Performance Attribution Analysis Software

Features, development steps, and costs

ScienceSoft’s clients get custom performance attribution solutions that address the common pain points of ready-made tools, such as generic models, limited asset coverage, predefined integrations, and rigid feature scope. We focus on analytics accuracy from day one, bake compliance controls into solution design, and apply API-first modular architectures to deliver interoperable software that scales with your business.

Performance Attribution Analysis Software in a Nutshell

Performance attribution analysis software is used to identify granular drivers for investment portfolio performance and assess their impact on returns. Such software automates composite construction, performance data aggregation, benchmarking, multi-level attribution measurement, and reporting.

Custom performance attribution software is a preferred choice for investment firms that want to automate multi-step workflows across their proprietary attribution analysis practices. Custom solutions can be built to support any required asset classes (equity, funds, derivatives, etc.), benchmarks (market indices, bespoke setups), and attribution analysis models, including multi-level Brinson, factor-based, fixed income, and tailored risk and ESG attribution models.

Investment firms often prioritize custom attribution analysis software to integrate performance and benchmark data from internal and third-party sources. Custom solutions can be connected to any required systems, including legacy software, and provide tailored data processing logic with embedded analytics for reference data validation, lineage tracking, and outlier detection.

Another strength of custom software is the ability to leverage artificial intelligence (AI) features without the privacy and accuracy tradeoffs of ready-made tools. Custom systems can accommodate attribution AI models trained on the company’s proprietary data. Such AI-powered software delivers accurate attribution insights aligned with the firm’s unique strategy while offering greater control over the security and transparency of intelligent operations.

Moreover, custom solutions can be natively designed in compliance with any necessary investment regulations (e.g., SEC, FINRA, MiFID, CMA) and attribution reporting standards (GIPS, PRIIP, GRESB for ESG attributions, etc.). When your needs or regulatory frameworks change, such software can be quickly extended with new features, interfaces, and controls.

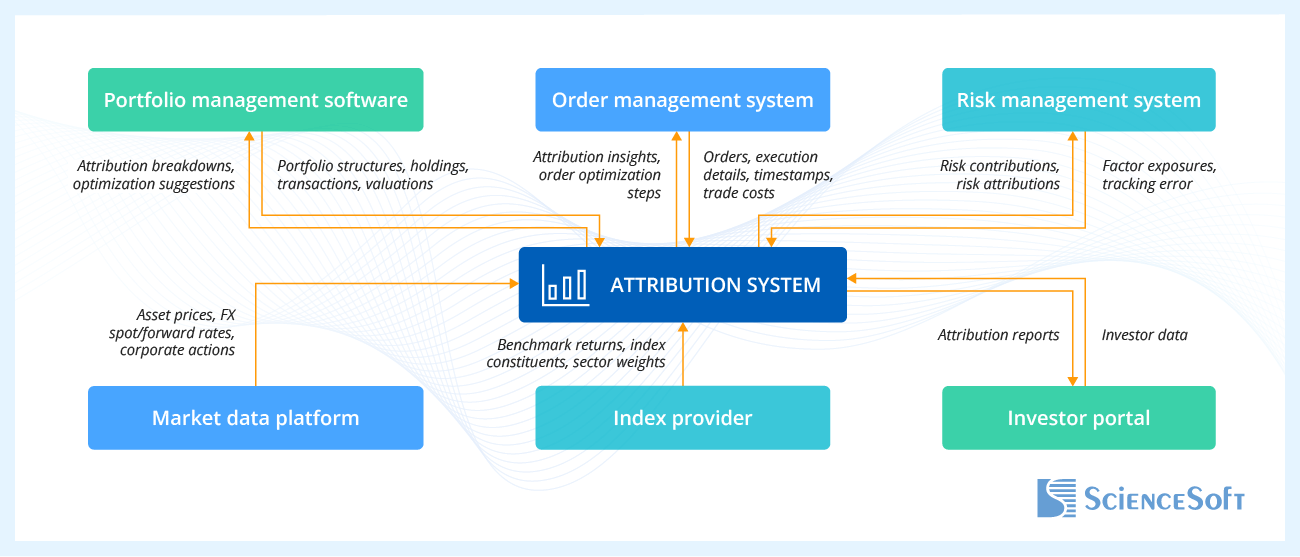

- Key integrations: portfolio management software, an order management system, financial data platforms, an investor portal, and more.

- Implementation time: around 9–15 months (core modules).

- Development costs: $150,000–$700,000+, depending on solution complexity. Use our free calculator to estimate the cost for your case.

Companies That Benefit From Performance Attribution Software

ROI of Tailored Solutions for Investment Attribution Analysis

A recent study by S&P Global found that nearly 50% of investment managers struggle to get the look-through granularity and adequate explanations for return sources with their legacy performance attribution tools. Moreover, 33%+ of companies cite extensive manual routines as their biggest hurdle for effective attribution analysis.

A custom attribution software that embraces rule-based and AI-powered automation can effectively address these pain points and bring the following measurable benefits:

Up to 10x growth

in attribution analysts’ capacity

90%+ quicker

preparation of reference data

40–50% faster

creation of attribution reports

More accurate

identification of return drivers

Sources: Datagrid, Finantrix, FactSet, S&P Global.

Granular, timely attribution reporting is a proven driver for investor trust and a servicing bottom line. While the exact uplift varies by case, my clients say that adopting comprehensive attribution reporting tools helped them confidently justify the value of active management, boost investor retention, and increase lifetime investor value. Seasoned firms that have weathered multiple market crises also note that better attribution software reduced churn during downturns, as it enabled investment managers to clearly show the rationale behind drifting results.

Functionality of Investment Performance Attribution Software

Below, ScienceSoft’s consultants list the core and intelligent features that lay the foundation for robust performance attribution software for the investment industry:

Core features

AI-supported features

Important Integrations for Performance Attribution Systems

- To align composite design and portfolio attribution analysis with preset portfolio structures.

- To quickly access performance data required for attribution estimates.

- To feed attribution insights into portfolio optimization decisions.

NB: If you manage valuations and IBOR/ABOR in a dedicated accounting system, you’ll require integration with that software as well.

- To factor trade timing, costs, and venue choices when assessing transaction-level asset allocation attribution.

- To share analytical results and optimization suggestions for higher-return investment ordering.

Risk management system

- To swiftly aggregate data on live factor exposures.

- To fuel risk models with up-to-date attribution insights and support proactive risk mitigation strategies.

Financial market data sources

E.g., Bloomberg, Refinitiv, ICE platforms

- For consistent asset pricing and FX rates across investment return calculations.

- To consider market behavior in attribution analytics.

- To estimate currency contributions for multi-currency portfolios.

Benchmark data sources

E.g., MSCI, FTSE Russell, S&P, Dow Jones databases

- To attribute returns and analyze allocation and selection effects against up-to-date benchmark data.

- For streamlined composition of tailored benchmark blends.

- To auto-populate personalized attribution reports with investor data.

- For quicker delivery of attribution reports to investors.

- To provide dynamic attribution reporting via in-portal dashboards.

NB: If you don’t offer a portal, consider integrating the solution with your CRM.

Steps to Develop Software for Performance Attribution Analysis

Below, ScienceSoft’s Project Management Office shares a roadmap and best practices for implementing custom attribution software within predictable timelines and budget limits.

1. Software requirements engineering

Investment software consultants interview an investment company’s project stakeholders to elicit requirements for the capabilities of the new performance attribution solution. They analyze the firm’s current performance and attribution analysis workflows to discover pain points and opportunities for improvement. This often involves auditing the company’s analytical toolkit and data models. Consultants at ScienceSoft additionally interview target business users of the solution (portfolio managers, investment analysts, etc.) to grasp users’ real operational hurdles and needs and define high-value features.

At this stage, it’s also essential to map out compliance requirements for the performance attribution solution. Compliance consultants surface relevant data protection standards (e.g., GLBA, NYDFS, GDPR) and operational regulations (e.g., SEC, GIPS, FINRA, MiFID II) to ensure compliant software design from the outset.

Based on the collected information, consultants compose a detailed software requirements specification (SRS). The SRS comprises all functional requirements (automated attribution workflows, configuration options, etc.), data requirements (e.g., reference data sources, frequency of updates), and non-functional needs like data traceability and user access controls.

|

|

A well-documented SRS creates a clear vision of the attribution software for project participants and ensures everyone is on the same page about the project’s goals. Here’s how ScienceSoft approaches documenting important project decisions to prevent misaligned visions and moves. |

2. Data architecting

Data architects design how data will flow through and reside within the performance attribution system. This includes defining how the software will collect raw input data (e.g., transactions, asset prices, benchmark indices) from internal systems and third-party sources, how it will cleanse, validate, and enrich that data, and where the analytics-ready data and analytical results will be stored. ScienceSoft opts for tailored storage spaces for various data types (e.g., a data warehouse for pre-processed data, a time-series database for time-stamped attribution outputs) to reduce storage costs and enhance data retrieval speed. Establishing data lineage pipelines ensures each data point across the system can be tracked back to its origin.

Security must be baked into the data architecture by design to protect sensitive investment and client data. At ScienceSoft, this stage includes planning data encryption (for data at rest and in transit), user authentication, role-based access control, and network safeguards.

|

|

Methods for integrating data that powers attribution analysis can vary depending on the data type and source. Our data architects prepared an overview of best practices for selecting the optimal data integration strategies for faster, cheaper, and more accurate analytics. |

3. Analytical model design

Data scientists design the analytical algorithms that will perform performance attribution calculations. Using pre-built attribution models and formulas where possible helps ensure the analysis is grounded in recognized methodology and accelerates logic design.

Yet ScienceSoft’s experience shows that out-of-the-box components alone rarely fully meet attribution analysis needs, especially in factor-based attributions where return drivers vary among investment firms. In this scenario, we construct custom models with bespoke attribution logic and configurable input and output parameters. Our data scientists configure calculation frequency (intraday, daily, multi-period, etc.) and optimize the algorithms for smooth performance across potentially large portfolio and benchmark datasets.

If you want AI-supported insights, this stage also covers designing machine and deep learning models for performance attribution analysis. Addressing the need for transparent model logic, data scientists at ScienceSoft create explainable AI algorithms that provide clear, traceable reasoning behind their analytical outputs.

|

|

Feedback from investment SMEs can reassure data scientists that the attribution analysis results make business sense. For example, portfolio analysts can review model assumptions and confirm their alignment with industry conventions, or check sample intelligent outputs and challenge logic clarity. Involving domain SMEs in logic validation is how ScienceSoft ensures the accuracy of complex financial solutions such as investment attribution analysis software. |

4. Technical design

During this stage, solution architects design the overall architecture of the performance attribution software, including its integrations with the required systems. ScienceSoft’s architects often recommend layered modular designs for investment analytics solutions. With such architectures, solution components (data import, analytics engine, reporting UI, etc.) can be built, deployed, and upgraded independently. For example, in a microservices design, a benchmarking engine might be containerized so it can be scaled horizontally if computation needs spike, and a reporting module might be built as a plugin that can be swapped out for a more advanced one later. By supporting easy software scaling and evolution, modular architectures help extend the useful life of attribution analysis solutions.

The interactions between solution components and with external systems are defined through reusable APIs and messaging workflows. Since investment attribution software requires connectivity to multiple data sources, it makes sense to opt for an API-first design, where integrations are planned before any other software parts. Such an approach promotes solution interoperability and optimizes integration efforts.

The tech stack is chosen to fit specific non-functional (performance, scalability, latency, security) requirements for the attribution solution. Architects at ScienceSoft also consider the specifics of the client’s IT ecosystem. For example, if the investment firm’s IT environment is primarily Microsoft-centric, we favor .NET techs and Azure cloud services that would ensure less integration complexity and lower licensing costs. Check how applying this approach helped us cut the TCO of the analytics system for a US hospitality investor.

|

|

Using out-of-the-box logic building blocks, third-party cloud services, pre-built APIs, and OOTB deployment scripts where possible can minimize the share of costly custom code and speed up attribution software engineering. Discover ScienceSoft’s dedicated page for more details on this and other proven practices to optimize development cost. |

5. UX and UI design

UX and UI designers map out user journeys and create interfaces tailored to the needs of specific user roles. Prioritizing straightforward navigation and clean layouts ensures users can quickly switch between data views, dashboards, and report sections. In practice, this means applying configurable modal windows and context-aware widgets, providing toggles and drill-downs, and using visual cues like color coding and contextual tooltips. Most of these components can be reused from all-purpose UI libraries like Microsoft Power BI. As for specific cases like visualizing performance metrics and attribution waterfalls, ScienceSoft’s UX/UI designers usually customize ready components from specialized libraries like Highcharts and Syncfusion to minimize design overhead.

Our designers also involve actual users in the design process through usability testing with clickable prototypes. By getting early user feedback, the team can discover if proposed data hierarchies, navigation flows, and layouts align with user expectations and work habits and can further refine them for higher convenience.

|

|

By the end of the UX/UI design phase, project managers have enough insights to scope software engineering tasks, compose the team, and precisely estimate development time and cost. Explore ScienceSoft’s knowledge base on PM best practices to learn how to organize project management properly and drive consistent and predictable delivery. |

6. Development and quality assurance

Developers code the back end of the performance attribution system (including analytics engines, data integration pipelines, APIs, and connectors), create user interfaces, and set up tiered storage for reference and analytical data. Following secure coding standards like OWASP ASVS helps minimize bugs and reduce vulnerability risks.

The development process is usually iterative, with every iteration covering the testing (functional, security, usability, etc.) of the newly built attribution features. To support this iterative, test-driven approach and leverage test automation, it’s important to adopt DevOps practices. Development automation ensures frequent, reliable releases and contributes to higher software quality since issues are caught early. At the same time, DevOps engineers at ScienceSoft always look at the economic side: if certain rare tasks are costly to automate, we opt to handle them manually to optimize development budget.

During this stage, the team also integrates the attribution analysis solution with the required systems. Rigorous integration testing is a must to confirm that investment data retains its accuracy and integrity when moving between systems. ScienceSoft’s engineers validate each integration for specific issues like missing and mismapped data, API rate limits, and failed encryption on data transfers so that no silent failures are undermining the analytics.

|

|

Iterative development methodologies let you adapt to changing requirements midway without costly rebuilds, but you need robust change control mechanisms to protect against scope and schedule creep. Check how ScienceSoft approaches change request processing to agilely implement feasible adjustments while preventing project time and cost inflation. |

7. Deployment and support

Engineers configure performance attribution software infrastructure, set up application performance monitoring, event logging, and security monitoring tools, and deploy the ready-to-use solution in production. ScienceSoft technical teams usually conduct a pre-launch compliance audit to confirm that all access controls, technical safeguards, and data management policies are implemented correctly.

Running user acceptance testing (UAT) before go-live helps verify that the attribution software works as intended in a real context. At ScienceSoft, we focus on test cases that reflect regular user workflows (e.g., loading a new set of portfolio data, generating a monthly attribution report) and include edge cases (e.g., handling a portfolio with no history, entering atypical attribution factors) to ensure the system behaves reliably in non-standard, error-prone scenarios.

Once your attribution analysis solution is launched, you need to set up its maintenance and support to ensure smooth software functioning and quick resolution of user issues. Explore ScienceSoft’s dedicated guide to learn the key steps, necessary skills, and sourcing options for organizing smooth support and maintenance processes.

|

|

Loss of project knowledge drastically complicates software maintenance and evolution, so it’s critical that your development vendor shares all critical technical information with the support team before leaving the project. To help you understand what’s to expect from the vendor during handover, here are some knowledge transfer best practices that our teams follow. |

Costs of Investment Performance Attribution Solutions

Developing custom software for investment performance attribution may cost from $150,000 to $700,000+, depending on the solution’s functional scope, the number and complexity of integrations, as well as performance, scalability, security, and compliance requirements.

Here are ScienceSoft’s sample cost ranges:

$150,000–$250,000

Basic attribution analytics software that:

- Estimates historical performance attribution across one asset class, e.g., funds or equity.

- Supports standard-only attribution measurement models.

- Integrates with 1–2 key data sources.

- Offers batch data processing (e.g., every 12 hours).

- Features pre-built customizable attribution report templates.

$250,000–$400,000

A custom attribution analysis solution that:

- Calculates performance and attribution across 2–7 asset classes.

- Integrates with 3–5 corporate and external systems.

- Enables batch and real-time data processing.

- Enables attribution analytics using tailored statistical and non-neural-network ML models.

- Provides a no-code template builder to create custom attribution report forms from scratch.

$400,000–$700,000+

A large-scale analytics system that:

- Supports 7+ asset classes and multi-asset composites.

- Covers the entire scope of performance attribution metrics, as well as risk and ESG attributions.

- Integrates with multiple back-office and third-party systems, including blockchain solutions.

- Features real-time analytics for instant attribution calculation.

- Offers intelligent attribution analysis using deep learning models.

- Provides interactive data visualizations and automated generation of complex reports.

Wondering how much your project will cost?

Use our online calculator to share your needs, and we'll get back to you shortly with an estimate. It’s free and non-binding.

Why Build Performance Attribution Software With ScienceSoft

-

Since 2007 in engineering custom solutions for the investment industry.

- Since 1989 in data analytics and AI to deliver intelligent software for financial performance measurement and attribution.

- Investment IT and compliance (SEC, FINRA, GLBA, GDPR, SOC 2, etc.) consultants with 5–20 years of experience.

- 45+ certified project managers (PMP, PSM I, PSPO I, ICP-APM) with experience in large-scale projects for Fortune 500 companies.

- Principal architects with hands-on experience in designing complex investment analytics solutions and driving secure implementation of advanced techs.

- 550+ software engineers, 50% of whom are seniors or leads.

- ScienceSoft served one of the world's top 3 asset managers with $5T+ in AUM.