Financial Software Consulting Services

Bring corporate financial management to new heights

Since 2007, ScienceSoft has been providing companies in 30+ industries with consulting and practical assistance on the design and implementation of reliable financial management software.

Financial software consulting services aim to help companies drive improvements across corporate financial management processes and target ambitious business innovations with the help of robust finance software and advanced technologies, such as cloud, AI and ML, big data, blockchain.

ScienceSoft’s Service Scope

Our financial software consulting services are customized to our clients’ needs and may cover:

Financial software audit and consulting on improvements

Auditing a client's existing financial management tools and their integration points, evaluating technical and economic pains of existing financial software, planning financial IT ecosystem improvements with software-only changes. ScienceSoft's services aim to ensure:

- Increased efficiency of the financial software landscape.

- Optimized costs of currently used financial solutions.

- Improved security of sensitive financial and business data financial systems store, and more.

Advanced financial technology consulting

Consulting on the use of cloud, AI and ML, big data, blockchain for:

- Ensuring high availability, scalability and security of a financial solution.

- Automated aggregation and comprehensive analysis of multi-dimensional finance data to predict particular aspects of the company’s financial performance.

- Getting intelligent recommendations on optimal decisions across financial processes.

- Facilitated traceability of financial transactions, and more.

Financial software development consulting

- Designing a financial management solution based on the customer's unique business needs.

- Choosing an optimal tech stack for solution development.

- Introducing an integration plan with relevant corporate software and third-party systems (e.g., financial data marketplaces, trading platforms).

Financial software modernization consulting

- Planning the gradual transition of a customer's financial software to modern techs without disrupting critical financial management operations.

- Expanding the software functionality and revamping legacy architecture and codebase to increase the solution's value.

Financial software implementation

ScienceSoft offers the following options:

- Financial software implementation in collaboration with a client's in-house IT team.

- Covering up to 100% of financial software implementation tasks and knowledge transfer to a client's in-house IT team.

Financial software maintenance

ScienceSoft provides practical assistance in:

- SLA-based financial software maintenance and support.

- Security assessment and compliance pre-audit for financial solutions.

- Financial IT automation

Financial Management Solutions ScienceSoft Specializes In

We are here to provide expert consulting for the successful implementation of one or several integrated corporate finance solutions:

- Improving financial data accuracy.

- Eliminating manual efforts across tasks involved in bookkeeping, invoicing, payroll accounting, financial planning and analysis, revenue management, tax management, investment and financial risk management, and more.

- Eliminating accountants’ manual tasks

- Increasing accuracy across multi-entity bookkeeping, invoicing, AP and AR, expense management, multi-location inventory accounting, financial data reconciliation, country-specific financial reporting, and more.

- Streamlining accounting processes in large organizations with complex operations and accounting needs.

- General ledger capabilities, the management of payables, receivables, taxes and payroll, asset and inventory accounting, automated invoicing and reconciliation, and more.

- Aggregating financial transactions across multiple business entities in real time, structuring and reconciling them.

- Accurate recording and reporting of multi-entity financial transactions and faster financial close.

- Automated customer invoicing and real-time receivables tracking.

- Management of collection procedures to cut DSO and past-due receivables and eliminate manual errors across the order-to-cash cycle.

- Automated invoicing workflow, payment tracking and processing.

- Streamlined general-purpose and industry-specific (e.g., medical, telecom, transportation) billing.

- Increased invoicing speed and accuracy and reducing revenue leakage.

- Automated e-invoice generation, processing, exchange, and tracking.

- Compliance with global, region- and industry-specific regulations, such as ZATCA regulations for Saudi Arabia, Directive 2014/55/EU for the EU, and more.

- End-to-end invoice processing – from invoice data capture and validation to invoice routing for payment and posting to the general ledger.

- Reduced cost of invoice processing and storage and shorter invoice-to-pay cycle.

- Eliminating manual tasks across all payment-related processes, from document processing and approval to payment execution and reconciliation.

- Advanced payment analytics to ensure accurate planning of liquidity and working capital.

- Automated cost estimation, budgeting, cost allocation, real-time cost tracking, and variance analysis at the company, department, and project level.

- Streamlining cost control and decreasing budget variance.

- Real-time revenue tracking, advanced revenue analysis, automated revenue recognition according to the up-to-date accounting standards.

- Ensuring faster revenue close, simplified revenue recognition compliance, precise revenue forecasting.

- Automated price calculation and updating across selling channels.

- Ensuring price performance visibility, streamlining price segmentation and discount management.

- Analytics-based price optimization for maximized profitability.

- Forecasting, tracking, and reporting corporate cash flows (including in various currencies).

- Streamlining cash management across multiple, including international, company branches and across complex bank account structures.

- Providing automation across corporate treasury activities, including cash, investment, debt, trade finance, and financial risk management.

- Streamlining management and enhancing visibility of investment and financing activities.

- Reducing idle cash, liquidity and credit risks.

- Creating and managing financial models (including multi-dimensional models).

- Automated calculations for various financial models.

- Simulating, analyzing and forecasting financial scenarios of any complexity.

- Gaining real-time insight into organization-wide financial transactions.

- Streamlining financial planning and analysis, improving decision-making on strategic activities.

- Machine learning for precise financial forecasting and process optimization.

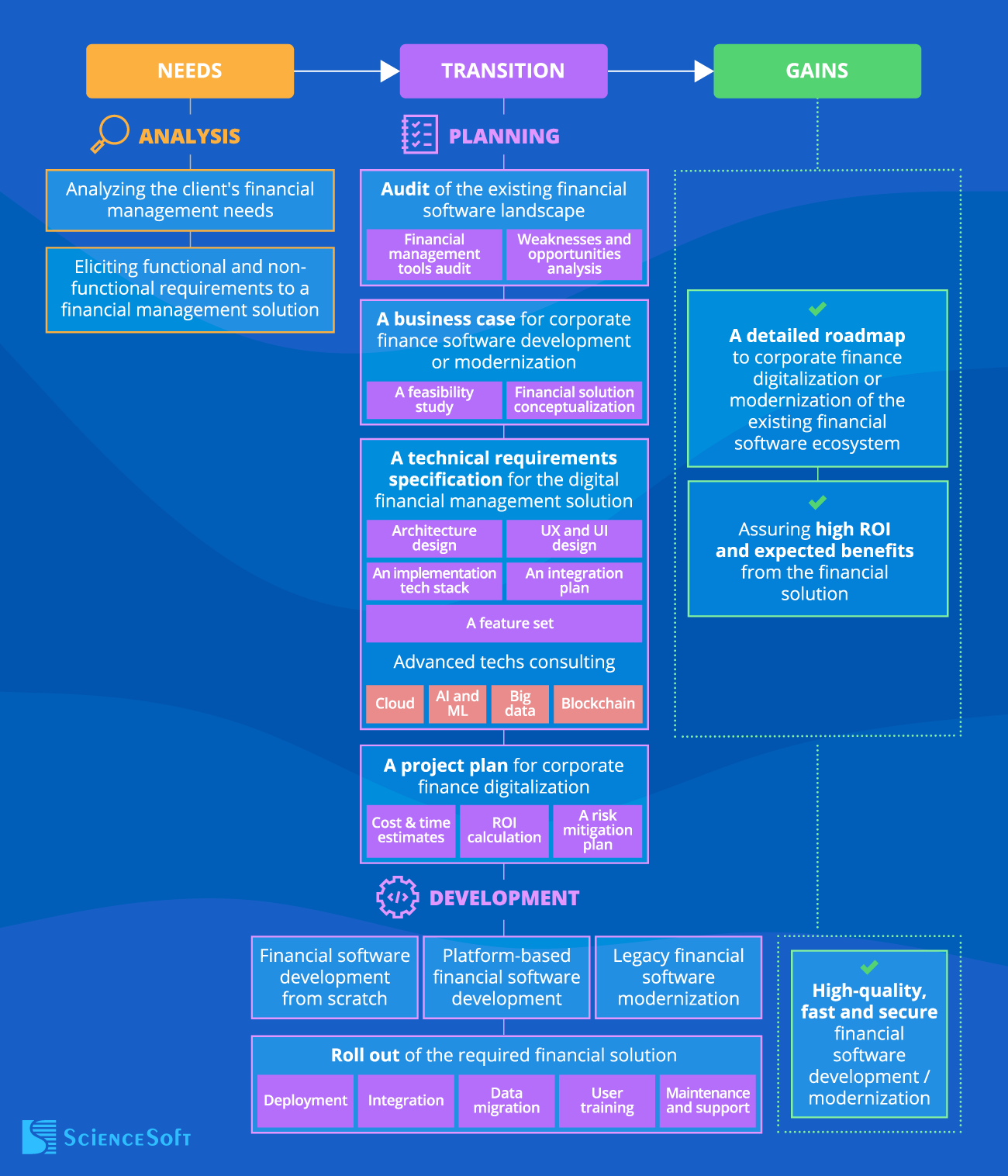

Key Steps of Digital Finance Consulting by ScienceSoft

ScienceSoft helps companies bridge the gap between a high-level digital transformation strategy and its actual fulfillment. Our typical digital financial management consulting process flow looks as follows:

- Analyzing financial management needs and eliciting requirements for a corporate finance solution.

- Auditing the existing financial software landscape, analyzing its weaknesses and opportunities.

- Preparing a business case for financial software development / modernization.

- Elaborating a technical requirements specification for the financial management solution.

- Introducing a project plan for finance digitization.

Additionally, we are ready to cover financial software engineering, evolution of legacy corporate financial tools, and after-launch support of the delivered solution.

Why Choose Digital Finance Consulting with ScienceSoft

- Since 2007 in financial IT and corporate finance software development.

- IT consultants and project managers having experience with 30+ industries, including manufacturing, retail, healthcare, BFSI, telecoms.

- Since 1989 in data science and AI to introduce advanced financial analytics.

- Since 2003 in cybersecurity to ensure world-class security of financial software.

- Compliance experts with 5–20 years of experience to ensure financial management software compliance with global, industry- and region-specific regulations.

- Quality-first approach based on a mature ISO 9001-certified quality management system.

- Robust security management supported by ISO 27001 certification.

Our awards, certifications, and partnerships

Benefits of Financial Software Consulting and Engineering by ScienceSoft

Understand the value you get from partnering with our team and follow the links to explore the descriptions of consulting, development, and project management practices behind our success-driven approach.

If you’re wondering how ScienceSoft’s practices will benefit your particular initiative or want to receive a tailored pack of success stories proving our domain experience, feel free to contact our consultants.

Minimized implementation risks

We carefully analyze the economic feasibility of custom financial software development and advanced financial technology implementation for your case to help you confidently decide on further steps. Our experts accurately scope the project, provide realistic cost estimates, and map potential risks so that you can adequately plan resources and expenses. Also, we can develop a proof of concept to check the viability of an innovative financial management solution.

Optimized project cost

We introduce the optimal functionality for your finance solution, design the modular architecture that will enable cost-effective software creation and maintenance, and suggest the proven toolkit for prompt delivery. Our project managers advise on the best-fitting development model and pragmatic team composition to complete the project within the intended time and budget. These measures help our clients unlock up to 3–12x development cost savings.

Effective collaboration

We render financial software consulting services in close collaboration with your stakeholders, sticking to their preferred communication forms, paces, and channels. This way, we get an in-depth understanding of your corporate finance transformation needs and achieve full alignment of the software design and implementation strategy with your specific requirements.

Service transparency

When engaged at the development stage, we define a tailored set of KPIs to measure the quality of services and financial software we deliver and report regularly on the accomplished tasks to ensure the client always stays updated on the project progress. Our experts provide exhaustive software documentation to facilitate solution maintenance and upgrading.

Guaranteed security

We design software powered with multi-layer data encryption, role-based access control, intelligent fraud detection, and other robust security mechanisms to ensure the safety of financial data and effectively respond to potential cyber threats.

Reliable Technologies & Tools We Use

Low-code development

DevOps

Containerization

Automation

CI/CD tools

Monitoring

Choose Your Service Option

Consulting on the corporate finance digital transformation

We create a roadmap to financial management digitalization, modernization of your existing digital finance environment, or adoption of new financial solutions and advanced techs.

What we do:

- Analyse your financial management needs and elicit requirements for the financial management solution.

- Suggest the optimal features, architecture, and tech stack for the financial software.

- Prepare a plan of integrations (with ERP, CRM, an inventory management system, a BI solution, etc.).

- Introduce a detailed project plan, including cost and time estimates, ROI calculations, and a risk mitigation plan.

Full-cycle corporate financial software development

We design and engineer custom financial management software tailored to your business needs or customize and implement a selected platform-based financial solution.

What we do:

- Conceptualize a financial management solution.

- Design the architecture.

- Engineer financial management software.

- Integrate the solution with the required systems.

- Run all necessary quality assurance procedures.

- Help your employees adopt the solution.

- Continuously support and evolve financial management software (if required).