Custom Accounting Software

Features, Benefits, ROI Factors, Costs

ScienceSoft applies 18 years of experience in engineering corporate financial software and practical knowledge of 30+ industries to deliver robust accounting solutions tailored to each company's specific needs.

Custom Accounting Software: The Essence

Custom accounting software is a solution that provides unique functionality tailored to each company’s specific needs across general ledger, payables and receivables management, asset and inventory accounting, financial data reconciliation, payroll and tax management, and financial reporting.

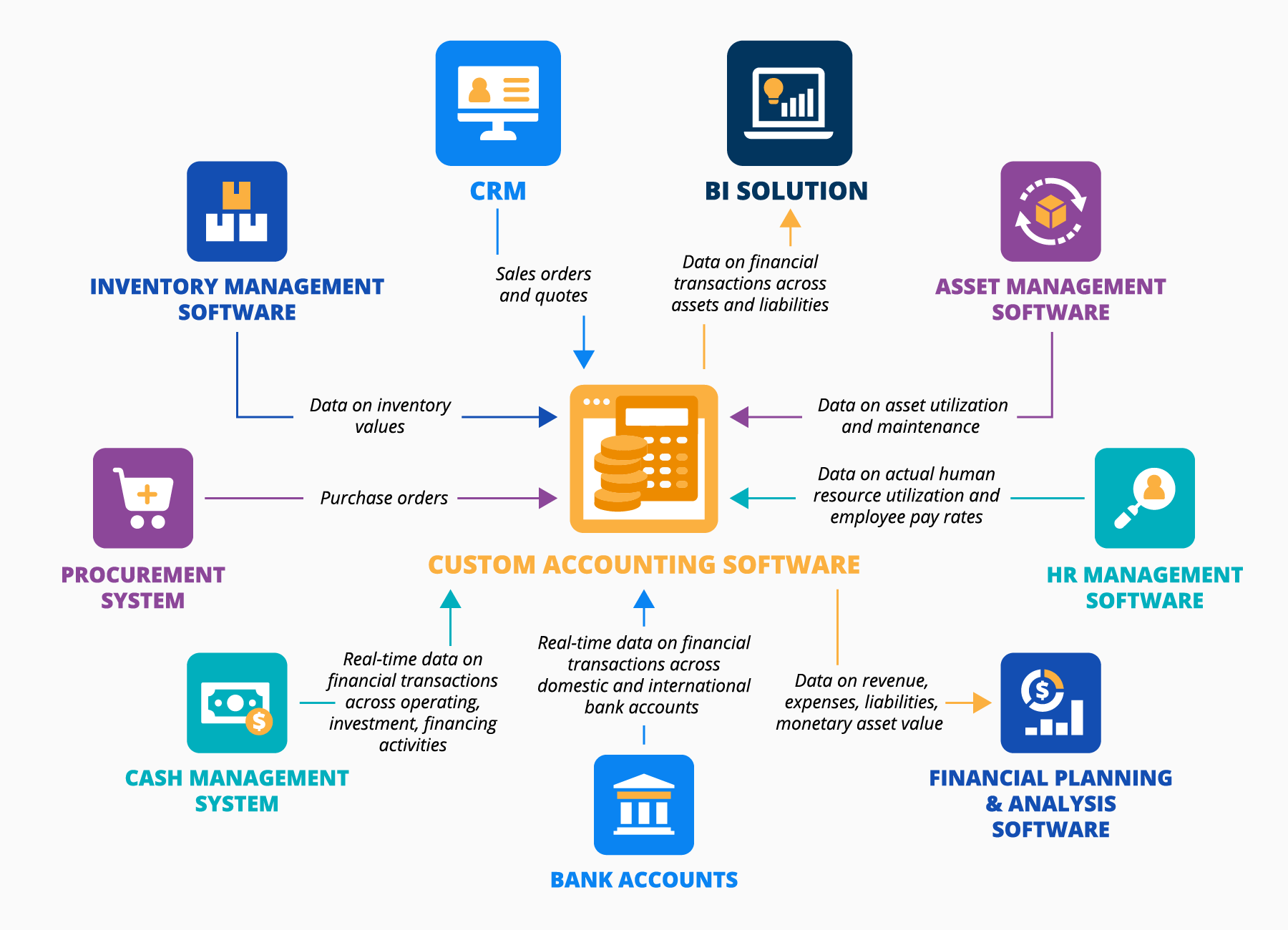

To ensure real-time financial data sync, custom accounting solutions may integrate with CRM, HRMS, an inventory management system, asset management software, a financial planning and analysis solution, and other business-critical systems.

The cost to develop a custom accounting system for a midsize company can range around $200,000–$400,000, depending on the solution complexity. Use our cost calculator below to estimate the cost for your case.

Annual ROI for custom accounting software may reach up to 290%.

Key Features of Custom Accounting Software

Custom enterprise accounting software is aimed to introduce unique capabilities to help companies from various industries maximize the efficiency of their accounting processes. Below, we have summarized core solution features based on ScienceSoft’s experience in accounting software projects.

How long does it take to develop accounting software?

The development of custom accounting software may take 6–12+ months, depending on the solution’s functional scope and complexity. ScienceSoft can deliver an MVP of your accounting app in 3+ months and consistently grow it to the fully-featured solution with major releases every 2–3 weeks.

Key benefits of custom accounting software

The annual ROI for custom accounting software may reach up to 290%.

Is Custom Accounting Software the Best Option for Your Needs?

Answer a few simple questions and find out whether you should opt for a custom solution or a pre-built accounting tool.

Do you need software providing specific features, e.g., custom payroll and tax calculations, investment accounting, or payment triaging based on non-standard rules?

Do you need an accounting solution providing compliance with the latest accounting standards (IFRS, GAAP, ASC, ZATCA, etc.) of the countries you operate in?

Do you want to leverage AI-supported accounting automation, e.g., to accurately predict GL balances, get intelligent advice on the optimal transaction dates, or spot accounting fraud?

Do you want to leverage blockchain-based accounting, e.g., for fully automated and immutable bookkeeping, accountants' workflow tracing, or crypto accounting?

Do you need to integrate your business accounting software with multiple back-office systems or legacy tools?

Do you operate in a regulated industry (e.g., healthcare, BFSI, public sector) and need advanced financial data security to meet strict legal requirements?

Do you need an accounting solution with various interfaces for different roles in the accounting team (e.g., A/R, payment, financial reporting specialists)?

Do you plan to evolve the software with new functional and non-functional capabilities in order to adjust it to changing business and legal requirements?

Do you have large teams involved in accounting processes and look to avoid the software fees associated with the per-user subscription model?

Please tell us a bit more about your needs

Answer at least 3 questions to get results.

You can go with off-the-shelf accounting software

Looks like market-available solutions are a viable option to meet your needs. Turn to ScienceSoft if you need help with choosing the optimal ready-made tool, its implementation, customization, or integration with your existing systems.

You definitely should consider custom development

A tailor-made accounting solution will help you reap the unique benefits that market-available software cannot offer. Turn to ScienceSoft to get a detailed assessment of a custom accounting system’s feasibility for your business situation.

Custom accounting software is your best choice

Looks like market-available accounting tools don’t fit your specific needs and won’t be able to provide the expected operational and economic feasibility. Turn to ScienceSoft to get a consultation on custom accounting software development and receive free cost and ROI estimates.

Go-To Integrations for Custom Accounting Software

ScienceSoft designs a cohesive business environment where the accounting solution is integrated with financial transaction sources and corporate finance planning systems. The main benefit of the integration is time-effective and accurate financial data entry.

- CRM: to automatically populate invoices with accurate customer data, payment terms, price and quantity of ordered goods.

- Inventory management software: to enable accurate recording of inventory values on inventory purchasing and utilization.

- Asset management software: to enable accurate calculation of the fixed asset depreciation.

- Procurement system: to enable the automated purchase order recording in the A/P ledger.

- HR management software: to enable accurate payroll calculation.

- A cash management system: to automatically create entries on financial transactions across operating, investment, financing activities in the general ledger and subledgers.

- Financial planning and analysis software: to support accurate financial performance analysis, financial planning, budgeting, and forecasting.

- Bank accounts: to enable faster reconciliation.

- BI solution: to enable accounting analytics and reporting.

Accounting Software Engineering Services by ScienceSoft

An accounting software development company with 36 years of experience in creating custom solutions, ScienceSoft helps businesses in 30+ industries build effective accounting systems tailored to their unique accounting needs.

Accounting software consulting

- Analysis of your accounting needs.

- Assessment of the existing accounting processes and tools.

- Suggesting optimal features, architecture, and tech stack for the accounting solution.

- Preparing an integration plan (with CRM, HRMS, asset management system, cash management software, etc.).

- Development cost & time estimates, expected ROI calculation.

Accounting software development

- Accounting solution conceptualization.

- Architecture design.

- Accounting software engineering.

- Integrating the custom accounting solution with the required systems.

- Quality assurance.

- User training.

- Continuous support and evolution of accounting software (if required).

Success Factors for Custom Accounting Software

In ScienceSoft’s accounting software engineering projects, we always look to cover the following important factors that help bring additional value across our clients’ accounting processes:

AI-driven accounting analytics

To get recommendations on the optimal payment queues and payment methods, depreciation calculation methods, and more.

Cloud deployment

To reduce accounting software maintenance costs, enable faster updates, and provide easily accessible workspace for global collaboration on accounting processes.

Easy-to-use APIs and connectors

To streamline accounting software integration with your essential back-office systems and relevant third-party tools.

Strong security is a must for corporate accounting apps. We power accounting solutions with robust data security mechanisms to control access to sensitive financial data, promptly spot malicious user activities, and easily recognize non-compliant and fraudulent transactions.

How to Develop Accounting Software

Accounting software development requires an accurate action plan to establish smooth project flow and prevent risks. Below, ScienceSoft describes the key steps of our custom accounting software engineering process to provide you with a general idea on how your project may look.

1.

Business analysis and requirements engineering

- Conducting interviews with the stakeholders and accounting subject matter experts to understand their challenges and needs.

- Auditing the currently used accounting software and IT infrastructure.

- Determining relevant regulatory compliance requirements (IFRS, GAAP, ZATCA, etc.).

- Composing a detailed list of functional and non-functional requirements for the accounting software.

2.

Accounting software design

- Creating an optimal feature set for the accounting software, including advanced functionality such as AI-supported payment planning, intelligent fraud detection, or blockchain-based bookkeeping.

- Designing the logic for accounting calculations, journal entries, reconciliation, and more.

- Designing a scalable and secure architecture for the accounting system.

- Prototyping convenient UX and UI, customizing it for various accounting roles (A/R specialists, payroll specialists, etc.).

- Planning accounting software integrations with the required corporate systems (CRM, inventory software, etc.) and external data sources (e.g., bank systems, payment gateways).

- Selecting a best-fitting development tech stack (programming languages, platforms, frameworks, third-party APIs, and more).

3.

Project planning

- Defining the deliverables, scope, and KPIs for the accounting software engineering project.

- Composing the optimal team and creating a detailed work breakdown structure.

- Estimating the project timelines, costs, and ROI/NPV.

- Analyzing potential risks and introducing a risk mitigation plan.

4.

Development, integration, and QA

- Coding the back end of a custom accounting system, including APIs.

- Creating role-specific user interfaces.

- Setting up accounting data storage.

- Establishing the required integrations.

- Quality assurance of the accounting solution (functional, security, performance testing, and more), performed in parallel with coding.

Optional:

- Designing and tuning AI models for accounting process optimization.

- Development of blockchain smart contracts for fully automated accounting operations.

5.

Financial data migration

- Migrating financial data from the currently used accounting tool or spreadsheets to the new solution.

- Identifying missed, duplicated, or inaccurate financial data and fixing the issues.

6.

Deployment and after-launch support

- Configuring accounting software infrastructure and solution deployment to production.

- Establishing robust infrastructure security, financial data backup and recovery procedures.

- Providing all necessary accounting software documentation, including user tutorials and maintenance guides.

- Training the accounting teams in a remote, in-person, or hybrid format.

- Monitoring accounting software performance and promptly fixing any arising issues.

- Running regular security and compliance audits.

- Accounting system upgrading with new features when needed.

Custom Accounting Software Costs

The cost of custom accounting software varies greatly depending on:

- The number and complexity of a solution’s functional modules.

- The type of automation (RPA or AI-powered features).

- The volume of data that needs to be migrated from spreadsheets and/or existing accounting software.

- The type of accounting software deployment (cloud, on-premises, hybrid).

- The number and complexity of integrations (with CRM, HRMS, asset management software, an inventory management system, a BI solution, etc.).

How much does it cost to build accounting software?

Based on ScienceSoft’s experience, the cost to build a custom accounting app of average complexity ranges from $200,000 to $300,000, while accounting software engineering for a large enterprise may cost more than $400,000.

Want to know the cost of your accounting solution?

About ScienceSoft

ScienceSoft is an international IT consulting and software engineering company headquartered in McKinney, Texas. Since 2007, we have been helping businesses build effective custom accounting software. Being an ISO 9001- and ISO 27001-certified company, we apply a mature quality management system and guarantee that cooperation with us does not pose any risks to our clients’ data security.