Insurance Policy Administration System

Features, Integrations, Benefits, Costs

ScienceSoft applies 13 years of experience in insurance software development to introduce reliable and secure insurance policy administration systems.

Insurance Policy Administration System: The Essence

An insurance policy administration system streamlines the management of the entire policy lifecycle, from issuance, through billing and endorsement, to termination.

The software enables analytics-driven risk assessment, demand forecasting, and policy pricing. It provides automated recordkeeping and centralized storage of all policy-related data and offers customer self-service capabilities.

Custom insurance policy administration software effectively handles complex and unique policy management processes and is especially helpful for carriers with a wide and varied insurance product portfolio.

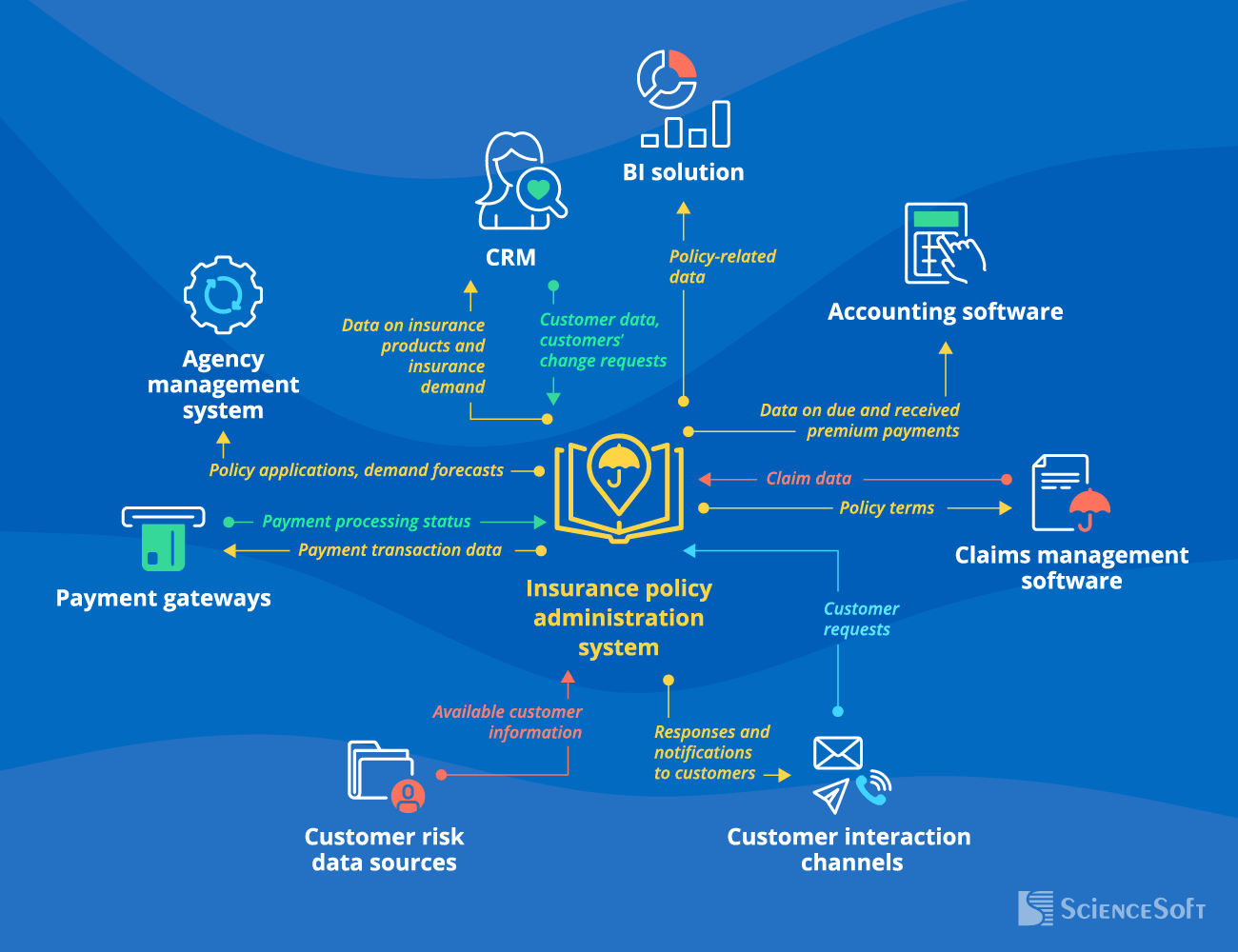

- Key integrations: CRM, an agency management system, claim management software, accounting software, etc.

- Implementation time: 9–12+ months for a custom insurance policy administration system.

- Development costs: $200,000–$600,000+, depending on the solution complexity. Use our online calculator to estimate the cost for your case.

Factors Driving the ROI for an Insurance Policy Administration System

Below, ScienceSoft outlines a range of important factors that help increase payback from the insurance administration solution:

Maximized automation

To eliminate time-consuming policy administration tasks like policy creation, registering, updating with new data, reissuing, etc.

Mobile access

To enable access of the insurer’s employees and policyholders to policy-related data and documents on the go.

Self-service capabilities for customers

To drive higher customer engagement and satisfaction, reduce the insurance team’s workload.

Advanced analytics

To accurately forecast insurance demand and get intelligent guidance on optimal policy pricing and upselling.

No-code policy template editor

To easily create templates for specific policy types like dental insurance, legal E&O insurance, or crop insurance.

Focus on security

To protect the system and data stored there from malicious employee activities and external cyber threats.

Make sure your policy administration system is scalable enough to handle various amounts of data, including voluminous data in various formats, from handwritten text to unstructured IoT big data. This will help you run document-intensive transactions smoothly.

Key Features of an Insurance Policy Administration System

ScienceSoft helps insurance businesses define and implement the optimal functionality to meet each company’s unique policy administration needs. Here, we share a list of features that form the core of an all-encompassing insurance policy administration solution:

Important Integrations for the Insurance Policy Administration System

- For prompt and accurate policy issuance and updating.

- For data-driven planning of marketing activities.

An agency management system

For accurate workload planning, financial planning, and streamlined task assignment.

For instant processing of premium payments and real-time view of payment progress.

- To recalculate due premium amounts for the renewed policies taking into account a customer’s claim history.

- For streamlined claim validation.

For automated recording of payment transactions in the general ledger.

For comprehensive policy analytics and advanced report visualization.

Customer risk data sources

For automated policy quoting with a full insight into a customer’s risk profile.

Specialized integrations you may require include:

Show more

Customer interaction channels

Mail systems, messaging apps, business phone systems, etc.

For fast and convenient omnichannel customer communication.

|

|

|

|

|

|

|

ScienceSoft’s best practice: Consider employing a service-oriented architectural model if you want seamless software updates and easy reuse of policy-related rules, algorithms, and templates across the enterprise-wide IT ecosystem. |

|

|

|

|

How to Develop an Insurance Policy Administration System

Insurance policy administration software development is a way for companies to get tailored capabilities for efficient digitalization of their unique policy issuing, updating, and renewal workflows. Below, ScienceSoft outlines key steps to build a custom solution:

1

Business needs analysis and requirements engineering for a custom policy administration system.

2

Designing the functionality (including security and compliance features), architecture, and tech stack for your policy administration software.

3

Project planning: deliverables, team, duration, budget, etc.

4

Policy administration software development.

6

Insurance policy data migration (from spreadsheets or a previously used policy management tool).

7

Establishing integrations with the required internal and third-party systems.

8

User training.

9

Continuous support and evolution of your policy management solution (optional).

Costs and Benefits of Insurance Policy Administration Software

From ScienceSoft’s experience, building a custom insurance policy administration system may cost around $200,000–$600,000+, depending on the solution’s complexity.

Want to know the cost of your tailored policy management solution?

With policy management software, insurance companies achieve the following benefits:

Off-the-Shelf Software ScienceSoft Recommends

Below, we list the leading policy administration software market offerings and describe their capabilities and limitations. These products provide comprehensive functionality to meet the non-specific business needs across the automation of policy issuance, updating, and renewal tasks.

Oracle Insurance Policy Administration

Best for

Group insurance, including health insurance.

Features

- Template-based creation of insurance products.

- Setting up complex benefit plans for large groups and national accounts.

- Rule-based underwriting and policy updating.

- Support for dynamic quoting.

- Real-time access to policy data for employees and customers.

- Detailed audit trail of insurance transactions.

- Built-in task management functionality.

Cautions

Solution integration with your legacy internal systems is costly and time-consuming. Plus, the product may not provide compliance with the local regulations you’re subject to.

VPAS Policy Administration System by Infosys McCamish

Best for

Personal life and annuity insurance.

Features

- Automated creation and updating of insurance policies.

- Automated calculation of customer segment-specific premiums.

- Various billing methods: direct mail, EFT/ACH, credit and debit card, etc.

- Support for multiple currencies and languages.

- Tracking and reporting the essential policy metrics.

- Instant messaging for internal teams and customers.

- Compliance with AML and OFAC requirements, GLBA, SOX, and more.

Cautions

The product provides limited customization capabilities. Also, it doesn’t cover quoting and rating functionality.

When to Opt for a Custom Insurance Policy Administration System

ScienceSoft recommends building a custom policy management solution in the following cases:

|

|

You need software providing specific functionality, e.g., LLM-supported policy review or blockchain-based policy recordkeeping. |

|

|

You need a solution providing compliance with all required legal regulations, including local regulations. |

|

|

You want to leverage advanced security of policy-related data and documents. |

|

|

You need a system that can be easily evolved with new functional and non-functional capabilities. |

|

|

You want smooth and cost-effective integration of insurance policy management software with your corporate tools. |

|

|

You have large teams involved in policy administration workflows and want to avoid high subscription costs for off-the-shelf products, which scale as the number of users grows. |

Build Insurance Policy Management Software With ScienceSoft

In insurance software development since 2012, we know how to create a powerful solution that can meet your unique insurance policy management needs. We provide:

Consulting services

- Analysis of insurance policy administration needs.

- Suggesting optimal features, architecture, and tech stack for an insurance policy administration system.

- Preparing a plan of integrations with the required internal and third-party systems.

- Consulting on security and compliance.

- Implementation cost & time estimates, expected ROI calculation.

End-to-end development services

- Insurance policy administration needs analysis.

- Software conceptualization and architecture design.

- Policy administration system development.

- Integrating the solution with the required systems.

- Quality assurance.

- User training.

- Continuous support and evolution (if required).

Our awards, certifications, and partnerships

About ScienceSoft

ScienceSoft is a global IT consulting and software development company headquartered in McKinney, Texas. Since 2012, we have been helping insurance companies implement effective policy administration solutions. Being ISO 9001- and ISO 27001-certified, we apply a mature quality management system and guarantee that cooperation with us does not pose any risks to our clients’ data security.