Underwriting Process Automation

Opportunities, Implementation Steps, Costs

In insurance software development since 2012, ScienceSoft delivers secure digital solutions for prompt and predictable automation of insurance underwriting processes.

Underwriting Automation in a Nutshell

Underwriting automation is meant to eliminate low-value manual efforts across insurance application processing, risk assessment, premium calculation, policy issuance and renewal.

An automated underwriting system can be augmented with artificial intelligence (AI) to provide intelligent guidance on optimal insurance pricing and enable instant detection of insurance fraud.

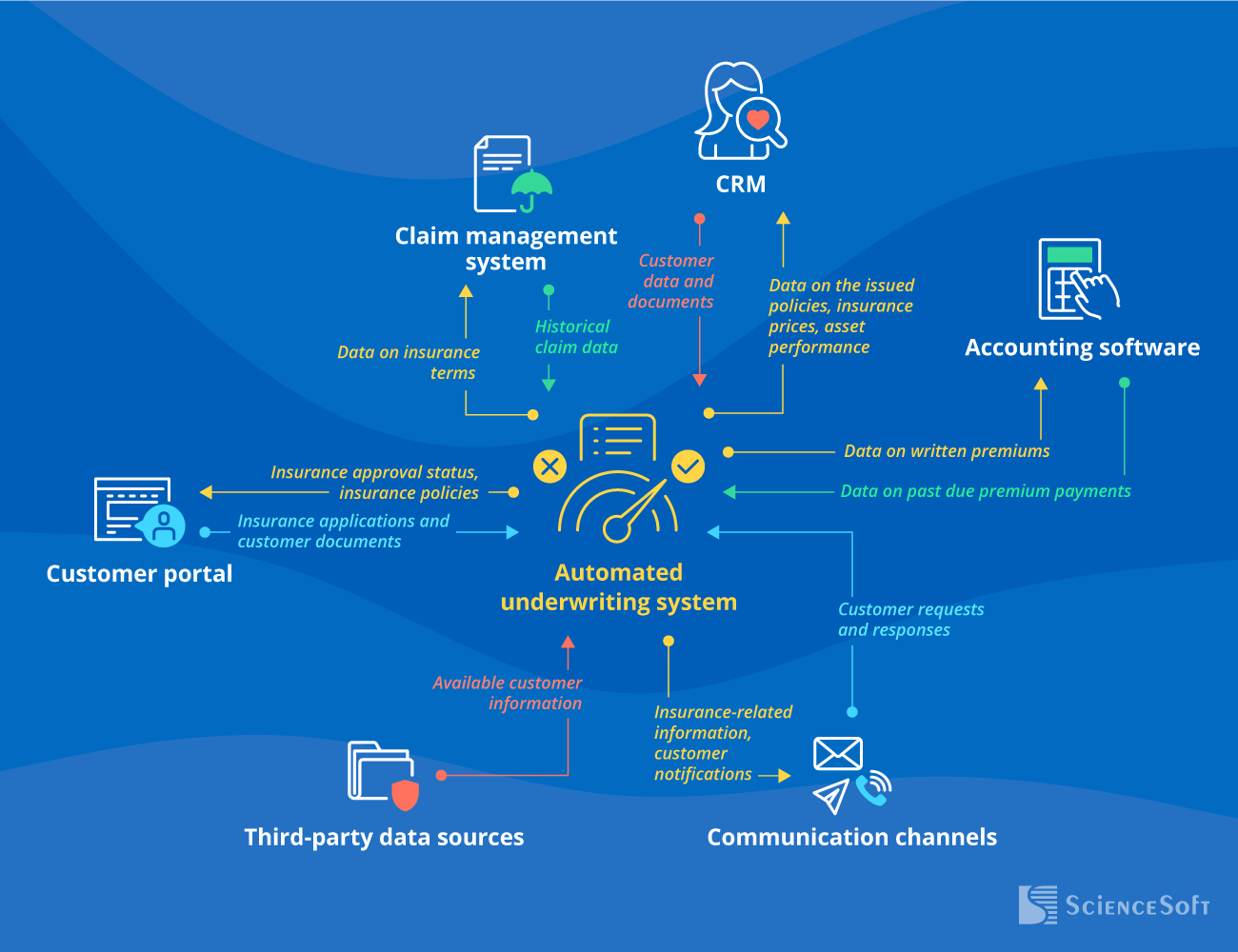

- Key integrations: CRM, a customer portal, a claim management system, accounting software, etc.

- Implementation time: 9–12+ months for a custom underwriting automation system.

- Development costs: $200,000–$600,000+, depending on the automation solution’s complexity. Use our online calculator to estimate the cost for your case.

- Average payback period: <12 months.

Main Underwriting Processes to Automate

|

|

|

|

|

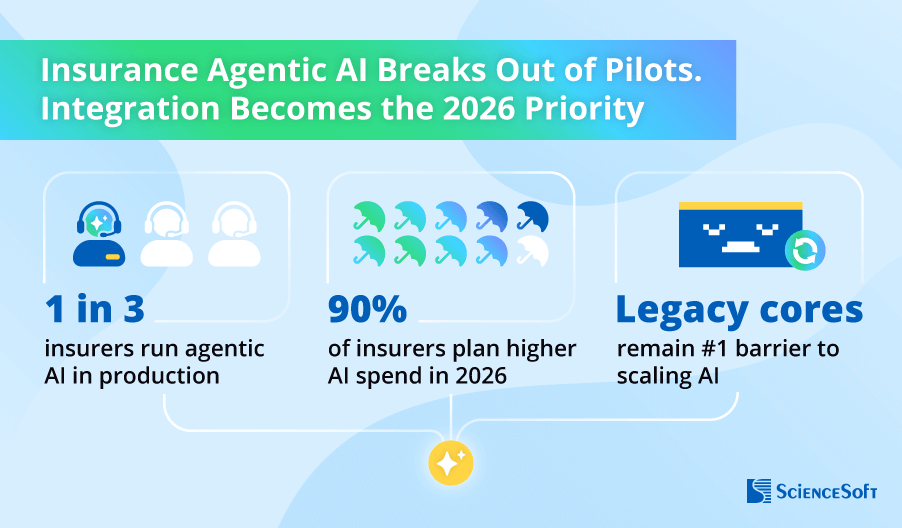

According to Accenture, 80% of insurance executives believe that automation, AI, and ML-based analytics can drive high value for their business. Underwriting is considered one of the largest use case segments for insurance automation. Deloitte emphasizes that implementing automated underwriting will not be easy or quick, but insurers should expect a high-benefit upside. GlobalData’s recent report names AI-supported underwriting a key emerging area of insurtech innovation that can potentially disrupt the entire industry. |

|

|

|

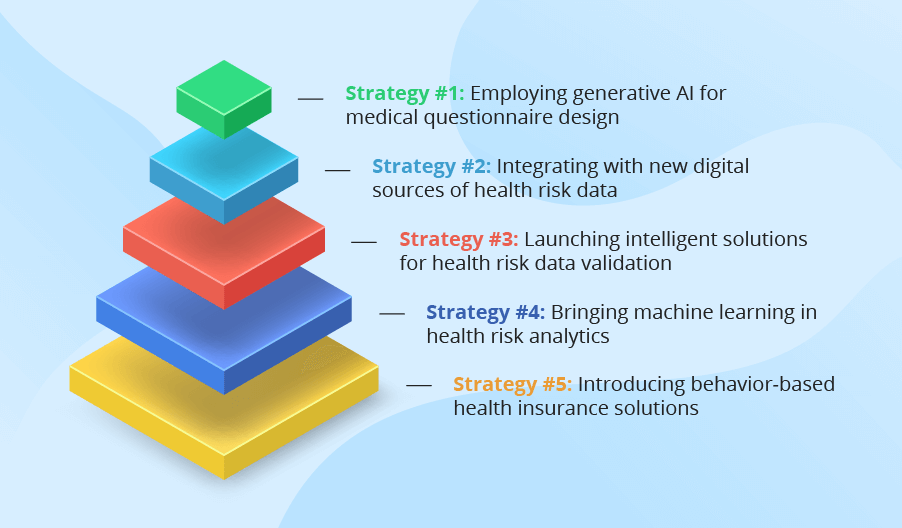

Some of the promising underwriting areas to automate are:

Data intake

Employ AI/ML, RPA, and NLP techs to get instant aggregation and accurate processing of insurance applications and customer documents. With multimodal technology, less than 10% of processing tasks will require human involvement.

Task management

Leverage intelligent triaging and automated assignment of underwriting tasks to meet applicants' expectations for quoting speed, maximize revenue potential, and drive higher underwriters' performance.

Risk assessment

Use advanced analytics and integrate your underwriting solution with multiple data sources for quick, high-precision assessment of customer risks. Consider adding GenAI assistants for straight-through application processing and risk scoring support.

Risk pricing

Apply advanced actuarial algorithms and AI personalization tools to ensure efficient, fair, and competitive insurance pricing. Leverage technology-native, dynamic insurance pricing models to drive up to 15% growth in revenue.

Policy management

Drive the increase in customer satisfaction and maintain a high retention rate by offering quicker issuing, updating, and renewal of insurance policies thanks to the end-to-end automation of a policy cycle.

Compliance

Simplify the adherence of your underwriting operations to your firm's internal policies and regulatory requirements by automating initial and perpetual compliance checks using rule-based and AI-supported engines.

Key Features of an Underwriting Automation System

ScienceSoft creates automated underwriting solutions with unique capabilities tailored to each of our clients’ specific needs. Below, our consultants compiled a list of features that form the core of comprehensive underwriting automation software:

Essential Integrations for an Automated Underwriting System

ScienceSoft recommends establishing the following key integrations to minimize human involvement in the underwriting operations and accelerate the underwriting cycle:

- For faster processing of insurance applications.

- To instantly inform the customers of the insurance approval or decline and speed up policy submission to the clients.

- To streamline policy creation and renewal.

- To keep the insurance agents up to date on the issued policies and due premium amounts.

- For data-driven planning of marketing and distribution activities.

- To consider a customer’s claim history when recalculating the insurance premium.

- For streamlined claim validation.

- To automatically record data on due payments in the general ledger and the accounts receivable ledger.

- To timely trigger insurance termination.

Third-party data sources

For data-driven risk assessment and pricing, real-time premium recalculation under dynamic pricing models.

Specialized integrations you may require:

Show more

Communication channels

For seamless omnichannel interaction with customers.

Show more

How to Maximize ROI for Automation in Underwriting?

Relying on 13 years of experience in insurance digital transformation, ScienceSoft’s consultants defined a range of factors that help drive high payback from an automated underwriting system:

Maximized degree of automation

To free underwriters from time-consuming manual tasks like processing applications, scoring customer risks, generating quotes, and more.

Robust security

To prevent insurance fraud, sensitive data leakage and guarantee reliable protection against cyber attacks.

To get a precise risk assessment and intelligent recommendations on the optimal personalized premium amounts and insurance coverage terms.

Leveraging versatile data from all the relevant sources, including non-standard ones like social media, helps calculate insurance prices with full insight into the customers’ financial risks, health risks, business specifics, lifestyle, location, and other available risk and profitability factors.

Ways to Automate Underwriting

|

|

Off-the-shelf insurance suite |

OOTB automated underwriting tool |

Custom underwriting system ScienceSoft recommends |

|---|---|---|---|

|

Essence

|

Implementing an all-in-one insurance software product that comprises functionality for underwriting process automation. |

Implementing market-available underwriting software, which typically enables RPA-based processing of insurance applications, automated risk scoring and quoting, and provides underwriting task tracking dashboards. |

Developing custom underwriting automation software to get all necessary functional and non-functional capabilities and achieve 100% compliance with all relevant legal frameworks. |

|

Pros

|

Establishing a cohesive insurance automation environment. |

A fast and cost-effective way to automate underwriting for insurance SMBs. |

Fully tailored features. The ability to leverage advanced techs (AI/ML, big data, blockchain smart contracts). Non-restricted scalability. Controllable security. Cost-effective integration with all necessary systems, including legacy software. |

|

Cons

|

High licensing/subscription cost, especially for large teams. Chances to obtain a large share of unnecessary functionality. Limited integration capabilities. Risks of vendor lock-in. |

Pre-defined features, integrations, security measures, and processing flows. Customization can be costly or impossible. May not provide compliance with your local insurance standards. |

Custom design requires additional time and investments. |

|

TCO components

|

Setup costs + customization and integration costs + licensing/subscription fees (typically high due to a wide range of covered digital insurance processes). |

Setup costs + customization and integration costs + ongoing subscription fees that scale with the number of users. |

Upfront investments in software design and development. Lower TCO in the long run. |

Which Approach to Underwriting Automation Fits Your Needs Best?

Answer a few simple questions and find out whether you should opt for a custom solution or a pre-built tool.

Do you need to automate underwriting for specific or innovative insurance types, e.g., medical malpractice, kidnap and ransom, mortgage, pay-as-you-live life and health, or usage-based auto insurance?

Do you need to automate specific underwriting tasks, e.g., application triaging based on custom rules, risk assessment based on custom criteria, or premium segmentation for your specific client segments?

Do you want AI-supported underwriting automation, e.g., to process high-volume risk data, predict risk events and losses, get prescriptions on optimal premiums, leverage dynamic insurance pricing, or detect fraud?

Do you want to automate underwriting tasks using blockchain smart contracts, enable premium payments in crypto, or get end-to-end traceability of underwriting transactions and events?

Do you need underwriting software providing compliance with the latest insurance regulations of the regions you operate in?

Do you need to integrate your automation solution with multiple back-office systems, legacy tools, or IoT-enabled software-hardware systems?

Do you need a solution offering advanced cybersecurity mechanisms (e.g., intelligent detection of cyber threats and instant enforcement of protective measures)?

Do you need an underwriting solution with various interfaces for different roles (e.g., underwriters, quotation specialists, managers, customers/brokers)?

Do you plan to evolve the automation solution with new functional and non-functional capabilities in order to adjust it to changing business and legal requirements?

Do you have large teams involved in underwriting processes and look to avoid the software fees associated with the per-user subscription model?

Please tell us a bit more about your needs

Answer at least 3 questions to get results.

You can go with off-the-shelf underwriting software

Looks like market-available solutions are a viable option to meet your automation needs. Turn to ScienceSoft if you need help with choosing the optimal ready-made tools, their implementation, customization, or integration with your existing systems.

You definitely should consider custom development

A tailor-made underwriting automation solution will help you reap the unique benefits that market-available software cannot offer. Turn to ScienceSoft to get the detailed assessment of a custom system’s feasibility for your business situation.

Custom underwriting software is your best choice

Looks like market-available automation tools don’t fit your specific requirements and won’t be able to provide the expected operational and economic feasibility. Turn to ScienceSoft to get a consultation on custom underwriting software development and receive cost and ROI estimates.

Underwriting Automation Costs

The costs and timelines to build an automated underwriting system may vary greatly depending on:

- The scope and complexity of functional modules, including features powered by advanced techs.

- Non-functional requirements: performance, scalability, availability, security, compliance, etc.

- The number and complexity of integrations.

- Role-specific requirements for UX and UI.

- The chosen sourcing model (full outsourcing, partial outsourcing, or all in-house), and more.

From ScienceSoft’s experience, a custom automated underwriting solution of average complexity costs around $200,000–$400,000. Building a comprehensive underwriting automation system powered with advanced analytics may cost $600,000+.

Want to know the cost of your underwriting solution?

NB! ScienceSoft can build your underwriting automation system from scratch or based on a low-code platform (e.g., Microsoft Power Apps). The latter option offers up to 70% development cost savings. However, it doesn’t allow introducing custom UX and UI design and provides limited room for advancing the solution’s performance.

Benefits of Underwriting Process Automation

Higher efficiency of underwriting teams

Automated underwriting systems enable insurers to establish straight-through risk evaluation, pricing, and quote creation flows for up to 90% of applications, driving an over 2x increase in underwriters’ productivity.

Faster underwriting flows

How long does automated underwriting take? Best-in-class automation solutions offer application processing in less than 4 minutes (compared to days or even weeks in case of a manual flow), which helps issue policies up to 95% quicker.

Cost-effective underwriting operations

The economics of underwriting automation are compelling: 10–25% operational cost savings (including labor and IT infrastructure expenses), potentially reaching 30–50% with AI-powered solutions. The investments in insurance underwriting automation typically pay off within 12 months.

Insurance revenue growth

Rule-based automation spurs an increase in underwriting capacity and accuracy due to minimized human involvement, and cognitive automation helps keep to the most profitable insurance prices, together driving a 10–15% increase in revenue.

Enhanced customer loyalty

Automated underwriting software helps prevent biased human decisions and ensures fair insurance pricing bound to each customer’s personalized risk, which can save the insureds up to 2x on premiums. With around half of policyholders saying that an individual approach affects their policy renewal decisions, automated underwriting becomes a go-to way for insurers to improve customer retention.

Underwriting Automation With ScienceSoft

In insurance software development since 2012, ScienceSoft provides full-scale consulting and development services to help insurers establish effective automation in insurance underwriting.

Our awards, certifications, and partnerships

About ScienceSoft

ScienceSoft is a global IT consulting and software development company headquartered in McKinney, Texas. Since 2012, we've been helping insurance companies implement robust underwriting automation. Being ISO 9001- and ISO 27001-certified, we apply a mature quality management system and guarantee that cooperation with us does not pose any risks to our clients’ data security.