Financial Process Automation

Your Complete Guide

ScienceSoft applies 18 years of experience in engineering corporate finance software to help companies in 30+ industries implement effective financial process automation.

Financial Process Automation in a Nutshell

Financial process automation helps businesses eliminate manual efforts across finance-related tasks, including bookkeeping, invoicing, payroll accounting, financial planning and analysis, revenue management, tax management, investment and financial risk management, and more.

Depending on their needs, companies can implement a financial process automation solution to digitalize particular financial operations or enable end-to-end automation of all corporate finance activities.

Finance automation is a way for companies to drive 1.5–5x higher financial teams’ productivity, achieve up to 90% reduction in the financial data processing costs, and establish 80%+ faster corporate finance operations.

- Implementation time: 6–13+ months.

- Costs: $200,000–$1,500,000+, depending on the automation solution's complexity. Use our cost calculator to estimate the cost for your case.

- Annual ROI: 200–290%. Use our calculator to estimate the ROI for your customized solution

Main Financial Processes to Automate

According to Prophix’s 2023 Finance Leaders Survey, 92% of finance leaders have already automated half of their daily tasks or are hoping to digitalize them by the end of 2023. Financial process automation creates forward momentum for rapid advancements across all core corporate finance areas:

Financial accounting and reporting

Automate 75%+ of tedious accountants’ tasks and get increased productivity of your accounting team along with full visibility of financial transactions. Benefit from 90% improvement in bookkeeping and financial reporting accuracy due to eliminated manual errors.

Billing and invoicing

Free your billing team for high-value tasks. A robust financial process automation system can eliminate up to 90% of manual billing-associated workflows. You get 2–3x faster and more accurate invoicing and around 50% reduction in DSO.

Financial planning and analysis

Streamline your financial planning and analysis processes and get instant access to the finance data you need. Harness the power of AI to achieve 95%+ financial forecasting accuracy and improved decision-making on financial and strategic activities.

Treasury management

Plan liquidity with full insight of enterprise-wide financial performance and reduce idle cash by up to 50% with intelligent guidance on optimal investing decisions. Get 50–75% reduction in financial risks due to real-time risk exposure calculation and tracking.

Compliance management

Entrust your tax and revenue management operations to the automation system and enjoy 100% compliance with the latest legal regulations. Get accurate tax and revenue reporting, faster tax payment and revenue recognition.

Get 4x faster price calculation and 3x faster price updating across various selling channels due to automation. AI suggestions on the pricing strategy optimization can bring 3–15% increase in sales revenue and 1–8% increase in gross margin.

NB: Automation in the finance industry goes beyond digital financial management and may comprise domain-specific workflows like credit underwriting, investment portfolio planning and analysis, or insurance claim settlement.

Financial Process Automation System: Key Features

Based on ScienceSoft’s experience with finance automation projects, a full-fledged financial process automation system should typically cover the following features:

Approaches to Financial Process Automation

There are several main approaches to automating the financial workflow, each having its benefits and limitations and defining the architecture of a finance process automation system. ScienceSoft suggests choosing the one that fits your business needs best.

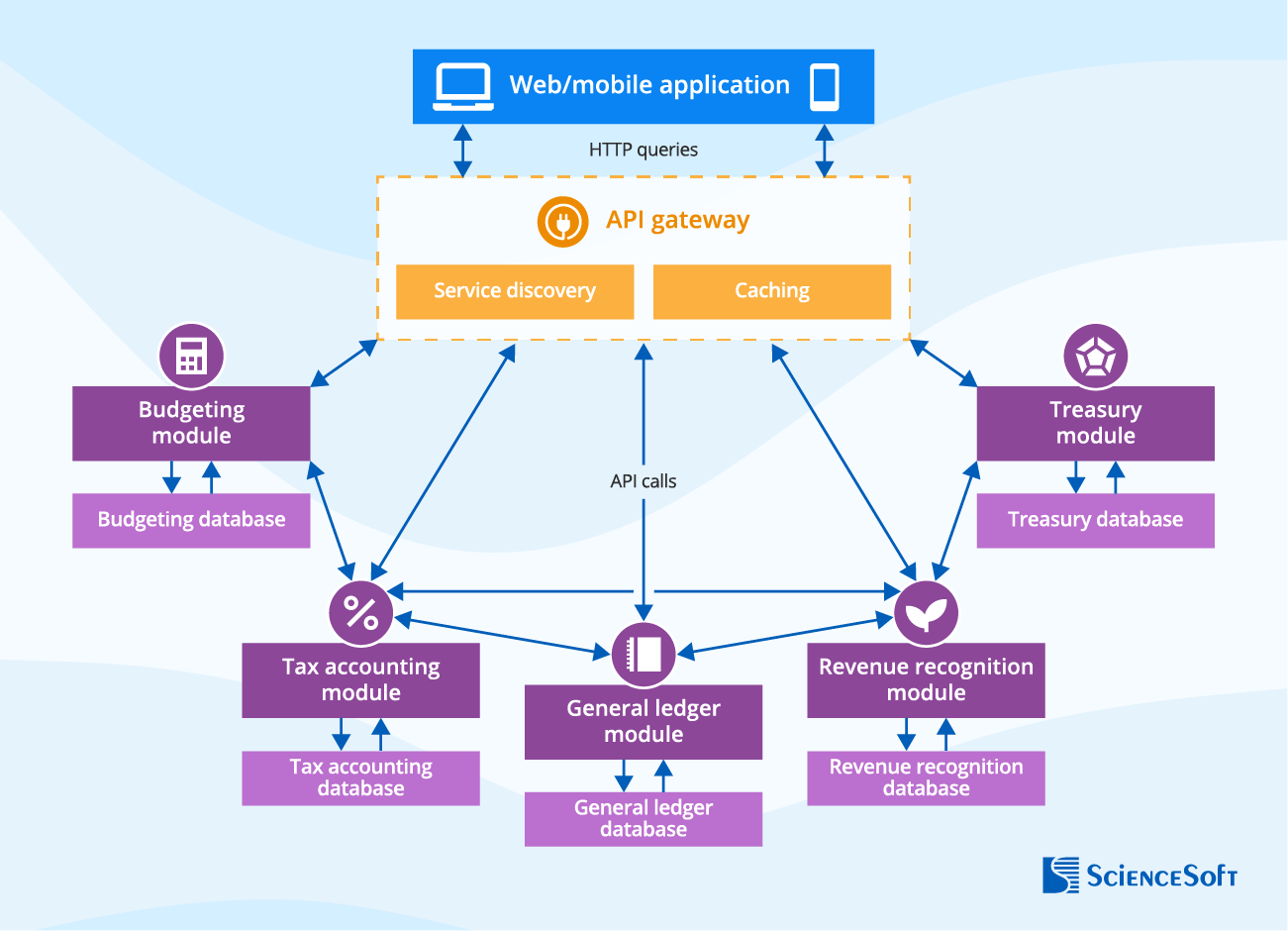

1. Implementing a solution composed of several ready-made or custom modules (or a combination of both), each automating a particular financial process and having its own data store. This option offers automation of all required financial activities and enables flexibility to independently evolve each solution’s module with new features as new business needs arise. However, the solution with such an architecture is resource-intensive to build and maintain and requires profound project management at the implementation stage.

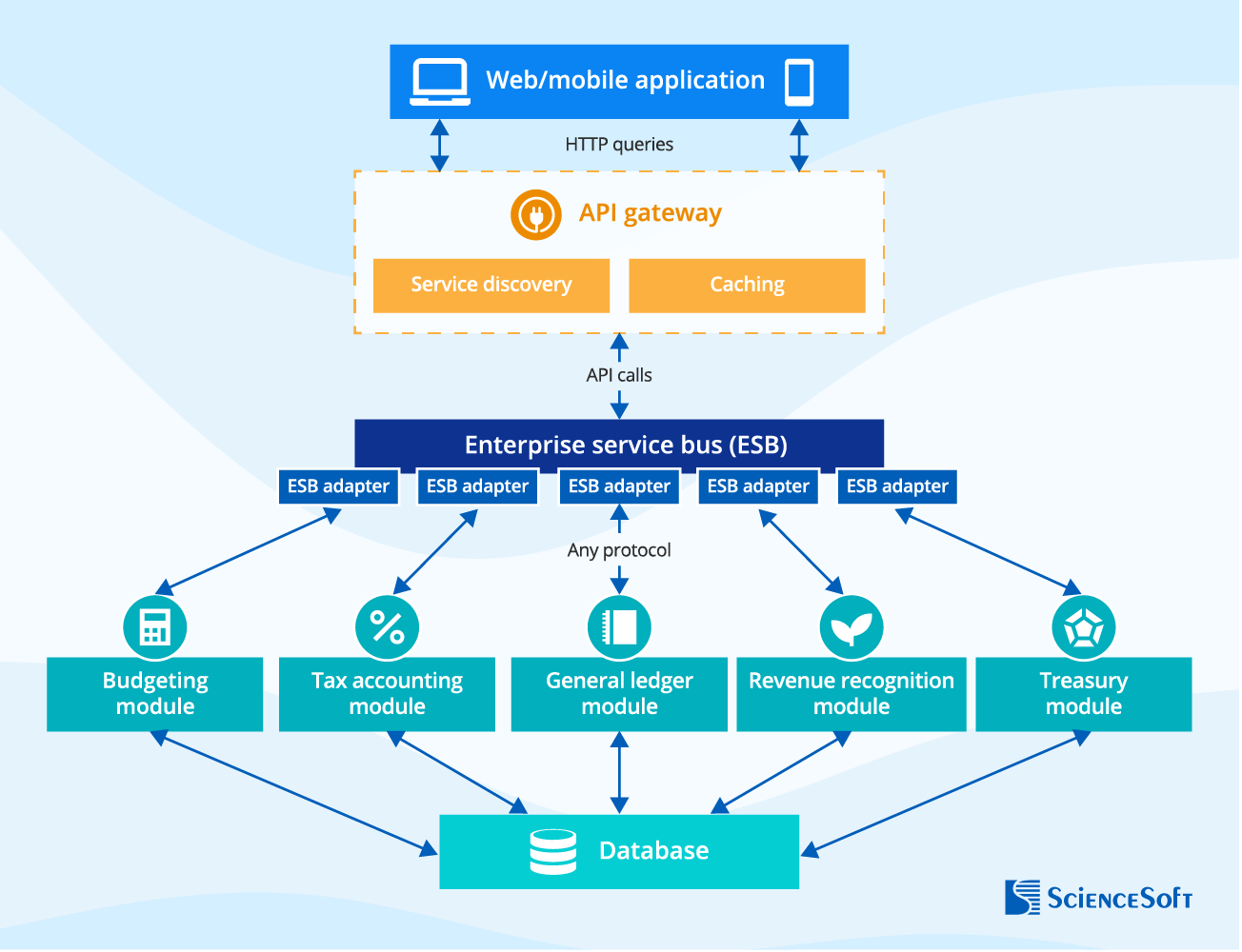

2. Implementing a custom-made highly integrated financial application. This option offers reduced software implementation time and simplified financial data governance due to centralized data storage. On the downside, a solution with such an architecture is difficult to evolve and scale. To connect it smoothly to other business-critical systems, you will also need to employ proper middleware (e.g., an ESB solution), which requires additional costs.

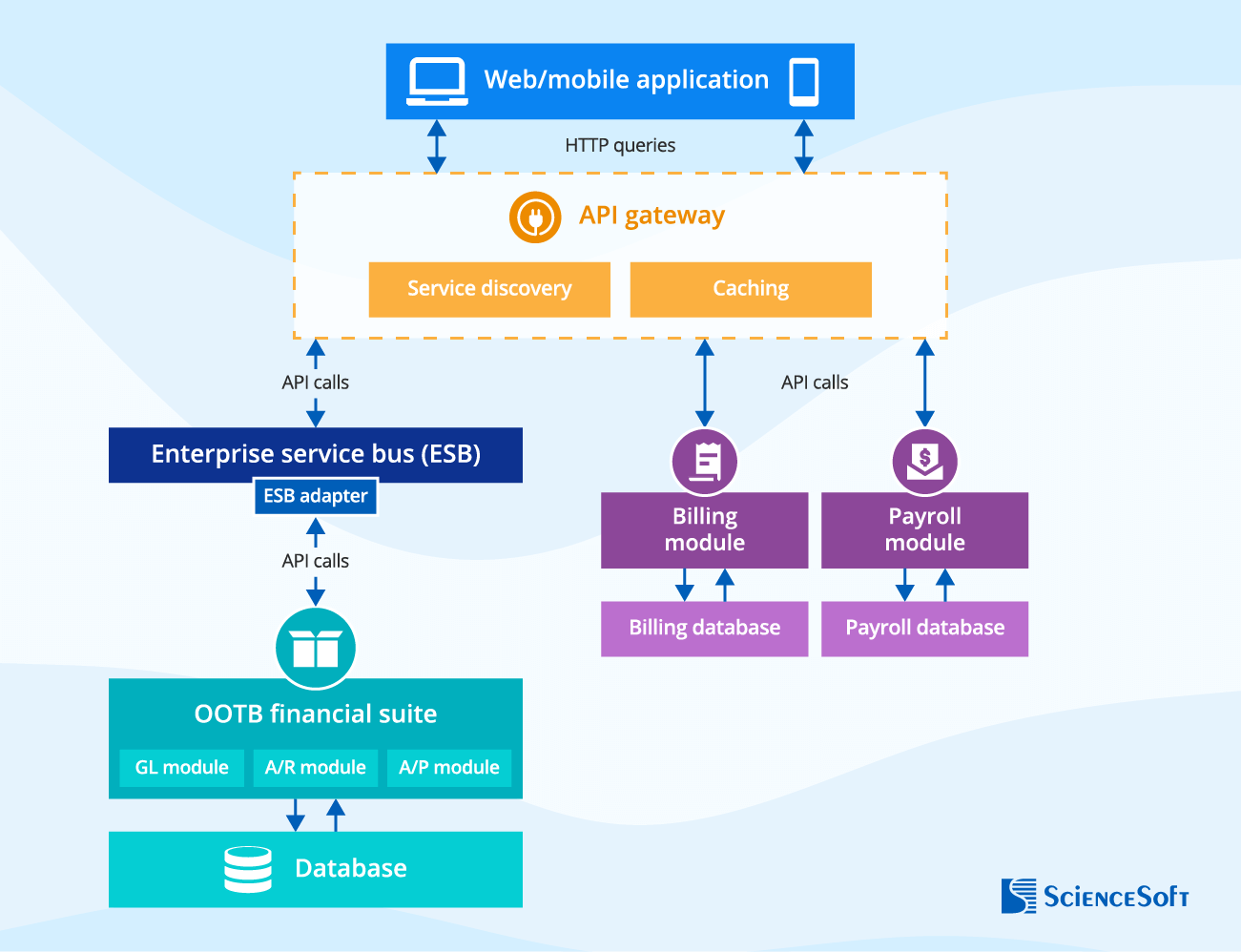

3. Implementing a ready-made highly integrated financial suite to cover core functionality for automation across finance and add several custom applications for areas where the suite cannot fully satisfy your company’s needs. This option allows quickly introducing automation of fundamental finance-related tasks in case you don’t need suite customization to meet your highly specific business requirements.

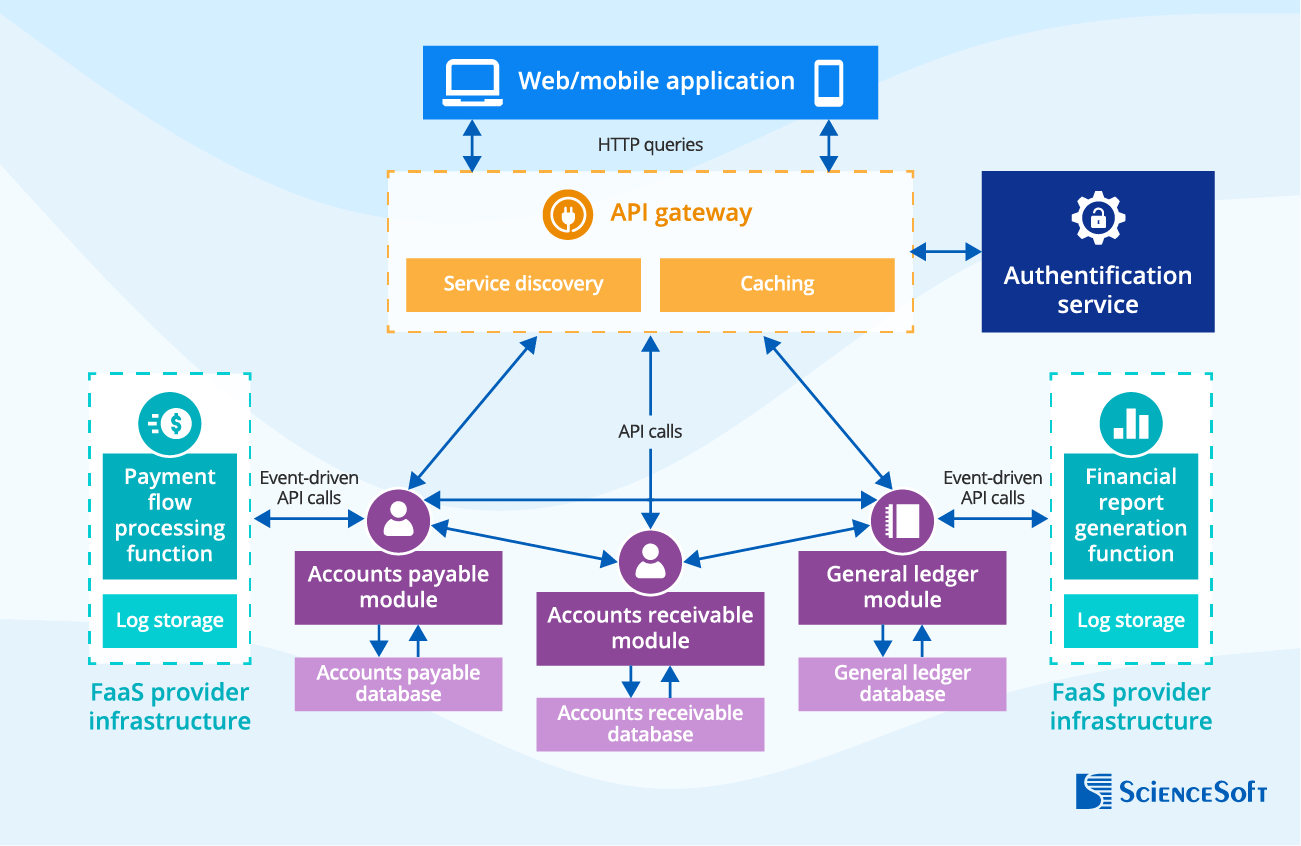

To get faster engineering and deployment of a cost-efficient and inherently scalable solution, consider adding serverless functions, each handling a particular financial team’s task. The functions can be independently invoked and auto-scaled on demand. This approach helps to effectively automate periodic workloads that require a lot of data processing, e.g., preparing regular financial reports or processing scheduled payment flows.

Which Approach to Finance Automation Fits Your Needs Best?

Answer a few simple questions and find out whether you should opt for a custom solution or a ready-made automation tool.

Do you need to automate specific financial tasks, e.g., calculation of regional taxes, investment accounting, or creating debt collection queues based on non-standard priority rules?

Do you want to leverage AI-supported finance automation, e.g., to predict financial performance, get intelligent advice on financial planning, or spot accounting fraud?

Do you need financial management software providing compliance with the latest corporate finance regulations of the countries you operate in?

Do you need to integrate your automated finance software with multiple back-office systems or legacy tools?

Do you operate in a regulated industry (e.g., healthcare, BFSI, defense, public sector) and need advanced financial data security?

Do you need a corporate finance solution with various interfaces for different roles in the financial management team (e.g., accountants, financial analysts, auditors)?

Do you plan to evolve the automation solution with new functional and non-functional capabilities in order to adjust it to changing business and legal requirements?

Do you have large teams involved in corporate finance processes and look to avoid the software fees associated with the per-user subscription model?

Please tell us a bit more about your needs

Answer at least 3 questions to get results.

You can go with off-the-shelf finance automation software

Looks like market-available solutions are a viable option to meet your finance automation needs. Turn to ScienceSoft if you need help with choosing the optimal ready-made tools, their implementation, customization, or integration with your existing systems.

You definitely should consider custom development

A tailor-made finance automation solution will help you reap the unique benefits that market-available software cannot offer. Turn to ScienceSoft to get the detailed assessment of a custom financial process automation system’s feasibility for your business situation.

Custom finance automation software is your best choice

Looks like market-available finance automation tools don’t fit your specific business requirements and won’t be able to provide the expected operational and economic feasibility. Turn to ScienceSoft to get a consultation on custom financial automation software development and receive cost and ROI estimates.

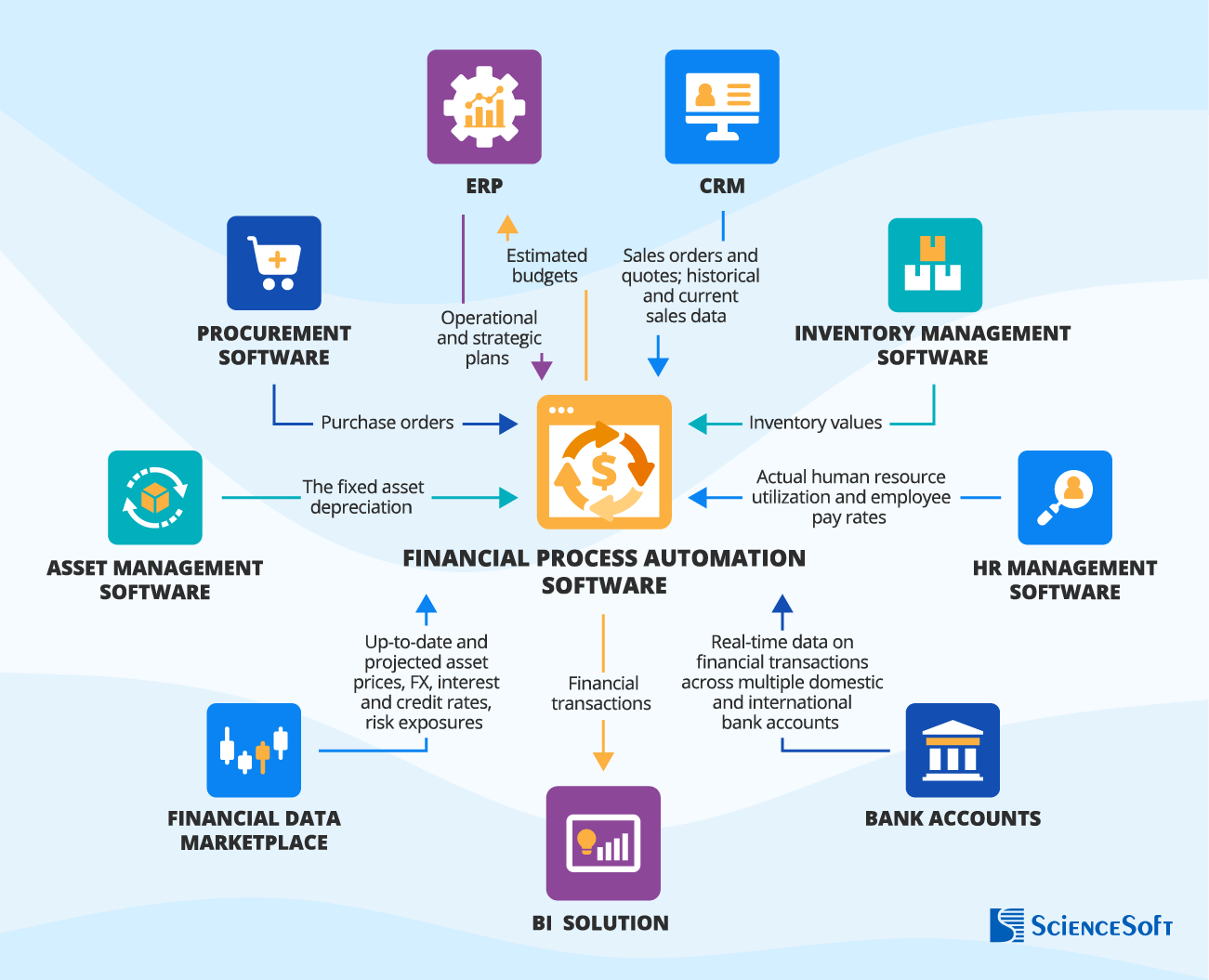

Key Integrations for the Financial Process Automation System

To ensure maximized automation across financial processes, ScienceSoft recommends that finance automation tools should be integrated with the following business-critical systems:

- ERP – for accurate automated financial planning and budgeting; to consider budget limitations during operational and strategic activities.

- CRM – for the automated input of customer data, payment terms, price, and quantity of ordered goods when generating invoices; for the automated calculation and recording of sales revenue in the general ledger, accurate revenue recognition, and data-driven revenue forecasting.

- Procurement software – for the automated purchase order recording in the A/P ledger.

- Inventory management software – for accurate recording of inventory values on inventory purchasing and utilization.

- Asset management software – for the automated recording of the fixed asset depreciation.

- HR management software – for the automated payroll calculation.

- Bank accounts – for faster reconciliation.

- Financial data marketplace – for the automated investment portfolio valuation, fair value calculation, building data-driven hedging strategies.

- BI solution – for advanced financial performance analytics and seamless financial reporting automation.

Success Factors for the Finance Automation Solution

In our financial process automation projects, we always cover a range of important factors to drive high value across the client’s corporate finance workflows and prevent the risks of operational inefficiency, low software adoption, insufficient data security, and regulatory non-compliance.

Maximized automation of rule-based financial tasks

To eliminate manual efforts across financial processes and free up the financial team for high-value, strategic financial activities.

AI-powered analytics

To accurately predict various financial performance variables and provide the financial team with intelligent recommendations on optimal decisions across financial processes.

User-friendly financial data visualization

To provide well-structured representation of financial data and financial performance patterns for facilitated insights on financial risks and opportunities.

Easy-to-use APIs

To facilitate integration between the solution’s modules and enable smooth connection to other business-critical systems.

Legal compliance

To ensure creation of financial documents in accordance with the latest global, country- and industry-specific regulations, such as GAAP, SOX, ZATCA regulations (for the KSA), GDPR (for the EU), etc.

Powerful security capabilities

To ensure the protection of sensitive data and minimize the risk of malicious user activities.

How to Automate Financial Processes

Below, we describe the key steps ScienceSoft takes to introduce effective financial workflow automation:

1.

Business analysis, scoping, and estimation

Our consultants explore your as-is finance workflows, analyze your automation needs, and audit your existing financial management tools (if any). We also determine relevant legal compliance requirements (e.g., IFRS, GAAP, ZATCA) for your corporate financial processes. Based on the collected information, we define the finance automation project scope and estimate the resources (team, timelines, budget) needed to complete the project.

Sometimes, the modernization of legacy financial software is a much more budget-friendly way to automate finance. At the initial project stage, we always analyze the feasibility of financial software revamp vs. replacement to define the winning approach.

2.

Financial software design

With your unique requirements in mind, we create a comprehensive list of automation features, including advanced functionality powered by AI or blockchain (if needed). Our architects define the optimal approach to financial process automation and design a secure and scalable architecture for your financial solution. We also create convenient, user-friendly UX and UI tailored to various financial roles (accountants, financial analysts, etc.).

With a complete software design, we can accurately plan the project timelines. We share a time-framed work breakdown structure with our clients to make sure all the stakeholders are aware of the planned initiatives.

3.

Financial software development

Based on the selected approach, we engineer financial process automation software from scratch, build a solution based on a selected platform (e.g., Microsoft Power Apps), or implement a ready-made financial management tool. If modernization is the most feasible option, we revamp your solution’s codebase, architecture, and tech stack, migrate it to the cloud, and upgrade it with the required features.

Using low-code platforms can substantially reduce the costs of creating a solution for finance automation. In ScienceSoft’s financial process automation projects, we rely on Microsoft Power Apps to offer 74% lower development costs.

4.

Integration

To establish a cohesive automation environment, we integrate financial software with the required corporate systems (e.g., CRM, inventory management, a BI solution), external data sources (bank accounts, financial data marketplaces, etc.), and third-party tools (payment gateways, messaging services). During this step, we also perform financial data migration from legacy systems or spreadsheets to the new solution.

5.

Quality assurance

Even a minor flaw in financial software code can lead to operational errors, data breaches, financial losses, and even legal fees. Knowing this, we run rigorous testing of financial software (including functional, usability, performance, and security testing) prior to deployment and promptly fix all the revealed issues.

6.

Establishing security

We enhance financial software with robust cybersecurity features like multi-factor authentication, data encryption, and AI-based fraud detection. Our security experts also implement powerful infrastructure security mechanisms to protect the solution and data it stores from employee negligence and cyberattacks.

7.

Employee training

Your financial teams may be reluctant to abandon their old routines, slowing down software adoption and reducing potential payback. ScienceSoft’s experts can draw up user training materials and conduct employee training to encourage your finance specialists to shift to digital workflows and help them quickly learn how to apply automation in their daily tasks.

Learn more about the specifics of each stage, required team roles, and possible cooperation models in ScienceSoft’s comprehensive guide to corporate finance digitalization.

Tech Stack for Financial Process Automation

To deliver effective finance automation solutions, ScienceSoft relies on a range of robust technologies and tools, including:

Low-code development

AI

Machine learning platforms and services

Machine learning frameworks and libraries

DevOps

Containerization

Automation

CI/CD tools

Monitoring

Blockchain

Smart contract programming languages

Frameworks and networks

Cloud services

Financial Process Automation Costs

The cost of implementing automation in finance department varies greatly depending on:

- The type of the finance automation solution’s architecture.

- The number and complexity of the solution’s functional modules.

- The degree of automation: implementation of robotic process automation (RPA) and AI-powered features.

- The volume of data that needs to be migrated from the spreadsheets and/or legacy financial software.

- The number and complexity of integrations with corporate systems, and more.

From ScienceSoft’s experience, engineering a custom financial process automation system of moderate complexity costs around $200,000–$500,000. A fully-featured solution that enables end-to-end finance workflow automation for large enterprises may cost $500,000–$1,500,000+.

Want to know the cost of your accounting solution?

Benefits and ROI of Automating Finance

Financial process automation can bring 200–290% annual ROI, driven by the following benefits:

Higher employee productivity

Financial process automation software eliminates low-value, error-prone manual workflows and supports decision-making, which drives an over 80% improvement in the productivity of financial teams.

Faster workflows

Finance automation is a way to avoid delays associated with lengthy and cumbersome manual processes and achieve up to 2x faster financial close, 2–3x faster billing, 85%+ faster approval of journal entries, payments, and financial documents.

Cost savings

Automation brings a significant reduction in finance-associated operational expenses, including labor, inventory, financial transaction and document processing costs. Automated invoice processing alone can bring 80–90% cost savings.

Minimized risks

With an automated finance system, you get 100% visibility into your company’s financial performance and can promptly spot any emerging risks to take the proper loss prevention steps.

Financial Process Automation with ScienceSoft

In financial software development since 2007, ScienceSoft helps companies build reliable automated finance solutions.

Consulting on finance automation

- Analysis of financial process automation needs.

- Discovery of the company's finance function, roles, financial management tools and their integration points.

- Suggesting the optimal functionality, solution architecture, and tech stack to automate finance.

- Preparing a plan of integrations with the required systems.

- Implementation cost & time estimates, ROI calculation.

Implementation of finance automation

- Automated finance solution conceptualization.

- Architecture design.

- Engineering the finance process automation system.

- Solution integration with the required systems.

- Quality assurance.

- User training in a preferred format.

- Continuous support and evolution (if required).

ScienceSoft’s Clients Say

About ScienceSoft

ScienceSoft is an international IT consulting and software engineering company headquartered in McKinney, Texas. Since 2007, we've been helping businesses implement effective automation in finance. Being an ISO 9001 and ISO 27001 certified company, we apply a mature quality management system and guarantee that cooperation with us does not pose any risks to our clients’ data security. If you are interested in getting a robust financial process automation solution, feel free to turn to ScienceSoft’s team.