Banking Data Analytics

Software Features, Costs, and Benefits

In data analytics since 1989 and in banking software development since 2005, ScienceSoft builds custom analytics solutions that help banks gain a 360-degree view of their processes, customers, and assets.

Banking Data Analytics: the Essence

Banking analytics is needed to consolidate and analyze diverse banking data, including sales, loans, investments, product and service portfolios, and customers. Banking analytics solutions allow banks to increase their wallet share, enhance customer loyalty, maintain regulatory compliance, manage risks, detect fraud, boost marketing effectiveness, and more.

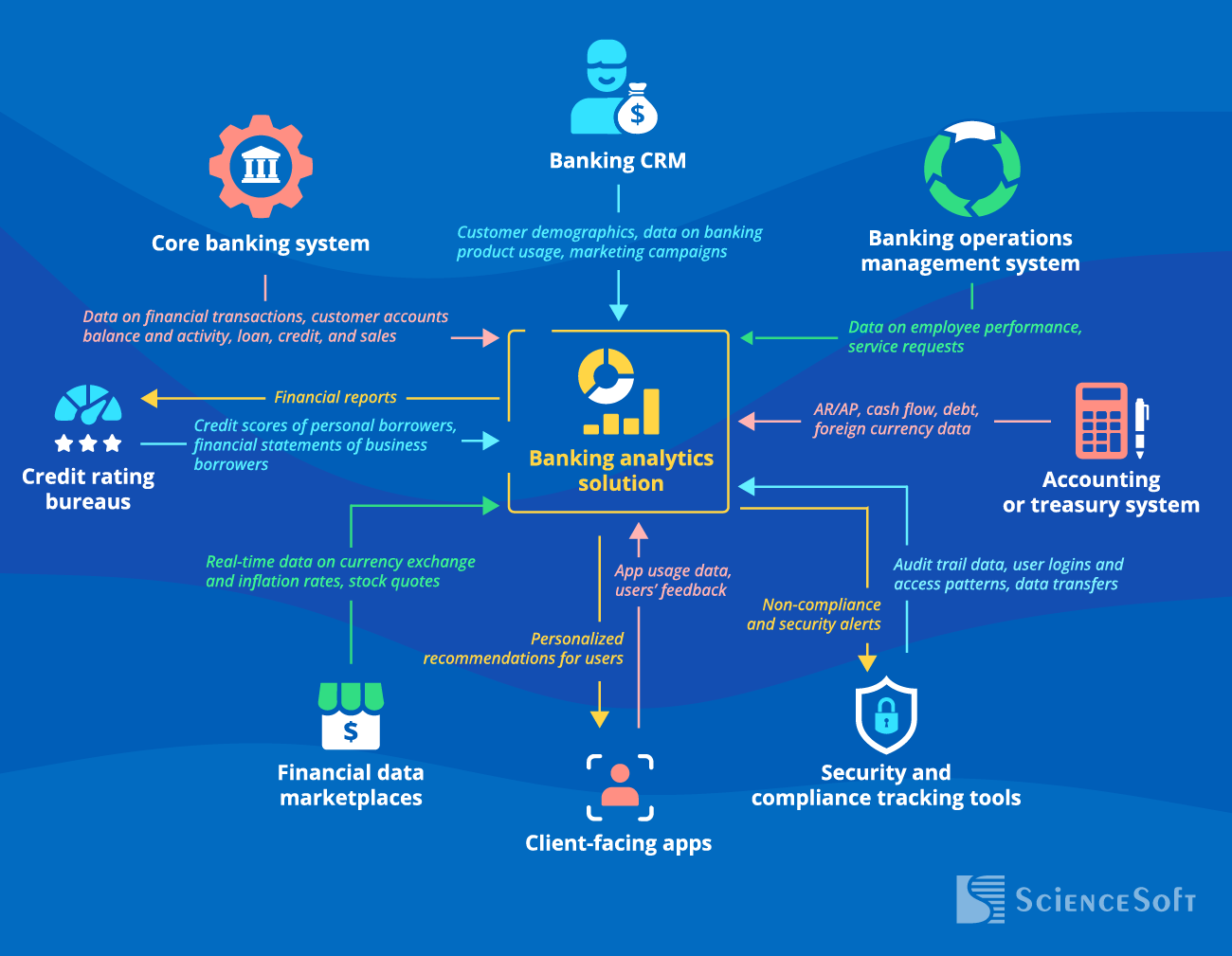

- Integrations: Core banking system, banking CRM, ERP, client-facing apps, fintech software, banking operations management system, accounting software, and more.

- Implementation costs: $100,000–$1,500,000, depending on the solution’s scope and complexity. To get a more precise estimate tailored to your needs, you can use our online cost calculator.

- ROI: up to 415% with a payback period of 6 months.

The Benefits of Analytics for Banking

Below, you can see the results of a Forrester survey illustrating the influence of mature data analytics practices on business outcomes in different domains, including banking. The BFSI sector has observed the most significant benefits and cost savings among the survey participants.

Banking Analytics: Key Features

Below, our consultants outline analytics software features that are most frequently requested by our clients in banking.

Implement Banking Analytics with ScienceSoft

ScienceSoft’s data analytics consultants, solution architects, software developers, and compliance experts are ready to assist you in building a reliable banking analytics solution that will fit your unique goals and the specifics of your bank.

Essential Integrations for Banking Analytics

Core banking system

- To continuously monitor financial transactions (e.g., payment, money transfer, lending, investment, insurance activities) and identify patterns in them.

- To detect fraud.

- To control and improve employees’ efficiency.

- To improve customer service request management.

- To get a comprehensive view of operational performance and enable its informed improvement.

Accounting or treasury system

- To analyze financial performance and take measures for its improvement.

Client-facing apps

(e.g., mobile banking, payment, money lending apps)

- To understand customer sentiment toward the provided services/products and personalize the offerings.

Security and compliance tracking tools

- To ensure complete adherence to regulatory requirements and maintain a secure banking environment.

Financial data marketplaces

- To get a complete view of the market situation.

- To get data for what-if modeling and forecasting.

Credit rating bureaus

(e.g., Experian, Equifax)

- To simplify the procedure of checking borrower creditworthiness.

- To enable automated financial report submission.

The optimal approach to integration depends on the existing software ecosystem and its architecture. For example, if the core banking system is already integrated with most of the systems (e.g., payment automation, loan processing, underwriting automation, CRM), a logical and cost-effective option would be integrating the analytics software with the banking system. However, if the data sources are disparate or are legacy, hard-to-integrate solutions, the best way is to integrate them directly into the analytics software via APIs.

How ScienceSoft Builds Reliable Banking Analytics Software

Case-specific analytics

We implement custom software features to address the unique needs of different bank types. For instance, a retail bank would benefit from cross-selling analytics, while commercial and investment banks may need scenario analysis (e.g., for credit risk or trading strategies modeling).

User-centric reporting

We create dashboards tailored to specific user responsibilities (e.g., real-time alerts for compliance officers, drill-down capabilities for customer service professionals) and build custom reports compliant with regulatory forms (e.g., Basel III) to streamline reporting to the relevant authorities.

Guaranteed solution security

We implement role-based user access to prevent the loss of sensitive information, audit trails to track user activity and identify suspicious actions in a timely manner, and build highly secure APIs to guarantee safe data exchange between the integrated systems.

Full regulatory compliance

We enable functionality to support compliance with all the required global and local regulations. For example, transaction monitoring and suspicious activity detection can be implemented to support compliance with AML requirements.

Costs and ROI of Banking Analytics Software

The cost of implementing a banking analytics solution may vary from $100,000 to $1,500,000, depending on software complexity. The major cost factors include data volume and diversity, the number of required integrations, and the need for big data analytics and ML/AI capabilities.

On average, data analytics in banking brings a 3-year ROI of up to 415% with a payback period of 6 months. The ROI drivers include improved customer retention, increased wallet share, and revenue growth associated with efficient cross-selling.

$100,000–$300,000

A basic solution that:

- Enables KPI tracking across 1–2 analytics areas, e.g., financial and marketing metrics.

- Integrates with 1–2 key data sources, e.g., a core banking system.

- Enables batch data processing (e.g., every 12 hours).

- Ensures scheduled and ad hoc reporting.

$300,000–$600,000

A solution of medium complexity that:

- Enables KPI tracking across multiple business areas: finance management, employee performance, customer management, etc.

- Integrates with 3–7 data sources, both corporate and external.

- Features batch and real-time data processing.

- Enables diagnostic and predictive analytics via non-neural-network ML models.

- Provides automated reporting capabilities.

- Enables automated reporting to regulators.

$600,000–$1,500,000+

- Monitors the entire scope of metrics, including market performance.

- Integrates with multiple back-office and third-party systems, including blockchain-based fintech software.

- Enables real-time big data analytics for instant KPI calculation and event monitoring (e.g., for financial fraud detection).

- Provides advanced root cause analysis and forecasting using machine learning.

- Offers AI-supported optimization and personalization recommendations.

- Enables automated generation of complex reports (e.g., consolidated reports, reports compliant with local banking regulations).

- Enables custom reporting in compliance with the established reporting forms like Basel III.

Want to know a more precise figure?

Answer a few simple questions about your needs to let our experts understand your situation and provide you with a custom quote quicker.

Consider ScienceSoft to Build a Reliable Banking Analytics Solution

Our awards, certifications, and partnerships

Named among America’s Fastest-Growing Companies by Financial Times, 4 years in a row

Named Best in Class in Web and Mobile Banking Software Development by FinTech Futures

Listed among Highly Commended tech partners at the Global FinTech Awards 2025

Awarded for measurable results in insurance digital transformation by The Global Insurer

Listed in IAOP’s 2025 Global Outsourcing 100 for the 4th year running

Microsoft Partner since 2008

AWS Partner since 2017

ISO 9001-certified quality management system

ISO 27001-certified security management system

About ScienceSoft

ScienceSoft is an IT consulting and software development company headquartered in McKinney, Texas. Since 1989, we help organizations in 30+ domains build analytics solutions that allow companies to benefit from complete visibility into their business processes, timely informed decisions, and proactive risk management. Being ISO 9001- and ISO 27001-certified, we guarantee top software quality and complete security of our clients’ data.