Custom Loan Servicing Software

360-Degree Overview

In lending software development since 2005, ScienceSoft helps lenders plan and build effective solutions enabling secure loan servicing automation. Explore the list of features composed by our lending IT consultants to embrace the potential of custom loan servicing software.

Loan Servicing Software in Brief

Loan servicing software streamlines lending portfolio management, loan repayment control, credit reporting, and other workflows taking place throughout the loan lifecycle. The solution enables automated borrower invoicing, payment reconciliation, debt collection, and loan trading.

Custom loan servicing software is the best fit for lenders looking to digitalize unique servicing processes and get AI-based guidance on debt recovery and portfolio optimization. A custom system provides advanced security of loan data and simplifies compliance with global and regional regulations.

When integrated with loan origination software, loan servicing software can introduce the capabilities of a full-cycle loan management system that automates the entire lending process.

|

|

|

|

|

|

|

|

|

Key Features of Loan Servicing Software

ScienceSoft creates secure, cloud-centered loan servicing solutions with functionality closely bound to our clients’ needs. Below, we share a feature set of a comprehensive loan servicing system to give you an idea of the capabilities of custom software.

Loan amortization planning

The software generates individual loan amortization schedules taking into account the pre-agreed loan terms (type, price, duration, repayment frequency, etc.). It enables the instant sharing of repayment plans with borrowers via email, a lending app, or a customer portal.

Borrower invoicing

Time-framed repayment amounts are calculated for each loan agreement based on custom formulas. The solution creates recurring invoices and sends them to borrowers according to a lender-defined schedule. Payment links, QR codes, and region-specific invoice elements are automatically applied to invoices.

Payment processing

Custom software supports multiple loan repayment methods (bank transfer, card, check, etc.) and enables real-time processing of multi-currency borrower payments via the connected payment gateways. Using the solution, lenders can auto-deduct monthly loan payments.

Loan repayment control

The solution automatically reconciles the received loan repayments and enables real-time transaction tracking by status (due, partially paid, fully paid), period, borrower, type (e.g., down payment, interest payment, service fee), and more. It instantly notifies loan officers about missed repayments.

Debt collection planning

Debts get automatically triaged for collection based on the loan amount, borrower delinquency level, debt aging, and other factors. AI can be used to analyze historical borrower interactions and payment behavior and prescribe the optimal personalized debt collection strategies.

Debt collection execution

Collectors can create custom payment reminders to debtors tailored by language, tone, frequency, etc. The software automatically sends personalized reminders, including AI-generated voice mails, to debtors via their preferred communication channels.

Debt recovery

Loan officers can set up custom rules to initiate particular actions based on debtors’ responses. For example, they can establish automated reporting of a borrower’s delinquency to credit bureaus, triggered by receiving a debtor's refusal to pay, or automated loan restructuring upon a borrower’s request.

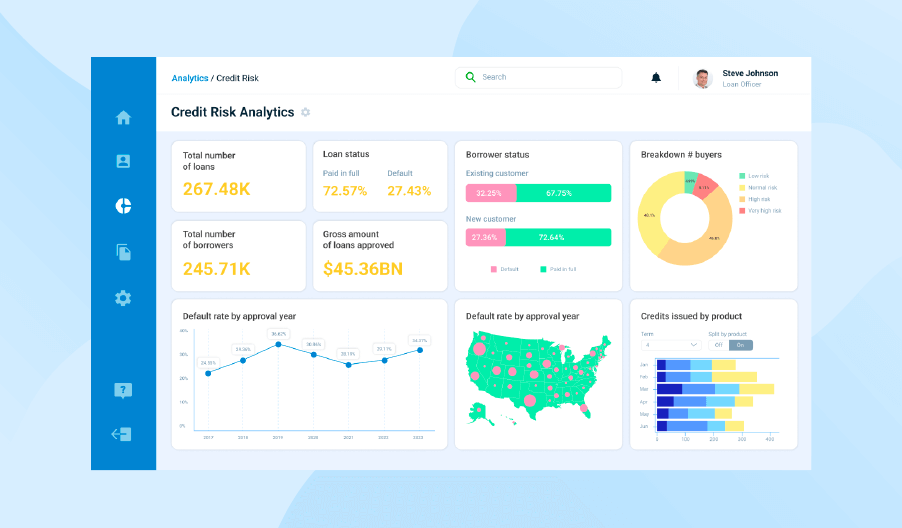

Loan portfolio management

Configurable dashboards offer a real-time overview of served loans and portfolio transactions. The software can rely on AI to analyze portfolio profitability and risks, prescribe the optimal portfolio limits and loan trading decisions. Loan purchasing and selling orders are created and closed automatically based on pre-set rules.

Analytics and reporting

The software enables real-time calculation and monitoring of all necessary metrics across the loan repayment progress, loan servicing team performance, and borrower behavior. It also generates scheduled reports on received, delayed, and missed loan repayments and submits them to the local regulators.

A built-in client portal enables borrowers to track the loan amortization progress, pay the invoices, create and submit requests for loan modification, forbearance, and transfer. The portal employs AI-based chatbots to help users solve arising issues 24/7.

Security

Loan data and the software are protected via role-based access control, multi-factor authentication (incl. biometric authentication), data encryption (incl. asymmetric encryption for blockchain-based lending systems), AI-based fraud detection, and other robust security mechanisms.

Explore ScienceSoft’s Featured Success Story

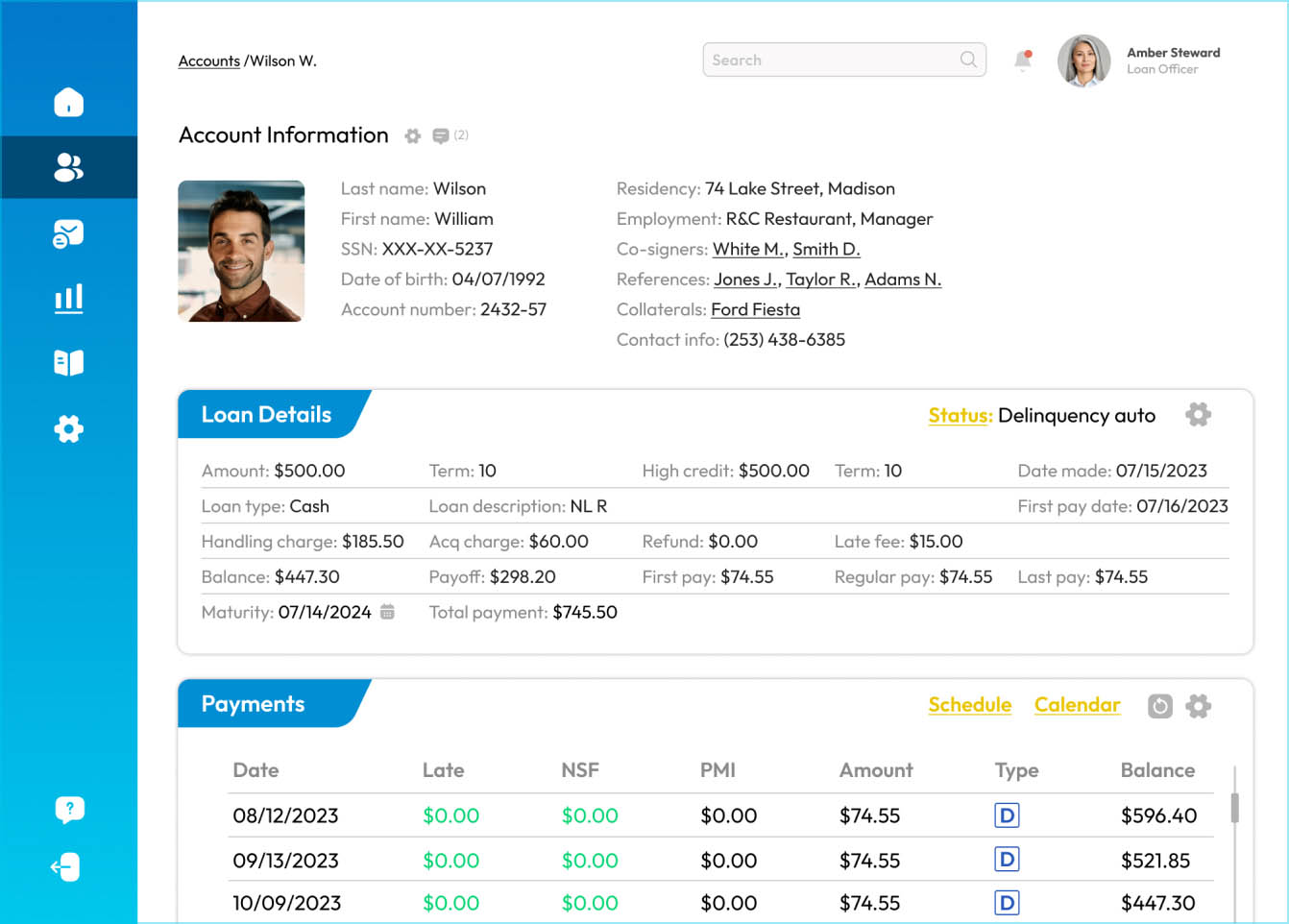

Custom Loan Management Software for a Reputable Microfinance Company

ScienceSoft developed a custom loan management system for a financial services company with 50+ offices across the US. The solution provides comprehensive loan servicing functionality:

- Real-time monitoring of servicing activities across the granted loans.

- Tracking received and due loan repayments.

- Automated debt collection.

- Scheduled and ad hoc reporting of credit repayments to the federal and state regulators.

About ScienceSoft

-

Since 2005 in engineering custom loan servicing and lending solutions.

- Principal architects with hands-on experience designing complex lending ecosystems and driving secure implementation of advanced technologies (AI/ML, blockchain, big data).

- IT consultants and project managers experienced in long-term digital transformation projects for Fortune 500 companies.

- In-house compliance experts with 5–20 years of experience to ensure lending software compliance with CCPA, CECL, CCAR, FCRA, FCBA, ECOA, FDCPA, GDPR, and other required global and region-specific regulations.

- Since 2003 in cybersecurity to ensure world-class protection of lending software and sensitive customer data.