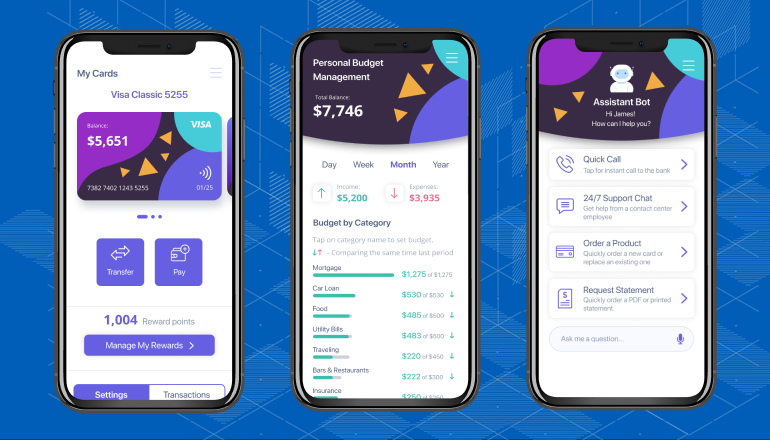

Mobile Banking Demo

Our interactive demo guides you through the use of a mobile banking app sample and shows some of its most useful features, including Photo Bill Pay, Assistant Bot communication, Personal Budget Management, and Rewards System.

While our demo shows only a limited number of features, any mobile banking app development project presents unlimited possibilities. Let’s have a closer look at additional functionality that can turn a banking app into an indispensable financial assistant for your clients.

Auto-payments

Go beyond offering Templates and let your clients choose to automate all their monthly payments. Clients with extremely busy schedules will appreciate having the weight of some to-do tasks off their shoulders. Just ensure they always stay in control of the situation by having the app send notifications about the payments made.

AR navigation

Help your clients easily find your bank’s ATM, banking center or an outlet of a loyalty program partner in unfamiliar locations. As one of our mobile app development case studies shows, the augmented reality geolocation feature serves as a convenient on-screen navigator that reads a user’s current location and directs toward the closest point of interest with an arrow. This feature is extremely helpful in large shopping malls, where the abundance of signs and markings makes it difficult to find the necessary spot.

Biometrical security

Keep up with the enhanced security measures offered by cutting-edge mobile devices and have biometrical identification integrated into your app. Face ID and Touch ID provide an additional security level and make operation approval faster and easier for clients. In case a client’s device doesn’t have biometrical sensors, the app will replace approval methods with PIN or Pattern.

Gamified budget management

Don’t underestimate the power of virtual achievements – many clients can restrain from crossing a custom-set budget margin, so they could earn an ultra-rare collectible trophy on staying within the planned expenditure for 6 months in a row. For people with overspending tendencies, receiving regular entertaining motivation to meet saving goals is invaluable. The hope of overcoming unhealthy spending habits may give such people enough ground to even become your bank’s new client.

Healthy lifestyle bonuses

Motivate your clients to lead a healthy lifestyle by using your banking app. Sounds bizarre? In one of our mobile banking app modernization projects, we integrated a feature that continuously counts the number of steps made by a user and then awards monthly bonus points depending on how active the user was. The app engagement rate skyrocketed as clients embraced the idea of collecting bonus points and using them to pay in the bank’s partner shops and restaurants.