Insurance Automation

A Guide to 2x Growth in Insurance Business Profitability

ScienceSoft applies 13 years of experience in insurance IT and 36 years in digital transformation services to help insurance companies automate their business processes in a secure and compliant way.

Insurance Automation: Key Aspects

Insurance automation aims to eliminate manual workflows across underwriting, billing, claims, policy updating, customer servicing, and other insurance processes.

Automated insurance systems inscreasingly rely on value-adding technologies such as generative and agentic AI, machine learning, image analysis, big data, and blockchain to make insurers' service operations more efficient and support sustainable business growth.

- Key integrations: a CRM, payment gateways, accounting software, a BI solution, etc.

- Implementation time: 10–18+ months for a custom insurance automation system.

- Development costs: $200,000–$4,000,000+, depending on the automation scope and complexity. Use our online calculator to understand the cost for your case.

- A payback period: 6–12 months on average.

Main Insurance Processes to Automate

Sales and distribution

Automate sales workflows, including lead management, policy quoting, and contract generation, to reduce time-to-sale and improve sales team efficiency.

Policy management

Get policy creation, updating, and renewal automated to drive a 50%+ increase in the team’s productivity and benefit from over 60% cost savings across policy administration workflows.

Billing

Eliminate 80%+ of manual policyholder invoicing, dunning, and payment tracking tasks and decrease billing costs by up to 80% while establishing 2–3x faster processes.

Claim management

Combine rule-based automation with advanced cognitive techs to intake, validate, and settle claims in minutes rather than days. Detect fraud with 95%+ accuracy using ML algorithms.

Risk management and actuarial analysis

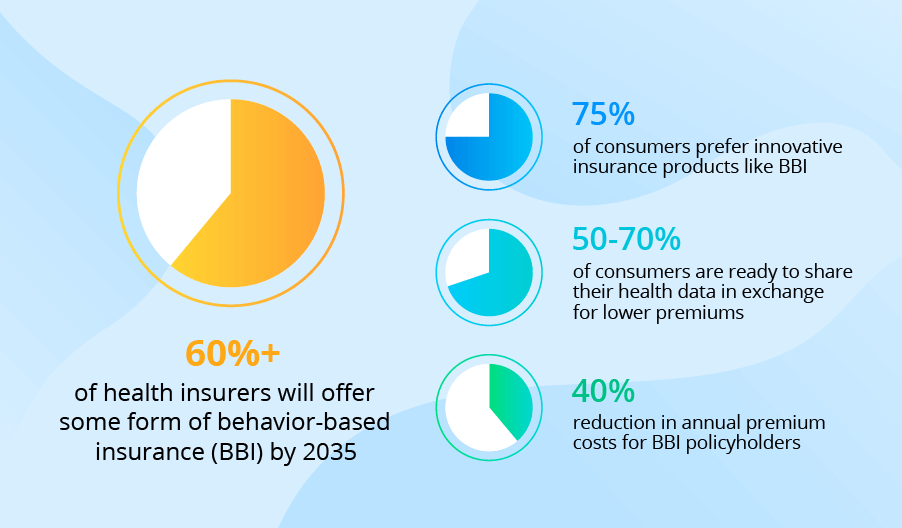

Leverage AI and big data to automate risk evaluation and actuarial calculations, reducing time spent on manual data analysis and improving the accuracy of risk predictions.

Reinsurance management

Automate the management and processing of reinsurance contracts and claims, improving data transparency, speed, and accuracy in risk-sharing processes.

Regulatory compliance

Simplify your adherence to insurance-specific legal requirements and data protection standards with real-time compliance checks and automated compliance reporting.

Customer interactions

Rely on intelligent virtual assistants to process up to 80% of omnichannel customer inquiries and cut the staff workload by over 2x while driving a 7%+ increase in customer satisfaction.

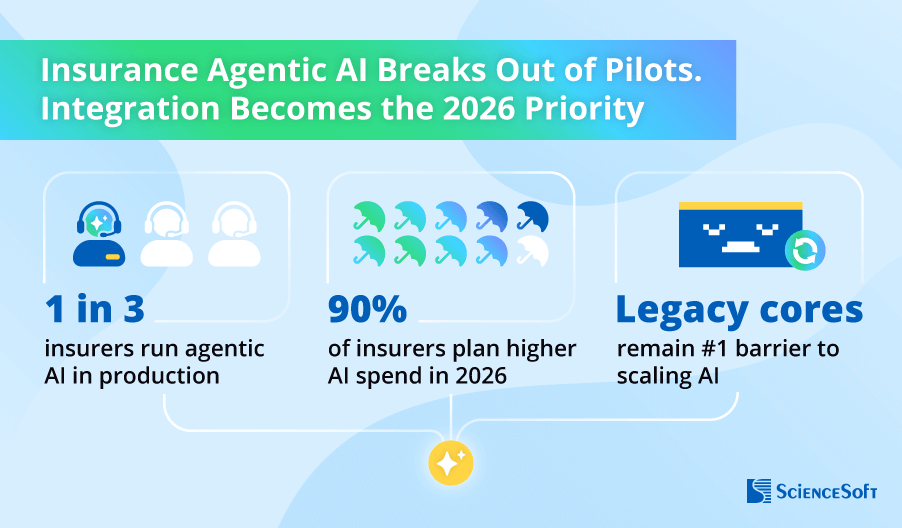

According to Accenture, 80% of insurance executives rank automation, AI assistants, and ML-based analytics as the top game-changing technologies for their business. A recent survey by OZ revealed that 80%+ of insurers already have their underwriting, claims, and policy administration workflows automated. Yet, most firms say they are at early digital journey stages and plan to increase investments in automation technology.

Nearly half of insurers are pursuing aggressive automation strategies to retain a competitive edge. McKinsey stresses that insurance leaders are adopting automation not only to improve their operations but also to launch new digital service models.

Key Features of an Insurance Automation System

ScienceSoft creates automated insurance systems with functionality bound to each customer’s unique needs. Below, we share a comprehensive list of the features commonly requested by our clients:

Agentic Automation: The New Frontier for Insurers

AI agents are transforming multi-step, judgement-heavy insurance processes that once required extensive human involvement. Watch the presentation by ScienceSoft’s Vadim Belski, Head of AI, from the 2025 Insurance Transformation Summit in Boston to learn what agentic AI technology holds for insurance and see our custom claims automation AI agent in action.

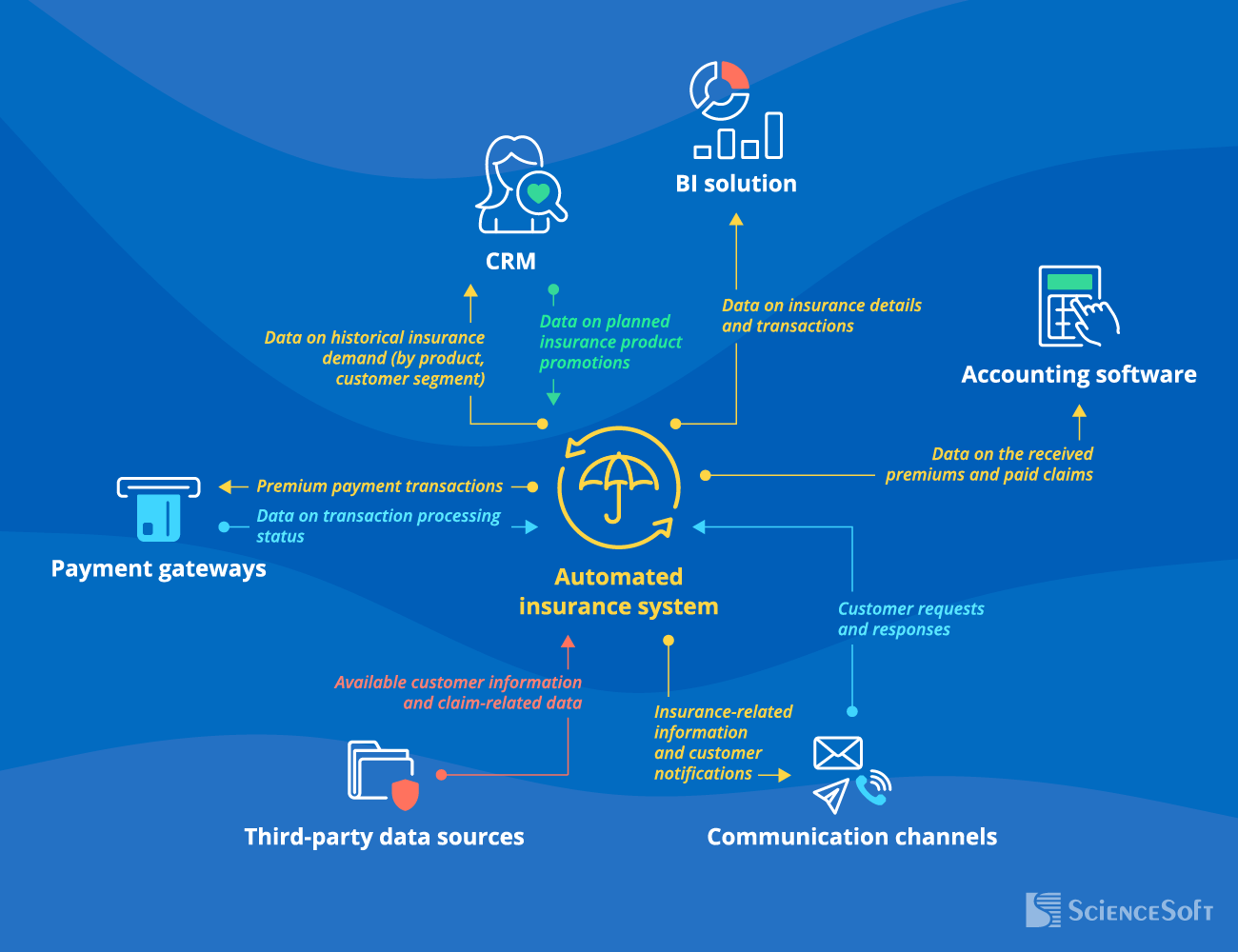

Important Integrations for an Automated Insurance System

Connecting the insurance solution with relevant internal and third-party systems helps improve the efficiency of insurance operations. ScienceSoft recommends establishing the following key integrations:

- For calculating the expected demand and data-driven planning of distribution and marketing activities.

- For informing the insurance teams about the planned promotions of particular insurance products.

For instant processing and real-time tracking of premium payments.

For automated recording of insurance-related financial transactions in the general ledger.

For comprehensive insurance analytics and advanced visualization and intuitive reports.

Third-party data sources

For accurate risk assessment, insurance pricing, claim validation, and damage estimation.

Specialized integrations you may require:

Show more

Communication channels

For fast and convenient customer interaction.

Show more

Success Factors for Insurance Automation

ScienceSoft’s experience shows that an ROI for the insurance automation system can be achieved in 6–12 months on average. To maximize the solution’s value for the client’s internal processes and drive faster payback from insurance business process automation, we always cover the following important factors:

End-to-end automation

To eliminate manual workflows across the entire insurance cycle, from underwriting, through claim processing, to policy renewal.

AI-powered analytics

To get data-driven risk assessment and optimal, risk-based insurance pricing, promptly identify insurance fraud, and more.

Operational compliance

To process insurance data in accordance with up-to-date regulatory mandates (AML/KYC, FIO, NAIC, NYDFS, HIPAA, etc.).

Proper user training

To help insurance teams quickly learn how to apply automation to streamline their daily tasks.

Security must be your priority from day one

Make sure your automation system and the data it uses are adequately secured against known and emerging cyber threats. Multi-factor authentication, role-based access controls, encryption of stored and transferred data, and intelligent analytics for threat detection are examples of robust mechanisms for protecting your data and software and strengthening the system’s compliance posture.

Ways to Automate Insurance Operations

There are three main approaches to automating insurance processes, each having its benefits and limitations. Below, ScienceSoft provides a high-level comparison of the three. Our insurance IT consultants can help you define the more feasible option for your business situation.

|

|

Ready-made insurance suite |

Platform-based insurance software |

Custom insurance automation system ScienceSoft recommends |

|---|---|---|---|

|

Essence

|

Implementing market-available insurance software, which typically features automated application processing, risk scoring, quoting, claims processing, and policy administration and provides task monitoring dashboards. |

Building an insurance solution with customizable, easy-to-deploy process automation rules based on a low-code platform, e.g., Microsoft Power Apps, Appian, or Pega. |

Building custom automated insurance software to get all necessary functional and non-functional capabilities and digitally transform insurance workflows of any complexity. |

|

Pros

|

|

|

|

|

Cons

|

|

|

|

Which Approach to Insurance Automation Fits Your Needs Best?

Answer a few simple questions and find out whether you should opt for a custom solution or a pre-built tool.

Do you need to automate specific or innovative insurance types, e.g., medical malpractice, kidnap and ransom, mortgage, pay-as-you-live life and health, or usage-based auto insurance?

Do you need to automate specific insurance tasks, e.g., risk scoring based on custom criteria, claims triaging based on custom rules, or loss inspection in hard-to-access locations?

Do you want AI-supported insurance automation, e.g., to leverage fully automated document processing, accurately predict risk events and losses, get suggestions on optimal premiums, or detect fraudulent claims?

Do you want to automate insurance tasks using blockchain smart contracts, enable premium payments in crypto, or get end-to-end traceability of insurance transactions and events?

Do you need insurance software providing compliance with the latest insurance regulations of the regions you operate in?

Do you need to integrate your automation solution with multiple back-office systems, legacy tools, or IoT-enabled software-hardware systems?

Do you need a solution offering advanced cybersecurity mechanisms (e.g., intelligent detection of cyber threats and instant enforcement of protective measures)?

Do you need an insurance solution with various interfaces for different roles (e.g., underwriters, policy administrators, claim specialists, analysts, customers/brokers)?

Do you plan to evolve the automation solution with new functional and non-functional capabilities in order to adjust it to changing business and legal requirements?

Do you have large teams involved in insurance processes and look to avoid the software fees associated with the per-user subscription model?

Please tell us a bit more about your needs

Answer at least 3 questions to get results.

You can go with off-the-shelf insurance software

Looks like market-available solutions are a viable option to meet your automation needs. Turn to ScienceSoft if you need help with choosing the optimal ready-made tools, their implementation, customization, or integration with your existing systems.

You definitely should consider custom development

A tailored insurance automation solution will help you reap the unique benefits that market-available software cannot offer. Turn to ScienceSoft to get the detailed assessment of a custom system’s feasibility for your business situation.

Custom insurance software is your best choice

Looks like market-available automation tools don’t fit your specific requirements and won’t be able to provide the expected operational and economic feasibility. Turn to ScienceSoft to get a consultation on custom insurance software and receive cost and ROI estimates.

Insurance Automation Costs

The costs and timelines of implementing custom insurance automation solution vary greatly depending on:

- The number and specifics of insurance processes (e.g., underwriting, billing, claim management, etc.) to automate.

- The functional complexity of the automation system, including the implementation of features powered by advanced techs (e.g., blockchain for insurance).

- Performance, availability, scalability, security, compliance requirements.

- The scope and complexity of integrations.

- The number of user roles.

- The sourcing model (full outsourcing, team augmentation, or all in-house) and team composition.

From ScienceSoft’s experience, an insurance automation project for an upper-midsize company may cost around $200,000–$1,500,000. Large enterprises with complex insurance processes should expect to invest $1,000,000–4,000,000+.

Want to know the cost of your insurance automation solution?

Key Benefits of Insurance Automation

Higher efficiency of insurance teams

Automated systems let insurers establish straight-through customer onboarding, risk evaluation, pricing, policy issuance, and claim decision-making flows. This brings up to a 50% reduction in employee workload alongside a 25–35%+ increase in the teams’ productivity.

Faster insurance processes

AI-supported insurance document automation allows insurers to process multi-format applications, risk evidence, and claim proofs over 50x quicker, which accelerates quote submissions and claim decisions by more than 4x. Insurance reports can be produced 2.5–75x faster.

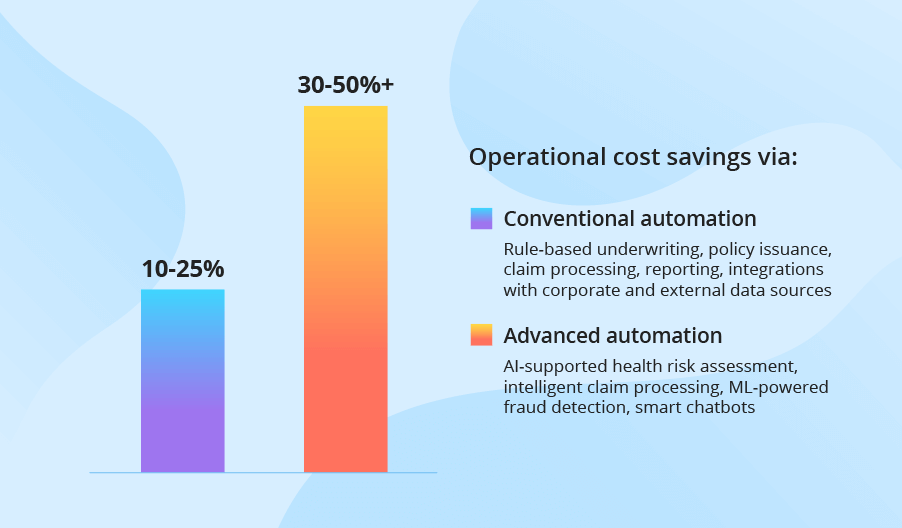

Operational cost savings

By automating core servicing tasks, insurers benefit from a 10–25% decrease in operational expenses due to removed manual routines and enhanced team performance. Employing an AI-powered insurance solution can bring a 30–50% cost reduction.

Minimized fraud-associated losses

Leveraging intelligent automation tools for insurance fraud detection can reduce fraud-associated losses by up to 90% due to the timely prevention of illegitimate services, undue claim payouts, and malicious employee transactions.

Twofold growth in business profits

Insurance automation at scale can help large insurers achieve up to a 50% increase in business profits over five years due to optimized operational costs, minimized risks, and maximized revenue potential enabled by new digital service models.

Enhanced customer experience

Digitalizing customer interactions and bringing automation into the insureds’ self-service processes helps elevate customer experiences and drive a drastic increase in customer satisfaction, promising up to a 4% increase in insurer revenue and EBIT growth rates.

Insurance Automation With ScienceSoft

In insurance software development since 2012, ScienceSoft provides a full scope of required services to help insurance companies plan and introduce robust business process automation.

Our awards, certifications, and partnerships

Insights From ScienceSoft's Insurance IT Experts

About ScienceSoft

ScienceSoft is a global IT consulting and software development company headquartered in McKinney, Texas. We design and build robust solutions to help insurance companies automate their business processes. Being ISO 9001- and ISO 27001-certified, we apply a mature quality management system and guarantee that cooperation with us does not pose any risks to our clients’ data security.