Artificial Intelligence (AI) in Lending

Features, Architecture, Costs, Techs

ScienceSoft brings 36 years of AI expertise and 20 years in loan software development to work side by side with lenders on AI solutions that drive smarter decisions, better risk control, and faster processes.

Key Opportunities Artificial Intelligence in Lending Unlocks

Artificial intelligence for lending helps establish up to 20x faster loan processing workflows, cut end-to-end origination cycles by more than 90%, underwrite 70–85%+ of credit applications outright, and reduce operational costs by 10–50%+ through intelligent automation.

By applying AI-powered analytics for borrower risk assessment, lenders can achieve a 25–50% uplift in loan approvals without taking additional risks and reduce delinquency rates by 30–40% due to sharper risk profiling. The technology promotes financial inclusion and helps reduce the risk scoring accuracy gap between low-income and wealthy applicants by 50–70%.

AI for Lending: Market Overview

The global market of artificial intelligence for the banking, financial services, and insurance (BFSI) industry is projected to hit $192.7 billion by 2034, growing at a CAGR of 22% from 2025 to 2034. Being one of the early adopters of AI, the lending domain benefits from improved operational efficiency, high accuracy of credit underwriting decisions, minimized risks, and excellent customer experience.

How AI for Lending Works

Main use cases

Loan offering personalization

AI analyzes the target clients’ digital footprint and suggests the optimal loan products, credit terms, and outreach channels to meet each potential borrower’s needs. Sharp personalization helps win new customers, improve client retention, and ultimately – increase revenue.

AI-powered optical character recognition (OCR), natural language processing (NLP), and image analysis technologies can automate up to 90% of manual loan application processing tasks and help improve workflow speed and accuracy.

Fraud prevention

AI instantly spots identity theft, employee or customer fraud, and payment fraud, including KYC/AML and OFAC violations. It allows lenders to prevent unauthorized access to services, avoiding sensitive data leakage and financial losses.

Borrower risk assessment

AI helps analyze the borrower risk profiles and accurately evaluate borrower creditworthiness. It helps improve financial inclusion and increase loan approval rate by up to 30% while keeping credit risks low.

Loan decisioning

AI can automatically approve loans for borrowers with low default risks and route high-risk applications for manual review. It helps eliminate 75%+ of manual credit decisioning tasks, get faster loan approval, and enhance borrower satisfaction.

To recommend the most profitable and competitive personalized loan prices, AI analyzes borrower risks, demand elasticity, borrowers’ propensity to buy, market-available credit rates, and expected financial gains.

Borrower interaction

Virtual assistants powered by large language models (LLMs) can take over 50%+ of borrower interaction tasks and help clients promptly solve transactional, technical, and security issues on a 24/7 basis. It frees the lending teams for high-value activities and improves the SLA performance for key metrics by 20%+.

Loan portfolio optimization

AI helps achieve 100% visibility of real-time loan portfolio risks and provides analytics-based recommendations on the proper actions (e.g., certain debt collection activities, loan extension, restructuring, or selling) to maximize portfolio profitability and prevent financial losses.

Architecture

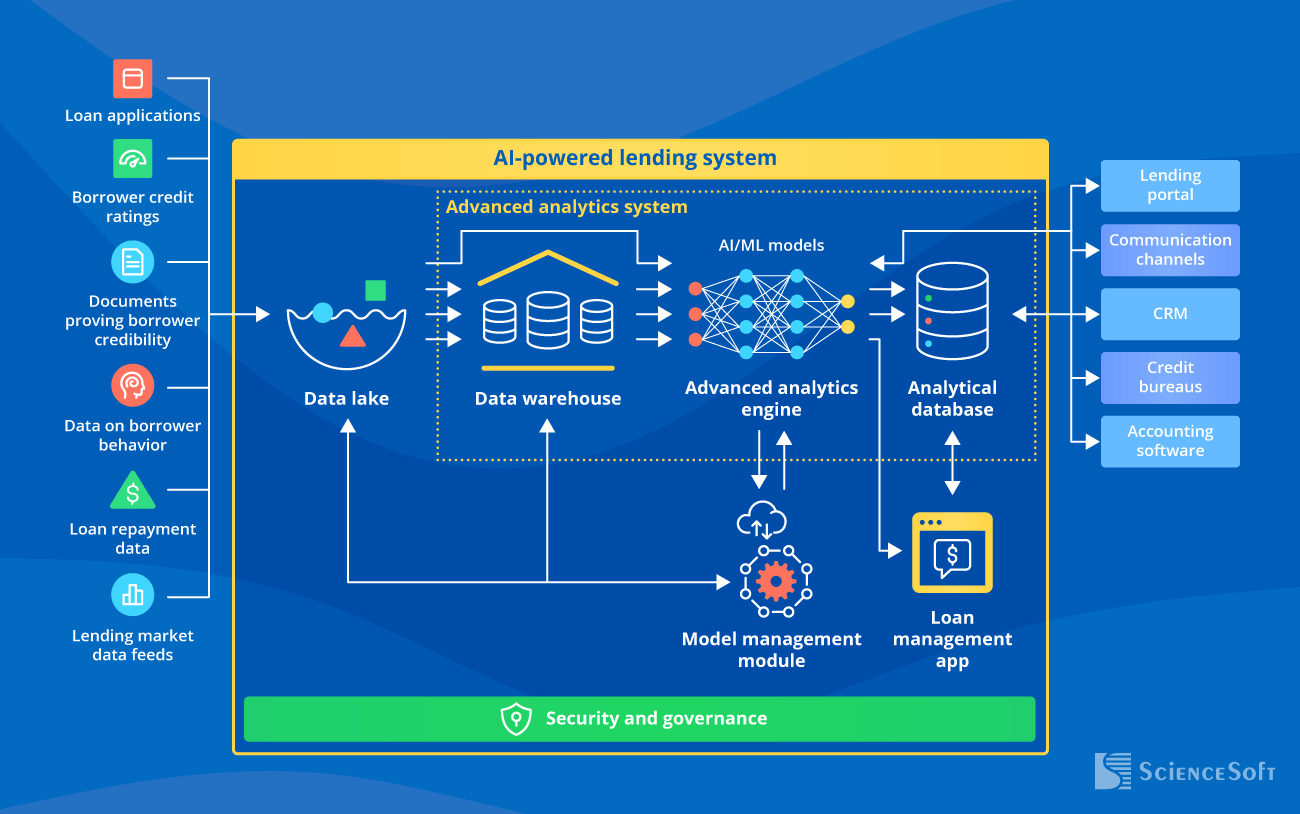

Below, ScienceSoft’s consultants share a sample layered architecture of an AI-powered lending solution with a neural network engine at its core, describing its key components, data processing flows, and typical integrations.

Such an architecture can be flexibly extended with LLM-based agents for end-to-end automation of data-intensive, judgement-heavy operations across the loan cycle.

- The lending data and metadata are uploaded from the available sources (borrower apps, credit rating platforms, payment gateways, financial data marketplaces, etc.) to the data lake for storage.

- The captured data is instantly transferred to the analytics system for preprocessing (filtering, cleansing, enrichment). The ready-to-analyze data is then stored in a data warehouse.

- Data scientists use the data to train lending AI models. Non-neural-network (non-NN) machine learning models are suitable for moderate analytics complexity, while neural networks (NN), including advanced deep learning models, are best for complex predictive and prescriptive tasks. Model engineering, training, and performance monitoring occur in the model management module.

- An advanced analytics engine with a pre-trained AI model at its core analyzes lending data, forecasts the required variables (customer behavior, financial performance, etc.), and prescribes the optimal actions.

- Analytical results get exported to the analytical database for storage. They are instantly communicated to the lending teams (via web and mobile lending apps) and integrated systems, e.g., CRM, accounting software, a lending portal, mail and messaging services.

- Analytical outputs are also used for continuous model learning: NN-based models self-learn from the obtained data, while non-NN ML models require supervised or semi-supervised learning.

Key features

Below, our consultants list the AI software features commonly requested by ScienceSoft’s clients from the lending industry.

Automated processing of different data types and formats

- Real-time aggregation and processing of lending-associated data (borrower data, loan applications, borrower credit ratings, financial market data feeds, etc.).

- Seamless acquisition and analysis of lending data in multiple formats: digital documents (PDF, JSON, CSV, XML, etc.), paper docs (including handwritten text), voice messages, video recordings, sensor data.

Automated communication and support

- Real-time processing of textual and voice borrower requests and human-like responses.

- Automated communication of loan-related decisions to borrowers, requesting additional data required for underwriting, reminders about upcoming and missed payments, etc.

- Automated processing of employee queries regarding particular lending aspects and instant generation of relevant responses.

Behavioral analytics

- Analyzing borrower behavior and needs based on their browsing history, payment history, social media activities, and facial expressions.

- Mapping the optimal personalized digital and on-site customer journeys: suggesting the products to display on the loan portal, matching borrowers with particular lending specialists, etc.

Digital lending security

- Geography-based KYC/AML verification for new borrowers.

- Biometric authentication (facial or fingerprint recognition) for lending app users.

- Automated detection of suspicious transactions, forged documents, and fraudulent events.

- Continuous monitoring and analysis of the lending teams’ digital activities and alerts on workflow non-compliance.

Lending analytics and forecasting

Capturing complex dependencies between the collected multi-dimensional lending data and providing precise quantification and forecasting of lending-relevant variables:

- Borrower risk scores.

- Non-financial collateral value and risks.

- Loan portfolio risks and profitability.

- Charge-off and delinquency rates.

- Loan demand by period, customer segment, loan product, location.

- Financial gains and losses from loan trading activities.

Data-driven lending optimization

Performing comprehensive analysis of risk and profitability factors and delivering data-driven suggestions on the optimal actions across particular lending areas:

- Decision-making on loan approval or rejection.

- Calculating personalized loan prices and coverage limits.

- Planning personalized debt collection strategies.

- Setting optimal loan portfolio limits.

- Purchasing and selling certain loans on the secondary market.

How Lending Companies Benefit From AI

US Commercial Lender Employs AI to Streamline Loan Origination

In 2020, Cross River, a US financial services company focused on commercial lending, launched an AI-based loan processing solution by Ocrolus to enhance its PPP loan origination processes during the COVID-19 pandemic. The solution automates the capture and processing of loan applications, borrower creditworthiness assessment, and loan decisioning.

With the help of AI, Cross River managed to eliminate low-value manual processes, achieve a 3x+ decrease in the loan cycle, and ensure high accuracy of underwriting decisions. The ability to promptly issue high volumes of loans helped Cross River become a top-4 PPP lender and represent over $6.5B in much-needed SMB financing in just 4 months.

In 2022, Cross River continued its AI-driven business transformation and teamed with SmartBiz to bring intelligent automation into its loan servicing processes.

Credit Underwriting AI Startup Raises $300M over a Decade

A US-based lending startup Zest AI developed an innovative AI-based solution for consumer loan underwriting.

The software automates the entire underwriting cycle, from loan application intake and validation to borrower risk evaluation and credit decisioning. It helps improve lending teams’ productivity, speed up loan origination, and ensure inclusive and fair lending. The solution’s users report an 18–32% increase in approval rates, $1M–$12M+ annual growth in business profits, and a 50%+ reduction in bad debt.

Zest AI raised over $300 million in funding from 2011 to 2022. Today, the company offers 250+ proprietary AI underwriting models and is named among the global leaders in credit underwriting automation. Zest AI’s solutions are used by lending giants like Citibank, Freddie Mac, First National Bank of Omaha, and Hawaii USA Federal Credit Union.

Overcoming the Main Challenge of AI for Lending

Many lenders hesitate to adopt AI because its decisions can feel like a “black box.” Limited visibility into how models work and concerns about potential bias in credit decisioning remain the biggest barriers to wider AI use in lending.

To address lenders’ need for impartial and transparent AI logic, ScienceSoft applies explainability techniques like LIME and SHAP to interpret the model’s step-by-step reasoning. By using boosting algorithms (LightGBM, XGBoost), we ensure that AI-produced risk scores are both accurate and explainable. For custom setups, we build inherently explainable ML models, train them on debiased datasets, and fine-tune algorithms to prevent lending data misuse and eliminate unintentional discrimination.

This approach helps lenders achieve fair and compliant credit decisioning and makes the rationale behind each analytical output transparent for regulators.

Costs of Implementing AI for Lending

From ScienceSoft’s experience, developing a custom artificial intelligence solution for lending may cost around $100,000–$650,000, depending on the solution’s complexity, the number of AI models, and the scope of integrations.

$100,000–$250,000

An AI-powered lending solution that relies on non-NN ML models to process data from 1–3 internal sources and delivers analytical output in batches.

$250,000–$450,000

AI-based software that employs NN models to process data from corporate and third-party sources and deliver intelligent predictions.

$450,000–$650,000+

A complex AI-based predictive and prescriptive system that uses advanced NN models for real-time processing of lending data from 5–10+ proprietary and third-party sources.

Lending AI Consulting and Implementation by ScienceSoft

In AI since 1989 and in loan software development since 2005, ScienceSoft designs reliable AI solutions for consumer, commercial, and mortgage lending.

Our awards, certifications, and partnerships

About ScienceSoft

ScienceSoft is a global IT consulting and software development company headquartered in McKinney, Texas. Since 2005, we have been delivering AI solutions for accurate, fast, and efficient lending processes. In our AI projects, we rely on robust quality management and security management systems backed up by ISO 9001 and ISO 27001 certifications.