Peer-to-Peer (P2P) Lending Platform Development

Features, Development Steps, Costs

ScienceSoft applies 20 years of experience in engineering custom solutions for the lending industry to help peer-to-peer lending businesses design and launch robust P2P lending platforms.

Peer-to-Peer Lending Software: Short Summary

Peer-to-peer (P2P) lending software aims to directly connect private lenders with individual and business borrowers without the involvement of third-party intermediaries, such as financial institutions or legal entities.

Also known as lending marketplaces, such platforms offer seamless criteria-based search of optimal loan offerings for borrowers and investment opportunities for lenders.

Custom P2P lending software can be powered with artificial intelligence and blockchain to enable accurate assessment of borrower credit risks, automate loan origination and servicing processes, and provide full traceability of P2P lending activities.

How to create P2P lending software in 7 steps

- Research the competition and target audience needs.

- Define the niche and USP for your P2P lending solution.

- Design P2P lending software and select the optimal tech stack.

- Determine project deliverables, scope, and resources.

- Develop your P2P lending software and run manual and automated tests.

- Establish integrations with the required business and third-party tools.

- Release and promote your P2P lending app.

Supported types of loans:

- Consumer and business loans.

- Domestic and cross-border loans.

- Fixed-rate and variable-rate loans.

- Secured and non-secured loans.

- Joint loans.

- Multi-currency loans (including cryptocurrency loans).

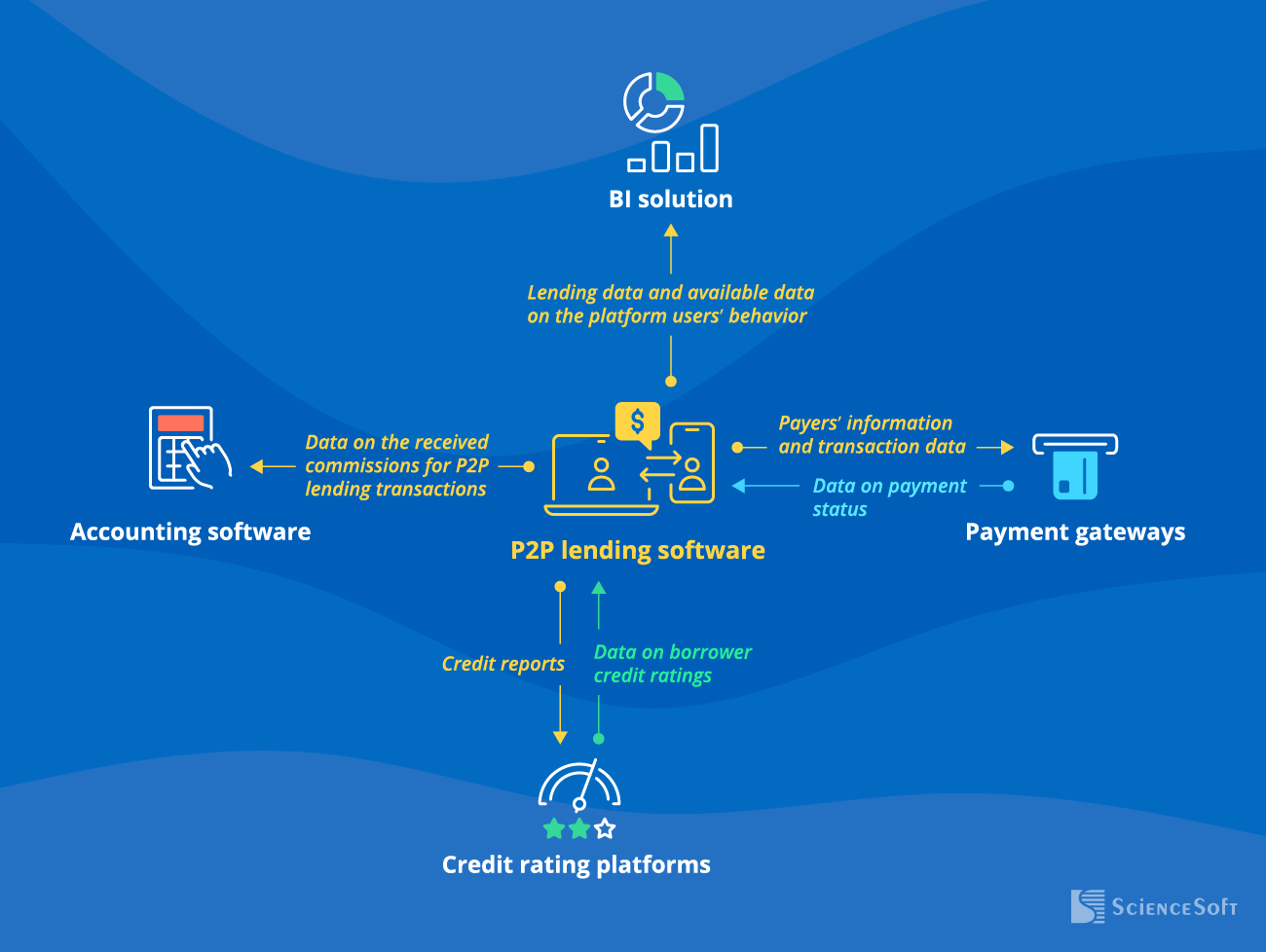

Main integrations: accounting software, payment gateways, a BI solution, credit rating systems.

Implementation time: 9–15 months on average for a custom P2P lending platform.

Development costs: $400,000–$1,000,000+, depending on the solution’s complexity. Use our free calculator to estimate the cost for your case.

Main Use Cases for P2P Lending Software

The global P2P lending market is expected to grow from $176.5 billion in 2025 to $1.38 trillion by 2034 at a CAGR of 25.73%. Key factors that drive the popularity of P2P lending platforms among borrowers and lenders are fast, cost-effective, highly accessible P2P credit services and high payback from P2P financing. This creates momentum for P2P lending companies to step into the fast-evolving market with a brand-new solution and promptly generate revenue.

At ScienceSoft, we recommend our clients to leverage the value of the peer-to-peer lending model in the following domains:

Consumer loans

Involving private lenders to finance the large-value personal expenses (e.g., home improvements, education, vacations, car purchase, or healthcare services).

Borrowers’ benefit: Lower loan price and faster funding compared to conventional lending.

Lenders’ benefit: The ability to achieve up to 12% annual ROI for investments with minimal risks.

Microlending for businesses

Connecting private and institutional investors with SMBs looking for microfinancing to expand the product line, purchase equipment, launch a marketing campaign, etc.

Borrowers’ benefit: Prompt access to the required funds at an affordable cost.

Lenders’ benefit: Higher payback compared to other investment options plus an opportunity to diversify portfolio risks.

Crypto lending

Introducing a blockchain-based lending marketplace that enables seamless origination and servicing of peer-to-peer cryptocurrency loans.

Borrowers’ benefit: High loan accessibility paired with minimal requirements to the credit history.

Lenders’ benefit: The ability to reach a global borrower base, generate significant profit, and maintain full transparency of lending operations.

Key Features of a P2P Lending Platform

In ScienceSoft’s peer-to-peer lending software development projects, our team creates solutions with unique functionality tailored to the needs of each specific client. Below, we share a comprehensive list of features that form the core of an effective P2P lending platform.

General functionality

Lender-side features

Borrower-side features

Admin features

Trendy P2P lending features to consider in 2025

Our P2P lending platform development company can power your solution with the cutting-edge artificial intelligence capabilities to introduce next-gen user experience and enable comprehensive insights into the platform performance.

For lenders

AI-based prescriptions on loan application approval or rejection; intelligent portfolio analytics.

For borrowers

AI-supported chatbots to help borrowers navigate the platform and solve any operational issues.

For admins

AI-powered forecasting of P2P lending demand and financial gains from the platform operations.

Main Integrations for P2P Lending Software

Integrating your solution with the following systems can help streamline borrower credit checks, lending-related payment processing, and ensure accurate accounting for lending transactions:

To accurately record revenue data in the general ledger.

Additionally, the platform can be integrated with the accounting systems of lenders to enable them to automate recordkeeping of due and received loan repayments.

provided by banks or independent payment processors (e.g., PayPal, Stripe, BitPay).

- For seamless funds settlement.

- To instantly notify payers on payment success or failure.

Credit rating platforms

of the selected credit rating bureaus (e.g., Experian, Equifax, TransUnion).

- For data-driven assessment of borrower creditworthiness.

- For streamlined submission of credit reports.

For comprehensive platform analytics and advanced visualization of P2P lending reports.

Key Steps of P2P Lending Software Development

Custom P2P lending software development is a way for companies to introduce precise functionality their target audience needs and leverage advanced tech-based loan automation to drive high ROI.

Below, ScienceSoft describes the main steps we take to help P2P lending businesses design and launch a competitive lending platform.

1.

Analysis and requirements engineering

We analyze the needs of your target audience (borrowers and lenders), research the competition, and communicate with key project stakeholders to discuss the P2P lending platform vision. Based on the collected data, we define functional and non-functional requirements for the solution and possible competitive advantages that can help you win on the P2P lending market.

2.

P2P lending platform conceptualization

With your unique requirements in mind, we design a feature set, architecture, role-specific UX and UI of the platform, as well as the integrations with the necessary internal and third-party systems. We also recommend the best-fitting techs and tools for platform implementation. If required, we can develop a Proof of Concept to quickly and cost-effectively test the solution’s technical viability.

3.

Project planning

We determine project objectives, deliverables, schedule, and budget; we also identify possible project risks and ways to mitigate them. All that lays the basis for composing the project team and designing collaboration workflows. At this stage, we also assess economic feasibility of the platform and introduce detailed estimations of the expected TCO and ROI.

4.

P2P lending software development

We develop the back end (including APIs) and front end of the platform and set up data storage. To ensure high quality of the solution, we run testing procedures in parallel with coding. We also establish DevOps environments (CI/CD, container orchestration, test automation, etc.) for streamlined P2P platform development, QA, and release.

5.

Platform integration with the required systems

We integrate the P2P lending system solution with your existing software and third-party tools, and conduct integration testing.

6.

Software release

ScienceSoft configures the platform’s infrastructure, backup and recovery procedures, and sets the ready-to-use solution live. We can also assist in creating a dedicated website to promote your P2P lending software.

7.

Support and evolution (optional)

We offer continuous monitoring and support of the P2P lending platform to ensure its stable performance, compliance with relevant regulations, and ability to provide smooth user experience. As your business grows, we can evolve the platform by introducing new features and advancing its non-functional capabilities.

Factors That Drive ROI for P2P Lending Software

To eliminate manual efforts across lending-related processes, save time for borrowers and lenders, and help win the larger audience.

A robust matching engine

To enable borrowers to easily find the most favorable loan offerings and help lenders define the most profitable investment opportunities.

Convenient UX and user-friendly UI

To increase platform adoption and ensure seamless borrower and lender journeys.

Easy-to-use APIs

To offer smooth platform integration with the lenders’ business-critical systems.

We Know Your Major Concerns – See How We Dispel Them

P2P lending software security

We power your solution with multi-factor authentication and AI-powered fraud detection to prevent unauthorized access and instantly spot malicious user activities. We also implement robust infrastructure security mechanisms (e.g., DDoS protection algorithms, firewalls, authorization controls for APIs, IDSs / IPSs, etc.) to ensure security of your IT system.

Regulatory compliance

Non-compliance with legal standards (e.g., PCI DSS, CCPA for the US, GDPR for the EU) may result in severe financial and reputational losses. We create P2P lending software with global and country-specific regulatory requirements in mind to ensure lending transaction processing and sensitive data storage in accordance with the relevant regulations.

Implementation Costs for P2P Lending Software

The major factors impacting the project cost are:

- Requirements to the functional capabilities of a platform, its performance, scalability, availability, and security.

- The number and complexity of integrations.

- The need to develop ready-to-use APIs to integrate the solution with end users’ systems.

- Requirements for the UX and UI for various user roles.

- The need to achieve and maintain regulatory compliance.

- The required development scope (PoC, MVP, a fully-featured solution).

- The chosen sourcing model (all in-house, team augmentation, or full outsourcing), team composition, tech stack, etc.

From ScienceSoft’s experience, a P2P lending platform development project of average complexity lasts around 9–15 months. The costs of custom peer-to-peer lending software range between $400,000 and $1,000,000+.

Want to understand the cost of your custom P2P lending software?

Implement P2P Lending Software With ScienceSoft

In lending software development since 2005, ScienceSoft provides a set of expert consulting and development services to help you implement a winning P2P lending platform.

Our awards, certifications, and partnerships

About ScienceSoft

ScienceSoft is a global IT consulting and software development company headquartered in McKinney, Texas. We help P2P lending companies design and launch reliable lending marketplaces that bring high ROI. Being ISO 9001- and ISO 27001-certified, we apply a mature quality management system and guarantee that cooperation with us does not pose any risks to our clients’ data security.