Investment Research Software

Features, development steps, costs

ScienceSoft relies on 18 years of experience in investment IT and 36 years in data analytics to engineer automated investment research solutions that help investment firms efficiently run their research and analysis operations.

Investment Research Software: Key Aspects

Investment research software is used to automate the aggregation, sorting, and analysis of data necessary for investment screening and decision-making. Such software offers intuitive search capabilities, screening tools, and rich reporting features. It also serves as secure centralized storage for source data and research deliverables.

Custom investment research software can automate an investment firm’s complex and non-standard research workflows and offer advanced visualization options for research data. It can be powered by artificial intelligence (AI) to automatically extract insights from massive sets of multi-format data, accurately forecast investment performance, and draft research documents. AI-supported solutions can also provide fully automated investor sentiment analysis.

Another advantage of custom software is that it can smoothly retrieve research source data from any required systems, including legacy investment software and alternative data platforms. Moreover, custom investment research solutions can be designed in compliance with an investment company’s local regulations (e.g., SEC for the U.S., CMA for the KSA) to simplify adherence to region-specific disclosure rules. If you want enhanced protection of sensitive research data, custom software can comprise advanced security mechanisms.

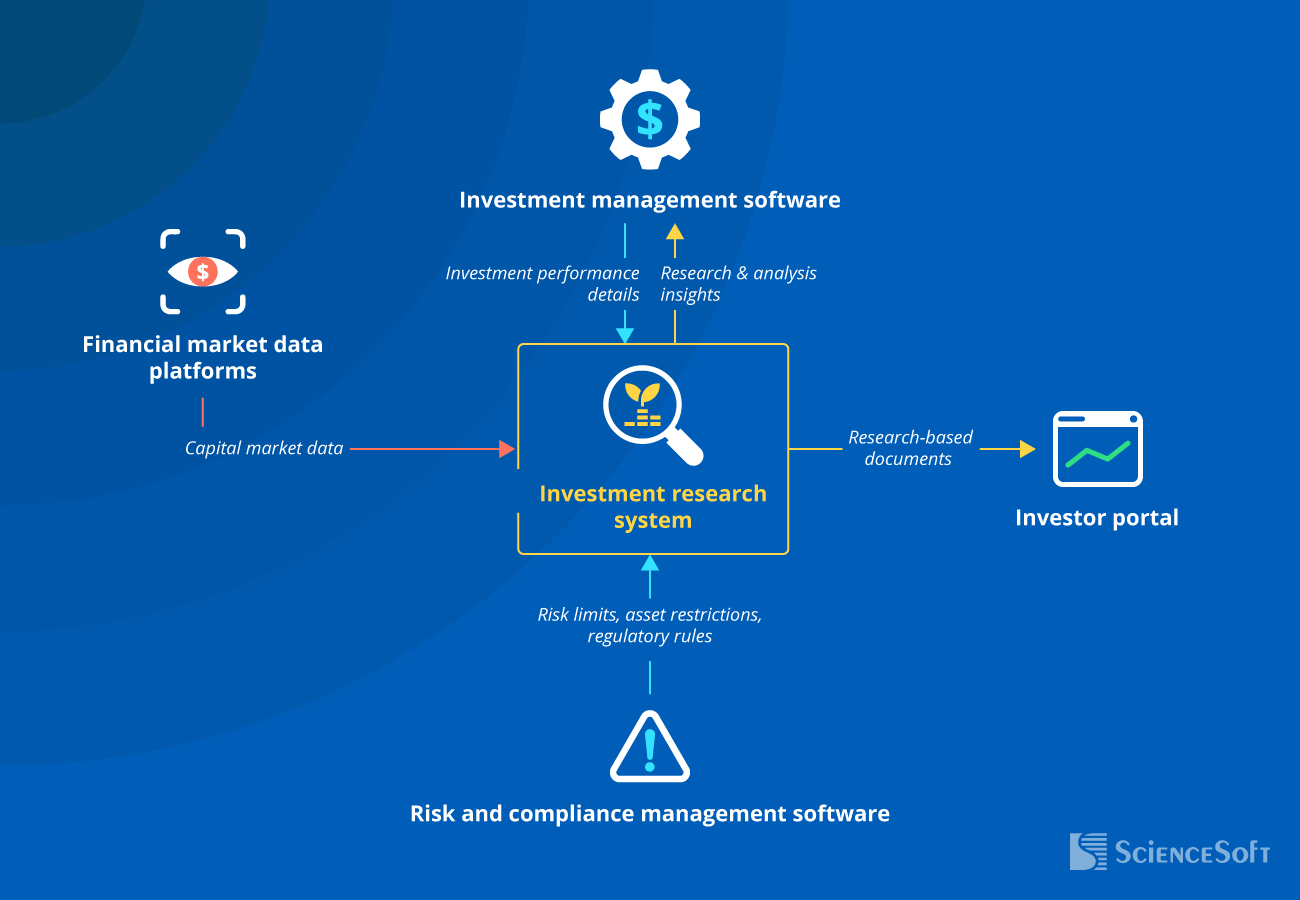

- Key integrations: financial market data platforms, investment management software, investor portal, and more.

- Implementation time: 7–13 months on average.

- Development costs: $150,000–$1,000,000+, depending on solution complexity and the chosen development approach. Use our free calculator to estimate the cost for your case.

How You Benefit From Custom Investment Research Software

In ScienceSoft’s experience, automating company-specific data aggregation, investment due diligence, and research reporting tasks can bring the following benefits:

Key Features of Investment Research Management Software

Below, ScienceSoft’s consultants share a list of features that would form the core of robust investment research software. Our team can develop the entire system from scratch or engineer particular functional modules for advancing the research solution you currently use.

Source data aggregation

The software automatically captures both structured and unstructured data relevant to investment research, including external feeds (e.g., stock indices, SEC filings, earnings releases, broker research, and ESG disclosures) and internal materials (existing investment memos, analyst notes, etc.). The data can be imported from connected systems and public sources in batches or in real-time. Users can configure custom rules for automated content tagging by ticker, industry, topic, and more.

Automated data processing

The software applies robotic process automation (RPA), intelligent image analysis, and natural language processing (NLP) to automatically parse the collected documents, visual content, and media recordings (e.g., earnings calls). It extracts the required metrics and narrative content, unifies data format, and presents insights in user-side dashboards. Advanced systems can recognize time-sensitive data (e.g., from earnings events) and flag it for priority analysis.

Research-relevant investment KPIs can be cited as is from original sources or calculated based on user-defined formulas. The software can calculate general metrics like P/E, EBITDA, ROE, ROIC, NAV, QoQ growth rates and asset-specific indicators, such as beta coefficient for stocks, GRM for real estate, J-curves for private equity, and kurtosis for hedge funds. More advanced solutions can also run statistical time-series analysis and apply machine learning (ML) diagnostic models for capturing non-apparent trends across multidimensional variables.

Investment screening and backtesting

Using interactive screening dashboards, investment researchers can filter investment options based on valuation ratios, capital efficiency, and custom criteria like ESG exposure or OFAC risk. The software supports multi-factor filtering and can export opportunity lists directly into investment models. If you require insights into investment performance over multiple market cycles (e.g., to validate momentum signals), the software can back-test the selected options and score them based on their historical yields.

Sentiment analysis

The software relies on NLP techs to retrieve contextual insights from gathered capital market news, financial reports, and social media posts. Large language models (LLMs) can be applied to capture sentiment directly from public media and identify explicit (hard facts, spoken investor attitudes) and latent (implied by post timing, author persona) market signals. The sentiment can be auto-segmented (by asset class, type, longevity, etc.), scored, layered over investment performance, and used as a screening filter.

Investment professionals can apply standardized modeling frameworks like DCF, DDM, LBO, SWOT, Monte Carlo simulation, or create custom statistical models with specific parameters to project future investment performance. The software calculates the necessary earning, valuation, and risk metrics and can run real-time what-if analysis and stress-testing for alternative fundamentals and macro scenarios. Modeling outcomes can be plotted side by side for streamlined investment assessment.

Advanced predictive analytics

Predictive ML engines analyze large research datasets in real-time and identify non-linear relationships between financial, market, and sentiment data. They generate accurate dynamic forecasts for entity performance, asset price movements, and risks even when historical relationships are weak or unstable. Advanced research solutions can include prescriptive AI models that analyze these intelligent projections to recommend the optimal investment decisions and risk hedging steps.

Investment document creation

Investment research teams can create branded templates for research reports, internal research notes (IRNs), investment memos, proposals, and other documents showcasing research findings. The software auto-populates these predefined templates with relevant data and auto-localizes the resulting documents when required. LLMs can be applied to compile multi-format data necessary for non-standard documents and put it into an easily digestible report format.

Research data can be visualized using a variety of general and investment-specific techniques. For example, you may choose spreadsheet-style tables for investment benchmarking, heatmaps for sentiment scores and macroeconomic risks, line graphs for asset performance trends, trend charts for YoY dynamics, scatter plots for risk volatility, and tree diagrams for revenue exposure.

Continuous event monitoring

Continuous investment research solutions support the real-time monitoring of asset price changes, earnings releases, corporate filings, regulatory actions, macro shifts, and other predefined events. The software dynamically updates screening watchlists and investment models as new, relevant data becomes available. Configurable alerts can instantly inform investment professionals about new events.

Workflow and compliance control

Managers can assign research tasks to team members and track progress via dynamic dashboards. The software logs every document version, edit, and comment in a centralized or blockchain ledger to provide time-stamped proof of authorship. It also verifies research workflow compliance against internal policies and regulatory rules. Configurable notifications alert users about predefined events, such as the assignment of a new research task or the identification of a data gap during the review process.

Collaborative investment research

Live multi-party editing and secure messaging features enable investment research specialists to co-author research documents, share files, and run threaded discussions in real-time. Users can annotate documents with highlights, in-line comments, and peer mentions to flag points for debate and link insights across team members. The software includes shared dashboards and event calendars for collaborative tracking of team-wide research deliverables.

Data storage and navigation

Research source data and produced documents get auto-tagged, indexed, and stored in a centralized repository. Intuitive search by tags and metadata lets investment teams easily find the required data. Custom solutions allow building generative AI assistants on top of a research knowledge base. Upon request, smart copilots can find the necessary information and communicate it to users in a manner closely resembling human dialogue, providing citations linked to exact data sources.

Security

Investment research data and the software are protected via permission-based access control, multi-factor authentication, data encryption, intelligent fraud detection, and other robust security mechanisms. The software enforces access controls at the user, role, team, and document levels to ensure only authorized individuals can manipulate sensitive research content. Custom solutions can provide compliance with SEC, GLBA, SOC1/SOC2, GDPR, NYDFS, CMA, and more.

See How Agentic AI Transforms Investment Research

Watch how ScienceSoft’s Investment AI Agent automates data collection, analysis, and insight generation for research teams. Built on the LangChain framework and powered by OpenAI’s best-in-class LLMs, the agent cuts research timelines by up to 70% and boosts analyst productivity by over 50% while ensuring the accuracy and relevance of intelligent findings.

Important Integrations for an Investment Research System

Financial market data platforms

e.g., Bloomberg, FactSet, Morningstar

For streamlined access to capital market data required for research and fundamental analysis.

Integrating the solution additionally with alternative data platforms (e.g., OFAC, ESG, commodity supply chain databases) will help you promptly capture data on non-finance risks.

- To leverage data on historical investment performance in research, modeling, and predictive analytics.

- To promptly act on investment opportunities identified through research.

The software can also be connected directly to investment platforms to collect data on platform trade outcomes and opportunities and to enforce investment decisions based on new insights.

To swiftly share research reports, research-based pitch decks, and investment proposals with investors.

If you don’t yet have an investor portal, automated document sharing can be established through the integration with traditional client interaction channels like email systems and messaging services.

Risk and compliance management software

To promptly validate that research-based investment options stay within company-specific exposure constraints and regulatory guidelines.

Six Steps to Create a Robust Investment Research Solution

Below, ScienceSoft’s development team shares their common steps and best practices to deliver robust investment research solutions while optimizing project costs and timelines.

1.

Requirements gathering

Investment IT consultants study the investment company’s research workflows and interview project stakeholders to elicit requirements for the research automation solution. As a result, the experts compose a detailed functional specification for the planned software. Below, we outline some crucial steps in requirements gathering for investment research software development projects and show their importance in real-life projects:

- Interviewing business users (researchers, analysts, investment managers, etc.) helps better grasp employee-level operational hurdles and needs. For example, in ScienceSoft’s investment software project for a family office, engaging the company’s analysts helped our consultants reveal specific bottlenecks in spreadsheet-based investment screening and modeling workflows. By focusing on the most critical employee pain points, we created a prioritized feature list that later helped us launch an MVP, which started delivering value on day one.

- Mapping the data types and sources to use in investment research at early planning stages ensures sharper software functional design and better choices of data processing and storage techs. For example, in ScienceSoft’s recent investment research software project, identifying all the target financial news websites helped us spot an abundance of CAPTCHA-intensive sources and proactively suggest automated CAPTCHA-solving features and techs to drive fast, uninterrupted data scraping.

- Compliance consultants can map regulatory requirements relevant to your software at early planning stages (e.g., SEC Regulation SCI rules for investment data protection, SOC 2 Type II requirements for the security of investment research software products). This way, your functional specification will cover compliance features from the outset.

2.

Solution design

During this stage, development teams design the architecture, tech stack, and UX/UI of the investment research solution.

- Modular cloud architectures (SOA, microservices) ensure the research solution can efficiently process and store large volumes of multi-format investment data. ScienceSoft’s architects recommend modular options for any solutions that need to support real-time analytics and compute-intensive intelligent automation. Check our Azure-based analytics software project for a hospitality investor to get an idea of how cloud modular solutions drive quick data processing while reducing costs. Moreover, modular architectures support agile implementation of new investment research features without affecting the entire system, which contributes to the solution’s longevity.

- Investment research often involves attention-heavy tasks where speed matters a lot, so it’s critical to design UX/UI for minimized user friction. Prioritize straightforward user journeys and clean layouts to ensure research teams can quickly toggle between source data, dashboards, and documents. Another major priority in UX/UI design for investment research software is creating vast interface customization options. This will allow researchers and investment managers to tailor workspaces for smoother handling of their specific workflows. For applications with complex workflows and data logic, close collaboration between UX/UI designers and technical experts is especially important. At ScienceSoft, UX/UI designers always work together with data engineers to ensure the solution’s research dashboards, analytical models, and document templates provide accurate data mappings and calculations.

- By using OOTB logic building blocks (e.g., QuantLib formulas, Azure ML pipelines), off-the-shelf UI components (e.g., Syncfusion’s pre-built charts), and reusable deployment scripts, you can reduce the share of costly custom coding and speed up development. Also, consider your current technology environment: for example, if you mainly rely on the Microsoft stack, it makes sense to build the research solution using Microsoft’s tools and services to cut licensing costs and streamline integrations. See how ScienceSoft applied this in practice for an investment regulator’s research solution.

Building a proof of concept (PoC) for the investment research solution is a smart move when you're planning intelligent automation or complex integrations with financial data providers. A PoC gives teams a safe space to test assumptions and validate the feasibility of particular features and technology choices. Early insights into non-apparent traps help avoid poor design decisions that may entail costly rework at later stages and drive up the solution’s TCO. For example, starting with a PoC for an investment AI copilot helped us quickly exclude unviable tech stack options, prove the advantages of the proposed architecture, and confirm the solution’s business value.

3.

Project planning

This is the stage where project managers scope the investment research software engineering tasks, assemble the development team, and estimate the project time and budget.

- Creating a RACI matrix and sharing it with all the stakeholders helps ensure everyone is on the same page regarding the responsibilities, accountability, and role-specific development aspects to focus on. At ScienceSoft, we apply this practice to facilitate efficient stakeholder collaboration and streamline project management.

- Financial market shifts, evolving user needs, and regulatory updates may entail new functional requirements mid-build. Documenting clear boundaries for scope extension and mapping structured workflows for change request processing will safeguard you from scope creep while ensuring fast, flexible implementation of feasible adjustments.

- An adequate set of KPIs is a must to accurately evaluate investment software project health and the quality of deliverables. Check ScienceSoft’s dedicated page to explore sample metrics we use for measuring the success of development projects.

4.

Development and testing

During this stage, developers code the back end of investment research management software (including APIs and specialized components like AI models for intelligent research), create user interfaces, and set up scalable data storage.

- Running testing in parallel with development will help you spot and fix code issues quickly. At ScienceSoft, we combine manual and automation tests to achieve maximized QA coverage while supporting frequent releases and staying cost-effective. Check our manual and automated testing comparison to learn when manual or automated testing works best and how to balance the two, depending on your specific project needs and constraints.

- Proactive risk management during development prevents rework, delays, budget derailments, and misaligned investment research software deliverables. ScienceSoft’s structured approach includes maintaining a live risk register, assigning ownership for risk mitigation, and running risk reviews at key milestones to swiftly address emerging issues. Discover what we do to minimize specific operational, technology, and external risks in more detail.

5.

Integration and data migration

Back-end engineers integrate the investment research solution with the necessary internal and third-party systems. You may also need to migrate source data, investment models, and research documentation from your existing tool to the new solution.

- Rigorous integration testing is a must to ensure APIs and connectors (both custom and third-party) are working as intended. ScienceSoft’s engineers validate each integration for specific issues like missing investment data, data mismatches, API rate limits, and encryption latency for transmitted data to quickly reveal silent failures that could undermine smooth and secure data flows.

- Automating data migration using custom scripts and ETL/ELT tools speeds up the process and eliminates risks of manual error, which is crucial for transferring large volumes of investment data. Same ETL/ELT pipelines are commonly used for the automated integration, cleansing, validation, and filtering of research source data, so you don’t bear extra costs for some migration-specific solutions here. Explore how ETL-supported data transmission works in ScienceSoft’s custom solutions for real estate investment analytics and capital market regulatory research.

6.

Deployment

At this stage, development teams configure investment research software infrastructure, set up data backup and recovery mechanisms, and deploy the ready-to-use solution in the live environment.

- Running user acceptance testing (UAT) before software go-live helps confirm that critical workflows function as expected and builds user confidence in the new research solution. Prioritize test cases that reflect real, day-to-day scenarios (authenticating in the system, reviewing intelligent insights, exporting screening results, etc.) and include some edge cases (e.g., entering conflicting tags, requesting data on faked or newly listed stocks). Covering edge cases helps ensure the software performs reliably under non-standard conditions and gracefully handles user errors and unexpected research content.

- Once your investment research solution is launched, you need to organize its support and maintenance to ensure smooth software functioning and quick resolution of user issues. Check ScienceSoft’s dedicated guide to learn the key steps, necessary skills, and sourcing options for setting up smooth maintenance and support processes.

Costs of Custom Software for Investment Research Management

Developing custom investment research software can cost between $150,000 and $1,000,000+, depending on the solution’s functional scope, performance, security, and compliance requirements, the complexity of integrations, and the chosen sourcing model (in-house or outsourced).

Here are ScienceSoft’s ballpark estimates for investment research solutions of different complexity:

$150,000–$250,000

A tailored solution built on a low-code platform like Microsoft Power Apps. The solution offers rule-based research automation and statistical analytics.

AI capabilities can be brought via add-ons; this will require separate licensing and development costs.

$250,000–$500,000

A custom solution that automates research operations via conventional rules and RPA. It includes statistical and machine learning models for diagnostic and predictive investment analytics.

$500,000–$1,000,000+

A large-scale research system featuring intelligent automation, including capabilities supported by generative AI. It covers advanced predictive and prescriptive engines for fundamental, sentiment, and risk analytics.

Why Engineer Investment Research Software With ScienceSoft

- Since 2007 in engineering custom solutions for the investment industry.

- Since 1989 in data analytics and AI development to create robust research management solutions powered by intelligent features.

- Investment IT and compliance consultants with 5–20 years of experience.

- 45+ certified project managers (PMP, PSM I, PSPO I, ICP-APM) with experience in large-scale projects for Fortune 500 companies.

- Principal architects with hands-on experience in designing complex investment solutions and driving secure implementation of advanced research techs.

- 350+ software engineers, 50% of whom are seniors or leads.

- Quality-first approach based on an ISO 9001-certified quality management system.

- Robust security management supported by ISO 27001 certification.

- ScienceSoft served an asset manager with $5+ trillion in AUM — one of only three firms operating at that scale.