Banking CRM

Features, Platforms, Costs, ROI

In banking software development since 2005 and in CRM consulting services since 2008, ScienceSoft will help you plan an effective CRM system tailored to the specifics of banking clients and processes.

Banking CRM: Highlights from Our Guide

Banking CRM helps manage interactions with different segments of bank customers using such features as a 360-degree view of each customer, customer preferences analytics, sales and marketing automation capabilities. Banking is one of the spheres where CRM systems are used eagerly. For example, a breakdown of Salesforce clients shows that banking is their third largest segment after professional services and manufacturing.

CRM for banks integrates with a core banking system, document management software and other business systems. The implementation cost for banking CRM ranges from $50,000 to $350,000 for platform-based solutions and from $150,000 to $400,000 for custom solutions. As banking CRM stores sensitive customer data, robust security controls must be implemented to mitigate the risks.

Benefits of Using CRM in Banking Services

|

|

Targeted upselling of banking products and services. |

|

|

Access to a complete customer view in real time. |

|

|

Omnichannel customer support, including via a call center, a live chat, mobile messaging apps. |

|

|

Fast response and resolution of customer cases. |

|

|

Positive customer experience achieved through a combination of customer self-service and live customer support. |

Approach the protection of sensitive customer data seriously

We say that banking institutions benefit from the access to all-round customer data. However, this access must not be granted freely but assigned to a bank’s employees according to their roles. Implementing role-based access control in a banking CRM is important to prevent insider threats.

Key Features of Banking CRM

ScienceSoft builds CRM systems for investment, commercial, or private banks in both retail and corporate sectors. Typically, we cover the following functionality:

Banking CRM Implementation: Success Story by ScienceSoft

CRM Development for a Bank With 7 Million Clients and 7,000 Employees

ScienceSoft implemented effective customer profile management, omnichannel sales pipelines, and advanced analytics to help the bank's sales and managerial teams across 180 branches perform better in their daily activities.

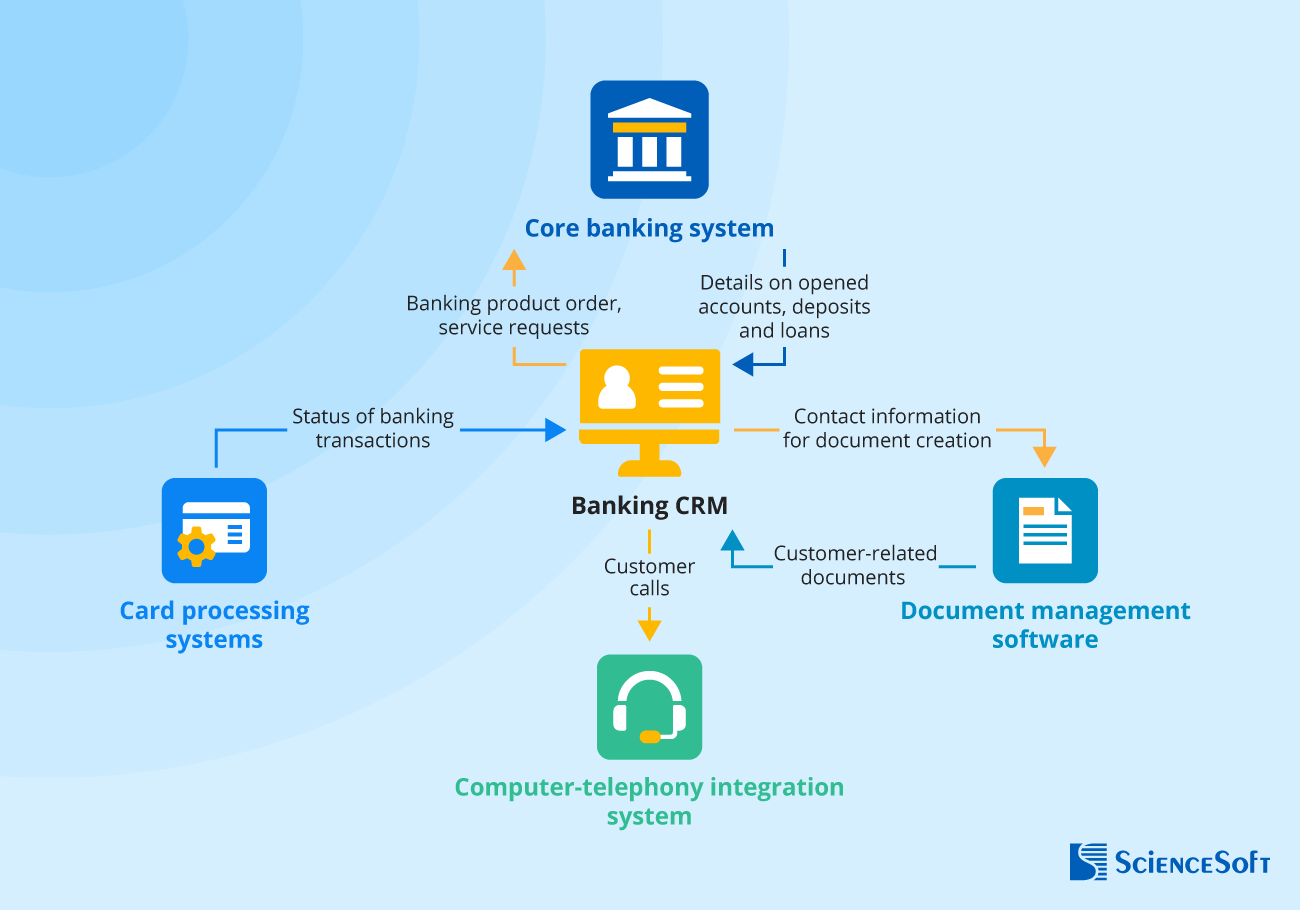

Valuable Banking CRM Integrations

ScienceSoft creates an ecosystem around CRM to achieve faster and more accurate banking processes.

- Banking CRM + core banking system: to transfer banking product orders (e.g., credit card issuance) or service requests (application for a loan) from CRM to a core banking system; to transfer data like details on opened accounts, deposits and loans from the core banking system to customer profiles in CRM to get a fuller picture of each customer’s situation and provide a more personalized customer service.

- Banking CRM + card processing systems: to track the status of banking transactions (e.g., loan payments, cash withdrawals, account transfers) directly in CRM (e.g., pending/completed).

- Banking CRM + document management software: to provide sales reps and customer service agents with access to customer-related documents directly in CRM; to enable auto-filling of the relevant data from CRM (such as contact information) into the document template for a streamlined document creation (e.g., service or mortgage proposals, contracts).

- Banking CRM + computer-telephony integration system: to let customer service agents and sales reps initiate and accept customer calls directly from CRM without switching tools.

Success Factors of Banking CRM

ScienceSoft shares best practices learned from CRM projects for banking organizations.

Achieve high level of automation of sales, marketing and customer service processes (e.g., automated assignment of opportunities and cases distribution to fitting specialists, automated distribution of emails to customers) to increase bank employees’ productivity.

Ensure comprehensive security features such as role-based access control, user activity logs, etc. to prevent data leaks and protect sensitive customer data (e.g., information related to customer property, income, personal data of individual customers, bank details of business customers).

Build advanced customer analytics capabilities to identify customer demand trends and use these insights to adjust a bank’s offering, see the opportunities for cross-selling and upselling (e.g., when to offer premium banking products).

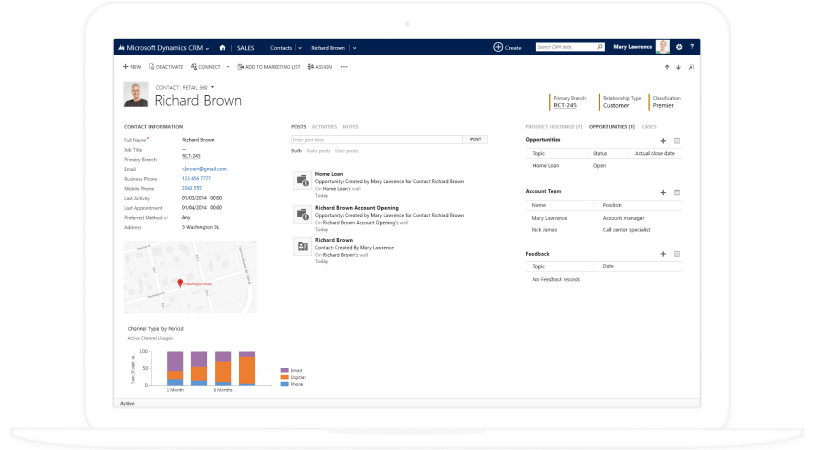

Don’t forget omnichannel customer support

Customers may need to contact banking support while being in different situations: outdoors or in a foreign country. You must give them an opportunity to use a communication channel they consider the most convenient in their situation. But don't worry about possible difficulties for your team – processing dialogues in different channels is convenient in modern CRM systems. For example, Dynamics 365 CRM offers support agents to work in the Omnichannel Agent Dashboard where they see all open cases from all queues.

Banking CRM Implementation Costs and Financial Outcomes

The cost of implementing platform-based banking CRM ranges from $50,000 to $350,000 for a bank with 100+ CRM users (excluding a monthly fee).

The cost of implementing custom banking CRM ranges from $150,000 to $400,000 (depending on needed functionality, complexity and number of integrations, complexity of data migration procedures, etc.).

The payback can be expected in ≈ 1-2 years of using banking CRM. You can anticipate ROI starting from ≈ 50-150% for both custom and platform-based solutions.

Want to understand the cost of your banking CRM?

Key financial outcomes of implementing banking CRM software

- Increased banking products and services sales volumes.

- Increased cross-sell and upsell revenue from banking products and services.

- Reduced time to solve customer cases.

- Boosted bank employees’ productivity.

Top CRM Platforms Recommended by ScienceSoft

ScienceSoft's team can help your organization implement one of the market-leading cloud CRM platforms, configure the solution to fit your workflows, and integrate it into your business IT system.

Microsoft Dynamics 365

Best for: midsized and large banks

Description

Leader in the 2025 Gartner Magic Quadrant for CRM Customer Engagement Center.

Features

- Omnichannel communication tools to engage with a bank’s customers through live chat, phone, messengers, etc. via the single interface.

- Wide customer case management features (automated case creation, routing, reassigning, reopening, merging similar cases, etc.).

- Customer Voice to track and analyze real-time customer feedback on banking products and services across channels.

- Seamless integration with other Microsoft apps, such as Office 365, Power BI, etc.

Pricing

Free 30-day trial.

Pricing depends on the chosen modules and license:

- Marketing: from $750 to $1,500 / tenant / month

- Sales: from $65 to $95 / user / month

- Customer Service: from $50 to $95 / user / month

Salesforce

Best for: midsized and upper-midsized banks

Description

Leader in Gartner CRM Customer Engagement Center Magic Quadrant for 16 consecutive years.

Features

- 360-degree view of individual and business customers of a bank.

- Advanced customer behavior analysis.

- Territory management to set up banking products and services sales territory rules.

- AI-powered recommendations for sales reps on the engagement with the customers (e.g., what is the best banking product offer to make).

- A chatbot to resolve customers’ typical cases (e.g., password reset) and route complex customer issues (e.g., credit card loss) to the right agent.

Pricing

Free 30-day trial.

Pricing depends on the chosen modules and license:

- Marketing cloud: from $400 to $3,750 / organization / month

- Sales cloud: from $25 to $300 / user / month

- Service cloud: from $25 to $300 / user / month

Creatio

Best for: small and midsized banks

Description

Leader in the 2025 Gartner Magic Quadrant for B2B Marketing Automation Platforms for the fifth year running.

Features

- Lead and opportunity management (qualification, distribution, history tracking, etc.).

- Creation of a bank’s product catalog to share product details with customers and automatically fill product data (e.g., interest rates, terms, repayment schedules) into document templates.

- Wide analytics features (e.g., lead and sales analytics, bank employees’ performance analytics).

Pricing

Free 14-day trial.

Pricing depends on chosen modules, cloud or on-site subscription and license:

- Marketing: Upon request to a vendor

- Sales: from $25 to $60 / user / month

- Service: from $35 to $60 / user / month

When Custom CRM for Banks Is the Best Choice

ScienceSoft recommends choosing custom CRM development in the following cases:

- You need CRM to automate multi-step, non-linear sales and customer service workflows in your bank.

- CRM should be accessed by a large number of users (e.g., if you have multiple bank branches distributed across the country) as an enterprise-scale license cost of a platform-based solution is high.

- You need advanced features that platform-based software can’t provide (e.g., AI-driven recommendations on banking products and services for cross-selling and upselling).

Implement Banking CRM With ScienceSoft

Banking CRM consulting

- Defining an optimal banking CRM feature set based on your business needs.

- Developing a business case (including the development cost, solution ROI).

- Designing CRM architecture (for custom solutions).

- Selecting a banking CRM platform (if not selected yet).

- Preparing a customization roadmap.

- Preparing an integration roadmap.

- Delivering UX and UI mock-ups (for custom solutions).

- Providing timing estimates for the implementation project.

Banking CRM implementation

- Banking CRM project planning.

- Custom CRM development or customizing platform-based CRM software.

- Quality assurance of banking CRM.

- Integration with a core banking system, card processing systems, etc.

- Data migration from legacy software.

- Conducting user training.

- Providing after-launch banking CRM support.

- Continuous banking CRM maintenance and evolution (if required).

Our awards, certifications, and partnerships

Named among America’s Fastest-Growing Companies by Financial Times, 4 years in a row

Named Best in Class in Web and Mobile Banking Software Development by FinTech Futures

Listed among Highly Commended tech partners at the Global FinTech Awards 2025

Awarded for measurable results in insurance digital transformation by The Global Insurer

Listed in IAOP’s 2025 Global Outsourcing 100 for the 4th year running

Microsoft Partner since 2008

AWS Partner since 2017

ISO 9001-certified quality management system

ISO 27001-certified security management system