Accounting Automation

Steps, Capabilities, Costs, ROI

ScienceSoft brings 18 years of experience in corporate financial software development to help companies design and implement effective accounting automation solutions.

Accounting Automation in a Nutshell

Accounting automation helps eliminate manual accountants’ tasks across bookkeeping, invoicing, payables, receivables, payroll, and more. Automated accounting solutions support multi-entity financial reconciliation, asset and inventory accounting, region-specific tax filing and financial reporting.

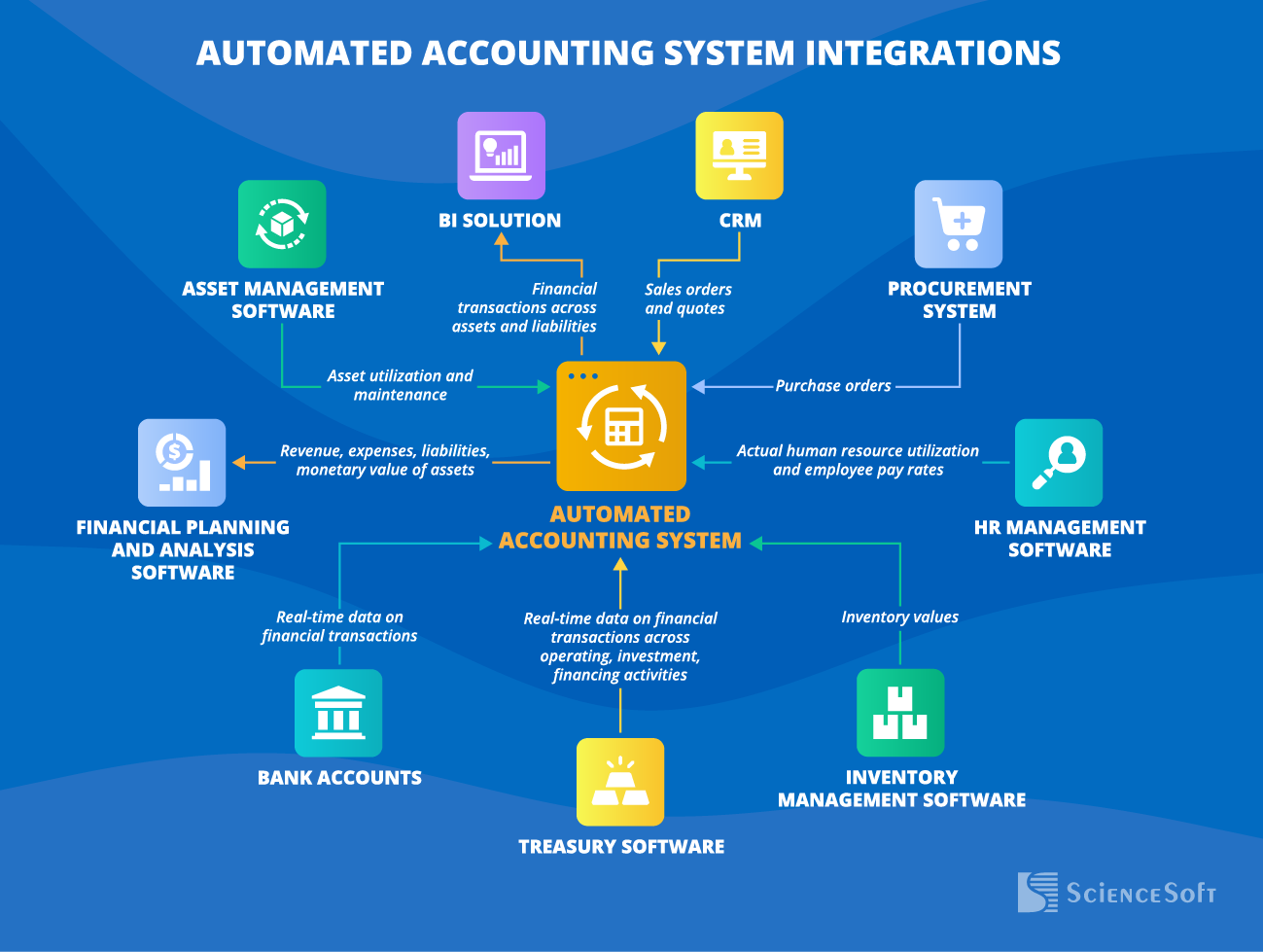

An automated accounting system integrates with CRM, HRMS, inventory management software, asset management software, a financial planning and analysis solution, etc.

The implementation of accounting automation may take 8–12+ months. The costs for building a custom automated accounting solution start from $200,000 and may exceed $500,000, depending on the solution complexity. Accounting automation may bring up to 290% annual ROI.

You are welcome to use our cost calculator to estimate the cost of accounting automation for your case.

Main Accounting Tasks to Automate

Bookkeeping

Get fully automated aggregation, processing, and recording of enterprise-wide financial transactions and achieve 3x+ improvement in accountants' productivity.

Document processing

Leverage the power of AI, RPA, and OCR techs to drive 2–3x faster and 95%+ more accurate financial document processing with no human involvement.

Financial calculations

Remove the most tedious and error-prone part of the accountants’ workflow. Get instant calculation of the required payment amounts and accounting metrics.

Pay up to 12x faster to improve vendor satisfaction and benefit from 40–400% growth in the payment team’s productivity.

Reconciliation

Speed up financial close by up to 3x with automated aggregation and multi-way matching of financial transactions.

Financial reporting

Employ automation to generate financial reports 3x faster and meet 100% of the reporting compliance requirements.

Automated Accounting System: Key Features

Below, ScienceSoft's consultants have composed a comprehensive list of automated accounting software features based on our experience in accounting digitalization. The actual feature set we implement in our projects depends on the specific accounting workflow automation needs and is defined individually for each client.

Journal entry automation

- Automated creation, updating, and approval of journal entries in the general ledger and subledgers on external and intercompany financial transactions, including multi-currency transactions.

- Customizable journal entry templates for various ledgers.

- Scheduled recurring and reversing journal entries.

- Automated attachment of source documents (invoices, receipts, checks, payroll reports, leases, etc.) to each journal entry.

- Automated consolidation of financial transactions across multiple intercompany ledgers and recording them in GL.

- Rule-based GL coding and transaction classification by category (asset, liability, equity, revenue, expenses, etc.)

- Automated calculation of GL balances.

- Rule-based re-allocation of the accumulated account balances to the branch/subsidiary account balances.

- Template-based invoice generation, including recurring invoices.

- Calculation and application of taxes, discounts (including those on early payments), additional charges (e.g., interest on late payments, insurance, carriage), and billable expenses.

- Automated workflow for multi-department invoice approval.

- Scheduled invoice sending to customers.

- Automated calculation of the received, due and overdue amounts, DSO, A/R turnover ratio, and more.

- Automated payment collection via various payment methods, including bank transfers, wire transfers, ACH, credit cards, checks, or by direct debit.

- Automated allocation of received payments to customer invoices.

- Scheduled collection notifications on due payments to customers (via email, messaging apps).

Accounts payable (A/P) automation

- Automated calculation of the amounts paid, partially paid, owed, DPO, A/P turnover ratio, etc.

- Automated capture, extraction, and validation of purchase invoice data against the corresponding purchase order data.

- Scheduled payments (to suppliers, vendors, governmental entities, etc.) via a pre-defined payment method.

- Multi-department payment approval.

- Notifications on payment dates.

Expense accounting automation

- Automated capture, extraction, and validation of data provided in receipts on business-related employee expenses (travel, transport, telecoms, etc.).

- Multi-department expense approval.

- Automated generation of expense reports.

- Automated calculation of reimbursement amounts for each employee.

- Automated recording of data on reimbursable employee expenses in the expense ledger and the general ledger.

- Scheduled payments of employee reimbursement.

Fixed asset accounting automation

Calculating, recording, and tracking:

- Original and capitalized value of fixed assets, including those in multiple locations, regions.

- Fixed asset depreciation based on various calculation methods (straight line method, double declining balance method, units of production method, sum-of-the-years’ digits method, etc.), or user-defined depreciation schedules.

- An asset’s tax basis.

Inventory accounting automation

- Automated creation of inventory records based on purchase orders.

- Recording and tracking inventory values of inventory items:

- Across multiple domestic locations, regions, intercompany entities.

- Across various stages of development and production, such as raw materials, in-progress goods, and finished goods.

Payroll automation

- Calculating employee salaries, overtime, bonuses, commissions, deductions, etc.

- Recording and tracking the calculated payroll amounts in the payroll ledger and the general ledger.

- Scheduled payments to employees.

Tax management automation

- Calculating VAT, sales, use, withholding, income, and other taxes based on the tax rates in regions a company operates.

- Recording and tracking data on the calculated tax amounts in the tax ledger and the general ledger.

- Automated tax filing under region-specific regulations.

- Scheduled tax payment.

Automated reconciliation

- Automated reconciliation of financial data in bank statements with GL, A/P, and A/R records.

- Automated removal of duplicate transaction records.

- Defining the outstanding transactions.

- Notifications to accountants on reconciliation discrepancies.

- Automated intercompany reconciliation.

Reporting and compliance

- Scheduled financial reports (monthly, quarterly, yearly, etc.) by region, entity, or consolidated reports, including income statement, balance sheet, cash flow statement, tax summary, and more.

- Compliance with GAAP (specifically ASC 606 and IFRS 15), SOC1 and SOC2, SOX, GDPR (for the EU), ZATCA regulations (for Saudi Arabia), industry-specific regulations.

Ways to Automate Accounting Processes

|

|

Business automation software |

Off-the-shelf accounting software |

Custom accounting automation system ScienceSoft recommends |

|---|---|---|---|

|

Essence

|

Implementing all-in-one market-available business automation software that includes a digital accounting tool. |

Implementing OOTB accounting software, which typically enables automated journal entries, general ledger management, reconciliation, financial reporting and provides basic accounting analytics. |

Building custom automated accounting software to get all necessary functional and non-functional capabilities and digitally transform your unique accounting workflows. |

|

Pros

|

Establishing a cohesive accounting automation environment. |

Automating accounting quickly and with moderate upfront investments. |

Getting a solution fully tailored to your accounting needs. The most favorable TCO in the long-term prospective. |

|

Cons

|

High subscription cost. Chances to obtain a large share of unnecessary functionality. |

Pre-defined features and integrations. Inability to evolve the solution when needed. Ongoing subscription fees, leading to high software TCO in the long run. |

Software design requires additional time and investments. |

Which Approach to Accounting Automation Fits Your Needs Best?

Answer a few simple questions and find out whether you should opt for a custom solution or a pre-built automation tool.

Do you need to automate specific accounting tasks, e.g., filing regional taxes, investment accounting, or creating payment and debt collection queues based on non-standard priority rules?

Do you need an automated accounting solution providing compliance with the latest accounting standards (IFRS, GAAP, ASC, ZATCA, etc.) of the countries you operate in?

Do you want to leverage AI-supported accounting automation, e.g., to accurately predict cash flow, get intelligent advice on the optimal transaction dates, or spot accounting fraud?

Do you want to leverage blockchain-based accounting automation, e.g., for fully automated and immutable bookkeeping, accountants' workflow tracing, or crypto accounting?

Do you need to integrate your automated accounting software with multiple back-office systems or legacy tools?

Do you operate in a regulated industry (e.g., healthcare, BFSI, public sector, defense) and need advanced financial data security to meet strict legal requirements?

Do you need an accounting solution with various interfaces for different roles in the accounting team (e.g., A/R specialists, financial reporting specialists, auditors)?

Do you plan to evolve the automation solution with new functional and non-functional capabilities in order to adjust it to changing business and legal requirements?

Do you have large teams involved in accounting processes and look to avoid the software fees associated with the per-user subscription model?

Please tell us a bit more about your needs

Answer at least 3 questions to get results.

You can go with off-the-shelf accounting automation software

Looks like market-available solutions are a viable option to meet your accounting automation needs. Turn to ScienceSoft if you need help with choosing the optimal ready-made tools, their implementation, customization, or integration with your existing systems.

You definitely should consider custom development

A tailor-made accounting automation solution will help you reap the unique benefits that market-available software cannot offer. Turn to ScienceSoft to get the detailed assessment of a custom accounting automation system’s feasibility for your business situation.

Custom accounting automation software is your best choice

Looks like market-available accounting tools don’t fit your specific requirements and won’t be able to provide the expected operational and economic feasibility. Turn to ScienceSoft to get a consultation on custom accounting software development and receive free cost and ROI estimates.

Important Integrations for the Accounting Automation System

Automation of accounting relies heavily on the integrations between the accounting software and other corporate systems to eliminate lengthy and error-prone financial data aggregation and faster distribute financial reports. ScienceSoft recommends setting the following integrations:

- CRM - for the automated input of accurate customer data, payment terms, price and quantity of ordered goods when generating invoices.

- Treasury software - for the automated creation of entries on financial transactions across operating, investment, financing activities in the general ledger and subledgers.

- HR management software - for accurate payroll calculation.

- Procurement system - for the automated purchase order recording in the A/P ledger.

- Inventory management software - for accurate recording of inventory values on inventory purchasing and utilization.

- Asset management software - for accurate calculation of the fixed asset depreciation.

- Financial planning and analysis software - for accurate financial performance analysis, financial planning, budgeting, and forecasting.

- Bank accounts - for faster reconciliation.

- BI solution - for facilitated accounting analytics and reporting.

How to Automate Accounting Processes

In ScienceSoft's projects, we typically perform the following key steps to automate accounting:

1.

Elicit requirements for accounting automation

We collaborate closely with your stakeholders and accounting subject matter experts to deeply understand your accounting automation needs. Our consultants compose a detailed list of technical and business requirements for the automation solution, advise on the best-fitting approach to accounting automation, and estimate the expected project cost.

2.

Design and plan the automation solution

With your specific requirements in mind, we design the optimal functionality, high-performing architecture, and pragmatic tech stack for accounting automation software. We care for the solution’s convenient UX and UI to drive high user adoption. Having finalized the software design, we accurately scope the project, prepare a detailed work breakdown structure, assemble the team, and introduce a tailored set of KPIs to control the project health.

Rapid advancements in AI, RPA, blockchain, and open APIs bring automation in accounting to new heights. However, we never push cutting-edge technologies just for the sake of trends. Our primary focus is on the client’s actual needs, and we seek to determine the winning combo of mature and advanced techs that will produce maximum value for the client’s accounting processes.

3.

Implement automated accounting software

We develop your accounting solution from scratch or based on a selected low-code platform. Our experts integrate the software with the required systems and migrate data from your previously used accounting tool or spreadsheets to the new solution.

After performing all necessary quality assurance procedures, we configure the IT infrastructure, implement robust security mechanisms, and set the ready-to-use accounting software live.

We suggest going with platform-based development if your accountants deal with a moderate volume of financial transactions and you don’t have specific requirements for the automation system’s UX and UI. Using low-code platforms helps substantially reduce the costs of creating an automated accounting solution. In ScienceSoft’s accounting automation projects, we rely on Microsoft Power Apps to offer over 70% development cost savings.

4.

Conduct employee training

Accountants are famous for loving their Excel spreadsheets and may resist automation if they are more comfortable with their conservative workflows. To help you overcome employee reluctance to change and drive high accounting software adoption, we devise a tailored adoption strategy (prioritizing automation areas that deliver quick and tangible results), draw exhaustive user documentation, and train your accounting staff to apply automation in their daily tasks.

Accounting Automation Challenges and ScienceSoft’s Effective Solutions

While more than 90% of accountants believe automation improves efficiency and 80% – agree they need to adopt automation to remain competitive, many companies still hesitate to implement accounting software due to a range of operational and security concerns. But having decades-long experience in accounting automation, ScienceSoft knows how to address any potential issues.

ISSUE

FIXED

Inaccurate financial calculations, which may result in severe financial and reputational losses.

We create reliable software with custom logic that ensures 100% accurate calculations and smoothly handles accounting operations of any complexity.

Our solution

ISSUE

FIXED

Sophisticated, hard-to-navigate accounting software interfaces hampering employee experience and restraining adoption.

We create clear, convenient UX and user-friendly UI that ensure intuitive software navigation and a short learning curve.

Our solution

ISSUE

FIXED

Automation system incompatibility with critical back-office systems, high integration costs.

We audit your IT system, design the solution to seamlessly work with modern systems, and build custom integrations to connect to legacy software.

Our solution

ISSUE

FIXED

Insufficient security of accounting software, which may compromise the safety of corporate funds and sensitive financial data.

We power accounting solutions with robust IAM controls, AI-based fraud detection, data encryption, and other powerful security mechanisms.

Our solution

ISSUE

FIXED

Failure to adhere to local GAAP standards, which leads to non-compliant financial reporting and complicates financial audits.

Our compliance experts help achieve accounting solution compliance with all necessary global and region-specific standards.

Our solution

ISSUE

FIXED

Lack of competencies required to maintain accounting automation software in-house.

Our L1–L3 support engineers are ready to care for the seamless performance of your accounting software in the long run.

Our solution

Reliable Techs and Tools We Use to Automate Accounting

Low-code development

AI

Machine learning platforms and services

Machine learning frameworks and libraries

DevOps

Containerization

Automation

CI/CD tools

Monitoring

Blockchain

Smart contract programming languages

Frameworks and networks

Cloud services

Accounting Automation Costs

The cost of implementing accounting automation varies greatly depending on:

- The number and scope of an automation solution’s functional modules and the degree of automation.

- The number and complexity of integrations.

- The volume of data that needs to be migrated from the spreadsheets and/or existing accounting software.

- Performance, availability, security, compliance requirements.

- Your plans for the future (the need to implement new automation features or accomodate changing regulatory standards).

- Sourcing model to automate accounting (all in-house, partial outsourcing, full outsourcing).

Based on ScienceSoft’s experience, a custom accounting automation system of average complexity costs around $200,000–$400,000.

Want to know the cost of your accounting solution?

Accounting Automation Benefits

Annual ROI for a custom automated accounting system may reach up to 290%. Investments in accounting automation typically pay off within 18 months.

Faster workflows

Accounting process automation removes time-consuming and cumbersome manual accountants’ tasks, driving 80%+ faster financial data processing, recordkeeping, A/R collections, financial close, and reporting operations.

Improved productivity

With an automated accounting process, your accountants are free from routine, rule-based processes like journal entries, financial calculations, report generation, GL coding, etc., which enables 1.5–5x higher team productivity.

Cost reduction

Automation is a go-to way to cut accounting-associated expenses, including labor, financial transaction processing, and consumable costs. Document automation (invoice processing, report generation) alone can bring 80–90% cost savings.

Enhanced control

Bookkeeping automation comes with a complete audit trail of accountants’ manipulations across the company’s funds and financial data. It helps establish 100% control of accounting flows and easily spot employee fraud.

Accounting Automation with ScienceSoft

In financial software development since 2007, ScienceSoft helps companies build reliable automated accounting solutions.

Consulting on accounting automation

- Analysis of accounting automation needs.

- Assessment of the existing accounting processes, tools, and their integration points.

- Suggesting optimal accounting automation features, solution architecture, and tech stack.

- Preparing a plan of integrations.

- Implementation cost & time estimates, expected ROI calculation.

Implementation of accounting automation

- Automated accounting solution conceptualization.

- Architecture design.

- Accounting automation system development.

- Integrating the solution with the required software.

- Quality assurance.

- User training.

- Continuous support and evolution (optional).

Accounting Automation FAQ

What is the impact of automation in accounting?

Automated accounting software eliminates low-value manual routines and helps accountants focus on strategic and analytical tasks. It accelerates financial data processing, bookkeeping, and reporting workflows and provides full insight into the company’s cash flows. In addition, it improves the accuracy of accounting operations, preventing the risk of financial mismatches and legal issues.

Can accounting workflows be completely automated?

According to McKinsey & Company, 77% of accounting operations can be fully automated with the existing technologies. Still, the remaining 23% of activities are semi-automatable, which implies the need for human involvement. Even the most sophisticated AI-based accounting systems require human intelligence to review machine output and act upon the derived insights.

How long does it take to develop custom accounting automation software?

Based on ScienceSoft’s experience, building a custom automated accounting system of moderate complexity takes 8–12 months on average. Our team can deliver an MVP of your accounting automation solution in 3–6 months and consistently upgrade it to fully-featured software with major releases every 2–3 weeks.

We currently use an old-fashioned accounting tool. Is it feasible to upgrade it with automation features, or should we implement a new system from scratch?

Accounting software revamp is usually faster and less costly than the adoption of a completely new system. However, if the accumulated tech debt and the share of undocumented legacy code are too large, building a new tool from scratch may be easier. At ScienceSoft, we analyze the feasibility of both approaches and advise on the winning option for your case.

Can my in-house IT team implement accounting automation, or is it cheaper to outsource?

It depends on the automation scope, the maturity of your in-house IT competencies, your readiness to manage the project, and your expectations regarding the project timelines and cost. From ScienceSoft’s experience, full outsourcing offers the most cost-effective and the least technically risky way to digitalize precision- and security-sensitive areas like accounting. We can carry out your automation initiative end to end, provide a dedicated team to co-source particular tasks, or augment your staff with our best financial technology experts.

Partnering with ScienceSoft, how can we be sure the project is going well and we’re getting quality software on time?

We define tailored KPIs to track the project pace and regularly report on the accomplished tasks. Our teams welcome frequent communication and openly discuss the flow with your stakeholders. We also give you direct access to our tracking tools and full project knowledge to ensure complete transparency of our processes and prevent vendor lock-in.

About ScienceSoft

ScienceSoft is a global IT consulting and software development company headquartered in McKinney, Texas. We help businesses establish effective accounting automation. Being ISO 9001 and ISO 27001 certified, we apply a mature quality management system and guarantee that cooperation with us does not pose any risks to our clients’ data security. If you are interested in getting a robust accounting automation solution, feel free to turn to ScienceSoft’s team.