Data Analytics in Insurance

Architecture, Features, Costs

ScienceSoft combines 36 years of experience in data analytics and AI with 13 years in insurance software development to design and implement reliable insurance analytics solutions.

Insurance Data Analytics in a Nutshell

Insurance analytics is a set of tools and methods that enable automated aggregation and analysis of data on diverse insurance facets, including sales, underwriting, claim management, finance, customer behavior, and workforce.

With robust data analytics, an insurer gets in-depth insights into the historical and projected performance of its business, which results in better-informed operational and strategic planning. AI-supported analytics solutions can provide intelligent guidance on the optimal insurance-related decisions to drive profitability, minimize risks, and deliver excellent customer experience.

Insurance fields that benefit from specialized analytics:

- Sales.

- Customer relationship management.

- Underwriting.

- Claim management.

- Financial management.

- Employee performance management.

Essential integrations: CRM, underwriting software, a policy administration system, claim management software, accounting software.

Implementation time: 9–15+ months for a custom insurance data analytics system.

Development costs: $100,000–$1,000,000+, depending on the solution’s complexity.

ROI: 300%+ for an intelligent insurance analytics system.

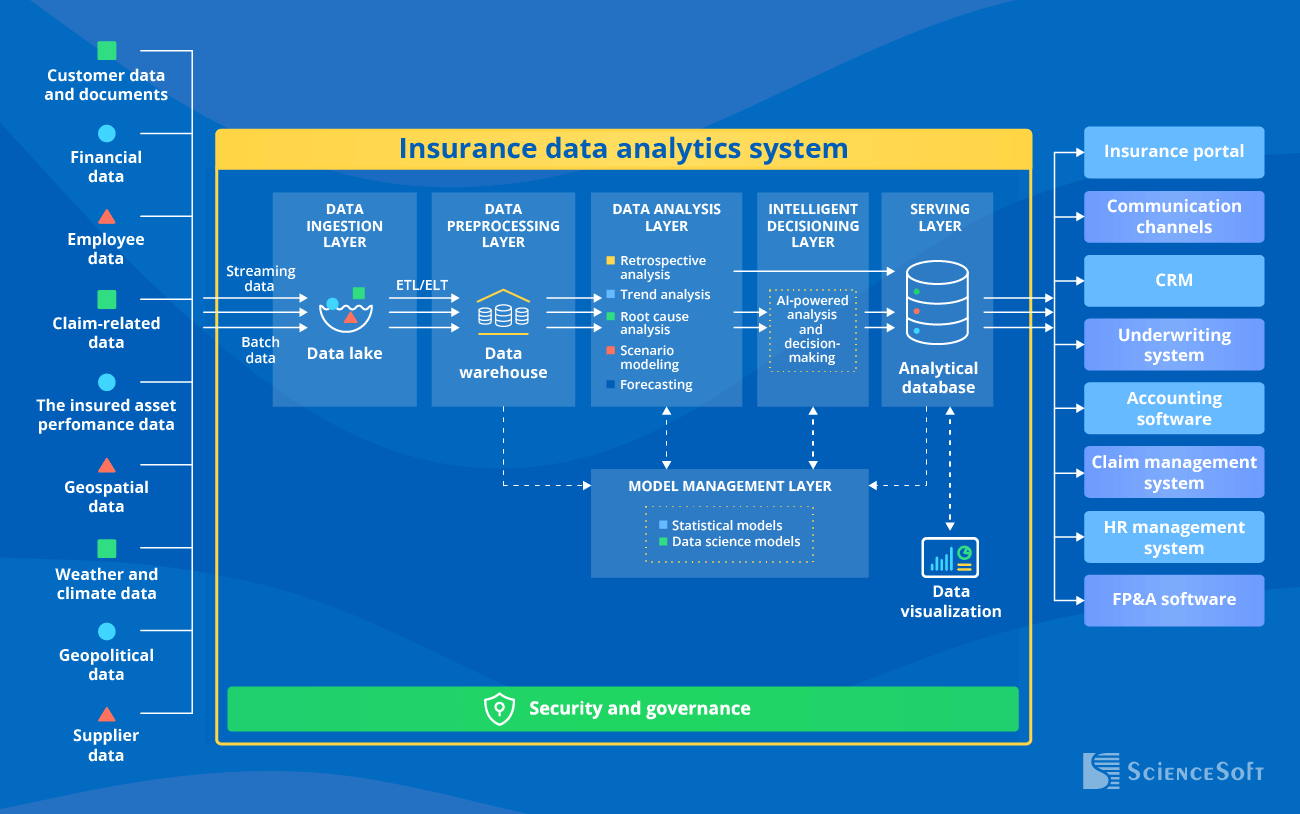

Sample Architecture of an Insurance Data Analytics System

If you’d like to get a general idea of how an insurance analytics system functions, first, here’s the high-level schema showcasing major system components and the purpose of each processing layer.

Data ingestion layer

enables the automated capture of multi-format insurance data from the integrated back-office systems (insurance software, financial software, HR management software, SRM software, etc.) and third-party data sources (payment gateways, internal systems of damage handling service providers, local credit rating platforms, telematics, and more). This layer comprises a data lake that stores all the incoming data in its raw format.

Data preprocessing layer

automatically performs insurance data sorting, filtering, cleansing, and enrichment to improve data quality and integrity. Under the extract, transform, load (ETL) approach, the data gets preprocessed on a separate server and is then routed to a data warehouse (DWH) for storage. Under the extract, load, and transform (ELT) method, the data gets transformed within the data warehouse.

Data analysis layer

pulls the preprocessed data from the DWH and performs trend and root cause analysis, scenario modeling, event forecasting, and other analytics, depending on the system’s purpose. The obtained analytical results can be used as a trigger for automatic actions or can go directly to the serving layer to become available to system users.

Model management layer

serves to design, version, upgrade, and store diverse statistical and data science (including AI-based) models for insurance analytics.

Intelligent decisioning layer

relies on AI models to prescribe optimal insurance-related actions, e.g., charging a particular policy price or rejecting a fake claim.

Serving layer

stores the analytical results and visualizes them. It can instantly send the analytics insights to the insurance professionals, relevant corporate systems (e.g., CRM, underwriting system, claim management system, insurance portal, accounting software), and communication channels (mail services, auto-dialing systems, etc.).

Insurance Data Analytics Software: Key Features

In ScienceSoft’s data analytics projects, we create high-performing analytics solutions bound to each client’s specific needs. Below, we provide a comprehensive list of features that would form the core of a robust insurance analytics system.

Power Your Insurance Processes by Modern Data Analytics

ScienceSoft’s team is ready to design and build a robust analytics solution to help you get a 360-degree view of your insurance operations and ensure accurate decision-making.

Steps to Implement Insurance Analytics

Below, ScienceSoft’s consultants describe the key steps needed to implement an effective insurance data analytics solution:

1.

Requirements engineering

This step aims to shed light on your insurance analytics needs and define functional and non-functional requirements for the future solution. Interviewing employees from various domains (customer relationship, underwriting, claim processing, etc.) and investigating current insurance data flows helps understand field-specific analytical needs. By auditing the data management infrastructure and available analytical tools, you can also assess infrastructure readiness for analytics implementation.

At ScienceSoft, this step also includes eliciting legal compliance requirements to design analytics software in accordance with IFRS17, SOX, CCPA, NYDFS, and other relevant regulations.

2.

Technical design

At the software design stage, the software architect would need to answer the following questions:

- What insurance analytics components do you need to implement (data lake, ETL/ELT pipelines, DWH, etc.)?

- What specific functions should your solution cover: customer risk assessment, claim processing and fraud detection, BI dashboards for different departments, etc.?

- What analytical models do you want to leverage: statistical, data science (non-NN or deep learning)?

- What architectural approach (monolith, modular, serverless) works best for your needs?

- What other systems (e.g., CRM, corporate finance management) the analytics system needs to be integrated with?

- What technologies and tools are the most suitable for the development of the analytics system?

We suggest modular SOA and microservices architectures if you need scalability to process growing data volumes or plan to evolve your analytics software over time. There are also analytics techniques that are best suited for particular processes, e.g., regression analysis for insurance risk modeling and pattern matching to spot fraudulent claims.

When composing an insurance analytics tech stack, we prioritize proven open-source development tools and go with ready-made logic and UI components where possible. This helps us deliver analytics faster and with less effort, which results in optimized project costs.

3.

UX and UI design

To streamline user adoption and shorten the learning curve, it’s best to provide specialized interfaces and tools for various roles (e.g., analysts, underwriters, loss adjusters, senior management). ScienceSoft’s UX/UI designers often study the existing analytics software used by our clients’ teams to provide familiar workflows and tools for them to easily navigate the new solution.

4.

Development and QA

This is the step where developers carry out the coding and set up data storage. Depending on the system design, developers may use pre-built components, but to adapt them to your insurance analytics flows, they will need to create a significant share of custom code.

ScienceSoft usually conducts rigorous testing in parallel with coding to fix any possible defects before the software goes to production.

If you want advanced insurance analytics, this stage will also cover the design and training of machine learning models for intelligent forecasting and optimization. Our data scientists can help create explainable models with clear, easy-to-interpret logical reasoning to ensure transparent and legally compliant AI-supported decisions.

5.

Integrations

By establishing integrations between your analytics solution, proprietary and third-party data sources, and corporate systems, you eliminate the need for manual data transfer and replication, which removes human errors and leads to increased speed and accuracy of insurance operations. ScienceSoft’s QA engineers recommend ending this step with integration testing to ensure smooth and safe connections between the systems.

6.

Deployment and knowledge transfer

Once the data management infrastructure is configured and robust network security mechanisms are in place, you can set the analytics system live. At this stage, ScienceSoft’s team draws up user guide materials and delivers comprehensive technical documentation to streamline system maintenance. We can also conduct full-scale training to help your insurance teams quickly master the new tool.

Costs of Insurance Data Analytics Software

Developing a custom insurance data analytics system may cost around $100,000–$1,000,000+, depending on the scope of the solution’s capabilities, data volume and complexity, the number of integrations, and security and compliance requirements.

Below, we share the approximate cost estimations based on ScienceSoft's experience in data analytics projects:

$100,000–$250,000

Building a basic data analytics solution that:

- Calculates KPIs across 1–2 insurance analytics areas, e.g., underwriting and policy issuance.

- Integrates with 1–2 key data sources.

- Offers batch data processing (e.g., every 12 hours).

- Features pre-built customizable insurance report templates.

$250,000–$400,000

Developing data analytics and BI software that:

- Calculates KPIs across multiple insurance areas: operations, finance, employees, etc.

- Integrates with 3–7 corporate and external systems.

- Enables batch and real-time data processing.

- Enables diagnostic and predictive insurance analytics using non-neural-network ML models.

- Provides a no-code template builder to create custom report forms from scratch.

$400,000–$1,000,000+

Building a comprehensive analytics system that:

- Covers the entire scope of business metrics, including insurance market performance, competitor benchmarks, and case-specific variables, e.g., projected damage severity for parametric insurance.

- Integrates with multiple back-office and third-party systems, including IoT and blockchain solutions.

- Features real-time big data analytics for instant KPI calculation and insurance event monitoring.

- Provides advanced root cause analysis and forecasting using deep learning models.

- Offers AI-supported prescriptive insurance analytics.

- Provides advanced data visualization capabilities and automated generation of complex reports.

Learn the Cost of Your Insurance Analytics Solution

ScienceSoft is ready to provide a free cost estimate for your specific case.

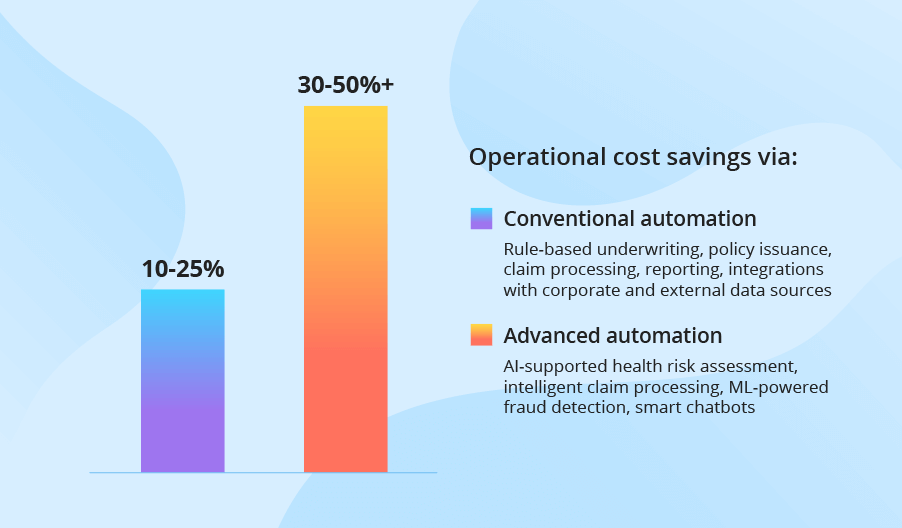

Major Financial Outcomes of Implementing Data Analytics in Insurance

|

|

|

|

|

|

|

NB! With AI, you can automate the vast majority of insurance analytics processes and use self-learning predictive and prescriptive models that adapt to the changes in your data. According to Accenture, an intelligent data analytics system can bring an ROI of 300% to 900%. |

|

|

|

|

|

|

|

|

When to Opt for a Custom Solution

ScienceSoft’s experts recommend developing a custom insurance data analytics system in the following cases:

- You need to build non-standard formulas and complex analytical models to calculate and forecast KPIs across specific insurance types, such as parametric insurance, kidnap and ransom insurance, or mortgage insurance.

- You need a solution that can seamlessly analyze insurance data in diverse formats, including handwritten text, voice recordings, and sensor data.

- You want AI-supported guidance on optimal policy prices, claim approval or rejection, employee task assignment, and other insurance-related decisions.

- You want to integrate your insurance data analytics solution with all required software, including legacy corporate tools.

- You need advanced security of insurance data and compliance with numerous local insurance regulations.

- You have large insurance teams involved in data analysis processes and want to avoid the sizable subscription fees for market-available analytics tools.

Implement Powerful Insurance Data Analytics With ScienceSoft

In data science since 1989 and in insurance software development since 2012, ScienceSoft has been providing full-scale consulting and implementation services to introduce effective insurance data analytics solutions.

Our Clients Say

Partnering with ScienceSoft for our software maintenance and evolution initiative has been an excellent experience. They identified and fixed several longstanding issues that had been causing us persistent difficulties. Special mention goes to the redesign of our reporting module, which increased reporting speed by 30 times.

Ted Frost, Managing Director at Frost Insurances

Insights From ScienceSoft's Insurance IT Experts

About ScienceSoft

ScienceSoft is a global IT consulting and software development company headquartered in McKinney, Texas. We implement business intelligence in insurance and deliver custom data analytics solutions powered by advanced techs. Being ISO 9001- and ISO 27001-certified, we apply a mature quality management system and guarantee the full security of our clients’ data.