As retail banking faced numerous challenges in recent years, not all financial institutions realize how to respond to them effectively. That is why ScienceSoft's IT consultants have come up with suggestions on how to take on the six most important challenges with banking software.

1. Tough competition

The competition within the banking industry has significantly increased, primarily thanks to the appearance of online banking services. As customers get used to digital channels to manage their finance, a retail bank's geography no longer defines its target audience and competitive market. Given that numerous fintech companies are also trying to win the same customers, retail banks are facing a much stronger competition than ever.

How banking software helps: Retail banks should analyze customer experience carefully to find new growth opportunities and adopt them quickly. Using data analytics, banks can customize their financial products and services and adjust them to customers' current needs and preferences.

2. Fragmented view of customers

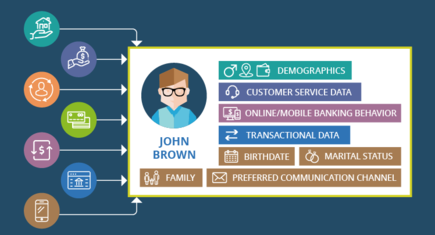

The majority of retail banks have a complex IT architecture that includes numerous banking software solutions, such as mortgage lending software, loan origination and servicing solutions, software for customer account management, mobile banking, etc. As a rule, each piece of software has its own database with particular kind of customer information. If a retail bank doesn't merge and compare data from these databases, it will have a fragmented view of their customers.

How banking software helps: As long as banks keep customer information scattered across isolated systems, they won't be able to understand the entire customer lifecycle across channels and products. To make it happen, banks should build a customer-centric IT architecture model based on a single view of the customer.

3. Decreased customer experience and loyalty

As banks stepped into the Age of the Customer, the quality of personalized customer experience and 'exceptional' customer service have become their primary concern. After the appearance of customer-oriented companies, such as Amazon, Google, Starbucks and Walmart, top-notch in-person and digital experiences have become the norm. Customers don't want to know about the hardships of building these experiences: they want immediate value and will go elsewhere if your bank can't provide it.

How banking software helps: To increase customer experience and loyalty, banks should first learn what is more important for customers and how they make their choices. Using emotion recognition software, banks can carry out an in-depth analysis of customers' sentiments and find out whether the quality of banking products and services satisfies them. In case a bank discovers customer discontent, it can use numerous IT advantages to solve this challenge. For example, a banking chatbot or mobile wallet can help to increase customer experience and loyalty whereas gamification can strengthen customer communications and build brand loyalty.

4. Low profit

Though much time has already passed since the last financial crisis, banks still strive hard to achieve a higher ROE. Facing greater capital requirements, low interest rates, slow income growth and greater regulatory pressure on sales incentives, banks ramp up cost reduction initiatives. To achieve that, some banks cut down on risky and less profitable business lines. Others, for example, Bank of America or JP Morgan Chase, shorten their branch networks in rural and low-profit areas. Yet, apart from these primary measures, banks can reach their projected cost-reduction goals with technology.

How banking software helps: To mount the challenge, banks can invest in mobile banking development. This measure can not only take up a bank's strategy to reduce branch costs, but also provide accessible, simple, easy-to-use and personalized banking services to customers. Of course, there is a risk that mobile banking may alienate less tech-savvy customers who prefer going to a physical branch. However, if you see a shift in customer behavior towards self-service (e.g., a wider use of ATMs and online banking), a mobile banking app can hit the big time.

5. Weak cross-selling

Though banks have always been laser-focused on effective cross-selling, getting sizable results is not an easy task. In particular, A.T. Kearney underlines that customers on average buy only 2-3 financial products from the same bank. One of the reasons that banks fail to cross-sell effectively is that they cannot keep a balance between pushing to sell more and making relevant offers to customers. A customer is more likely to purchase a product from those sales representatives that already understand customers' requirements and know their needs before they meet. For efficient cross-selling, banks should suggest only those services that will help customers manage their financial affairs.

How banking software helps: A banking CRM system will bring structure and purpose into cross-selling activities. Using this software, sales representatives can focus on delivering personalized financial advice instead of cross-selling products and services that a customer doesn't need or already has. In addition, banking CRM allows detecting the most value-generating customers to give them special attention as well as identify customers that are most likely to buy a particular banking product. If a bank wants to boost cross-selling, CRM software can become a wise assistant that guides sales representatives through all cross-selling workflows.

6. Identity theft

No doubt, security must play a central role in any banking IT initiative, because any data breach has a great impact on a bank's revenue, brand value and consumer trust. That is why financial institutions must carefully evaluate security threats and implement software solutions that add to fraud protection.

How banking software helps: As the number of mobile devices with biometric capabilities constantly grows, banks can implement biometric authentication to verify a customer's identity. Given the uniqueness of biometrics, it is currently much more secure than any conventional security system.

It's time to consider your digital strategy

As the global digitalization trend is approaching retail banking, financial institutions of all sizes should learn to predict, prioritize and measure technology investment. Banks need to think not only on how to digitize the existing products and services, but also on how to develop a long-term strategy that will entirely transform their business. From our IT consulting practice, we advise:

1) Build flexible software systems that can be easily adapted to the rapidly changing market needs.

2) Create partnerships with fintechs to drive innovation.

If a bank unveils a wise digital strategy, accurately picks out banking software solutions and creates effective partnerships, it will lead to a success in the long run.

Choose IT solution

Banking Software Consulting & Solutions

Need an IT solution that will suit your specific business needs? Thrive with our platform-based and custom banking software.

Choose IT solution