Lending Analytics

Software Features, Integrations, Costs, and Benefits

In data analytics since 1989, ScienceSoft helps financial institutions build tailored solutions for data-driven credit risk assessment, informed improvement of loan portfolio management, and streamlined loan servicing.

Lending Analytics: The Essence

Lending analytics helps drive insights from loan, borrower, market, and other credit data. Lending analytics software lets companies make risk-proof lending decisions, get a real-time view of loan portfolio performance and loan servicing, stress-test lending strategies via what-if models, and more. By incorporating advanced lending software development, organizations can further optimize these processes, ensuring that their analytics tools are tailored to their specific lending needs and challenges.

- Key integrations: loan management system, treasury software, CRM, accounting software, customer-facing apps, credit rating bureau platforms, financial data marketplaces.

- Costs: $100,000–$600,000, depending on software complexity. You can use our online cost calculator to get a more accurate estimate based on your specific requirements.

- ROI: up to 260% with a payback period of 3 months.

Benefits of Lending Analytics

Things to Consider When Building Lending Analytics Software

Tailored risk assessment models

Identifying risk assessment factors specific to loan types and customer groups you deal with is essential. For instance, if you grant mortgage loans, you will likely benefit from loan-to-value ratio and property type analytics. If you work with personal loans, you may need to prioritize evaluating income stability and existing debt obligations.

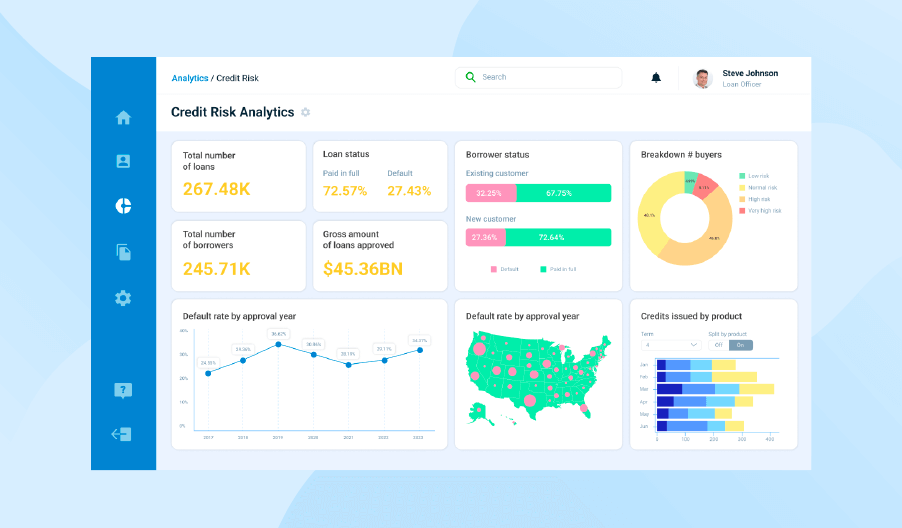

Custom reports and dashboards

Analytics software needs to produce dashboards that can be easily tailored to different user groups. For example, underwrites may leverage drill-down capabilities for comprehensive borrower risk assessment, while debt collection teams may need real-time updates to prioritize their efforts.

Data security

Analytics software should support the encryption of personal and financial data at rest and in transit to prevent data loss and damage. Among the necessary security features is also role-based access management. It will help you ensure your employees don’t get information outside their responsibilities and permissions.

Analytics software must enable data storage and transfer according to personal data protection laws like SOX, SOC1 and SOC2, PCI DSS, GDPR, NYDFS, CCPA. Additionally, it can facilitate compliance with financial management and customer protection regulations like TILA, RESPA, HDMA, FCRA, ECOA for the US, MCD for the EU, SAMA for the KSA. One of the key features to facilitate compliance is the generation of standardized documents for reporting to authorities (e.g., Metro 2 form).

Key Features of Lending Analytics

Essential Integrations for a Lending Analytics Solution

Note: we can also integrate your software with case-specific solutions, e.g., a core banking system, mortgage automation software, P2P lending software.

- To provide a 360-degree view of loan portfolio performance and enable its informed improvement.

- To assist in borrower risk mitigation.

- To monitor regulatory compliance adherence.

- To ensure efficient debt collection.

- To enable informed optimization of hedging strategies.

- To manage collateral risks and optimize loan-to-value ratios.

- To enable multidimensional customer segmentation and tailor credit plan offerings.

- To evaluate customer satisfaction level.

- To optimize revenue generation and cash flow management

- To enable accurate revenue and expenses recording in the general ledger.

Customer-facing apps

E.g., a customer portal, customer mobile apps, a company website.

- To identify patterns in borrower repayment behavior.

- To detect loan application fraud.

Bank accounts or payment software

- To enable tracking of loan-related transactions and streamlined loan reconciliation.

- To identify transactional fraud.

Credit rating bureau platforms

E.g., Experian, Equifax.

- To simplify credit rating checks.

- To enable automated credit reports submission.

Financial data marketplaces

- To get real-time visibility into the market situation.

- To build what-if scenarios of market-related impact.

- To enable collateral analytics.

Cost & ROI of Lending Analytics Software

Lending analytics software implementation may cost from $100,000 to $600,000+, depending on software complexity. Some cost-defining factors are the number of integrated sources, data processing specifics (batch or real-time), the use of ML/AI-powered capabilities, and more.

On average, data analytics in lending brings an ROI of up to 260%, breaking the investment even within 3 months. The main ROI drivers are capabilities for what-if scenarios creation and comprehensive credit risk assessment.

$100,000–$150,000

A basic solution that ensures:

- KPI tracking across 1–2 analytics areas, e.g., loan servicing metrics.

- Integration with 1–2 key data sources, e.g., a loan management system.

- Batch data processing (e.g., every 12 hours).

- Scheduled and ad hoc reporting.

$150,000–$400,000

A solution of medium complexity that ensures:

- KPI tracking across multiple business areas, e.g., finance, loan management, etc.

- Integration with 3–7 data sources, including corporate software and external systems.

- Batch and real-time data processing.

- Diagnostic and predictive analytics via ML models.

- Automated reporting to regulatory authorities.

$400,000–$600,000+

An advanced solution that ensures:

- Comprehensive analytics across all the required business areas, including market situation.

- Integrating multiple internal and third-party systems, including software powered by blockchain.

- Real-time big data analytics (e.g., for transactional fraud detection).

- Advanced ML/AI-powered features (e.g., route-cause analysis and forecasting, recommendations on service personalization).

- Automated generation of consolidated reports and reports compliant with local regulations.

Learn the cost of your lending analytics solution!

Use our online cost calculator. All you need to do is tick answers to our questions about your analytics needs, and our experts will provide you with a ballpark quote. It is free and non-binding.

ScienceSoft is Ready to Assist You at Every Step of Lending Analytics Implementation

Our team can create a robust analytics solution to consolidate multi-source data you need for comprehensive lending analysis. We’ll build tailored features based on the specific factors considered in your business, including the markets you operate on and customer segments you target.

Our awards, certifications, and partnerships

About ScienceSoft

ScienceSoft is an IT consulting and software development company headquartered in McKinney, Texas. Since 1989, we have been building industry-specific analytics solutions for 30+ domains and helping businesses get a data-driven view of their performance, adopt efficient risk mitigation, and get valuable insights for making day-to-day and strategic decisions. Being ISO 9001 and ISO 27001-certified, we can guarantee top software quality and complete security of our clients’ data.