Payment Orchestration Software

Features, Implementation Steps, Costs

ScienceSoft applies 20 years of experience in payment software development to help companies design and build effective payment orchestration solutions.

Payment Orchestration Software: The Essence

Payment orchestration software is an innovative digital tool aimed to streamline the entire payment handling process, from transaction authorization to payment settlement and reporting.

Also known as a payment orchestration layer, such software helps optimize and facilitate the integration of multiple selling platforms a business uses with the processing systems of various payment service providers.

Custom payment orchestration software effectively handles complex and unique orchestration workflows, provides compliance with all required data protection standards, and helps companies unlock new revenue streams.

- Key features: AI-powered transaction validation, algorithm-based transaction routing to the best-fitting payment processor, comprehensive payment analytics.

- Main user groups: financial services companies, merchants, merchant aggregators (ecommerce platform providers, ecommerce marketplace owners, etc.).

- Necessary integrations: selling channels, payment processing systems, accounting software.

- Implementation time: 9–12+ months for a custom payment orchestration system.

- Development costs: $250,000–$1,000,000+, depending on the solution’s complexity. Use our cost calculator to estimate the cost for your case.

- Key financial outcomes: reduced payment processing costs, revenue growth.

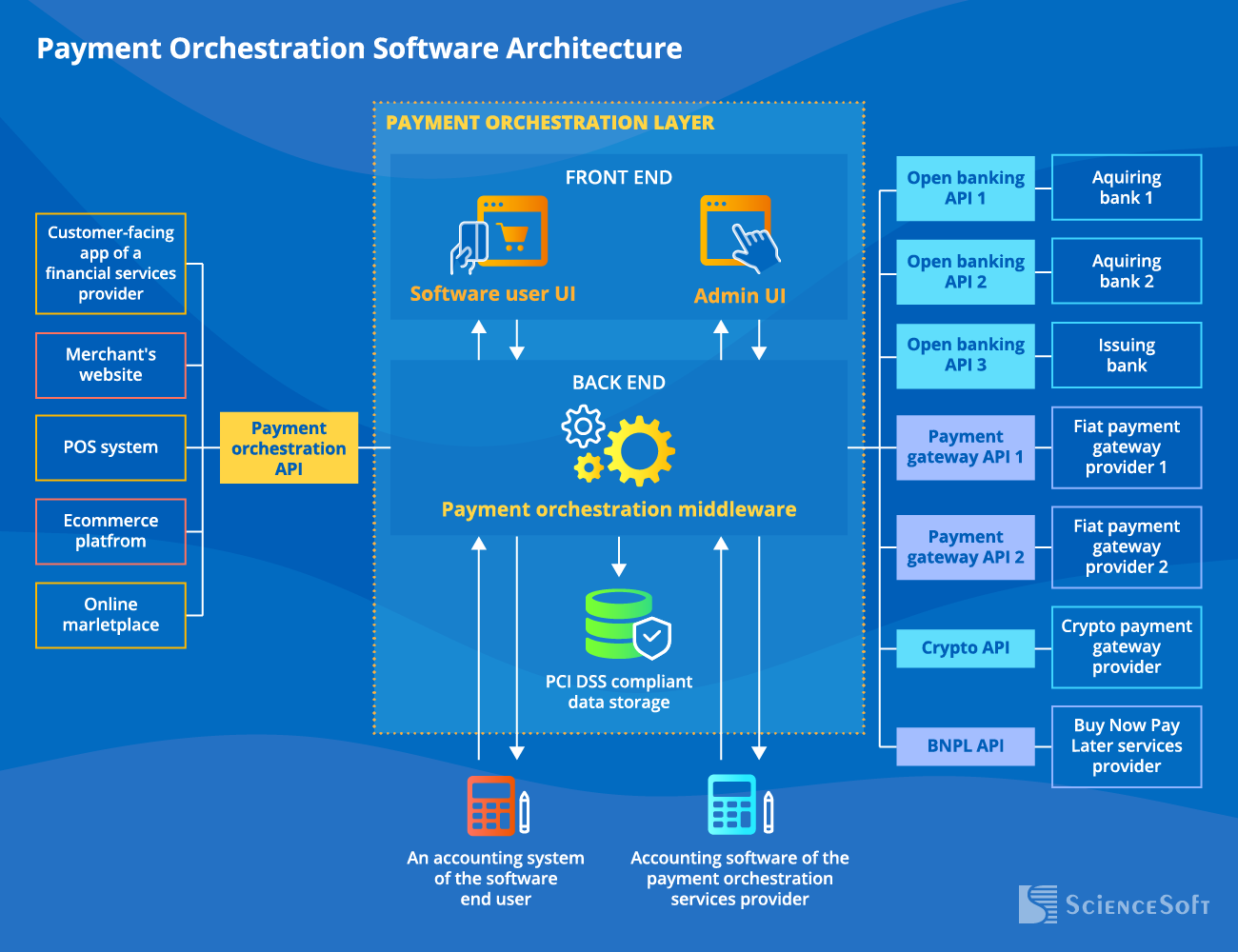

A Sample Architecture of Payment Orchestration Software

Payment orchestration systems ScienceSoft delivers typically comprise:

- Payment orchestration middleware to aggregate and validate customer payments, route them for processing, and notify the users of payment success or failure.

- PCI DSS-compliant data storage to ensure the security of cardholders’ sensitive data and enforce proper data retention and deletion policies.

- Web and mobile interfaces for the platform’s admins and users to monitor payment transactions, processing fees and access the results of payment analytics.

To operate efficiently, payment orchestration software needs to seamlessly integrate with:

- Multiple selling channels (e.g., customer-facing apps of financial services providers, merchants’ websites and POS systems, etc.) to automatically aggregate real-time payment transactions.

- Processing systems of multiple payment service providers (PSPs), such as acquiring banks, independent payment processors, payment gateway providers, to instantly route valid transactions for settlement.

Additionally, payment orchestration software can be integrated with the accounting systems of the software end users to instantly export data on successful payments from customers and receive notifications to timely charge due payments (e.g., recurring payments). If the platform is offered for a fee, it also integrates with the accounting software of the payment orchestration services provider to automatically record data on the received subscription payments.

|

|

|

|

|

|

ScienceSoft’s best practice: For optimized project costs and streamlined solution integration with the required systems of PSPs, we employ ready-to-use APIs:

|

|

|

|

|

|

Key Features of Payment Orchestration Software

ScienceSoft delivers payment orchestration systems with unique functionality tailored to each client’s specific requirements. Below, we list the solution’s features typically requested by our clients:

Main Approaches to Implementing Payment Orchestration Software

Approach #1.

Developing custom payment orchestration software

Best for: Midsize and large companies looking to establish tailor-made payment orchestration flows or introduce a brand-new payment orchestration solution for their customers (free or for a fee).

Advantages: Custom solutions provide the functionality tailored to the company’s specific payment orchestration needs (e.g., user-defined payment methods, currencies, billing flow, etc.). When needed, new features can be easily added. Also, custom software seamlessly integrates with legacy systems and complies with all the required regulations. Companies planning to monetize their unique payment orchestration offering get the opportunity to generate additional revenue.

Cautions: Custom software design may take up to 3 months, plus the responsibility for maintaining the payment orchestration infrastructure and PCI DSS compliance fully lies on the company.

ScienceSoft’s best practice: We thoroughly analyze the needs and expectations of target users to elicit all functional and non-functional requirements for the solution.

Approach #2.

Integrating a third-party payment orchestration platform

Best for: SMEs with non-specific payment flows that want to provide their customers with a variety of payment options and ensure minimized processing fees.

Advantages: A fast and cost-effective way to leverage payment orchestration with no need to set up the in-house orchestration environment.

Cautions: Complete dependence on a third party to orchestrate payments, which enhances operational and security risks and leads to extra fees for middleman services. Also, companies have to rely on the pre-defined payment orchestration functionality and the payment service providers of the platform owner’s choice.

ScienceSoft’s best practice: With your company’s needs in mind, we shortlist market-available systems and thoroughly analyze their functionality, scalability, economic feasibility and other relevant specifics to help you select the optimal orchestration platform.

Success Factors for Payment Orchestration Software

Whether you opt for a third-party platform or custom software, make sure your solution covers a range of essential factors that drive the overall ROI of payment orchestration:

|

|

Easy-to-use APIs. To enable prompt and effortless integration with customer-facing apps and accounting systems of the required user groups. |

|

|

Intelligent routing. To leverage AI-based selection of the optimal payment service providers. |

|

|

Comprehensive analytics. To get valuable insights into the performance of particular payment methods and customer purchasing behavior. |

|

|

System scalability. To smoothly handle the growing amount of payment transactions, e.g., associated with seasonal demand spikes. |

|

|

Support for cross-border payments. To reach the international audience and increase revenue potential. |

|

|

Focus on security and compliance. To protect the system from unauthorized access and guarantee the safety of sensitive data it stores. |

If you opt for an off-the-shelf payment orchestration system, make sure the software is vendor-agnostic, i.e., it doesn’t by default prioritize any particular payment service provider(s) and always considers user preferences for transaction routing.

How to Build Payment Orchestration Software

Payment orchestration software development requires an accurate action plan to ensure smooth project flow and prevent financial and technology risks. Below, ScienceSoft describes key project steps to provide you with a general idea on how your custom payment orchestration software development process may look.

1

Business and end user needs analysis and requirements engineering for your payment orchestration system.

2

Designing the optimal functionality (including security and compliance features), architecture, and tech stack for payment orchestration software.

3

Project planning: deliverables, milestones, budget, team, etc.

4

Custom payment orchestration software development.

5

Quality assurance in parallel with coding.

6

Establishing integrations with the required internal and third-party systems.

7

Designing and implementing policies to achieve compliance with the required regulations.

8

Establishing security mechanisms to protect your payment orchestration solution and sensitive data it deals with.

9

Continuous support and evolution of your payment orchestration software (optional).

Implementation Costs of Payment Orchestration Software

The development costs and duration vary greatly depending on:

- The number and complexity of a solution’s features, including the implementation of AI-powered analytics.

- The number and complexity of integrations, including the development of ready-to-use APIs.

- Availability, scalability, performance, and security requirements.

- Sourcing model (all in-house or outsourced) and the development team composition.

From ScienceSoft’s experience, custom payment orchestration software of average complexity may cost around $250,000–$400,000, while a complex orchestration platform with advanced analytics and support for cross-border payments costs $1,000,000+.

Integrating a prebuilt payment orchestration system with a merchant's selling platform may cost around $30,000–$100,000+.

Want to learn the cost of your payment orchestration solution?

Benefits of Payment Orchestration Software

|

Reduced payment processing fees due to the automated transaction routing to the most cost-effective processing system. |

Facilitated payment monitoring due to the centralized view of all payment transactions across multiple payment service providers. |

|

Reduced number of payment failures, thus minimized revenue losses due to the automated transaction rerouting to another payment processor if any problems arise. |

Minimized risk of payment fraud due to AI-powered transaction validation prior to settlement. |

|

Access to new markets due to the support for country-specific payment methods and the ability to smoothly process cross-border payments. |

Improved customer experience due to a variety of available payment methods and fewer payment declines. |

Market-Available Payment Orchestration Software ScienceSoft Helps Implement

If you opt for a prebuilt solution, we recommend you to consider one of the following products that are acknowledged as the leading payment orchestration market offerings.

Spreedly

Best for

Financial services companies and merchant aggregators of any size.

Features

- Ready-to-use APIs to integrate with business-critical software of merchants, merchant aggregators, and fintech companies.

- Prebuilt connections to over 120 leading payment service providers.

- Support for 100+ currencies.

- Configurable rules for payment routing.

- Analytical dashboards providing full insight into the performance of particular payment methods.

- AI-powered detection of payment fraud.

- Compliance with PCI DSS.

Cautions

Integration with custom or legacy systems may be expensive.

IXOPAY

Best for

Large merchants and merchant aggregators.

Features

- Support for multiple payment methods, including bank transfers, cards, digital checks, digital wallets, and more.

- Pay by Link and QR-code-based payments.

- Configurable criteria for transaction validation.

- Automated reconciliation of payment transactions.

- Calculating and tracking payment processing fees.

- Secure mass payouts to merchants.

- Prebuilt plugins to integrate with popular ecommerce platforms.

- Ready-to-use APIs to connect to a merchant’s selling system.

Cautions

The platform may not provide compliance with the country- and industry-specific regulations you need to meet.

Payoneer

Best for

Midsize ecommerce businesses operating internationally.

Features

- Support for 200+ global and local payment methods.

- Prioritizing or limiting particular payment methods for various customer segments.

- Configurable region-specific rules for transaction routing.

- Real-time monitoring of payment transactions.

- AI-based analysis of customers’ purchasing behavior.

- Plug and play integration with popular ecommerce platforms, such as Adobe Commerce (Magento), WooCommerce, Shopify, etc.

- Payment data encryption.

- Compliance with PCI DSS and PSD2.

Cautions

Solution customization to your unique payment orchestration needs may appear costly and effort-consuming.

Implementation of Payment Orchestration Software With ScienceSoft

In payment software development since 2005, ScienceSoft helps companies develop reliable and secure payment orchestration solutions. Our services are tailored to our clients' needs and can be related to:

Consulting on payment orchestration software

- Analysis of business needs and the solution’s target users.

- An optimal feature set, architecture design, and tech stack for the payment orchestration solution.

- A plan of integrations with the required systems.

- Security and compliance consulting.

- An implementation roadmap, including a risk mitigation plan and cost & time estimates.

Implementation of payment orchestration software

- Software conceptualization.

- Payment orchestration solution development.

- APIs development to expand the solution’s integration capabilities.

- Integration with the required systems.

- Quality assurance.

- Software support and evolution (if required).

About ScienceSoft

ScienceSoft is a global IT consulting and software development company headquartered in McKinney, Texas. We help businesses in various industries design and implement effective payment orchestration software. Being ISO 9001 and ISO 27001 certified, we apply a mature quality management system and guarantee that cooperation with us does not pose any risks to our clients’ data security.