Trade Order Management Software for Buy-Side

Features, Development Steps, Costs

ScienceSoft’s engineers custom order management solutions that resolve the common challenges of ready-made tools, such as generic, restricted features, limited asset coverage, and predefined integrations. We focus on logic accuracy and compliance and apply API-first modular architectures to deliver interoperable software that scales with your business.

Trading Order Management Software in a Nutshell

Trade order management software (OMS) is used to automate routine buy-side tasks across the trade order lifecycle, such as order entry, compliance checks, placement, execution control, and post-trade settlement. The software centralizes ordering operations and offers comprehensive trade analytics.

A custom trade order management system is a preferred choice for investment firms that want to automate multi-step workflows across their specific trading strategies and global target markets. Custom solutions can be built to support diverse order types for a broad range of asset classes, including alternative vehicles like derivatives and crypto assets. They can also be designed in compliance with any necessary investment regulations, including local frameworks (e.g., SEC for the US, CMA for the KSA, MiFID II for the EU).

Another advantage of custom trading OMS is that it can be integrated with any required systems, including legacy software, local broker platforms, and modern wealthtech tools. When your needs or regulatory rules change, a custom system can be freely extended with new features, integrations, and controls.

Quod Financial, in its recent paper on trade ordering systems, also names customized intelligent automation among the main value drivers for a trade OMS. Custom systems have an edge over off-the-shelf tools: they can accommodate artificial intelligence (AI) features tailored to the investment firm’s unique business context without flexibility and accuracy tradeoffs. For many companies, this is a strong argument in favor of proprietary systems.

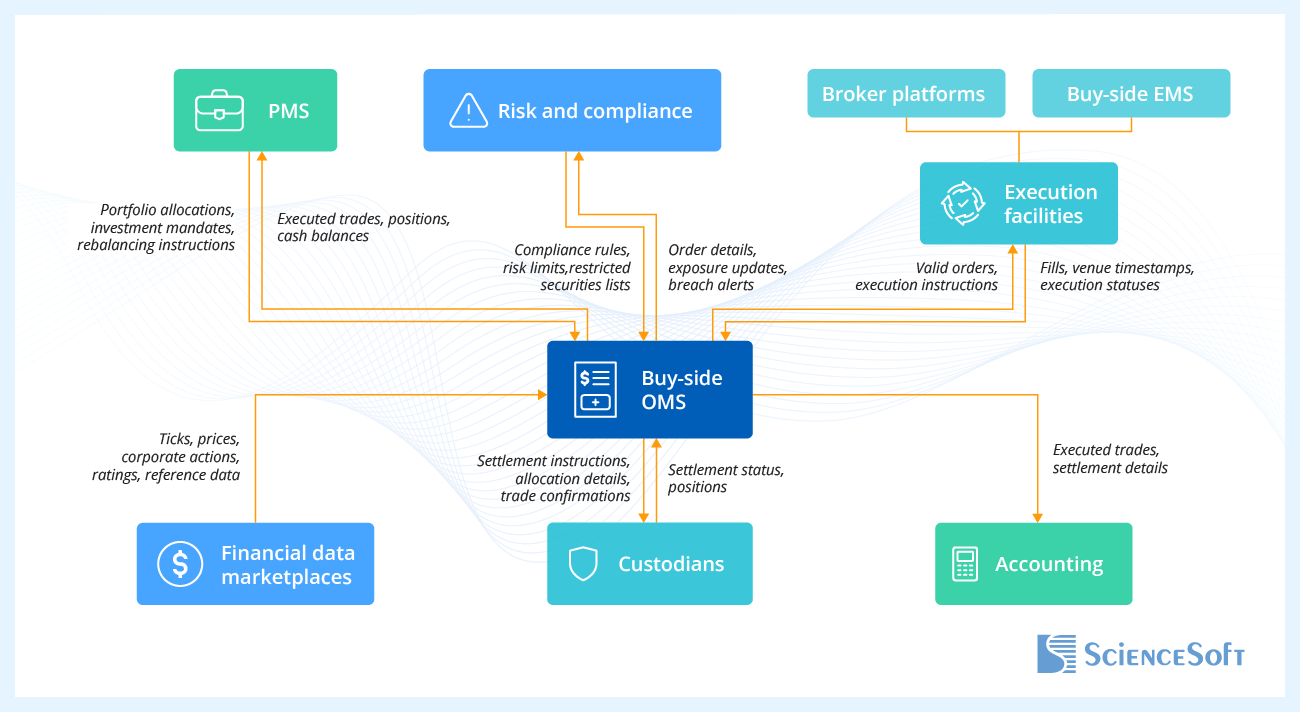

- Key integrations for a trade OMS: portfolio management software, a buy-side execution management system, broker platforms, investment accounting software, and more.

- Implementation time: around 9–15 months for core OMS modules.

- Development costs: $150,000–$1,200,000+, depending on solution complexity. Use our free calculator to estimate the cost for your case.

Investment Entities That Benefit From Tailored Trade OMS

Major ROI Drivers of a Trade Order Management System

Improved process efficiency

Automation in the OMS eliminates tedious manual tasks and accelerates order management operations, which translates into faster capital deployment and lower operational costs per order.

Enhanced ordering capacity

By automating simple orders and freeing managers for more complex transactions, OMS enables investment firms to handle larger trade volumes and grow AUM without additional staffing.

Lower trade error rates

Automated order controls prevent mistakes caused by human missteps and incorrect trade instructions, eliminating the costs associated with trade failures, corrections, and compliance breaches.

Functionality of Trade Order Management Software

Below, ScienceSoft’s consultants list the core and intelligent features that would lay the foundation for a robust OMS for the investment industry:

Core features

How AI Can Enhance Trading Order Management

Intelligent automation is increasingly gaining traction among investment and wealth management firms, with 58%+ of domain players projecting AI to be their biggest tech investment over the next three years.

ScienceSoft suggests extending OMS with the following AI capabilities to drive the efficiency of trade ordering operations further:

Important Integrations for a Trading Order Management System

- To ensure trade ordering alignment with portfolio strategies and mandates.

- To leverage up-to-date execution and position data for informed portfolio planning and rebalancing.

- To access current regulatory and internal policies required for accurate pre-trade and post-trade compliance checks.

- To enable risk managers to continuously monitor trade exposures and compliance status.

Execution facilities

E.g., broker platforms / sell-side execution systems (via standardized protocols like FIX) or an internal execution management system.

- To automatically submit orders for execution and capture order statuses and execution details.

Financial data marketplaces

E.g., Bloomberg, FactSet, S&P Global.

- To access capital market data required for asset screening, order sizing and validation, trade placement, and settlement planning.

Custodian systems

Through DTCC, SWIFT, or other standardized protocols.

- For streamlined trade confirmation, settlement instruction sharing, and settlement status control.

- To quickly reconcile trade transactions and cash positions.

- To automatically share trade and settlement data necessary for bookkeeping and financial reporting.

Steps to Build a Robust Trade Order Management Solution

Below, ScienceSoft’s Project Management Office shares a roadmap and best practices for implementing custom trading OMS within predictable timelines and budget limits.

1.

Engineering software requirements

Investment IT consultants gather and document requirements for the new trade order management system. This assumes close collaboration with the investment firm’s stakeholders and OMS business users to ensure nothing important is overlooked. Based on the collected information, consultants compose a software requirements specification (SRS).

- The depth and completeness of initial discovery directly impact the accuracy of preliminary estimates and the predictability of the entire project. To ensure accurate estimation, consultants at ScienceSoft study the investment firm’s order management workflows (roles, target asset classes, data flows), functional requirements for the OMS (supported order types, must-have and nice-to-have automation features, analytics complexity, etc.), as well as non-functional needs (system performance, scalability, latency, security, integrations).

- By defining compliance requirements for the trade OMS at this early stage, you ensure compliant solution design from the outset. Our compliance consultants analyze and map both the relevant data protection standards (e.g., SEC’s Reg SCI, GLBA, GDPR, SOC 2) and operational regulations (SEC, FINRA, Dodd-Frank, etc.). They also scope the client’s internal compliance mandates, such as specific rules for order handling, instruction approval, and trade audit trails.

2.

Trade OMS design

Core activities at this stage include designing the architecture of a trade order management system, selecting a tech stack, and designing role-specific UX and UI.

- Modular architectures (SOA, microservices) allow independent development and evolution of trade OMS components, which enables iterative software delivery, shortens time to launch, and contributes to the solution’s longevity. Moreover, modular options support logic reuse across system components, driving up OMS accuracy and reducing development efforts. At the same time, architects at ScienceSoft consider each solution’s functional specifics and performance needs when selecting the optimal architecture patterns. For example, if your OMS requires ordering for high-frequency trade execution, architects prioritize hybrid design, where speed-sensitive trade modules are built into a monolith architecture that offers the quickest data exchange, and the rest of the system is designed using modular patterns.

- By using ready-made logic building blocks, off-the-shelf UI components, pre-built third-party components (e.g., authentication, low-latency messaging, reporting), and reusable deployment scripts, you can reduce the share of costly custom coding and speed up development. Consider low-code platforms like Microsoft Power Apps for non-execution parts of the OMS — from our experience, this helps cut down coding costs for ancillary modules by up to 70%.

- Tailoring navigation, layouts, and data density for each ordering team role is a must for maximizing adoption, driving employee efficiency, and minimizing human error. For example, portfolio managers value comprehensive blotters with drill-down options, and compliance experts prefer minimalistic screens with clear alert displays. At ScienceSoft, we apply adaptable user journeys and customizable layouts to meet the distinct needs of various user segments without inflating UX/UI design efforts.

3.

Project planning

Project managers map the scope of project tasks, compose a work breakdown structure (WBS), define the resources needed to deliver trade order management software, and estimate project timelines and budget.

- A solid risk mitigation strategy will help you effectively address arising obstacles. PMs at ScienceSoft plan responses to both known and potential risks, including technical and integration challenges, resource constraints, and regulatory shifts that affect trade operations. Explore our deadline management and budget management practices to understand how proactive contingency planning helps us prevent delays and cost leakage in complex endeavors like trade OMS development.

- It’s easy for an OMS project to balloon in scope if every new idea is added without discipline. Our PMs define structured scope management and change control processes upfront so that any additional feature requests are evaluated for feasibility and impact and scheduled appropriately. Progress reporting is another aspect we plan before development to prevent misaligned stakeholder actions and creeping work scope.

Consider planning the OMS project in phases, starting with a minimum viable product (MVP) or priority module delivery. For example, phase 1 might span core features like order entry, compliance, and post-trade settlement; phase 2 can add advanced analytics, and so on. This phased approach ensures that high-value functionality is delivered first and accelerates productivity gains for trade order teams. It also helps prevent scope creep — new ideas can be slotted into later phases without derailing early development iterations.

4.

Development and testing

During this stage, developers code the back end of the trade order management system (including specialized components like AI models for intelligent order handling), create user interfaces, and set up scalable data storage.

- Implementing DevOps (CI/CD, container orchestration, etc.) helps significantly speed up development, testing, integration, and deployment operations. It also eliminates manual errors and minimizes regression risks in production releases. Discover how ScienceSoft leverages DevOps to enable rapid, reliable trade order software delivery with deployment failure rates under 5%.

- Running testing in parallel with coding helps catch issues before production, when they are easier and cheaper to fix. Our QA engineers run multiple layers of testing, including functional testing, component integration testing, performance testing (load, stress, spike, endurance), usability testing, and security testing. Test automation is our primary approach for fast, high-coverage quality checks; however, we also utilize manual testing where automation is not feasible or when a more exploratory approach is needed (e.g., when evaluating code security and trade data handling accuracy).

- By setting up a dedicated test environment that mirrors the production setup (including connections to test market data and execution venue simulators), you can validate trade OMS behavior under realistic operational conditions. Check how we applied this practice in ScienceSoft’s early trade automation software project to confirm system readiness for live trade ordering on the NASDAQ and NYSE American exchanges.

5.

Integration and data migration

At this stage, engineers integrate the new OMS with the necessary internal and third-party systems. If replacing or upgrading an existing ordering system, you may also need to migrate trade data (positions, reference data, open orders, etc.) to the new solution.

- Most brokers, custodians, and market data services offer ready-to-use APIs and protocols (e.g., FIX interfaces) so that you can integrate your OMS with their platforms quickly and in conformance with industry standards. Integrating with legacy in-house systems may require building custom adapters and connectors or implementing specialized middleware. In both scenarios, integration testing is key for confirming that systems synchronize smoothly and securely.

- When moving trade data from an old system to the new OMS, do it in controlled stages with small batches. This way, if any issues arise, you can quickly roll the batch back without affecting all the transferred data. Data engineers at ScienceSoft use automated migration scripts with testing checkpoints across data extraction and transfer stages. This prevents manual migration errors and helps validate the integrity and completeness of data during transition. Reconciling the data between the new OMS and the old system after the final cut-over helps confirm that there are no accuracy issues.

When running integration tests, pay special attention to glitches in data translation (field mismatches, timing issues, etc.), as these lead to the costliest errors, such as incorrect instructions, prolonged trade booking, and complete order failures.

6.

Deployment and support

Development teams configure secure infrastructure for order management software, finalize the necessary testing activities, and deploy the solution to production.

- New regulatory rules for trading can come into effect during development. Running a compliance audit just before the go-live will let you double-check OMS compliance with the latest sectoral regulations.

- Given the sensitivity of trade data and the OMS, you need to ensure that the production environment is protected via enterprise-grade security mechanisms. ScienceSoft’s minimal tool stack includes firewalls, intrusion detection/prevention systems, and SIEM systems for continuous monitoring. We also apply the principles of least privilege for system accounts and encryption for data in transit and at rest. After-launch penetration testing and vulnerability assessment of the live environment is another best practice to make sure no security holes were introduced during deployment.

- Once the OMS is live, regular maintenance (applying patches, adding new features, tuning performance, etc.) is needed to keep the solution running smoothly. You also need to organize L1–L4 support to help users who encounter issues and quickly resolve technical problems. Check out ScienceSoft’s dedicated page for ways to set up efficient maintenance and support operations both for outsourced and in-house scenarios.

Any post-launch issues in trade OMS can immediately evoke financial losses, so plan the go-live event carefully. Choose a date that minimizes risk, for example, a weekend or market holiday when trading is paused. A detailed go-live checklist covering data backups, final user communications, and switching interfaces from old to new OMS will help your teams avoid confusion and errors across last-minute tasks. It’s also crucial to have support engineers on standby and a clear rollback plan if something goes wrong.

Costs of a Trading Order Management Solution

Developing custom software for trade order management may cost from $150,000 to $1,200,000+, depending on the solution’s functional scope, the number and complexity of integrations, as well as performance, scalability, security, and compliance requirements.

Here are ScienceSoft’s sample cost ranges:

$150,000–$250,000

A tailored solution built on a low-code platform like Microsoft Power Apps. The solution offers rule-based automation of order creation and tracking tasks across traditional asset classes. It integrates with core internal systems (e.g., portfolio, execution) and features statistical analytics.

AI capabilities can be brought via add-ons; this will require separate licensing and development costs.

$300,000–$600,000

A custom solution that automates multi-step order management workflows, including multi-broker routing tasks, via algorithmic rules and RPA. The solution integrates with internal systems, broker endpoints, and custodians. It supports traditional and established alternative instruments and includes statistical and machine learning models for order analytics.

$600,000–$1,200,000+

A large-scale custom system that handles complex order management operations and straightforward execution tasks across traditional and alternative vehicles, including structured and crypto products. The system integrates with internal and third-party systems, including specialized brokers/venues and market data platforms. It offers tailored automation, analytics, and assistive features powered by AI, including GenAI.

Wondering how much your OMS project will cost?

Use our online calculator to share your needs, and we'll get back to you shortly with an estimate. It’s free and non-binding.

Why Develop Trading OMS With ScienceSoft

- Since 2007 in engineering custom solutions for the investment industry.

- Investment IT and compliance (SEC, FINRA, GLBA, GDPR, SOC 2, etc.) consultants with 5–20 years of experience.

- 45+ certified project managers (PMP, PSM I, PSPO I, ICP-APM) with experience in large-scale projects for Fortune 500 companies.

- Principal architects with hands-on experience in designing complex investment management systems and driving secure implementation of advanced techs.

- 550+ software engineers, 50% of whom are seniors or leads.

- ScienceSoft served one of the top 3 global asset managers with $5T+ in AUM.