Payment App Development

A Step-By-Step Guide

ScienceSoft applies 20 years of experience in payment software development to help companies plan and build apps that deliver secure, seamless payment experiences.

Payment Application Development: Summary

Payment app development helps companies provide their customers with a fast and convenient way of sending and receiving digital payments. Custom payment apps offer comprehensive functionality for funds management, support all required payment methods and currencies, provide advanced security of customer’s personal and payment data, and can be easily evolved with new features.

Key steps to create a payment app

- Analyze payment needs and gather requirements.

- Plan the project's scope, duration, and budget.

- Design the payment app and select the appropriate tech stack.

- Develop the payment app and conduct quality assurance.

- Integrate the application with the necessary systems.

- Deploy the payment application and organize support.

- Timelines: 6–11 months on average.

- Cost: $150,000–$2,000,000+, depending on the type of a payment app. Use our cost calculator to estimate the cost for your custom solution.

- Required skills: a project manager, a business analyst, a solution architect, a UX designer, a UI designer, a front-end developer, a back-end developer, a DevOps engineer, a QA engineer.

Why Tap into the Payment App Market

An overall trend towards finance digitalization and cashless settlements, amplified by the growth of the ecommerce industry, drives the increasing popularity of online payments. The global digital payments market was estimated at $121.53 billion in 2025 and is predicted to hit $358.81 billion by 2030, growing at a CAGR of 19.43%. The increasing volume of digital payments spurs the demand for web and mobile payment apps, making the payment app market a lucrative niche to step into.

Go-to monetization strategies for a payment app

- Charging a transaction processing fee (a flat fee or a percentage of the payment amount).

- Charging a fee for premium services, e.g., faster payment processing, higher transfer limits, or advanced security.

- Applying a markup on the currency exchange rate for cross-border transactions.

- Earning the interest on float accounts.

- Selling in-app advertising.

- Monetizing the app user data upon user consent.

How to Build a Payment App

Below, ScienceSoft describes the essential steps we take to introduce reliable and secure payment applications tailored to the clients’ unique requirements.

Step 1.

Analysis and requirements engineering

At this stage, ScienceSoft’s consultants:

- Communicate with key project stakeholders to discuss the payment app vision or discuss payment handling needs.

- Introduce a detailed list of requirements for the solution, which describes:

- The type of a payment app.

- The required platform to base a payment app on (web, mobile, or both).

- Functional capabilities a payment app is expected to provide, e.g., support for particular payment methods (cards, bank transfer, e-wallet, etc.), currencies (fiat and crypto), payment models (e.g., recurring payments, split payments), and more.

- The data the app should be able to process (customers’ personal information, credit card data, crypto wallet address, etc.).

- Requirements for the app’s UX and UI.

- Non-functional requirements, including security and compliance requirements (e.g., AML/KYC requirements to prevent payment fraud, PCI DSS requirements for secure credit card payments processing, and more).

Step 2.

Project planning

The accurate planning of web and mobile payment app development can substantially reduce project timelines and prevent operational and financial risks. During this stage, ScienceSoft’s team:

- Defines objectives, KPIs, and milestones for the project.

- Determines project deliverables, duration, and budget.

- Forms the project team and designs collaboration workflows.

- Outlines possible project risks, defines a risk mitigation strategy and plan.

- Estimates the expected TCO and ROI of the payment application.

Step 3.

Payment application design

This step involves:

- Introducing an optimal feature set for a payment application, including security and compliance features.

- Designing accurate logic for payment automation.

- Designing a secure and scalable architecture of a payment app:

- Creating a detailed description of how the app’s functional modules and a database should perform.

- Determining integration approaches between the app’s components.

- Designing UX and UI for the required user roles, such as individual users, corporate users, app admins:

- Conducting UX research to understand the behavior of the app’s target audience.

- Describing user interactions with the app, creating functional wireframes and content layouts.

- UX prototyping.

- Designing the visual appearance of the app and introducing UI mockups.

- Providing a payment app integrations plan with the required payment processing networks, suggesting optimal ready-to-use integration solutions (particular open banking APIs, crypto APIs, etc.), if needed.

Step 4.

Tech stack selection

When selecting techs and tools for payment app implementation, ScienceSoft adheres to the following practices:

- We rely on best-performing technologies and tools to ensure the high quality of the application.

- We compare possible techs and tools in the context of the client's priorities (e.g., prompt development, minimized project cost, etc.) and form an optimal tech stack with the client’s goals in mind.

- We employ platforms, frameworks, and ready-made components where possible to streamline development and optimize project cost.

Step 5.

Payment application implementation

The implementation of a payment processing app with ScienceSoft usually includes the following stages:

1. Development

- Establishing development and delivery automation environments (CI/CD, container orchestration, etc.).

- Creating the server-side code of a payment app.

- Developing role-based user interfaces.

- Implementing a PCI DSS compliant database.

- Performing unit tests in parallel with coding.

2. Integration with required systems

- (for bank-based payment apps) App integration with a bank’s payment processing system.

- (for other payment apps) App integration with the required payment processing networks using banking APIs and/or crypto APIs.

3. Quality assurance

- Designing a test strategy, a test plan, test cases and checklists.

- Writing and running automated test scripts, if relevant.

- Conducting functional, including integration, and non-functional testing.

- Fixing defects revealed during testing.

4. Deployment

- Configuring the app’s infrastructure, backup and recovery procedures.

- Implementing infrastructure security tools (authorization controls for APIs, DDoS protection algorithms, firewalls, IDSs / IPSs, etc.).

- Deploying the payment application in the production environment.

Developing and launching an MVP helps promptly obtain end user feedback and rapidly adjust the app for higher user value. It allows for lower investments and faster payback from the app implementation. We can deliver an MVP of a custom payment app in 3–5 months and consistently grow it to the fully-featured solution with major releases every 2–3 weeks.

Step 6.

Support and evolution (optionally)

ScienceSoft offers continuous monitoring and optimization of the payment application to ensure its stable performance, compliance with relevant data security standards and regulations, and ability to provide smooth payment experience for end users. We can evolve the app by adding new features and perfecting its non-functional capabilities.

Types of Payment Applications We Develop

ScienceSoft is ready to help you design and build the type of a payment app that fits the specifics of your business best.

A bank-based payment app

Employs existing banking infrastructure (a transaction processing system, a payment gateway) to process and settle digital payments in fiat currencies.

Best for: established traditional banks, neobanks.

A standalone payment app

Relies on non-banking payment processing infrastructure, enables fast and cost-effective funds transfer between the app’s users.

Best for: fintech startups focused on payments, including crypto startups.

A social-media-centric payment app

Provides a digital wallet embedded in the social media platform, allows for instant peer-to-peer payments between the social network users.

Best for: social media companies.

A mobile-OS-based payment app

Offers a digital wallet built upon a mobile OS for NFC- and QR-code-enabled offline payments and convenient online payments.

Best for: mobile device manufacturers.

How Much It Costs To Make a Payment App

The costs of building a payment app vary greatly from case to case. Below, ScienceSoft lists the major factors that affect the project budget:

Core cost factors

- The type of a payment app (determines the spend on integrations with payment processing networks).

- The number and complexity of the app’s features.

- The platform to base the app on (web, mobile, or both).

- (for mobile payment apps) Supported mobile platforms (iOS, Android).

- The number of user roles and specific UX and UI requirements for each role.

- Performance, scalability, availability, security requirements for the app.

Operational cost factors

- License fees for cloud services, ready-made app components (e.g., KYC/AML verification services, messaging services), integration components (banking APIs, crypto APIs), security tools.

- Maintenance of PCI DSS compliance, including annual PCI audits.

- Payment application support services.

From ScienceSoft’s experience, developing a payment application may cost from $150,000 to $2,000,000+.

For reference, a mobile payment app of average complexity may require the budget of $150,000–250,000, and a comprehensive web payment app with an independent processing engine at its core — $1,500,000–2,000,000+.

Want to learn the cost of your payment app?

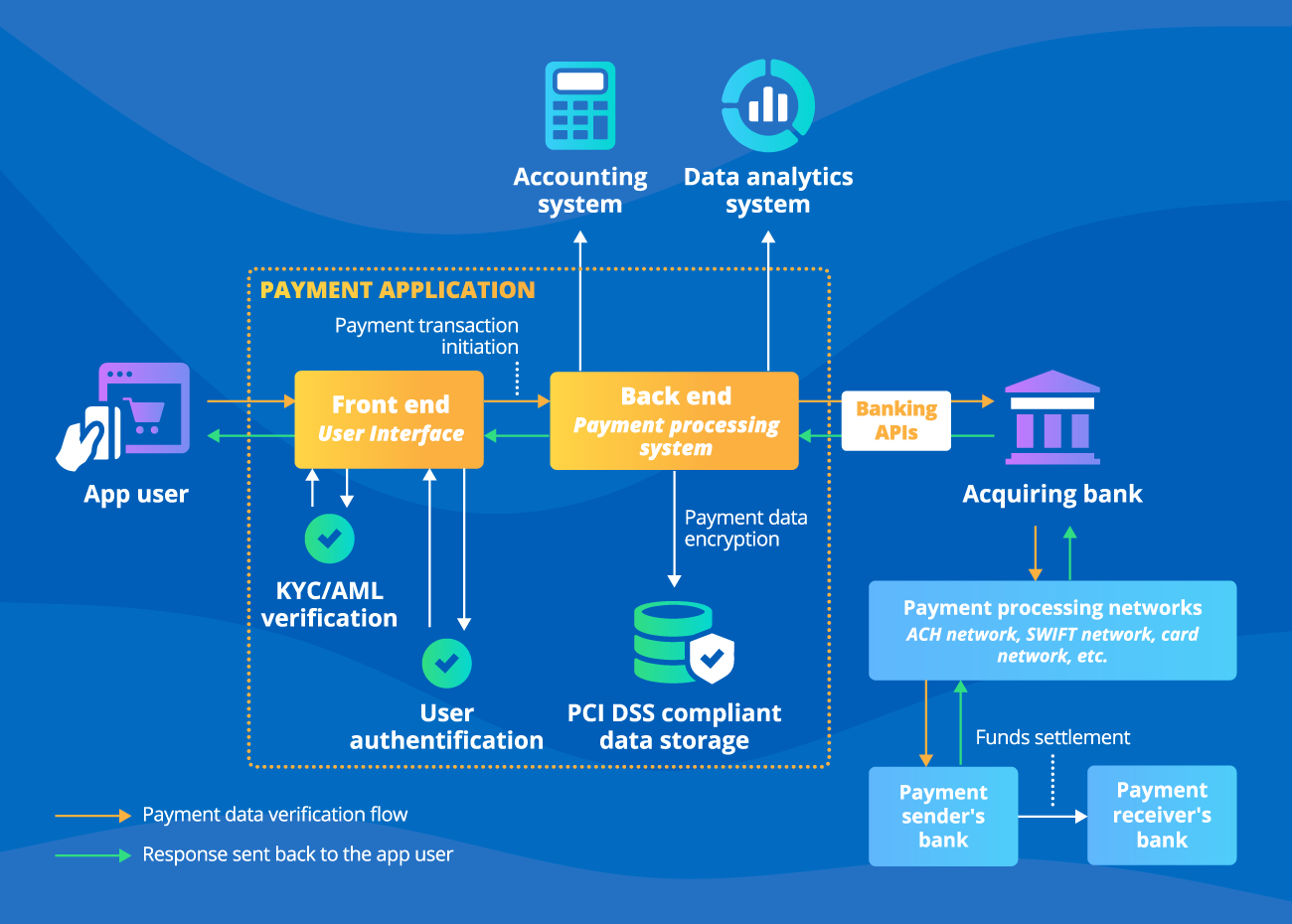

A Sample Architecture of a Payment Application

Payment applications ScienceSoft delivers typically comprise:

- Web and/or mobile interface for end users to interact with the application (make and accept payments, check the account balance, monitor spend, etc.).

- A payment processing system to verify a user’s personal and payment information, trigger funds settlement and control its progress.

- PCI DSS-compliant data storage to ensure the security of cardholders’ sensitive data and enforce proper data retention and deletion policies.

To operate properly, a payment app needs to ensure a seamless payment data flow to the payment processing networks (e.g., the ACH network, SWIFT, VISA / MasterCard / American Express card network). Bank-based payment apps rely on direct integration between the bank’s existing processing system and the networks. Other payment apps usually employ banking APIs to integrate their payment processing system with a chosen acquiring bank, validate the required user information (e.g., via 3D Secure mechanisms), and streamline its further transfer to the processing networks and other banks.

Note! Cryptocurrency payment processing requires integration with dedicated blockchain networks of the crypto coins that a payment app supports. ScienceSoft recommends employing ready-to-use cryptocurrency APIs (e.g., Coinbase API, CoinGate API) to streamline the connection of a P2P payment app to the required blockchain networks.

Additionally, a payment app can be integrated with an accounting system of the app owner to instantly record data on the received transaction fees. The solution may also be connected to the data analytics system to share relevant data required to analyze the app users’ payment behavior.

Key Features of a Payment Application

From ScienceSoft’s experience, companies looking to develop a payment application usually expect the solution to cover the following functionality:

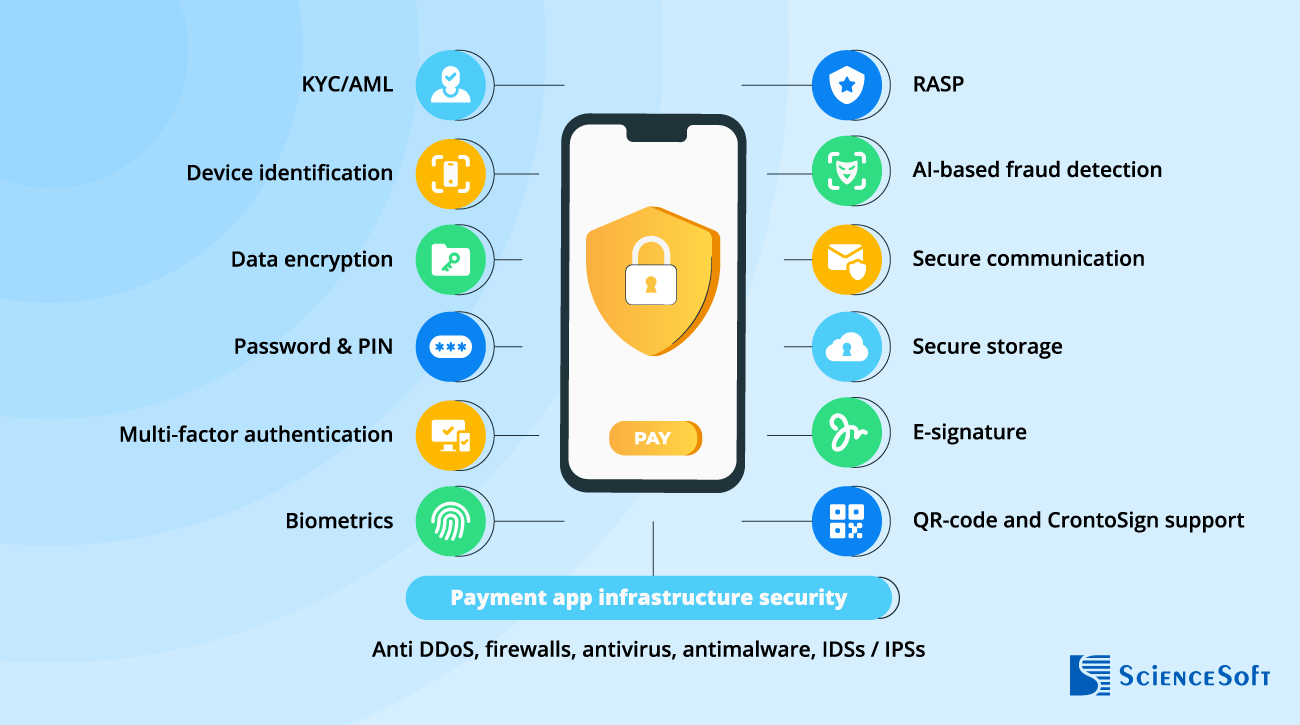

Ensuring robust payment app security

Cybercrime surrounding the field of e-payments reaches new heights year by year, and payment software is an attractive target for fraudsters. Identity deception, phishing, malware attacks, DDoS attacks are only few examples of cyber threats that, if not addressed properly, may result in funds theft and sensitive data breaches, leading to severe financial and reputational damage.

ScienceSoft implements powerful protective measures to secure your app against malicious actors:

- Geography-based KYC/AML and OFAC verification for app users.

- Multi-factor authentication, including biometric authentication (e.g., facial or fingerprint recognition).

- Automated device identification and binding to user account.

- Payment and user data encryption, including asymmetric encryption for crypto payments.

- Transaction signing using a digital signature.

- Password management.

- Automated generation of one-time passwords (OTP) to verify a user for logging and transacting.

- EMVCo-compliant 3D Secure authentication.

- AI-powered detection of payment fraud, which is critical as financial fraud becomes more sophisticated.

- Runtime application self-protection (RASP).

- Authorization controls for APIs.

- DDoS protection, firewalls, IDSs / IPSs, antivirus protection, EDR, SIEM, XDR, SOAR.

Why Build a Payment App With ScienceSoft

-

Since 2005 in payment software development.

- Since 2003 in cybersecurity to ensure world-class protection of payment applications.

- In-house compliance experts to guarantee payment app compliance with relevant global, country- and industry-specific standards and regulations.

- Principal architects with hands-on experience in designing complex payment solutions and driving secure implementation of advanced techs.

- Quality-first approach based on an ISO 9001-certified quality management system.

- Robust security management supported by ISO 27001 certification.

Our awards, certifications, and partnerships

Typical Roles on ScienceSoft’s Payment App Development Teams

Project Manager

Creates a project plan, prioritizes the scope of work and monitors its execution, coordinates communication between the team members, reports the progress to the stakeholders.

Business Analyst

Analyzes needs and expectations of a client/target users and translates them into functional and non-functional requirements for the payment application.

Solution Architect

Designs the architecture of the payment application and its integration points with the required systems.

UX Designer

Performs UX research, designs user interactions with a payment application, conducts usability testing.

UI Designer

Creates the style of the user-facing interfaces and introduces a UI kit for user interface development.

Front-end Developer

Delivers UI of a payment app and fixes defects found by the QA team.

Back-end Developer

Delivers the code of the app’s back end, integrates the solution with relevant systems, and fixes defects found by the QA team.

DevOps Engineer

Containerizes payment app’s components, configures CI/CD pipelines for streamlined app development, testing, and release.

Quality Assurance Engineer

Creates and implements a test strategy, a test plan, and test cases to validate the quality of the payment app against the quality requirements defined in the project plan.

Sourcing Models for Payment Application Development

Your Benefits From Payment App Development With ScienceSoft

We ensure application compliance with PCI DSS, 3D Secure, AML/KYC regulations, CCPA, PSD2 and GDPR (for the EU), other relevant global, country- and industry-specific standards.

Fast payback

We rely on an iterative approach to payment app development to introduce the fundamental functions first and speed up payback.

ScienceSoft’s Tech Stack for P2P Payment App Development

We know how to create a payment app for impeccable performance, full security, and seamless growth. In our projects, we usually rely on the following proven tools and technologies:

Consider Professional Services to Build Your Payment App

ScienceSoft applies 26 years of experience in web development and 20 years – in mobile to provide companies with:

Consulting on payment app development

- Market and competition analysis.

- Payment app conceptualization.

- Defining product differentiation and a unique selling proposition (USP).

- Optimal feature set, architecture design, UX and UI design, and tech stack.

- A plan of integrations with the required systems.

- Security and compliance consulting.

- An implementation roadmap, including a risk mitigation plan.

End-to-end payment app development

- Payment app idea productization and brand design.

- Architecture design.

- Web and mobile payment application development.

- Developing APIs to expand the app’s integration capabilities.

- App integration with the required systems.

- Quality assurance.

- Support and evolution of the app (optional).

About ScienceSoft

ScienceSoft is a global IT consulting and software development company headquartered in McKinney, Texas. Since 2005, we have been helping companies create reliable and secure payment apps. In our payment software development projects, we employ robust quality management and data security management systems backed up by ISO 9001 and ISO 27001 certifications.