|

|

Automation technologies and digital tools drive changes throughout the entire mortgage workflow, from application processing to closing. According to STRATMOR, 48% of mortgage companies have already implemented robotic process automation (RPA) software to eliminate manual data processing tasks and plan to further expand RPA use. 83% of mortgage providers report having at least one back-office automation solution driven by artificial intelligence (AI). |

|

|

|

Among the most prominent mortgage areas to automate are:

Data intake

Rely on AI, RPA, and image analysis techs to get instant capture and processing of mortgage applications and customer documents. Up to 95% of processing tasks can be automated.

Mortgage underwriting

Employ advanced big data analytics and integrate your mortgage solution with multiple data sources to get 100% precise and 3x–30x faster evaluation of customer risks.

Mortgage closing

Drive 20–50% reduction in the mortgage loan cycle and 35%+ increase in the team productivity with the automated generation and sharing of multi-party mortgage close documents.

Mortgage debt recovery

Get full visibility of late payments, automate personalized reminders to debtors, and leverage AI-supported debt recovery planning to minimize delinquency and avoid effort-consuming mortgage foreclosure.

Types of mortgage loans to automate:

- Residential and commercial mortgages.

- Fixed-rate and adjustable-rate mortgages.

- Private and institutional mortgages.

- Forward and reverse mortgages.

- Conventional mortgages, including high-balance loans and jumbo loans.

- Government-backed (e.g., FHA, VA, USDA) mortgage loans.

- Interest-only mortgages.

- Construction loans, and more.

Ways to Set Up Mortgage Process Automation

|

|

Off-the-shelf mortgage software |

Custom mortgage automation system |

|---|---|---|

|

TCO components

|

Initial setup costs + customization and integration costs + licensing/subscription fees that scale with the number of users. |

Upfront investments + the cost of after-launch support and evolution of the mortgage system. Lower TCO in the long run. |

|

Functionality

|

Defined by the mortgage software vendor. Chances to obtain a large share of unnecessary functionality. Additional features are restricted to third-party plugins and extensions. |

Defined by customers and fully tailored to their needs. Can cover features that go beyond a typical mortgage solution's scope (e.g., enable automated mortgage trading on the secondary market), as well as features supported by advanced techs (AI/ML, blockchain, etc.). |

|

Customization

|

Limited capabilities. |

Unlimited capabilities. New features can be introduced on demand. |

|

Integration

|

API-enabled integration with popular software products. Connection to custom solutions and legacy systems may be complex or impossible. |

Seamless integration with all required corporate and third-party systems, including legacy software. |

|

Learning curve

|

May be steep due to complicated, inconvenient UX and UI. |

Short due to convenient UX and intuitive UI tailored to various user roles. |

|

Scalability

|

Restricted to the vendor’s platform capabilities. |

Non-restricted. The system scales instantly to accommodate the spikes in mortgage applications. |

|

Security

|

Fully depends on the vendor’s cybersecurity practices and cannot be controlled by the customer. |

Minimized security risks due to custom code design and the ability to add advanced security features. |

|

Regulatory compliance

|

Typically limited to compliance with global data security standards. |

Compliance with all necessary global, regional, and industry-specific regulations, including case-specific standards (e.g., Fannie Mae and Freddie Mac requirements for mortgage securitization). |

|

Maintenance and support

|

Performed by a mortgage software product vendor. |

Provided by an in-house team or an outsourced dedicated vendor. |

Which Approach to Mortgage Automation Fits Your Needs Best?

Answer a few simple questions and find out whether you should opt for a custom solution or a ready-made automation tool.

Do you need to automate specific mortgage tasks, e.g., borrower credit risk scoring based on custom formulas, processing mortgage documents in user-defined languages, or calculating property taxes based on country-specific tax rates?

Do you want to leverage AI-supported mortgage automation, e.g., to predict borrower risks, get intelligent advice on mortgage application approval, or spot mortgage fraud?

Do you want to leverage smart-contract-enabled automation of mortgage operations and blockchain-based traceability of mortgage transactions?

Do you need mortgage software providing compliance with the latest lending regulations of the countries you operate in?

Do you need to integrate your automated mortgage software with multiple back-office systems or legacy tools?

Do you need a solution offering advanced cybersecurity mechanisms (e.g., intelligent fraud detection)?

Do you need a mortgage solution with various interfaces for different roles in the team (e.g., underwriters, mortgage officers, debt collectors)?

Do you plan to evolve the automation solution with new functional and non-functional capabilities in order to adjust it to changing business and legal requirements?

Do you have large teams involved in mortgage origination and servicing processes and look to avoid the software fees associated with the per-user subscription model?

Please tell us a bit more about your needs

Answer at least 3 questions to get results.

You can go with off-the-shelf mortgage automation software

Looks like market-available solutions are a viable option to meet your automation needs. Turn to ScienceSoft if you need help with choosing the optimal ready-made tools, their implementation, customization, or integration with your existing systems.

You definitely should consider custom development

A tailor-made mortgage automation solution will help you reap the unique benefits that market-available software cannot offer. Turn to ScienceSoft to get the detailed assessment of a custom mortgage automation system’s feasibility for your business situation.

Custom mortgage automation software is your best choice

Looks like market-available mortgage automation tools don’t fit your specific business requirements and won’t be able to provide the expected operational and economic feasibility. Turn to ScienceSoft to get a consultation on custom mortgage automation software development and receive cost and ROI estimates.

Key Features of a Mortgage Automation System

In mortgage automation projects, ScienceSoft creates software with unique functionality bound to the specific needs of each mortgage lender. Below, we share a list of features that form the core of a mortgage processing system and help automate up to 90% of mortgage-related activities.

Built-in customer portal functionality is optional for a mortgage processing system. However, this module can help facilitate borrower onboarding and ensure a fast and smooth lead-to-close cycle with minimal manual efforts. If you already have a customer portal, ScienceSoft can integrate it with mortgage software. If not, we can power your mortgage automation system with borrower self-service capabilities.

Important Integrations for the Mortgage Automation System

- For accurate borrower risk scoring and automated input of up-to-date borrower information when generating mortgage documents.

- For data-driven planning of mortgage product promotions and consistent communication with borrowers.

Credit rating platforms

of the selected credit rating bureaus (e.g., Experian, TransUnion, Equifax)

- For facilitated assessment of borrower creditworthiness and prompt submission of mortgage reports.

Mortgage insurance systems

of the selected mortgage insurance providers (e.g., Arch MI, National MI, Enact)

- For data-driven modeling of mortgage amortization scenarios and automated calculation of mortgage insurance fees for borrowers.

Land registration system

of a local property registration authority

- To simplify and speed up the registration of deeds and transfer of title.

- For instant processing and real-time tracking of mortgage repayments.

- For accurate recording of mortgage-related transactions in the general ledger.

The mortgage company’s bank accounts

- To timely make payments on mortgage-related transactions.

- For facilitated reconciliation of mortgage payments.

When used by banks, a mortgage automation system can be integrated directly with a core banking system.

- To plan the optimal hedging strategies for the mortgage loan portfolio.

- To initiate mortgage loan purchasing and selling.

In addition, mortgage software can be integrated directly with mortgage loan trading platforms to establish automated mortgage loan trading processes.

- For comprehensive mortgage analytics and advanced mortgage data visualization.

Factors that Drive ROI for Mortgage Automation

Below, ScienceSoft’s consultants outline the main factors that help achieve high payback from mortgage automation system implementation:

To eliminate time-consuming and error-prone manual efforts across the entire mortgage loan cycle.

To ensure automated mortgage processing in accordance with global and country-specific regulations.

To get an accurate assessment of borrower credit risks and intelligent recommendations on the optimal mortgage terms for each client.

To provide a seamless flow of mortgage-related data among the lender’s teams, borrowers, and external partners and avoid double data entry.

Make sure your mortgage automation system provides scalability to smoothly process an increasing amount of mortgage applications and high-volume close documents to support your business growth.

Cost of Mortgage Automation

The costs and timelines of implementing custom mortgage automation software vary greatly depending on:

- Automation scope: mortgage origination automation, mortgage servicing automation, etc.

- The complexity of a solution’s functional capabilities, including AI-based features.

- The number and complexity of integrations.

- Non-functional requirements, including security and compliance requirements.

- The volume and complexity of data to be migrated from spreadsheets or an existing mortgage processing system.

- The sourcing model (full outsourcing, partial outsourcing, or all in-house), team composition, tech stack, etc.

From ScienceSoft’s experience, a custom mortgage automation solution of average complexity costs around $400,000–$1,500,000. Large financial institutions looking to build a complex mortgage automation system powered with advanced analytics should expect to invest $2,000,000+.

Want to know the cost of your mortgage lending solution?

Benefits and ROI for Mortgage Process Automation

Despite the substantial upfront investments, mortgage automation can bring up to 840% annual ROI for large companies.

Operational cost savings

Automation helps mortgage providers achieve an up to 50% reduction in operational expenses, including labor, document processing, deal closing, and debt collection costs.

Growing volume of issued mortgage loans

Mortgage underwriting automation and AI-supported mortgage decision-making drive a 15–20% increase in mortgage loan origination volume with no additional employee efforts.

Faster mortgage underwriting and servicing

Mortgage process automation is a way to prevent delays associated with lengthy and cumbersome risk assessment and mortgage closing. Digital mortgage software helps mortgage lenders establish more than 24x faster processes.

Higher productivity of mortgage teams

Mortgage automation software eliminates low-value, error-prone manual workflows, which brings a 35–50% improvement in the productivity of mortgage teams.

Mortgage Automation with ScienceSoft

In lending software development since 2005, ScienceSoft provides a full scope of IT services to help mortgage lenders establish effective mortgage process automation. We drive mortgage projects to their goals, applying our development best practices to ensure that the agreed budget and timeframes are met.

About ScienceSoft

ScienceSoft is a global IT consulting and software development company headquartered in McKinney, Texas. We help financial services providers design and build effective solutions for mortgage workflow automation. Being ISO 9001- and ISO 27001-certified, we apply a mature quality management system and guarantee that cooperation with us does not pose any risks to our clients’ data security.