Investment Data Management Software

Features, development steps, costs

ScienceSoft applies 18 years of experience in investment IT and 36 years in data services to engineer secure digital solutions that help investment firms efficiently manage their multi-format business data.

Investment Data Management Software: Quick Overview

Investment data management is the systemic approach to integrating, processing, organizing, and storing investment data according to regulatory standards (e.g., NYDFS, GDPR) and the investment firm’s specific needs. In most cases, investment data management frameworks are designed to support analytics and reporting and ensure compliant data operations.

Investment data management solutions are meant to automatically aggregate investment data from disparate sources, clean the data from inconsistencies, and transform it into segmented datasets ready for statistical processing. Apart from data processing, sometimes, such solutions include basic analytics features, which support straight-through analysis of portfolio performance and time-sensitive insights (e.g., technical time series). However, most investment companies rely on separate solutions for comprehensive descriptive and predictive analytics.

Custom investment data management solutions are the preferred choice for investment firms that need to smoothly collect data from multiple systems (including legacy tools) and automate specific data processing operations. Custom systems can be powered by artificial intelligence (AI) and robotic process automation (RPA) to enable fully automated capture and processing of multi-format investment documents, media files, and web sentiment. They can be designed to cover the functionality of a full-fledged investment analytics solution and provide AI-assisted data search.

Another advantage of custom investment data solutions is that they can be designed in compliance with region-specific investment regulations (e.g., SEC for the US, CMA for the KSA, MiFID II for the EU). Also, if you’d like to incorporate enhanced data protection, custom systems can be built to comprise advanced security tools and provide a tamper-resistant record of data operations in blockchain.

The biggest benefit of custom software is that it lets investment organizations retain complete control over sensitive data and data management processes. According to Bloomberg, this is the top reason why 50% of investment firms globally rely on proprietary data management tools.

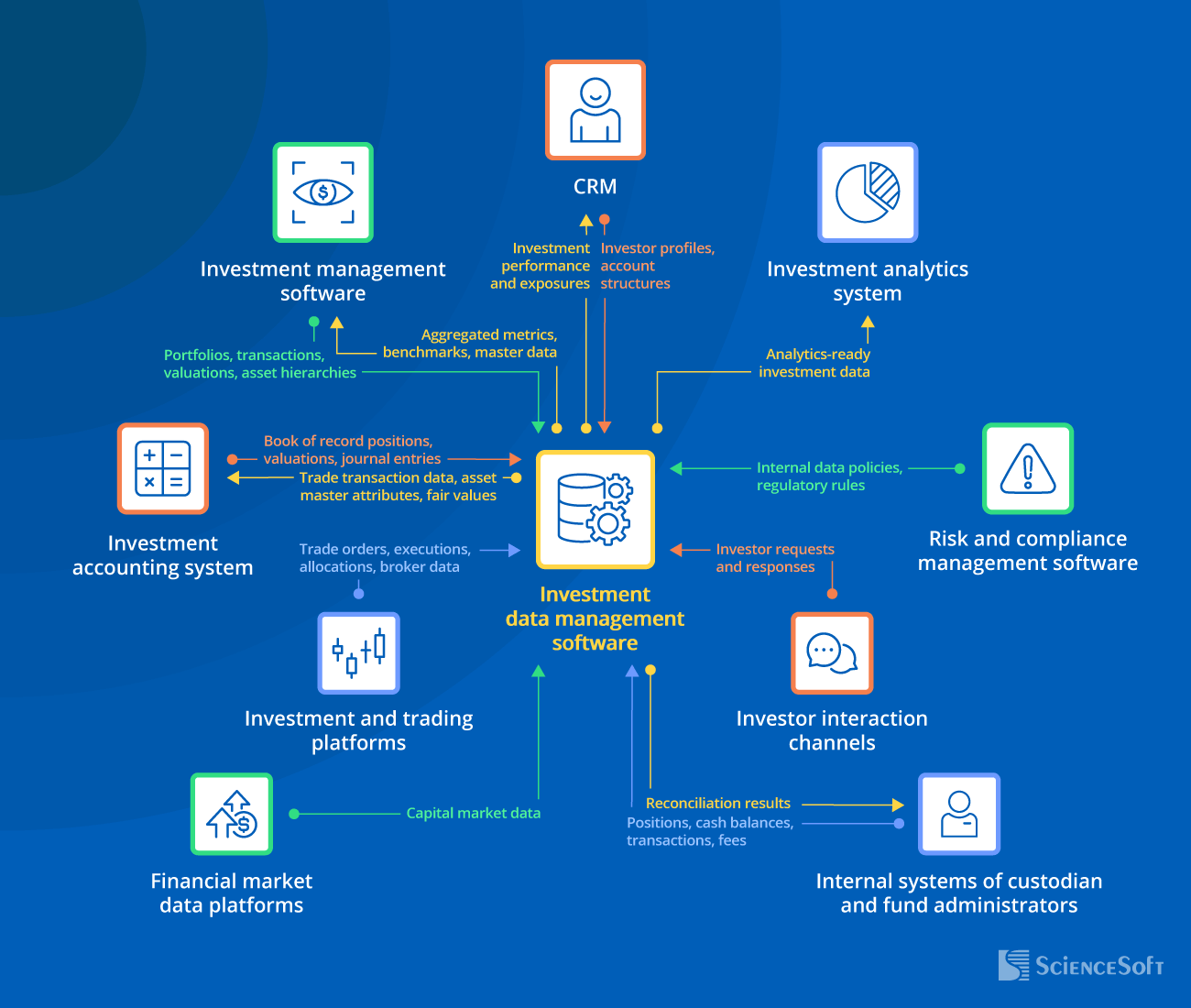

- Key integrations: investment management software, CRM, investment accounting system, investment platforms, financial market data platforms, and more.

- Implementation time: 7–13 months on average.

- Development costs: $70,000–$1,500,000, depending on solution complexity. Use our free calculator to estimate the cost for your case.

Investment Data Types Software Helps Manage

Structured investment data

- Investment transaction and trade records.

- Time-series market data (prices, FX rates, yields).

- Security master data (identifiers, attributes).

- Portfolio performance snapshots.

- Investment accounting entries.

Semi-structured investment data

- XML regulatory filings (e.g., Form PF, AIFMD).

- JSON fund reports.

- SWIFT messages (e.g., MT540–MT599 series).

- Valuation files with embedded comments.

- Emails with semi-tabular content in the body.

Unstructured investment data

- Investor reports and pitchbooks.

- Scanned investment agreements.

- Free-text investor emails.

- Audio transcripts (e.g., from earnings calls).

- Digitized handwritten documents (e.g., investment memos).

According to a recent report by IDC, 90% of the data generated by investment firms comes in an unstructured format, and 42% of this data is never reused for analytics. 96% of the surveyed investment leaders admit they are struggling to unlock the full value of unstructured data, citing data silo and the lack of necessary processing tools as their major challenges.

Meanwhile, Crisil, with a reference to a 2023 study by PwC, says that using unstructured data for investment decision-making can help companies achieve a 30% increase in investment ROI. For your organization, building a data management solution to smoothly process both structured and unstructured data means gaining insights that most competitors miss and directly improving the profitability of your investment decisions.

Key Features of an Investment Data Management System

Below, ScienceSoft’s consultants share a list of features that would form the core of a robust investment data management solution. Our team can engineer the all-in-one system from scratch or develop particular functional modules for upgrading the data management solution you currently use.

Data processing workflow customization

Users can configure custom investment data hierarchies, rules for processing specific data types (e.g., investment document parsing, portfolio-wide position consolidation), data storage control workflows (versioning, recovery, storage performance assessment, etc.), and more. A low-code editor lets investment professionals manage rules without involving IT specialists.

Data aggregation

The software automatically captures and maps multi-format investment data, including investor information, portfolio structures, transactions, market indicators, and sentiment feeds. This data can be gathered from integrated systems (via APIs and connectors) and public web platforms (via RPA-supported web scraping). It can also be uploaded in real time or batches according to a pre-set schedule.

The software consolidates the collected heterogeneous investment data according to the company’s chosen data integration model: extract, transform, load (ETL), extract, load, transform (ELT), data virtualization, or data propagation. Custom software can be designed to automatically compress, partition, and encode the integrated data for faster and less resource-intensive processing.

The software applies machine learning (ML), intelligent image analysis, and natural language processing (NLP) to automatically parse the collected investment documents, financial news and sentiment, visual content, and media recordings. It extracts the required metrics and narrative content, unifies data format, and presents insights in user-side dashboards.

Data standardization

The software transforms incoming investment data into consistent formats (e.g., normalizes security classifications, unifies date formats) based on user-defined rules. Financial instrument, issuer, investor, and currency names are auto-coded using common investment-specific conventions (e.g., ISIN, CUSIP, ISO 4217) or the investment company’s internal identifiers.

Data validation and cleaning

The software applies custom rules or ML algorithms to detect missing, duplicated, gapped, and stale investment data pieces. It instantly reports data flaws to the responsible employees and can enforce automated data corrections using fallback logic and reference data (e.g., filling missing asset prices based on available market feeds).

Master data management

The software continuously verifies the accuracy of master records for investment products, securities, portfolio benchmarks, investors, and other required entities and synchronizes the records across integrated systems. Reference attributes can be updated ad hoc based on user input or automatically as new data appears.

Data classification

The software auto-classifies and tags investment data based on user-defined taxonomies reflecting asset classes, sectors, geographies, and more. ML algorithms can categorize unstructured data like investor documents and tag them based on relevance to specific criteria. Users can review and manually override classifications.

Data storage

Processed investment data is instantly routed for storage to a pre-defined data-specific repository (e.g., a data warehouse, an SQL database for asset time-series data, a blockchain record system for order transactions). All stored data pieces include timestamps, version history, and source lineage. The software auto-indexes investment documents for easier search.

Data visualization

Depending on user needs, investment data can be presented in hierarchical structures, directory-based views, or dynamic business intelligence (BI) dashboards. The software can automatically render structured investment data (valuations, positions, attributions, etc.) into trend charts, graphs, time series plots, heatmaps, and other interactive visual formats.

Data search and navigation

Users can locate the necessary investment data by filters, tags, and metadata. The software presents search results with links to original data views and source files. Large language models (LLMs) can be applied to process natural language search queries, instantly retrieve investment data and documents, and present search results in a user-defined format.

Dataset construction

A drag-and-drop dataset builder with intuitive data selection, merging, grouping, filtering, and calculation fields lets users create curated datasets for various investment needs (asset screening, OFAC screening, trade technical analysis, deal pipeline tracking, ML model training, etc.). Users can automatically convert custom dataset design rules and data views into templates.

Compliance control

The software continuously vets investment data management processes against the company’s data governance policies and operational regulations (e.g., SEC, FINRA, CMA). It flags non-compliant activities, reports them to compliance owners, and can automatically enforce corrective workflows, e.g., routing out-of-order investment data to quarantine and blocking its distribution.

Security

Investment data and the software are protected via role-based access control, multi-factor authentication, data encryption at rest and in transit, data masking, intelligent fraud detection, and other robust security mechanisms. Custom investment data management solutions can support compliance with GLBA, CCPA, NYDFS, GDPR, SOC1/SOC2, and other regulations.

Analytics features (optional)

Financial calculations and modeling

Users can build custom formulas for calculating investment metrics and design tailored statistical models for scenario outcome forecasting. The software can calculate general metrics like time-weighted returns, NAV, VaR, alpha/beta, and asset-specific indicators, such as J-curves for private equity and beta coefficients for stocks. The software can automate what-if analysis and provide side-by-side outcome comparison.

Intelligent investment data analytics

Machine learning can be applied to diagnose large volumes of investment data in real time, spot patterns and trends (including latent behavioral, risk, and market signals), and forecast any required metrics and events like time-sensitive technical indicators or long-term yield from alternative investments. Advanced solutions can provide AI-powered suggestions on the optimal investment decisions and operational improvements.

Synthetic investment data creation

Advanced data management solutions can leverage time-series models (e.g., ARIMA, GANs, diffusion models) and LLMs to automatically generate realistic investment datasets. For example, the models can simulate security price trajectories, investor transactions, and controversial sentiment observable in the market. The data can be used to train and calibrate investment AI algorithms on technical, fundamental, diversification, and risk hedging concepts.

Important Integrations for Investment Data Management Software

A recent study by Vitreous World found that delayed access to the necessary data is the biggest hindrance for investment firms when it comes to efficient analytics and decision-making.

ScienceSoft suggests that integrating investment data software with the following systems and implementing real-time data processing pipelines can help effectively address this challenge:

To quickly import data on historical investment performance and share aggregated insights and benchmarks for accurate investment planning.

To get an aggregated view of investor profiles and account-associated investment performance for investor reporting.

To centralize accounting records for simplified auditing and financial reporting; to swiftly reconcile financial transactions.

Trading platforms

E.g., order management software, execution management software, third-party investment and trade platforms.

To collect data on trading transactions, outcomes, and opportunities.

Investor interaction channels

An investor portal, email systems, messaging services.

To maintain a complete, traceable record of communications with investors.

Risk and compliance management software

To promptly validate investment data management compliance with company-specific policies and regulatory guidelines.

Financial market data platforms

E.g., Bloomberg, FactSet, Morningstar.

To streamline the aggregation of capital market data needed for investment research and analysis.

Internal systems of custodians and fund administrators

To capture and reconcile custodians’ transactional records against internal records.

To quickly leverage company-wide investment data in analytics.

You may not need this integration if your data management system covers comprehensive analytics.

Steps to Create a Robust Investment Data Management Solution

Below, ScienceSoft’s development team shares a high-level roadmap and best practices for delivering robust investment data management solutions with optimized total cost of ownership (TCO).

1.

Requirements engineering

Investment IT consultants conduct interviews with an investment company’s project stakeholders, including target business users of the solution (data managers, investment analysts, compliance reviewers, etc.), to elicit requirements for the capabilities of the new data management software. Among other aspects, consultants discover the types, formats, and sources of investment data, as well as the processing speed that the solution must support.

Consultants at ScienceSoft also study the investment company’s data consolidation, transformation, and analytics processes, along with currently used data management tools to reveal non-apparent opportunities for system improvement and project cost optimization. For example, auditing the hospitality investment company’s existing data storage and automated reporting workflows at early project stages let our team quickly determine the root cause of slow asset data processing and speed up reporting twofold even before developing a full-scale data solution.

At this stage, it’s also essential to define compliance requirements for the investment data management solution. Compliance consultants map relevant data protection standards (e.g., GLBA, NYDFS, GDPR) and operational regulations (e.g., SEC, FINRA, CMA, MiFID II) to ensure compliant software design from the outset.

Based on the collected information, consultants compose a detailed software requirements specification.

2.

Data architecting

Data architects design the blueprint for how investment data will be collected, processed, stored, and accessed across the system. This includes defining the structure and relationships between data from diverse sources, mapping data lineage rules, and designing master data management and referencing rules. The architects plan zero-trust security measures like data encryption and role-based access controls. Incorporating tailored data profiling, validation, and exception handling workflows at the architectural level will help ensure consistent data quality checks and minimize the risks of downstream data errors.

This stage also involves choosing data storage types (such as database, data warehouse, data lake, or data hub) and methods for integrating investment data from multiple, disparate data sources. Our data architects prepared an overview of best practices for selecting the optimal data integration strategies and optimizing integration and storage solutions for faster, cheaper, and more accurate performance.

3.

Technical design

During this stage, solution architects design the overall architecture of the investment data management system, including its integrations and security components. Since the investment company’s needs and sectoral regulatory frameworks evolve constantly, it makes sense to opt for modular designs like SOA or microservices. By supporting easy software scaling and evolution, modular architectures help extend the useful life of investment data solutions.

Next, architects select the optimal tech stack for investment data integration, processing, and storage, keeping in mind specific non-functional (performance, scalability, latency, security, TCO) requirements for the solution. ScienceSoft recommends applying reusable components (ready-made logic blocks, pre-built APIs, OOTB deployment scripts, etc.) where applicable to cut development time and cost without trading off solution quality. Modular architectures allow integrating turnkey third-party services for handling non-specific data management tasks, which significantly reduces coding overhead. Check how using the ready web scraping scripts and integrating a third-party CAPTCHA service helped us engineer a high-performing solution for capital market news aggregation while minimizing the share of costly custom code.

The approved technical vision typically gives project managers enough insights to plan the software engineering tasks, compose the team, and estimate the project time and cost. Make sure you accurately scope the project, organize collaboration, and draw change request processing workflows before getting to development. In our recent PM consulting engagement, failing to cover these aspects cost the investment authority delays, waste, and creeping scope of its data solution, and it wasn’t easy to get the project back on track. Explore our knowledge base on PM best practices to learn how to organize project management properly from day one.

4.

UX and UI design

UX and UI designers map out user journeys and create interfaces tailored to the needs of specific user roles. For instance, investment researchers may need a dynamic stock screener with intuitive ticker filtering, whereas portfolio managers may require portfolio performance dashboards with rich data visualization and the ability to drill down into individual allocations.

For each user role, designers focus on creating interfaces that simplify data access, streamline navigation, and ensure visual clarity of the aggregated insights. Creating interactive prototypes and engaging end users in usability testing helps quickly validate proposed data hierarchies, navigation flows, and layouts so that designers can further refine them for higher convenience.

In most cases, investment firms never have to engineer data management UI from scratch. All-purpose libraries like Microsoft Power BI provide vast sets of prebuilt components that fully cover general data visualization needs. As for specific cases like visualizing portfolio KPIs or security prices, you can customize ready components from specialized libraries (we recently used Syncfusion and Highcharts, but there are options). In my practice, custom UI engineering was only needed in highly specific scenarios or when designing commercial data tools that competed on a unique UI. For example, we needed to build custom dashboards for a capital market regulator who dealt with huge volumes of multi-source investment activity data.

5.

Development and quality assurance

Developers code the back end (including APIs and connectors) and front end of the data management system and set up secure, scalable storage for investment data. Following secure coding standards like OWASP ASVS and running peer code reviews helps minimize bugs and reduce vulnerability risks.

Data management features are typically delivered in iterations, with every iteration covering the testing of the newly developed and already existing functionality. To support this iterative, test-driven approach and ensure frequent, reliable releases, it’s important to implement DevOps and maintain CI/CD pipelines. At ScienceSoft, we also prioritize iterative development methodologies to agilely adapt to changing requirements mid-way and prevent costly rebuilds.

During this stage, the team also integrates the investment data management solution with the required internal and third-party systems. Rigorous integration testing is a must to confirm that investment data retains its accuracy and integrity when updated and transferred between the connected systems. Test environments must mirror production as closely as possible to allow validation under realistic data volumes, vendor APIs, processing flows, and edge cases.

6.

Deployment and support

Engineers configure investment data software infrastructure, set up network protection and data backup mechanisms, and deploy the ready-to-use solution in production. Before go-live, technical teams conduct a compliance audit to confirm that all investment data management controls, technical safeguards, and data retention policies are implemented correctly.

At ScienceSoft, this stage includes transferring the knowledge to the client’s IT team and sharing detailed documentation for the investment data management solution to simplify maintenance and evolution. Another key post-launch step is implementing system performance monitoring and maintenance, along with organizing efficient user support. To help you understand what’s needed to ensure smooth system functioning and prompt user assistance, here are some best practices that our software support engineers follow.

Robust Tech Stack for Investment Data Management Solutions

Costs of Investment Data Management Solutions

Developing a custom investment data management solution can cost between $70,000 and $1,500,000, depending on the solution’s functional scope, the types of data to be handled, the complexity of integrations, as well as performance, scalability, security, and compliance requirements.

Here are ScienceSoft’s ballpark estimates for common investment data solution types:

$70,000–$300,000

A solution that aggregates investment data in batches from 2–7 sources. It automatically processes structured data and comprises an analytics-ready data warehouse.

$300,000–$600,000

A solution that enables automated collection and straight-through processing of structured and semi-structured investment data from 5–20 sources. The system includes a data warehouse and comprehensive BI capabilities.

$600,000–$1,500,000

A large-scale system that offers real-time aggregation of structured and unstructured investment data from 15+ internal and external sources. It includes AI-supported data processing features and handles data preparation for intelligent analytics.

How You Benefit From Well-Organized Investment Data Management

Why Engineer Investment Data Solutions With ScienceSoft

- Since 2007 in engineering custom solutions for the investment industry.

- Since 1989 in data management, analytics, and AI development to create robust investment data management systems powered by intelligent features.

- Investment IT and compliance consultants with 5–20 years of experience.

- 45+ certified project managers (PMP, PSM I, PSPO I, ICP-APM) with experience in large-scale projects for Fortune 500 companies.

- Principal architects with hands-on experience in designing complex investment solutions and driving secure implementation of advanced techs.

- 350+ software engineers, 50% of whom are seniors or leads.

- Quality-first approach based on an ISO 9001-certified quality management system.

- Robust security management supported by ISO 27001 certification.

- ScienceSoft served an asset manager with $5+ trillion in AUM — one of only three firms operating at that scale.