Artificial Intelligence (AI) for Insurance Underwriting

Features, Architecture, Costs

ScienceSoft relies on 36 years of expertise in AI and 13 years in engineering insurance software to design and build robust AI solutions for underwriting.

Insurance Underwriting AI: The Essence

Artificial intelligence for insurance underwriting drives a 67% decrease in manual underwriters’ tasks and cuts the average underwriting decision time from days to minutes while maintaining a 90–99%+ accuracy rate in autonomous risk scoring.

For complex policies, AI helps reduce underwriting cycle time by 31% and improve risk assessment accuracy by 43%. In addition, AI helps introduce personalized customer experiences and enables innovative underwriting models (e.g., behavior-based dynamic pricing) that unlock up to 15% growth in revenue.

Large carriers can achieve up to a 30% improvement in portfolio performance and up to 3% better loss-ratios through AI’s ability to factor unstructured, previously inaccessible data into insureds’ risk profiles and underwriting decisions.

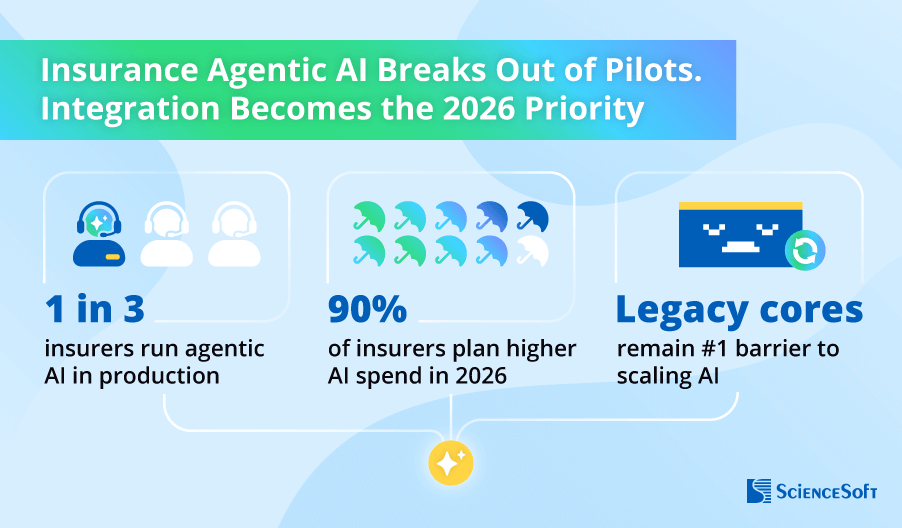

AI for Insurance Underwriting: Market Info

The global market of AI in insurance is projected to grow from $14.99 billion in 2025 to $246.3 billion by 2035, exhibiting a CAGR of 32.3%. Underwriting is considered one of the largest use case segments for AI in insurance.

GlobalData names AI-assisted underwriting a key area of insurance innovation that has the potential to disrupt the entire industry. BCG, in its 2025 paper, estimates that 36% of total AI value for insurance can be captured across the underwriting function alone.

The main drivers for the popularity of AI-powered underwriting solutions are the growing demand for fast, efficient processing of large insurance data volumes, precise risk evaluation, and fair policy pricing.

How AI for Insurance Underwriting Works

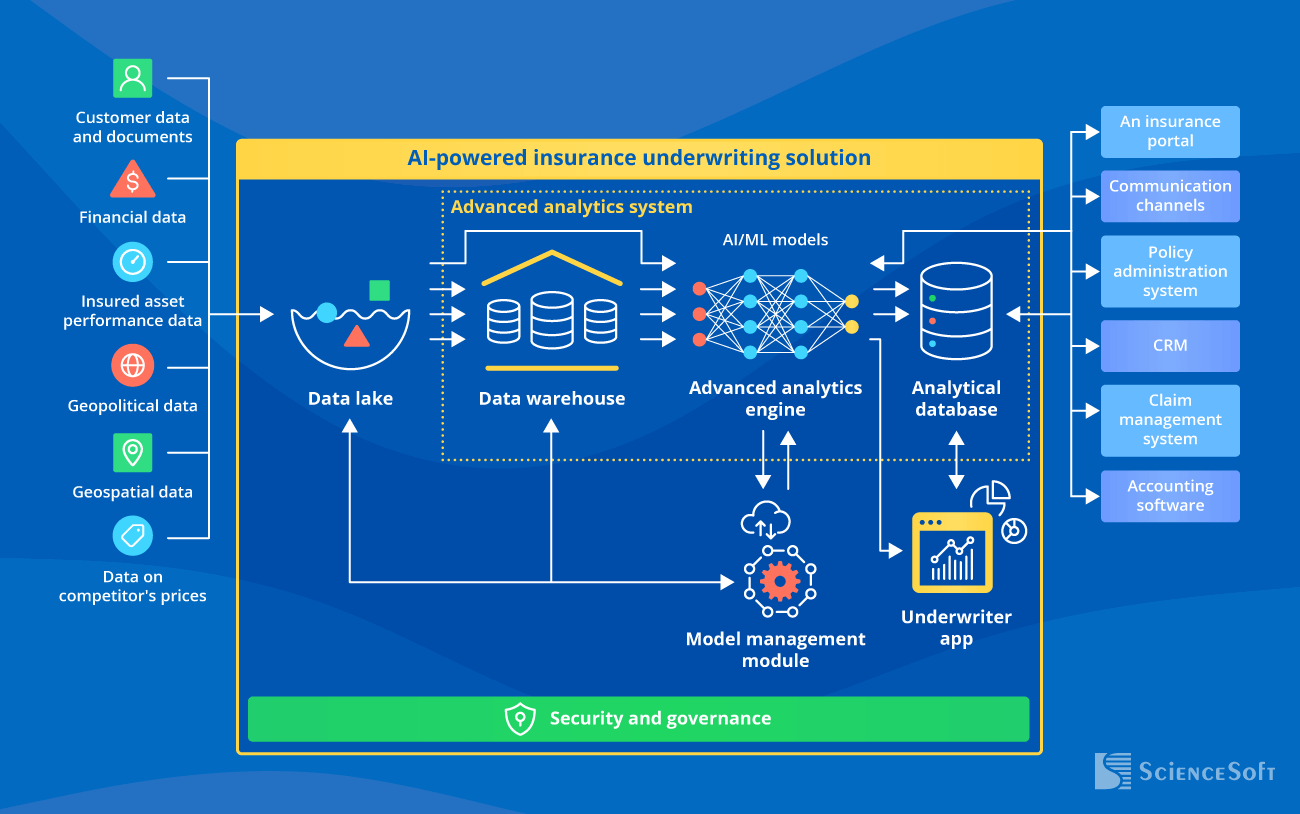

Architecture

Below, ScienceSoft’s consultants share a sample layered architecture of an intelligent underwriting solution with a deep learning engine at its core, describing its essential components and the process of AI-assisted insurance underwriting.

Such an architecture can be flexibly extended with LLM-based agents to automate end-to-end underwriter workflows across risk data consolidation, scoring, quoting, and policy issuance.

An AI solution for insurance underwriting comprises the following components:

- A data lake stores structured and unstructured customer and risk-associated data and multi-format insurance documents pulled from the available sources.

- A data warehouse is needed to store the fully cleansed, structured, ready-to-analyze data.

- An advanced analytics engine has a pre-trained machine learning model (a neural network) at its core. It analyzes complex dependencies between multiple loss and profitability factors and offers intelligent suggestions on optimal personalized insurance prices.

- An analytical database stores the analytical results and makes them available for further use (e.g., communicating pricing details to customers and agents, continuous AI model self-learning).

- An underwriter app with rich visualization capabilities enables underwriters to track and report the captured risk data and analytical results (exposure forecasts, price prescriptions, etc.).

- A model management module is used by data scientists to create, train, fine-tune, and monitor the performance of intelligent analytical models.

Such software integrates with:

- An insurer’s corporate systems (e.g., CRM, claim management software, an insurance portal, a policy administration system) and communication channels (email, messengers, auto-dialing systems, etc.) to import relevant historical information and share underwriting-related data and decisions.

- Third-party data sources (credit rating bureaus, medical information bureaus, social security administration, etc.; the tracking systems of telematics providers, smart utility companies, etc.) to obtain available customer and risk-relevant information.

Main use cases

Insurance application processing

- Automated processing of omnichannel insurance applications to free underwriters from tedious manual tasks and speed up the request-to-quote cycle.

- Intelligent application triaging to prevent underwriting leakage.

Risk assessment

- Fast and accurate quantification of client-specific risks to help underwriters properly price insurance and speed up policy issuance.

- Continuous capture and analysis of risk-relevant data from all available sources to promptly address the evolving financial threats.

Fraud and non-compliance detection

- Matching the data provided by customers to the data available in relevant public sources. It helps spot identity fraud and document forgery and prevents illegitimate access to insurance services.

- Underwriter behavior analytics to identify non-compliant activity.

Key features

ScienceSoft understands that all insurance companies have their business specifics and may need various degrees of AI-enabled process automation. In our projects, we engineer underwriting AI solutions with unique functionality bound to each client's requirements. Here, we share a sample feature set of AI software we can deliver:

Automated data intake and processing

Intelligent image analysis, natural language processing (NLP), large language model (LLM), and big data processing technologies enable the automated capture and processing of insurance data in various formats: from text documents and digital images to video streams and IoT data feeds.

Insurance application triaging

With the help of AI, insurance applications can be automatically prioritized for processing based on their expected profitability, urgency, and estimated time-to-quote. In addition, AI determines the applications that require a manual check and instantly routes them to the underwriters.

Advanced risk analytics

AI offers data-driven evaluation and scoring of customer-associated economic, geopolitical, weather, and natural disaster risks. AI-powered forecasting models deliver accurate predictions on the probability of loss across particular clients, locations, periods, insurance types, etc.

Underwriting decision-making

AI analyzes customer documents and risk profiles and automates decision-making on insurance application approval or decline. For each approved application, AI recommends the most favorable insurance coverage terms (max amount, duration, etc.) based on the client’s risk score.

Insurance price optimization

AI automatically calculates the optimal insurance prices based on the analysis of complex non-linear dependencies between diverse loss risk factors, customer-specific price elasticity of demand, and profitability goals.

Dynamic insurance pricing

AI calculates the optimal personalized insurance prices based on real-time data on a policyholder’s health state and geographic location, driving behavior and traffic conditions, insured asset utilization and facility conditions, etc.

Automated communication

AI-powered virtual assistants can take over simple communication tasks that typically require underwriters’ involvement. For example, generative AI bots can request missing customer documents and communicate the estimated insurance price to the agent in a human-like manner.

Advanced behavioral analytics

AI detects customer and employee behavior anomalies based on the analysis of historical behavioral patterns. It can instantly spot customer fraud and non-compliant employee activities and enforce the optimal actions to mitigate the negative impact (e.g., block the suspicious account or notify the employee’s supervisor).

How Insurance Companies Benefit from AI for Underwriting

Large Commercial Insurance Carrier Benefits from Optimized Risk Pricing

In 2021, the Berkshire Hathaway Homestate Companies (BHHC), a US commercial insurance group with 50+ years in the domain, launched Z-FIRE, an AI-based wildfire risk assessment solution by ZestyAI.

The solution leverages 200B of diverse data points to produce commercial property-level wildfire risk scores. It relies on a proprietary AI model trained on 1,400+ wildfire events and historical loss data over a 20-year period.

With the help of AI, BHHC gets a comprehensive picture of a property’s true risk, which allows the company to improve the accuracy of policy pricing.

In 2022, BHHC expanded the use of Z-FIRE to further enhance its underwriting processes. The solution is currently used by BHHC’s underwriters in 12 wildfire-prone US states.

Underwriting AI Startup Raised $71M in 6 Years

An Israel-based insurtech startup Planck has developed an AI platform for commercial insurance underwriting.

The solution automates the entire insurance application processing cycle and helps generate personalized quotes in minutes rather than days. It captures and analyzes massive volumes of customer and risk-relevant data from thousands of sources and delivers comprehensive risk insights in <5 seconds. With intelligent recommendations on optimal application approval and quoting decisions, insurers get the opportunity to decrease loss ratios by 1–3%.

Planck raised $71 million in funding from 2016 to 2022. Today, the company operates globally and continues expanding its underwriting AI product range with innovative offerings.

Costs of AI-Powered Software for Insurance Underwriting

From ScienceSoft’s experience, developing a custom artificial intelligence solution for insurance underwriting may cost around $100,000–$650,000+, depending on the solution's complexity.

Want to understand the cost of your AI-powered software for insurance underwriting?

The major factors that affect the development budget and timelines are:

- The solution’s functional scope.

- The number and complexity of AI models.

- Performance, scalability, security, and compliance requirements for the software.

- The number and complexity of integrations.

- Requirements for the UX and UI of the underwriting application.

- The required development scope (PoC, MVP, a fully-featured solution).

- The sourcing model and team composition.

Security mechanisms we work with

- Data protection: DLP (data leak protection), data discovery and classification, data backup and recovery, data encryption.

- Endpoint protection: antivirus/antimalware, EDR (endpoint detection and response), EPP (an endpoint protection platform).

- Access control: IAM (identity and access management), password management, multi-factor authentication.

- Application security: WAF (web application firewall), SAST, DAST, IAST (security testing).

- Network security: DDoS protection, IDS/IPS, SIEM, XDR, SOAR, email filtering, SWG/web filtering, VPN, network vulnerability scanning.

The Challenges of AI for Insurance Underwriting

While 80%+ insurers are pursuing AI initiatives, many still doubt AI’s ability to address certain operational and ethical aspects of underwriting. But having decades-long expertise in AI implementation and insurance digital transformation, we know how to address these challenges.

Challenge #1: Potential biases in AI decisions

Training an underwriting artificial intelligence model to provide near-perfect risk profiling outputs may sometimes lead to overestimation of loss potential and insurance overpricing. It poses the risk of unintended discrimination against certain customers and may result in heavy legal penalties.

Solution

Solution

ScienceSoft recommends involving professional data scientists to design and train the underwriting AI model. They will help compose an appropriate training data set and accurately configure the model’s hyperparameters and initial weights to ensure that the model is not overfitted and is capable of producing ethical and explainable risk-based price suggestions.

Hide

Challenge #2: Decisioning based on outdated data

AI-powered underwriting systems need to instantly collect the latest risk-associated data to assess risks accurately, ensure appropriate insurance pricing, and take timely loss prevention measures. To achieve this, the software would need direct access to all relevant data sources (credit rating platforms, telematics platforms, weather tracking systems, etc.) and ingest new data as soon as it appears.

Solution

Solution

To obtain real-time insurance risk data, an underwriting system has to be seamlessly integrated with all relevant data sources. Secure APIs help promptly establish smooth integration between an AI-powered underwriting solution and multiple corporate and external data sources. Note that AI software connection to legacy back-office systems may require custom-built integrations.

Hide

Underwriting AI Consulting and Implementation by ScienceSoft

In AI development services since 1989 and in insurance software development since 2012, ScienceSoft has been delivering reliable AI solutions for insurance underwriting.