Custom Treasury Management System

Features, Integrations, Financial Outcomes

In financial software development since 2007, ScienceSoft creates state-of-the-art treasury solutions that help companies boost the efficiency of their cash, debt, investment, and financial risk management workflows.

Treasury Management System in a Nutshell

A treasury management software automates corporate treasury activities, including cash, investment, debt, trade finance, and risk management. Custom treasury software can provide AI-based financial analytics to ensure high accuracy of treasury decisions, maximize profitability, and minimize risks.

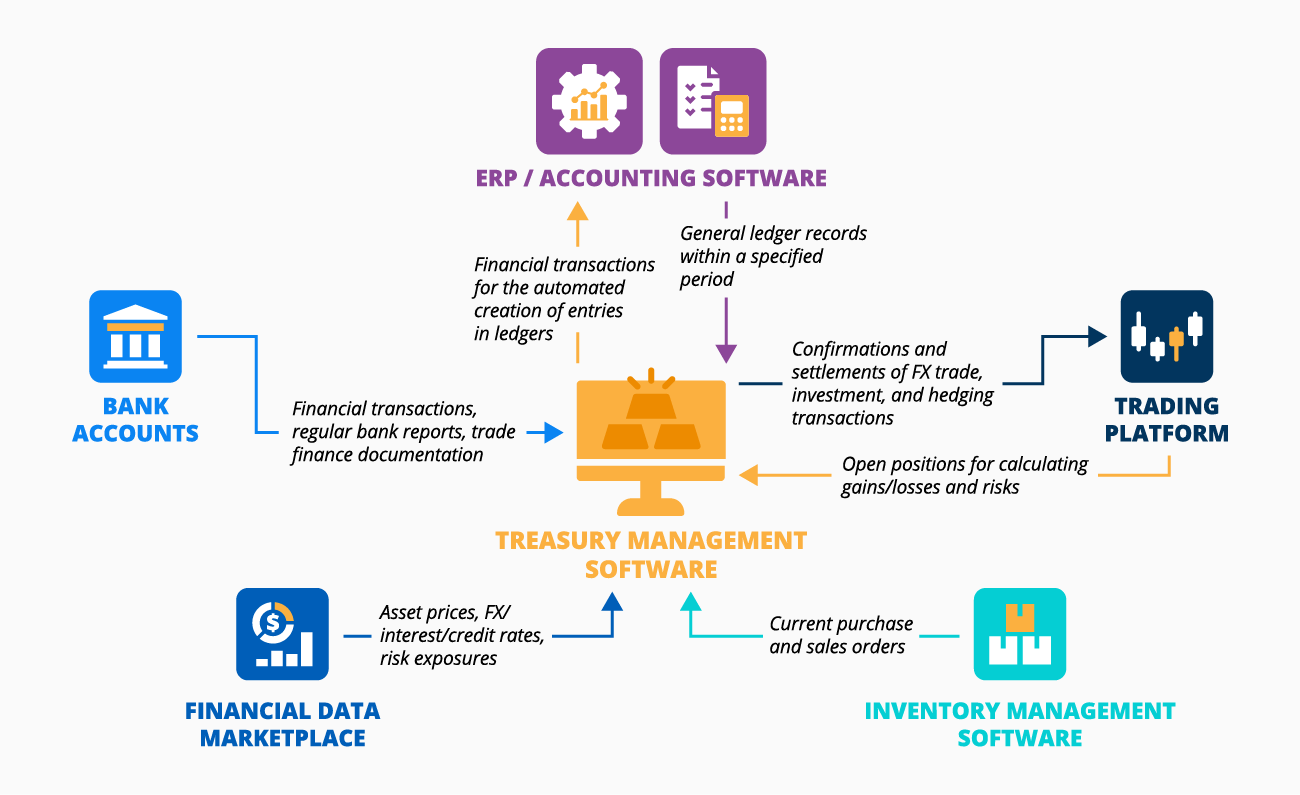

A treasury solution integrates with accounting software, bank accounts, trading platforms, and more.

The implementation of a custom treasury management system of average complexity takes 6–12 months, while building a high-end solution may require a minimum of one year. Average costs for building a custom treasury system vary from $400,000 to $1,000,000+, depending on the solution complexity. Use our cost calculator to estimate the cost for your case.

ROI for the custom treasury management system may reach up to 280%. An average payback period for such a solution is about 5 months.

Treasury Management System: Key Features

Below, ScienceSoft shares a sample feature set that forms the core of a treasury management solution. However, each real-life use case for such software is unique, so functionality should be elaborated on and tailored to the business specifics accordingly.

Benefits of a Treasury Management System

The ROI for a custom treasury system may reach up to 280%. An average payback period for such a solution is around 5 months.

Is Custom Treasury Software the Right Fit for You?

Answer a few simple questions and find out whether you should opt for a custom solution or a pre-built treasury tool.

Do you need software providing specific features, e.g., calculating risk exposures and asset fair values based on custom formulas or transaction confirmation based on non-standard rules?

Do you want to leverage AI-supported treasury automation to accurately plan and optimize cash, investment, and financing activities?

Are you dealing with crypto asset finance and need a blockchain-based solution for automated crypto treasury management?

Do you need a treasury solution providing compliance with the latest financial regulations (SOX, SEC, CFTC, EMIR, SAMA, etc.) of the countries you operate in?

Do you need to integrate your treasury software with multiple back-office systems, third-party financial platforms, or legacy tools?

Do you need a solution powered with advanced financial data security mechanisms like transaction e-signing or intelligent detection of employee fraud?

Do you need treasury software with various interfaces for different roles in the treasury team (e.g., financial analysts, payment specialists, investment specialists, etc.)?

Do you plan to evolve the software with new functional and non-functional capabilities in order to adjust it to changing business and legal requirements?

Do you have large teams involved in treasury tasks and look to avoid the software fees associated with the per-user subscription model?

Please tell us a bit more about your needs

Answer at least 3 questions to get results.

You can go with off-the-shelf treasury software

Looks like market-available solutions are a viable option to meet your needs. Turn to ScienceSoft if you need help with choosing the optimal ready-made tool, its implementation, customization, or integration with your existing systems.

You definitely should consider custom development

Tailor-made treasury software will help you reap the unique benefits that market-available tools cannot offer. Turn to ScienceSoft to get a detailed assessment of a custom treasury system’s feasibility for your business situation.

Custom treasury software is your best choice

Looks like market-available treasury tools won’t be able to provide the expected operational and economic feasibility for your needs. Turn to ScienceSoft to get a consultation on custom treasury software and receive free cost and ROI estimates.

Important Integrations for the Treasury Management System

To enhance visibility of treasury activities, streamline reconciliation, and ensure accurate and timely financial accounting, ScienceSoft recommends setting up the following integrations:

Accounting software

- For the automated creation of entries in the general ledger, accounts payable and accounts receivable ledgers.

- For faster reconciliation.

- For accurate financial reporting.

Bank accounts

- For centralized transaction tracking across multiple domestic and international bank accounts.

- For streamlined reconciliation.

- For quick sharing of trade finance documents (e.g., letters of credit, bank guarantees) with relevant banks.

Trading platform

- For faster confirmation and settlement of FX trade, investment, and hedging transactions.

- To quickly calculate gains, losses, and risk exposures for various investment portfolios and asset classes.

Financial data marketplace

- For streamlined investment portfolio valuation and benchmarking.

- For informed fair value calculation.

- For the data-driven design of hedging strategies.

Supply chain management software

- To assess supply chain data necessary to plan trade finance activities.

ROI Factors for a Treasury Management System

In ScienceSoft's projects, we always seek to cover the following important factors to maximize the value and cost-efficiency of treasury management software:

A high degree of automation

To automate such tasks as, e.g., logging into connected bank accounts and market data platforms, retrieving and reconciliating of relevant financial data, generating financial reports, etc.

AI-powered financial analytics

To accurately forecast operating cash flow and financial gains under investing and financing activities, as well as get intelligent prescriptions on optimal liquidity planning, payment, investment, financing, and hedging actions.

Embedded BI tool

To enable advanced analysis and reporting on financial data across various treasury activities.

Well-documented APIs

To enable integration between the treasury management solution and accounting software, multiple bank accounts, trading platforms, etc.

How to Develop Treasury Software

Treasury software development is a complex process that involves business analysis, solution planning and design, coding, testing, integration, and extensive user training. Implementation of treasury systems with ScienceSoft covers the following important steps:

1

Business needs analysis and eliciting requirements for the treasury system.

2

Introducing the optimal feature set, architecture design, and tech stack.

3

Project planning: scope, deliverables, duration, budget, team composition, etc.

4

Custom treasury software development.

5

Quality assurance in parallel with coding.

6

Financial data migration (from spreadsheets or a previously used treasury tool).

7

Integration with other corporate solutions and relevant third-party systems.

8

User training.

9

After-launch support and evolution of the treasury solution (optional).

Treasury System Implementation Costs and ROI

Based on ScienceSoft’s experience, average costs for building a custom treasury management system vary from $400,000 to $1,000,000, depending on the solution complexity.

Want to understand the cost of your treasury solution?

Off-the-Shelf Treasury Software ScienceSoft Helps Implement

For companies with non-specific treasury management needs, ScienceSoft can help implement, customize, and integrate one of the market-leading treasury software products.

SAP Treasury and Risk Management

Key strengths

- Straight-through processing of various financial transactions, including money market, FX, derivatives, securities, and debts.

- Native integrations with SAP S/4HANA Cloud ERP, SAP Data Intelligence, SAP Cash Application.

- Self-paced user training.

Features

- Customizable investment categories and investment portfolio hierarchy.

- Credit risk control based on preset limits.

- Automated calculation of key risk and return metrics, including exposure, future values, sensitivities, and value at risk.

- Automated evaluation of hedging strategies based on simulated transactions and market data scenarios.

Best for

Managing comprehensive investment, funding, credit, hedging activities for large enterprises.

Active Liquidity Platform by Kyriba

Key strengths

- More than 40,000 pre-built payment scenarios for more than 1,000 banks.

- Embedded BI providing advanced financial data visualization and payment analytics.

- ML-powered real-time fraud detection based on the pre-set detection rules.

Features

- In-house banking management.

- Centralized eBAM with signatory authorizing and tracking, audit trails, FBAR reporting, and more.

- Automated bank reconciliation.

- Cash flow and FX exposure forecasting.

- Hedging recommendations based on the approved cash flow forecasts.

Best for

Managing liquidity risks, payments, trade finance and investments for midsize businesses.

Reval by ION

Key strengths

- Configurable OOTB bank connectivity service.

- Integrated market data feeds providing accurate derivative valuations.

- Compliance with ASC 815, ASC 820, ASC 820-10, IAS 39, IFRS 7, IFRS 13, IFRS 9, SEPA, FBAR, and more.

Features

- Automated cash positioning and bank reconciliation.

- Centralized payment workflow via cash pooling, payment factory, multilateral netting, intercompany clearing.

- Automated risk exposure calculation for all major asset classes, including FX, interest rates, structured rates, energy, agriculture, metal.

- Financial risk modeling and analysis.

- Alerts on suspicious financial data manipulations and fraud attempts.

Best for

Managing cash, liquidity, investment risks and hedge accounting for midsize to large organizations.

Treasury System Development with ScienceSoft

With 18 years of experience in engineering financial software and practical knowledge of 30+ industries, ScienceSoft offers full-cycle services to deliver effective treasury solutions.

Treasury system consulting

- Treasury management needs analysis.

- Audit of the existing treasury management processes and tools (if any).

- Suggesting optimal treasury system features, architecture, tech stack.

- Preparing a plan of integrations with the required systems.

- Implementation project cost & time estimates, expected ROI calculation.

Treasury system engineering

- Treasury solution conceptualization.

- Architecture design.

- Treasury system development.

- Integrating the solution with the necessary systems.

- Quality assurance.

- User training.

- Continuous support and evolution (if required).

About ScienceSoft

ScienceSoft is a global IT consulting and software engineering company headquartered in McKinney, Texas. Since 2007, we've been helping businesses build effective treasury systems tailored to their finance and risk management needs. Being an ISO 9001- and ISO 27001-certified company, we apply a mature quality management system and guarantee that cooperation does not pose any risks to our clients’ data security.