Microinsurance Software

ScienceSoft brings 13 years of experience in insurance software development to deliver high-quality digital solutions that help carriers effectively automate microinsurance operations.

The Essence of Microinsurance Software

Microinsurance software is explicitly designed to streamline short-term, low-cost coverage under the emerging microinsurance model. Such software offers core insurance automation functionality and typically includes customer self-service features for efficient microinsurance delivery.

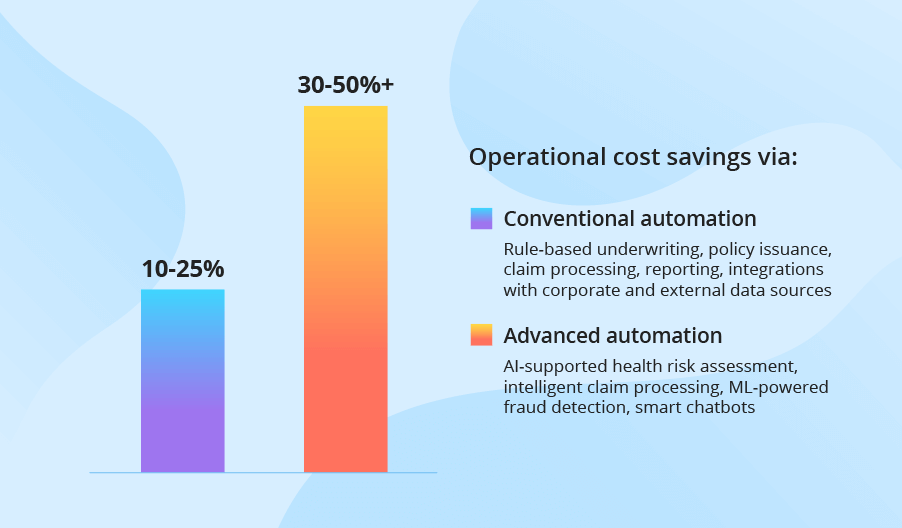

Custom microinsurance software can automate any required microinsurance type and be easily upgraded with new capabilities if your business needs change. Custom solutions often employ artificial intelligence for accurate risk assessment, premium calibration, and claim validation.

When built on blockchain, microinsurance software offers advanced security and full traceability of insurance data and transactions. Relying on region-agnostic cryptocurrency payments makes microinsurance products accessible to customers worldwide.

|

|

|

|

|

Necessary integrations for microinsurance systems:

Implementation time: 9–15+ months for custom microinsurance software. Development costs: $200,000–$800,000+, depending on insurtech solution complexity. Use our free calculator to estimate the cost for your case. Payback period: <12 months. |

|

|

|

Why Develop Custom Microinsurance Software

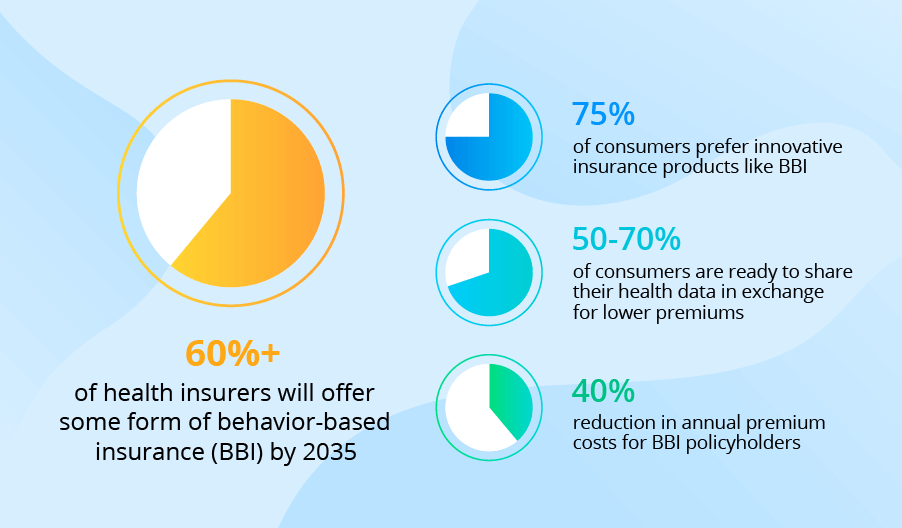

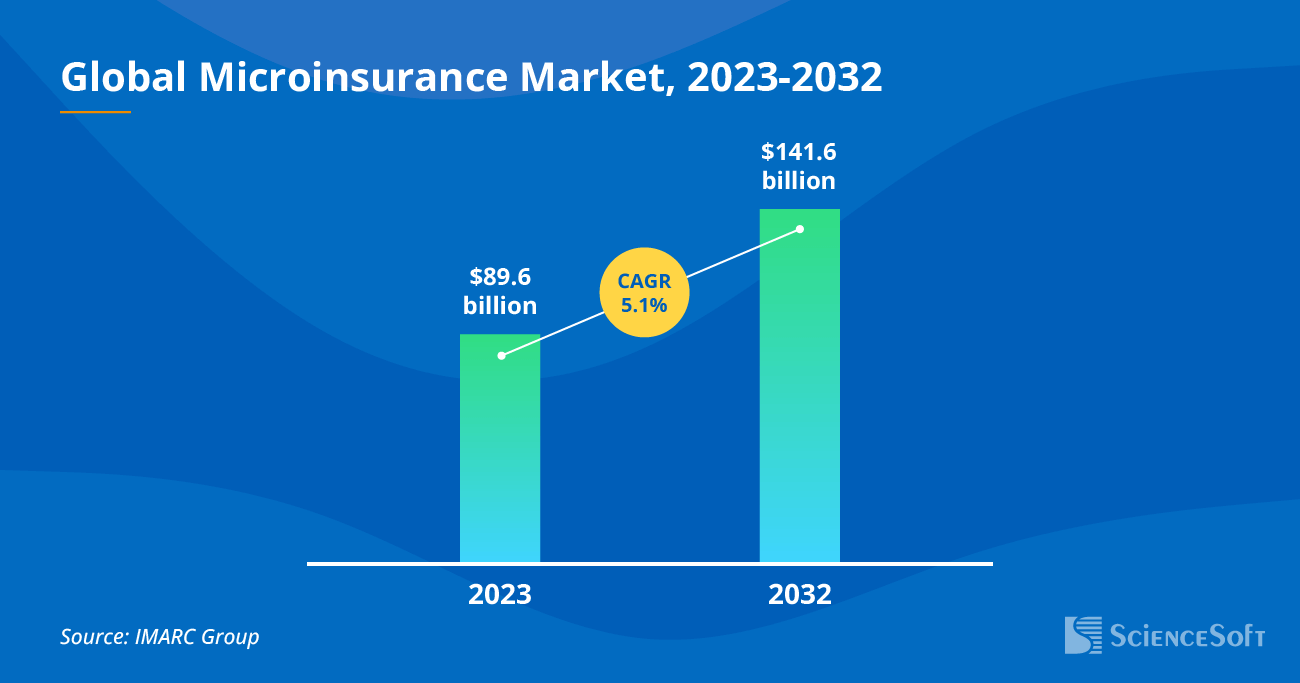

The global microinsurance market is projected to reach $141.6 billion by 2032, witnessing a CAGR of 5.1%. Key factors driving the steady market growth are the insurers’ intent to enhance insurability for low-income segments of the population and introduce affordable short-term coverage against temporary perils.

Insurers are increasingly adopting digital solutions for streamlined microinsurance distribution and management. Insurance firms may choose custom software to automate microinsurance processes and smoothly integrate micro-products into their existing service workflows. For insurtech startups, building direct-to-consumer microinsurance apps, plug-and-play tools for insurers, or embedded solutions (e.g., for add-on insurance in retail, travel, transportation) is a way to tap into the growing market and quickly win clientele.

Microinsurance Types Custom Software Can Automate

ScienceSoft creates flexible and secure microinsurance solutions tailored to each client’s unique scope of coverage options. Here are some examples of microinsurance types that can be digitally enabled by custom software:

Health and personal safety insurance

- Health microinsurance.

- Temporary disability insurance.

- Accidental death insurance.

- Burial insurance.

Property and agriculture insurance

- Household property insurance.

- Car microinsurance.

- Crop and livestock insurance.

Financial security and income insurance

- Lost income insurance.

- Credit and mortgage insurance.

- Involuntary unemployment insurance.

Travel and event insurance

- Travel cancellation insurance.

- Flight delay insurance.

- Coverage for inclement weather.

Embedded product insurance

- Short-term quality insurance (e.g., for cars, electronics, appliances, furniture).

Embedded service insurance

- Short-term liability insurance (e.g., for utility, installation, and repair services).

Key Features of Custom Microinsurance Software

Below, ScienceSoft’s insurance IT consultants present a comprehensive list of features that would lay the foundation for a robust microinsurance system.

Microinsurance product management

- Customizable templates to create and display microinsurance products in the insurance provider’s internal systems and client-facing apps.

- Setting up and updating microinsurance terms:

- Policy coverage and duration thresholds.

- Policy extension terms.

- Insurance product availability in particular locations.

- Criteria for customers to qualify for a particular microinsurance type: age, occupation, income level, proofs of product or service purchase, etc.

- Designing product bundles where microinsurance is paired with other internal or third-party offerings (discounts, loans, health checkups by partnering healthcare providers, etc.).

Advanced:

- AI-powered suggestions on optimal microinsurance terms based on the analysis of product profitability and segment-specific demand.

Microinsurance application processing

- Automated aggregation and processing of microinsurance applications from customer self-service apps, email, agent CRM, third-party platforms, etc.

- Rule-based customer pre-qualification against the preset requirements.

- Automated application approval for eligible customers.

- (For embedded insurance) Straight-through issuance of standard policies triggered by a customer’s request or the company’s default sales terms.

Advanced:

- OCR-enabled conversion of paper applications to the required digital format (CSV, PDF, TXT, etc.).

- Machine-learning-supported customer data cross-checking with the data from third-party sources (e.g., credit rating bureaus, medical information bureaus, SSA registries) to prove its validity.

- Rule-based customer risk assessment based on:

- Customer age, health state, and family medical history.

- Customer lifestyle (occupational hazards, high-risk hobbies).

- Customer driving record.

- The as-is state and value of the insured asset.

- Location-specific risks: weather, climate, natural disaster risks.

- Customer past claims history.

- Individual risk scoring based on custom formulas.

- Customer segmentation based on the risk score.

Advanced:

- AI-powered prediction of customer-specific risks and impact severity.

Microinsurance pricing

- Automated calculation of individual insurance premiums based on a client’s risk profile and preset coverage terms.

- (For pay-per-mile auto insurance) Rule-based calculation of due premiums under a usage-based pricing model.

Advanced:

- AI-powered suggestions on the optimal basic premiums for various customer segments, microinsurance types (for insurers), and product/service types (for embedded insurance) based on segment-specific demand, competitor prices, and the company’s profitability requirements.

- Dynamic insurance repricing based on the current policyholder location and behavior and the as-is state of the insured asset (enabled via integration with third-party risk data platforms and insureds’ tracking devices).

- Template-based invoice generation, applying personalized coverage terms and premium amounts.

- Automated recurring billing for installment payments.

- Generating payment links and QR codes and sending them to customers.

- Support for multiple payment methods, including bank transfers, cards, digital wallets, direct carrier billing, biometric payments, SMS and USSD payments.

- Real-time invoice tracking by status: sent, paid, due, etc.

- Scheduled dunning notifications to customers in case of non-payment.

Advanced:

- Multi-language and multi-currency (including cryptocurrency) invoices.

Policy management

- Template-based generation of simple, easy-to-read microinsurance policies tailored to the insurance type, risks covered, language, and location.

- Automated policy updating with the new customer data and changed coverage terms.

- Rule-based policy renewal and termination.

- Centralized storage of microinsurance policies and invoices.

- Role-based permissions to create, edit, and share policies.

Advanced:

- Policy signing using an e-signature.

- Policy term formalization in the blockchain smart contracts for fully traceable policy updates and straight-through claim payouts.

Claim adjudication

- Automated processing of microinsurance claims and claim-supporting documents like medical reports, accident reports, photos of injuries and damaged property, travel documents, and testimonies of witnesses.

- Rule-based claim approval or rejection.

- Rule-based submission of damage inspection requests to internal and third-party inspectors (loss adjusters, servicing specialists, product quality control teams, etc.).

Advanced:

- AI-powered claim validation against the policy terms and claim-related data from third-party sources (e.g., healthcare provider systems, GIS and telematics platforms, social networks).

- Detection of fraudulent claims and fraud reporting to responsible employees using large language models (LLMs).

- Remote damage evaluation in rural areas using AI, IoT, and computer vision technologies.

Claim settlement

- Claim prioritization based on claim date, loss amount, damage severity, etc.

- Automatically calculating due claim payment amounts.

- Automated payments (full, partial, split, recurring) of valid claims.

For parametric microinsurance:

- AI-powered forecasting of predefined risk events based on the analysis of real-time weather, climate, geospatial, flight, traffic, financial, and other risk-relevant data.

- Automated claim payouts, triggered by predefined events (e.g., an earthquake in a customer’s location reaches a certain magnitude or flight delay time reaches a certain limit).

- Automated calculation and tracking of microinsurance sales, underwriting, claim resolution, profitability, and other metrics.

- Customizable dashboards for various microinsurance roles: actuaries, policy admins, claim specialists, analysts, etc.

- Template-based creation of microinsurance reports for senior management and regulators (FIO, NAIC, NICB, etc.).

Advanced:

- AI-powered predictive analytics to forecast microinsurance demand, premiums written, and claim costs (by period, customer, region, etc.).

Customer self-service options

- Self-onboarding, managing personal information via a web or mobile app.

- Calculating microinsurance prices using an online calculator.

- Template-based creation of microinsurance applications.

- Paying premiums by a preferred payment method.

- Filing online claims, attaching claim evidence documents.

- Tracing policies and microinsurance transactions.

Advanced:

- Multi-factor authentication, including biometric authentication.

- AI-powered chatbots to help customers solve operational issues and find answers to common questions.

- Instant messaging with insurer reps.