Fintech Software Development Services

ScienceSoft has been engineering software for banking, financial services, and insurance since 2005. Our clients rely on our experience in advanced technologies and benefit from the future-proof cloud architectures we design to introduce competitive fintech solutions.

Custom fintech software development services result in tailored and easy-to-evolve solutions for automated financial service delivery. Fintech solutions often rely on AI/ML, big data, blockchain, IoT, and other advanced techs to transform BFSI workflows and introduce engaging customer experiences.

ScienceSoft designs and builds robust fintech solutions that help BFSI companies upgrade business operations and leverage new service models while ensuring data security and regulatory compliance. Our unwavering commitment to our clients’ success is proven by ScienceSoft’s presence on the IAOP Global Outsourcing 100 list for the fourth year in a row.

Opportunities for fintech firms: market at a glance

The fintech market is on the rise and is projected to exceed $1.13 trillion by 2032, growing at a CAGR of 16.2%. The dynamic technology landscape continuously unveils new opportunities, so every startup has a chance to tap into an emerging niche and win the segment leadership. The economics of presenting a successful fintech product are staggering, with fintech leaders exhibiting three-digit percentages of annual revenue growth and attracting billion-dollar investments despite the persisting macroeconomic uncertainty. For BFSI incumbents, advanced fintech tools can bring 30–50% operational cost savings with a potential twofold increase in profits through new digital service models.

Custom Fintech Solutions ScienceSoft Delivers

From simple mobile apps to large-scale networks for multi-party transaction processing – as a custom fintech software development company, ScienceSoft ensures prompt and predictable implementation of all kinds of fintech initiatives.

Client-facing apps

Convenient and secure web and mobile applications that provide self-service options and seamless digital experience for a financial services provider’s customers:

Complex processing systems

Large-scale systems with a comprehensive processing engine at their core – they are able to handle complex operations specific to a particular BFSI segment:

Peer-to-peer (P2P) platforms

Secure and scalable online platforms that connect multiple BFSI providers with individuals and SMBs in need of financial services and automate complex multi-party financial activities:

- P2P lending software

- P2P insurance platforms

- Investment platforms

- Crowdfunding platforms

Process automation solutions

Software aimed to streamline particular operations for a business or its consumers, e.g., enable payment automation, underwriting automation, or portfolio management automation.

Financial fraud detection software

Advanced cybersecurity tools that instantly identify and prevent malicious behavior of a company’s employees and clients (e.g., automated insurance fraud detection solutions).

Compliance monitoring systems

Software enabling real-time monitoring of the financial IT system and employee adherence to the internal service policies and regulatory requirements.

Intelligent virtual assistants

AI-powered agents that handle personalized customer communication and can provide clients with intelligent advice on the proper payment and investment actions.

Digital wallets

Online apps that enable fast and easy payments and money transfers while ensuring full security of the users’ personal and billing information. Cryptocurrency wallets to transact and manage crypto assets.

Crypto assets

Tokenized assets that represent tradeable securities, utilities, rewards, particular financial rights, and more. Blockchain-based digital currencies that serve as a means of payment, exchange, and value storage.

Data analytics systems

Comprehensive solutions powered by advanced data science techs that help drive valuable insights from a company’s business data and optimize financial operations:

Financial CRM solutions

Software that helps financial service providers manage interactions with different customer segments and automate service planning & analysis activities:

Digital collaboration solutions

Platforms and networks providing a digital collaboration environment for a BFSI company’s internal teams and external partners, as well as for multiple financial services providers:

Instant account verification, cash-flow-based insights, pay-by-bank rails, and real-time risk signals are the proven levers for removing friction across customer experience and fintech servicing. By integrating fintech products and back-office systems with trusted open finance providers like Plaid, Mastercard Open Banking (Finicity), and MX, ScienceSoft empowers fintech firms to accelerate onboarding, streamline money movement, unlock cleaner data for personalization, and ultimately boost user engagement.

How Each Finance Domain Benefits From Tailored Fintech Tools

- Convenient 24/7 access to banking services for customers via self-service banking apps.

- Fast and easy delivery of banking services due to automation of core banking operations.

- Prompt and error-free processing of financial transactions with the help of open banking APIs.

- Fully paperless banking process under the innovative neobanking model.

- Instant, accurate, and secure payment processing via custom and third-party payment gateways.

- High customer satisfaction due to seamless digital payment experience and support for trending payment options: QR code-based payments, NFC-enabled onsite mobile payments, peer-to-peer (P2P) money transfers, and more.

- Domestic and cross-border cryptocurrency payments enabled by the blockchain technology.

- Prompt AI-powered risk assessment and loan-related decision-making.

- Analytics-based loan pricing in compliance with regulatory rules.

- Efficient payment collection and debt recovery enabled by rule-based and AI-supported automation.

- Fast access to funds for borrowers and attractive investment opportunities for lenders under the P2P lending model.

- Automated processing of mortgage applications and calculation of mortgage-associated fees.

- AI-supported collateral valuation, and continuous risk monitoring.

- Automated mortgage close, servicing, and foreclosure processes.

- Scalable digital storage for large-volume mortgage documents.

- Full visibility into borrower performance and associated risks due to real-time API-enabled borrower data collection.

- Data-driven insurance underwriting and risk-based insurance pricing.

- Automated actuarial workflows.

- Prompt and accurate claim settlement due to instant capture and intelligent validation of claim data.

- Facilitated collaboration between insurance teams, clients, and vendors via multi-role insurance portals.

- Support for innovative insurance models, such as parametric insurance and pay-as-you-live insurance, enabled by integrations with IoT tracking systems.

Financing

- Minimized financing-associated fees due to intelligent advice on the optimal loan amount and duration.

- Automated calculation of charges and commissions under the financing activities.

- P2P financing platforms to enable highly accessible and cost-effective financing transactions, including crowdfunding transactions.

- Transparent and secure blockchain-based financing, including ICO and STO.

- Accurate investment decisions due to AI-powered guidance on portfolio optimization.

- Streamlined trading activities due to automated transaction opening, confirmation, renewal, and closing.

- Minimized investment risks due to precise estimation of the expected financial gains and intelligent advice on the proper hedging strategies.

- Secure, fast and cost-effective financial transactions due to blockchain-based transaction handling with no involvement of intermediaries.

- Automated transaction enforcement using smart contracts.

- Easy access to the global market due to DeFi solutions’ ability to seamlessly process cross-border transactions.

Corporate finance management

- 50–90%+ of manual tasks eliminated across core finance functions due to financial management process automation.

- Streamlined control over enterprise-wide financial activities due to real-time collection of data on all finance-related operations.

- Comprehensive financial analytics powered by AI.

- 1–8%+ rise in gross profit margin with new, technology-supported pricing and billing models.

Personal finance management

- Fast and convenient planning of spend and savings by period and expense category with the help of personal finance apps.

- The ability to drive higher savings thanks to intelligent recommendations on personal budget planning and spend optimization opportunities.

- End-to-end traceability of personal expenses due to automated timestamped recordkeeping of financial transactions.

Advanced Financial Technologies to Power Your Software

ScienceSoft enhances financial solutions with the following cutting-edge technologies to drive the speed, accuracy, security, and transparency of BFSI service flows:

A backbone of advanced financial analytics and data-driven operational decisioning. Automates financial data processing, fraud detection, and customer interaction:

Provides full traceability of financial data flows and offers fast, secure, and cost-effective payment transaction processing without the involvement of third parties:

Helps establish straight-through processing of multi-format financial data and obtain in-depth insights into aspects like financial performance, operational efficiency, and customer behaviors, needs, and risks.

Ensures cost-effective fintech software scalability to process and store growing data volumes. Enables 24/7 fintech solution availability with remote access for BFSI servicing teams, customers, and partners.

Enables real-time data gathering from customer devices, servicing equipment, and security systems to enhance financial service safety and convenience.

AI/ML, blockchain, IoT, and hybrid reality are becoming increasingly intertwined, giving massive impetus to fintech innovations. At ScienceSoft, we keep our fingers on the pulse of fintech fusion trends and continuously grow our cross-domain skills to help our clients who trailblaze emerging niches like metaverse, wearable banking, behavior-based insurance, and autonomous financial advisory quickly turn their high-level concepts into full-scale solutions.

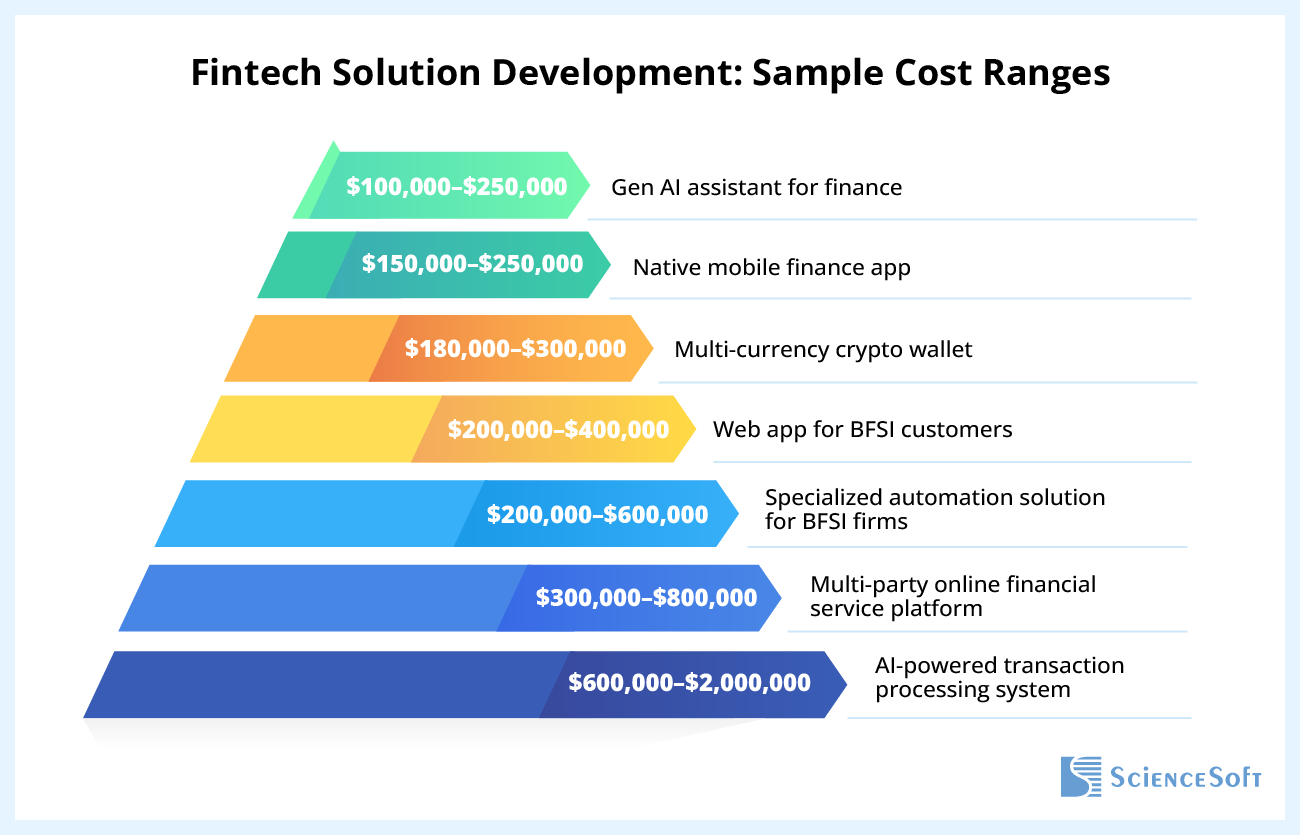

Fintech Software Development Costs

From ScienceSoft's experience, fintech software development costs may vary from $100,000 to $2,000,000+, depending on the type of software you want to build, the complexity of the solution's functional and non-functional capabilities, the scope of integrations, security and compliance requirements.

Wondering how much your custom fintech solution may cost? Use a calculator below to estimate the required investments for your case.

Learn the Cost of Your Fintech Solution

Please answer a few quick questions about the financial solution you’re looking to build. This will help our experts better understand your needs and calculate a tailored quote much faster.

Thank you for your request!

We will analyze your case and get back to you within a business day to share a ballpark estimate.

In the meantime, would you like to learn more about ScienceSoft?

- Project success no matter what: learn how we make good on our mission.

- Since 2005 in financial IT services: check what we do.

- 4,200+ successful projects: explore our portfolio.

- 1,400+ incredible clients: read what they say.

ScienceSoft's Services to Drive Your Fintech Initiative to Success

Our fintech application development company provides full-cycle consulting and engineering services to help fintech startups, software product companies, and traditional BFSI services providers build effective and secure fintech solutions. Achieving project goals despite time and budget constraints and changing requirements is ScienceSoft's top priority.

Fintech software consulting

We define a best-fitting niche and a unique selling proposition for your fintech solution and design an optimal feature set, architecture, UX and UI, and toolkit. You also get expert advice on security and compliance and a detailed implementation plan to minimize project risks.

Fintech software development

We engineer your fintech solution, integrate it with the required systems, and run the necessary quality assurance procedures. We can also provide after-launch software support. You promptly get a solution with powerful capabilities tailored to your business and end user needs and receive all necessary documentation.

Modernization of legacy finance software

We can rearchitect your solution, migrate it to cloud, or revamp its legacy codebase and tech stack. In addition, we can upgrade software with new features to support your unique workflows – a fast and cost-effective way for you to get a modern fintech solution fueled by advanced techs.

Why Build Fintech Software With ScienceSoft

- Since 2005 in engineering IT solutions for the financial services industry.

- Fintech developers proficient in advanced techs: AI/ML, big data, blockchain, IoT.

- Since 2003 in cybersecurity to ensure world-class protection of fintech software.

- Compliance experts with 5–20 years of experience to help achieve fintech software regulatory compliance.

- Quality-first approach based on an ISO 9001-certified quality management system.

- Robust data security management supported by an ISO 27001 certificate.

Our awards, certifications, and partnerships

See How You Benefit From Partnering With Us

ScienceSoft’s experience shows that flexibility is key to meeting each client’s fintech software development goals while addressing the expectations regarding the timelines and budget.

Check the cards to understand your potential gains and follow the links to discover the development and project management practices behind our value-centered offer:

Flexible cooperation models

- Full outsourcing of custom fintech software development.

- A dedicated team to take over a part of your project.

- Team augmentation with the required number (from 0.5 to 150+ FTEs) of our best talents.

- T&M, T&M with a cap – for advisory activities or agile implementation of a fintech solution.

- Fixed price – for software development divided into clear stages (fixed price for each stage).

- A monthly subscription fee – for support activities.

Flexible development pace

- Quick project start (1–2 weeks).

- An MVP of your fintech software in 3+ months.

- Frequent releases (every 2–4 weeks).

- Rapid resource provisioning and on-demand team scaling to speed up software delivery.

Flexibility to adapt to changes

- Established change request management flows to agilely implement viable changes.

- Offering individually-paced collaboration forms and tuning communication frequency depending on the project needs and client preferences.

And here’s where our approach remains the same for every fintech project to ensure smooth implementation and top-flight quality of the solutions we deliver:

Guaranteed risk-free cooperation

achieved via accurate time and cost estimation, early planning of risk mitigation steps, and the analysis of custom fintech software development feasibility for each specific case. Also, we can develop a Proof of Concept to test the viability of a fintech solution in real life.

Guaranteed service transparency

thanks to our mature practices of joint project scoping and success measurement, open discussion of potential gains and challenges, regular KPI-based reporting on the development progress, and systematic approach to documentation and knowledge sharing.

achieved via employing intelligent fraud detection, data encryption, multi-factor authentication, including biometric authentication, advanced infrastructure security tools, SIEM, and more.

Reliable Techs & Tools to Develop Fintech Solutions

AI

Machine learning platforms and services

Machine learning frameworks and libraries

DevOps

Containerization

Automation

CI/CD tools

Monitoring

Blockchain

Smart contract programming languages

Frameworks and networks

Cloud services