Asset Tokenization in Investments

Solution Architecture, Technologies, Costs

In investment IT since 2007 and in blockchain development since 2020, ScienceSoft offers full-cycle tokenization services and custom tokenization solutions to help asset management companies boost asset liquidity and streamline investment transactions.

Investment Companies Are Rapidly Tokenizing — Market Poised to Grow 40x by 2030

In the last few years, there has been a surge in asset tokenization projects among traditional investment service providers and Web3-native players. In late 2024, tokenized securities accounted for more than $2.13 billion in assets under management (AUM) by BlackRock, Franklin Templeton, and other early movers who succeeded with tokenization technology.

97% of institutional asset managers agree that tokenization will revolutionize investments, and 70% plan to invest more in asset tokenization. The growing popularity of investing in tokenized funds is fueling the demand for tokenization. According to KPMG, in 2024, over 90% of institutional investors were expressing a keen interest in tokenized assets.

Boston Consulting Group (BCG) and ADDX anticipate that by 2030, the value of tokenized assets will reach $16 trillion (a 40-fold increase from 2022) and represent 10% of global GDP. The World Economic Forum believes that these projections may come true by 2027.

BCG stresses that the asset tokenization market may already reach maturity in 2026, so asset management firms should act swiftly to seize maximum financial benefits.

Opportunities driving investment firms to choose tokenization

Access to a broader investor base

Fractional asset ownership drives asset liquidity and reduces barriers to investing for previously uncovered lower-net-worth investors. Blockchain’s globally accessible infrastructure lets asset managers easily attract foreign investments.

High operational efficiency

Tokenized assets come with fully automated investment transaction processing, clearing, and settlement, bringing investment firms a 40%+ improvement in operational efficiency.

Quick settlements

Both domestic and cross-border transactions with tokenized funds are processed on blockchain within milliseconds and settled in seconds rather than days.

Reduction in costs

Automated operations and cost-effective processing of tokenized asset transactions with no financial and governmental intermediaries let investment firms cut asset management expenses by up to 50%.

Enhanced investor trust

Blockchain creates an entirely transparent, immutable record of tokenized asset transactions and offers advanced transaction security. This improves trust between asset managers and investors.

Asset Tokenization in Investments: How It Works

Asset tokenization in investments is used to represent tradeable real-world assets as digital tokens. A token can be created for the whole asset as well as a portion of it, which allows for shared asset ownership and partial trading.

Tokenized assets are issued, stored, and traded on the blockchain according to the rules specified in dedicated smart contracts. Smart contracts can be designed to comply precisely with the investment company’s requirements for the supply, distribution, and valuation of tokenized assets (aka tokenomics), regulatory requirements for token investment transactions (e.g., SEC, FINRA, CMA), and technical requirements for transacting posed by the selected blockchain network.

An investment organization can offer and manage tokenized assets on its proprietary platform or a third-party platform (e.g., Securitize, Kaleido). The tokens can be further listed on other platforms for secondary trading. Crypto wallets enable secure self-custody of tokenized assets.

Real-world assets that can be tokenized on blockchain

Equities (stocks)

Bonds

Venture capital

Funds

E.g., mutual funds, ETFs, hedge fund shares.

Money market instruments

E.g., cash, treasury bills, CDs.

Trade finance assets

E.g., invoices, letters of credit.

Commodities

E.g., energy, metals, agricultural products.

Loans and mortgages

Infrastructure investments

Artworks and collectibles

Carbon credits

Six tech components you need to launch an asset tokenization solution

- Token smart contracts (protocols) will be automatically enforcing rule-based transactions across token issuance, distribution, and trading. They should also include proxy contracts that will allow you to update automation rules as business needs and regulatory requirements change.

- A blockchain network to host the transactional ledger and the sandboxed environment that executes smart contract code. Most platforms are hosted on the Ethereum blockchain.

- An asset issuance and management platform that will let you configure asset tokenomics and monitor tokenized asset transactions. You’ll have to either engineer it from scratch or adopt a third-party platform.

- Interoperability solutions (oracles) to communicate with systems and data sources outside the base blockchain network.

- Crypto wallet for the custody of crypto funds received from investment activities.

- Off-chain storage for cheap and scalable storage of transactional metadata and financial market data feeds.

Choosing between a custom vs. ready-made tokenization platform

Tokenizing on a third-party platform makes sense if you deal with only a few asset types and prioritize speed and simplicity. SEC-native platforms like Securitize offer go-to toolkits for compliant token minting and management, reducing time-to-market and regulatory burden.

But if your asset pools are large and complex or you want maximized control, flexibility, and long-term cost efficiency, a custom token issuance solution is a better option. With custom software, you can write your own business logic and compliance rules, avoid sharing data with any third parties, and establish smooth integrations with your internal systems. As a result, you reduce counterparty risk and avoid growing platform fees as your token offering scales. Plus, a custom platform puts your brand front and center, and you maintain a direct relationship with investors without a third party in between.

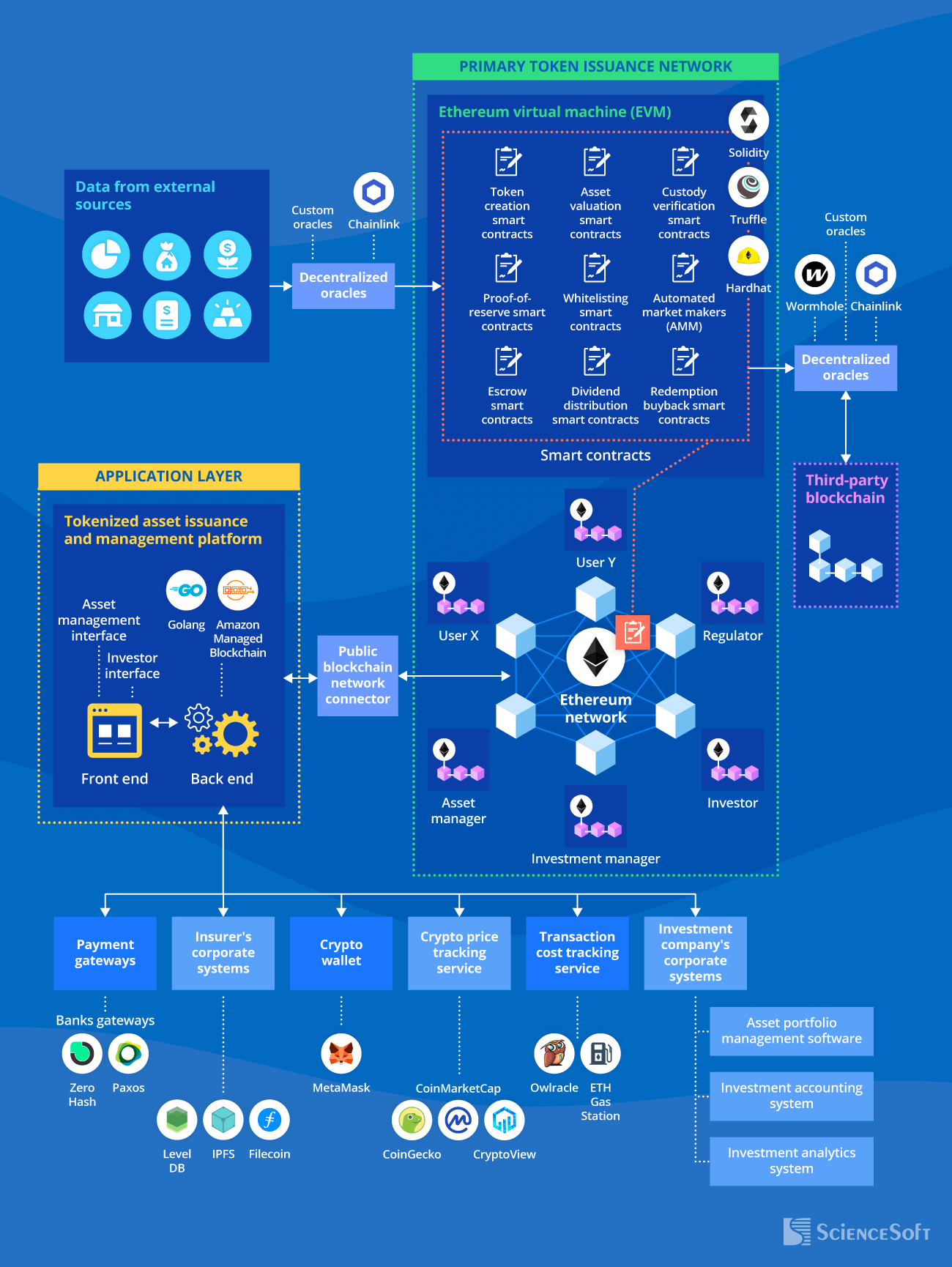

Architecture for Investment-Specific Asset Tokenization Solutions

Below, ScienceSoft’s blockchain consultants share a sample architecture that can be used as a robust foundation for asset tokenization solutions in the investment industry.

In the proposed architecture, asset tokens are issued on a custom token offering platform operated by an asset management organization. The platform offers role-specific interfaces for investment professionals to manage tokenized assets and related transactions and for investors to purchase asset fractions.

Smart contracts are hosted and executed on the Ethereum blockchain, a scalable, interoperable L1 network designed specifically to accommodate smart contracts and dApps. It’s costlier than L2 blockchains (Avalanche, Polygon, Arbitrum, etc.) but ensures stronger security and integrity for initial token offerings. Tokenized asset transactions (issuance, valuation, selling, dividend payment, etc.) are recorded in Ethereum’s public blockchain ledger and are visible to all investment parties.

Oracles enable the import of investment-relevant data from off-chain systems (e.g., stock indices, FX data, and commodity prices from capital market data platforms). They also enable tokenized asset bridging across other blockchains for secondary trading.

Transaction-related documents like formal investment orders, deal agreements, and ownership transfer forms are stored in the off-chain decentralized storage.

Why avoid primary investment token issuance on Layer 2 networks

Although Layer 2 blockchains like Polygon or Avalanche offer cheaper and quicker transactions, I recommend investment firms not to use them for primary token issuance. Layer 2s rely on the main network for final proof of settlement but apply their own consensus and bridging mechanisms for validating transactions and submitting them to the mainnet. Every additional mediation layer increases security and integrity risks, which is unacceptable for investments. In contrast, Ethereum’s direct, single-layer proofs ensure strong asset integrity and safety. A winning strategy for security, trust, and broader investor reach would be to issue asset tokens on the mature Ethereum network and then bridge them to selected L1 and L2 networks.

Benefits of the proposed architecture

ScienceSoft’s architecture and technology choices aim to optimize the cost of developing and operating the tokenization solution while ensuring its accuracy, security, and smooth performance:

|

|

Developing asset tokenization software on the Ethereum main network lets investment companies ensure the integrity and security of tokenized assets. |

|

|

Frameworks like Truffle and Hardhat provide intuitive integrated development environments (IDE) and prebuilt logic components for smart contracts. This streamlines and accelerates the development of smart contracts for tokenization. |

|

|

Decentralized oracles (by Chainlink, WormHole, or custom-built) run consensus-based validation of off-chain data prior to transmitting it to the blockchain. This helps ensure the reliability of external capital market data feeds and minimize security risks. |

|

|

Enterprise crypto wallets like MetaMask Institutional offer robust multi-party access controls, multi-signature transaction approvals, compliance management, and reporting features. Such wallets enhance security for complex collaborative workflows across tokenized assets. |

|

|

Storing large-size investment document files in decentralized storage networks like IPFS and Filecoin helps avoid costly on-chain storage. This option is also 70%+ cheaper than popular centralized storage like Amazon S3. |

Reliable Tech Stack for Asset Tokenization in Investments

In ScienceSoft's tokenization projects, we usually employ the following technologies and tools:

Smart contract development and testing frameworks

Blockchain frameworks and networks

Blockchain cloud services

DevOps

Containerization

Automated deployment and configuration

Why writing custom code is inevitable for tokenization

Prebuilt frameworks make the development of asset tokenization solutions much easier. However, some components still require extensive custom coding. The primary example is smart contracts, which serve to automate unique tokenomics across each investment company’s specific assets. In my practice, smart contract engineering is one of the most complex parts of any tokenization project. You need both robust tech skills to ensure protocol quality and background in investments to design accurate automation rules.

How Investment Industry Players Succeed With Asset Tokenization

Franklin Templeton’s Tokenized Mutual Fund Attracted $410M

In 2021, Franklin Templeton, a global asset management giant with $1.6T+ in AUM, launched the first US-registered tokenized mutual fund Franklin OnChain U.S. Government Money Fund (FOBXX). The fund allows investors to use USDC stablecoin as a bridge for fiat investments and enables 24/7 asset transfers in sub-seconds.

FOBXX was originally tokenized on the Stellar blockchain and was issued as BENJI token on Franklin Templeton’s proprietary platform. The company further expanded its token to Polygon, Aptos, Avalanche, Arbitrum, Ethereum, and Base networks. Franklin Templeton also introduced iOS and Android Benji Investments apps to facilitate tokenized asset trading for US investors.

As of December 2024, FOBXX was the second-largest tokenized fund with a $410 million market cap and the third-largest player on the US market of tokenized securities (16.6%).

Key techs: Stellar, Polygon, Avalanche-C, Aptos, Arbitrum, Ethereum, Base, Rust, WASM, Solidity, Zero Hash, Sui.

BlackRock’s Tokenized Fund Became #1 by AUM Within 40 Days

In March 2024, BlackRock, the world's largest investment company by AUM, launched its first tokenized fund, the BlackRock USD Institutional Digital Liquidity (BUIDL). BlackRock’s assets were tokenized by Securitize and issued on the Ethereum network. BNY Mellon was involved in enabling BUIDL interoperability between blockchain and centralized market platforms.

Through the tokenization, BUIDL gives investors broader access to on-chain fund offerings and provides near real-time trade transaction processing. Investor KYC/AML checks, asset ownership transfers, settlements, and dividend accruals and distributions are fully automated. BUIDL became the world’s largest tokenized fund by AUM in less than 40 days.

Tokenization remains a key focus of BlackRock’s digital asset strategy. In November 2024, BlackRock announced that BUIDL would be launching new tokenized asset classes on Aptos, Arbitrum, Avalanche, and Polygon blockchains.

Key techs: Ethereum, Solidity, Securitize, BlackRock Aladdin®, Zero Hash, Wormhole.

Other prominent examples of asset tokenization in investments: gold tokenization by HSBC, private equity tokenization by Hamilton Lane, collateral tokenization by JP Morgan, structured note tokenization by UBS, and real estate tokenization by Elevated Returns.

Tokenizing Real Estate: Revolution or Hype?

For 10 years, asset owners in the US have consistently ranked real estate as the best long-term investment. Still, high costs and low liquidity historically hindered investor demand. See the interview with Mary Zayats, Financial IT Principal Consultant at ScienceSoft, to learn why tokenization is believed to transform real estate investing and what factors may slow its adoption.

ScienceSoft: 18 Years at the Forefront of Investment IT Innovations

- Since 2007 in software engineering for the investment industry.

- Since 2020 in blockchain development and asset tokenization.

- Solidity, Rust, Vyper, Golang, Java, Python, C++, and JavaScript developers on the team.

- Compliance experts with 10+ years of experience to ensure that an investment asset tokenization solution meets the requirements of SEC, AML/CFT, GLBA, FINRA, NYDFS, GDPR, and more.

- Since 2003 in cybersecurity to protect tokenized asset software from cyber threats.

- ScienceSoft has been featured among the Top 10% European Solidity (Ethereum) Development Companies by Aciety for the second consecutive year.

- The quality of ScienceSoft's services is confirmed by one of the world's top 3 asset managers with $5T+ in AUM.

Our awards, certifications, and partnerships

Cost of Tokenizing Assets in Investment

From ScienceSoft’s experience, an investment asset tokenization project lasts, on average, 3–6 months and costs around $200,000–$500,000+, depending on the type of assets to tokenize, the chosen tech stack, the number and complexity of smart contracts, and token interoperability requirements.

Wondering how much your tokenization project will cost? Use a cost configurator below to get a free estimate for your tokenized asset solution.

Learn the Cost of Your Tokenized Asset Solution

Simply answer a few questions about your asset tokenization needs. This will help our team estimate the cost for your unique case much quicker.

Thank you for your request!

We will analyze your case and get back to you within a business day to share a ballpark estimate.

In the meantime, would you like to learn more about ScienceSoft?

- Project success no matter what: learn how we make good on our mission.

- 4,200+ successful projects: explore our portfolio.

- 1,400+ incredible clients: read what they say.