Investment Management Software

Features, development steps, and costs

ScienceSoft’s clients get custom investment management solutions that address the functional, integration, and compliance constraints of ready-made software. We focus on software logic accuracy from day one, always factor in regulatory rules when designing investment software, and apply flexible modular architectures to create interoperable software that stays relevant for 10+ years.

Investment Management Software: Key Aspects

Investment management software is used as a centralized platform for managing investor relationships, multi-asset portfolios, and multi-brokerage investment activities. Such software automates processes like investment research, portfolio construction, trade execution, risk control, and reporting.

Custom investment management software is a preferred choice for companies that want to orchestrate and automate multi-step workflows across proprietary capital formation, investment operations, and hedging. Custom solutions can be built to support a broad range of asset classes, including alternative investment vehicles like real estate, private equity, derivatives, and crypto tokens.

Investment firms often opt for custom software to leverage tailored analytical and automation features powered by artificial intelligence (AI). Custom systems can accommodate investment AI models trained on the company’s proprietary data. Such AI-powered software delivers accurate insights aligned with the firm’s investment strategy and, at the same time, provides investment managers with greater control over the security and transparency of intelligent operations.

Another advantage of custom investment management software is that it can be integrated with any required systems, including legacy software and innovative fintech tools. Custom solutions can also be designed in compliance with any necessary investment regulations, including local frameworks (e.g., SEC for the US, CMA for the KSA) and domain-specific rules (e.g., AIFMD directive for the EU alternative funds). Plus, such software can be freely upgraded with new capabilities when the company needs or regulatory rules change.

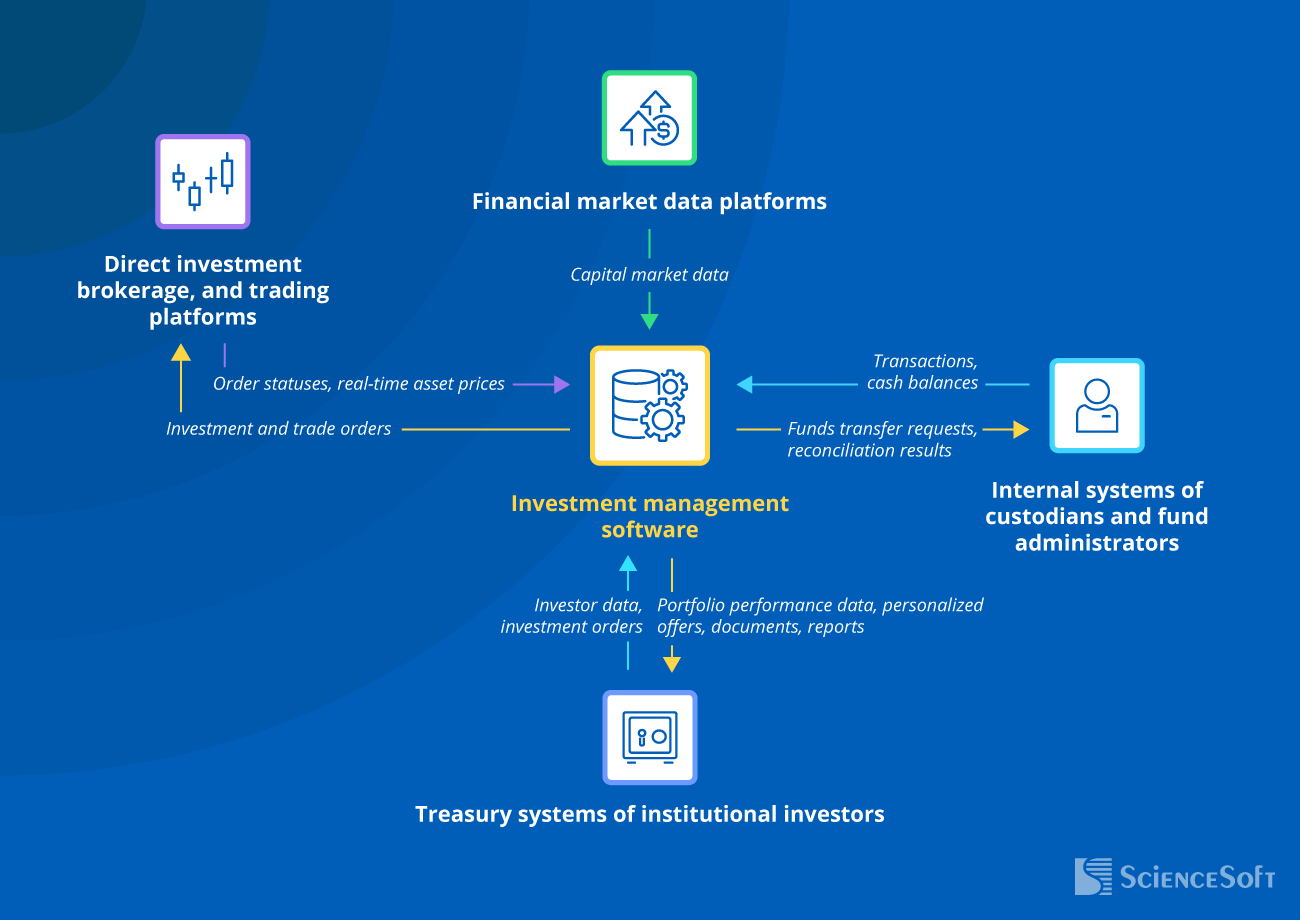

- Key integrations: investment, brokerage, and trading platforms, financial market data platforms, custodians’ systems, and more.

- Implementation time: core modules — 9–15 months on average; a full-featured solution — up to 18–24 months.

- Development costs: $150,000–$2,000,000+, depending on solution complexity. Use our free calculator to estimate the cost for your case.

ROI for Automated Investment Management Solutions

According to Deloitte & ThoughtLab, 50% of investment management firms are getting a high ROI from automating their service processes. Financial planning, risk management, portfolio accounting, and investor reporting are cited as the areas of the highest return.

Traditional and alternative investment managers report the following company-wide gains with the investment software that automates such tasks:

Niche Investment Management Firms That Benefit From Custom Software

Key Features of an Investment Management System

Below, ScienceSoft’s consultants share a list of features that serve as a basis for a robust investment management solution. Our team can engineer an all-in-one system from scratch or develop separate, functional components to upgrade the software you currently use.

Important Integrations for Investment Management Software

- For streamlined investor account management

- For faster order placement and execution.

- To track order execution progress and analyze investment outcomes.

- To instantly capture market signals and capitalize on short-term opportunities.

Financial market data platforms

E.g., Bloomberg, Morningstar, FactSet

To access capital market data required for investment research, fundamental and technical analysis, portfolio valuation, and risk prediction.

NB: Investment management software can also be integrated with asset-specific databases relevant to the firm’s investment profile, e.g., sector-specific business databases for private equity firms and real estate databases for REITs.

Internal systems of custodians and fund administrators

- To speed up the replenishment of funds across brokerage accounts.

- For streamlined reconciliation of IBOR records against custodians’ records.

- For quicker aggregation of investor data and investment orders.

- To instantly share investment performance details, personalized offers, documents, and reports with investors.

Steps to Create Robust Investment Management Software

Below, ScienceSoft’s development team shares a high-level plan and best practices for creating reliable investment management software with an optimized TCO.

1.

Engineering software requirements

Investment IT consultants analyze the investment firm’s servicing processes and business needs and elicit requirements for the new investment management software. Based on the collected information, consultants compose a software requirements specification.

- Consider interviewing target business users of the solution (portfolio managers, account managers, investment analysts, etc.) alongside the firm’s project stakeholders. This step helps better grasp the employees’ daily operational needs and reveal non-apparent bottlenecks that may require specialized software features for improved workflow efficiency. For example, applying this approach in ScienceSoft’s investment management software project for a family office helped our consultants uncover the team’s persisting troubles with data reconciliation. As a result, we prioritized implementing auto-reconciliation functionality in the MVP, so that the client can reap productivity gains as soon as the solution is set live.

- By defining compliance requirements for the investment management solution at this early stage, you ensure compliant software design from the outset. Compliance consultants at ScienceSoft analyze and map both the relevant data protection standards (e.g., GLBA, NYDFS, GDPR, SOC 2) and domain-specific operational regulations (SEC, FINRA, SOX, CMA, MiFID II, etc.).

- With detailed documentation, it’s easier for consultants to communicate their assumptions to the investment firm’s stakeholders and keep the development teams aligned on the project’s goals and constraints. If you are looking to implement systemic documentation processes to drive transparent and consistent teamwork across the SDLC, explore how ScienceSoft approaches documentation.

2.

Technical and UX/UI design

This stage covers processes like business logic design, architectural design, UX and UI design, and tech stack selection for the investment management system.

- All-in-one investment management software offers vast opportunities for business logic reuse. For example, the same risk assessment models can be utilized in portfolio analytics and compliance checks, balance formulas can be applied for both institutional and retail accounts with minimal modification, and back-office investment ordering logic can be abstracted and reused in the investor portal dashboards. Reusing logic components where possible is how ScienceSoft builds up investment software accuracy, reduces development efforts, and minimizes risks to logic integrity in future evolution activities.

- Most investment management systems would benefit from modular architectures (SOA, microservices, modular monolith) that support logic decoupling and reuse and enable independent component development, scaling, and upgrading. For investment firms that face heavy regulatory scrutiny, like broker-dealers and hedge funds, architects at ScienceSoft suggest choosing a modular monolith architecture for streamlined data management processes. For software covering trading features, a monolith architecture that offers minimized latency and the quickest data exchange would still work best. A win-win option here would be to apply a hybrid architecture, where a trading module is built into a monolith and the rest of the system is designed using flexible, modular patterns. Check how ScienceSoft’s architects select the best approach for each particular case.

- Investment software tech stack is one of the primary points for cost optimization. By using low-code platforms (e.g., Microsoft Power Apps), ready-made logic building blocks (e.g., QuantLib formulas, Spark’s ML components), OOTB UI components (e.g., TradingView’s pre-built charts), and reusable deployment scripts, you can cut the share of costly custom coding and speed up development.

Just like functional needs, requirements for the UX and UI of investment management software vary significantly among various user groups. For example, investor relationship managers value clean aggregated views with slice and dice capabilities, portfolio managers benefit from comprehensive dashboards with rich data visualization options, and investment accountants prefer minimalistic, spreadsheet-like screens. Tailoring user journeys, navigation, layouts, and data density for each investment team role is critical to fostering operational efficiency and accuracy at scale. At ScienceSoft, we apply adaptable layouts (customizable widgets and dashboards, context-aware interfaces, configurable modal windows, etc.) to accommodate different user needs within a single platform without inflating design efforts.

3.

Project management

Project managers map the scope of project tasks, define the resources needed to deliver investment management software, and estimate project timelines and budget.

- Engineering a fully-featured investment management system is a lengthy and demanding project that deals with a large degree of uncertainty. Applying Agile project management methodologies will let you speed up development, flexibly scale the teams when needed, and quickly adapt to changing requirements. 90%+ of ScienceSoft’s investment software projects were led under Agile frameworks and were delivered within the original time and budget agreements.

- A pragmatic risk mitigation plan is a must to prevent project disruptions and investment management software depreciation during development. PMs at ScienceSoft proactively plan responses to both known and potential risks, including regulatory changes that affect digital investment operations and shifting investor preferences, which may entail changes in functional and UX/UI design.

- Mapping structured policies for change request processing and scope extension before development will safeguard you against scope creep and inflation of delivery timelines. In one of our recent projects, an investment regulator failed to organize these processes properly, which led to uncontrollable scope creep. Discover what scoping and change management practices ScienceSoft’s PM consultants applied to get that problematic project back on track.

4.

Development and testing

At this stage, developers code the back end of investment management software (including specialized components like ML models for portfolio performance forecasting), create user interfaces, and set up scalable data storage.

- Implementing DevOps (CI/CD, container orchestration, etc.) helps speed up development, testing, integration, and deployment operations. It also eliminates manual errors and minimizes regression risks in production releases. For intelligent investment management solutions, engineers at ScienceSoft additionally employ AI-specific DevOps tools (MLOps or LLMOps, depending on the models in question) to ensure consistent delivery automation.

- By running QA activities in parallel with coding, you can detect potential issues quicker and avoid their costly resolution at later stages. At ScienceSoft, we tailor our approach to QA based on each project's needs while aiming for the same high unit test coverage threshold (95%+) for every investment solution. If you’d like to learn about the QA tactics we apply to inherently complex solutions, such as investment management software, you can visit our dedicated page.

- Well-organized collaboration between the project stakeholders prevents misaligned deliverables, drifting task priorities, and delays. In ScienceSoft’s experience, a formalized approach with clearly defined communication aspects, owners, formats, and schedules always brings substantial value in investment software projects involving large cross-functional teams. For instance, this was the case in our stock investment management software project, which involved 20 data scientists from ScienceSoft alone. In our projects, we typically apply our own set of best practices for efficient and transparent collaboration.

5.

Integration and data migration

This is the stage where back-end engineers integrate the investment management solution with the necessary corporate and third-party systems. During this stage, you may also need to migrate investment data from your existing system to the new software.

- Most custodian, brokerage, and trading venues offer ready-to-use APIs so that you can quickly integrate your investment management system with their platforms. Integrating with legacy corporate software (e.g., if you plan to retain existing accounting or compliance tools) may require custom connectors. In both scenarios, integration testing is key for ensuring smooth and secure data flows between the connected systems.

- Migrating investment data in small fractions and outside working hours will let you quickly roll back the changes if something goes wrong without affecting investment teams’ workflows. At ScienceSoft, data engineers establish automated migration pipelines with testing checkpoints across data extraction, transformation, and transfer stages. This prevents manual migration errors and helps validate the integrity, accuracy, and completeness of investment data during transition.

6.

Deployment

Development teams configure investment management software infrastructure, finalize the necessary testing activities, and deploy the solution to production.

- Regulatory mandates evolve rapidly, especially in the field of innovative investment technologies like AI and blockchain. Running a pre-launch compliance audit will let you double-check software compliance with the latest sectoral regulations.

- User acceptance testing (UAT) is critical for making sure that investment teams will have a smooth experience with the new solution. It allows the development team to fix any previously unnoticed usability issues before the software goes live. You can further deploy the solution for a pilot run across a limited number of users to make sure it performs well in live settings. Check how ScienceSoft applied this in a recent bond investment management software project.

- Configuring robust network protection tools (SIEM, IDS/IDP, firewalls, intelligent UEBA, etc.) is another key step you need to complete at this stage. It is necessary for securing your investment management system and its underlying infrastructure against cyber threats.

- Once your investment management software goes live, you need to organize its support and maintenance. Check out ScienceSoft’s dedicated page for ways to establish efficient L1–L4 support operations both for outsourced and in-house scenarios.

Tech Stack for an Investment Management Platform

Low-code development

AI

Machine learning platforms and services

Machine learning frameworks and libraries

DevOps

Containerization

Automation

CI/CD tools

Monitoring

Blockchain

Smart contract programming languages

Frameworks and networks

Cloud services

Costs of Investment Management Solutions

Developing custom investment management software may cost from $150,000 to $2,000,000+, depending on the solution’s functional scope, the number and complexity of integrations, as well as performance, scalability, security, and compliance requirements.

Here are ScienceSoft’s sample cost ranges:

$150,000–$400,000

Basic investment management software built on a low-code platform like Microsoft Power Apps. It offers RPA-supported automation and statistical analytics across key investment operations (portfolio management, accounting, reporting) and traditional asset classes (stocks, bonds).

$400,000–$800,000

A custom solution that automates the whole spectrum of investment management operations for a particular domain (e.g., stock, private equity, or real estate investing). It features intelligent data processing capabilities, rule-based automation for multi-step workflows, and ML-powered predictive analytics.

$800,000–$2,000,000+

A large-scale custom system that handles complex investment management, deal management, and trading operations for both traditional and alternative assets. It offers AI-supported automation, optimization, and analytics features, including innovative capabilities powered by GenAI and LLMs.

Learn the Cost of Your Investment Solution

All you need is to answer a few questions about your business requirements. This will help our experts better understand your needs and deliver a tailored estimate much faster.

Thank you for your request!

We will analyze your case and get back to you within a business day to share a ballpark estimate.

In the meantime, would you like to learn more about ScienceSoft?

- Project success no matter what: learn how we make good on our mission.

- Since 2005 in investment IT services: check what we do.

- 4,200+ successful projects: explore our portfolio.

- 1,400+ incredible clients: read what they say.

Why Build Investment Management Software With ScienceSoft

- Since 2007 in engineering custom solutions for the investment industry.

- Investment IT and compliance consultants with 5–20 years of experience.

- 45+ certified project managers (PMP, PSM I, PSPO I, ICP-APM) with experience in large-scale projects for Fortune 500 companies.

- Principal architects with hands-on experience in designing complex investment solutions and driving secure implementation of advanced techs.

- 350+ software engineers, 50% of whom are seniors or leads.

- Quality-first approach based on an ISO 9001-certified quality management system.

- Robust security management supported by ISO 27001 certification.

- ScienceSoft served an asset manager with $5+ trillion in AUM — one of only three firms operating at that scale.