Asset Tokenization: Complete Overview of Tokenized Assets

In IT since 1989 and in blockchain and cryptotech development since 2020, ScienceSoft helps companies from 30+industries tokenize their assets.

Tokenized Assets: the Essence

Tokenized assets are blockchain-based tokens that represent the ownership over particular physical and digital assets. Asset tokenization is aimed to help companies leverage secure and transparent transfer of asset ownership, improved asset liquidity, fast and cost-effective asset trading.

With a 50x increase predicted between 2022 and 2030, from $310 billion to $16.1 trillion, tokenized assets are expected to make up 10% of global GDP by the end of the decade.

- Steps to tokenize assets: Select an asset to tokenize, create a tokenomics model, choose a blockchain platform for asset tokenization, develop smart contracts, integrate a crypto wallet, launch the token for trading on primary and secondary markets.

- Cost of asset tokenization: $100,000–$300,000+. You're welcome to use our free calculator to estimate the cost for your case.

- Average timeframes for the tokenization of assets: 3–6 months.

Assets ScienceSoft Helps Tokenize

Intellectual property

Patents, copyrights, trademarks, trade secrets.

Physical property

Fleet, equipment, luxury goods (cars, apparels, accessories).

Physical commodities

Energy, precious metals and stones, agricultural products like coffee, wheat, beans, etc.

Artworks and collectibles

Antiques, coins, stamps, books, paintings, sports memorabilia, pieces of digital art.

Medicines

Medical and pharmaceutical products, clinical trials.

Tickets

Purchased and free tickets, loyalty/reward points.

In-game assets

Characters, player cards, pieces of virtual land, skins, weapons.

Asset Tokenization is Booming, Real Estate to Ride the Wave

Tokenization lets asset owners improve asset liquidity and trade without geographical boundaries and traditional intermediaries. In our interview with Mary Zayats, Financial IT Principal Consultant at ScienceSoft, we explore how tokenization is disrupting the asset management landscape and what factors may hinder its adoption, using real estate as an example.

ScienceSoft’s Asset Tokenization Services

Having proven expertise in building blockchain-based solutions, ScienceSoft provides full-cycle consulting and development services for the tokenization of assets. We ensure that the project's agreed time and budget are met and that uncertainties are handled agilely.

Key Capabilities Tokenized Assets Provide

Asset-backed tokens and underlying smart contracts provide unique capabilities to meet specific asset management needs, improve asset liquidity, and streamline asset management.

Fractional asset ownership

A digital token can be created for a user-defined portion of an asset. This introduces the capability for shared ownership of an asset and partial asset trading.

Peer-to-peer asset trading

The ownership of tokenized assets can be transferred directly between asset owners and investors without the involvement of third-party intermediaries, such as governmental entities or financial institutions.

End-to-end asset traceability

Asset owners and investors can trace the whole history of activities performed over tokenized assets in a distributed ledger. It helps verify asset origin and provenance and prevent fraud and counterfeiting.

Smart contract-based automation

Smart contracts automatically enforce fixed actions related to tokenized assets upon particular events pre-defined by token issuers. For example, asset ownership is transferred to the investor upon payment for the asset.

Automated recordkeeping

All transactions on tokenized assets, including those initiated by smart contracts, are automatically validated, timestamped, cryptographically encrypted, and recorded in the immutable ledger available to asset owners and investors.

Asset Tokenization Solutions by ScienceSoft

Asset tokenization platforms

Decentralized platforms for secure and legally compliant issuance and crowdsale of asset-backed tokens.

Asset tokenization smart contracts

Protocols that automate execution of pre-programmed rules related to the issuance and trading of tokenized assets.

Tokenized assets

Blockchain-based tradeable tokens backed by the underlying tangible and intangible assets.

Tokenized asset management solutions

Digital wallets for storing crypto keys and transacting various types of tokenized assets.

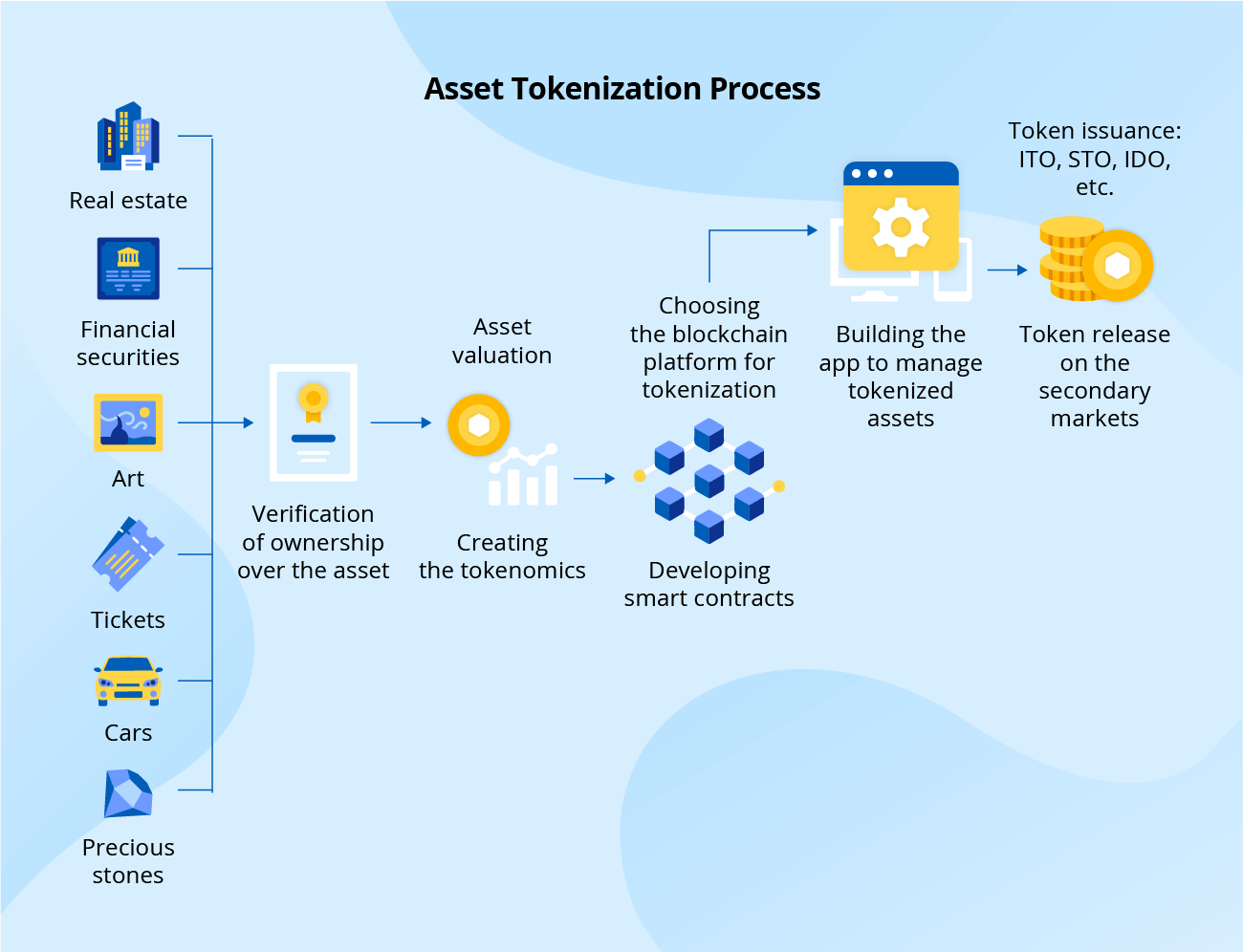

How to Tokenize an Asset

Asset tokenization is a multi-step process that involves creating the tokenomics for the selected asset type, building smart contracts to issue the tokens, and establishing the dedicated framework to operate and trade the tokenized assets.

An asset tokenization process with ScienceSoft looks as follows:

1

Select an asset to tokenize

We analyze your business needs, the needs of your target audience, and market trends to determine the assets to tokenize and ensure the economic feasibility of tokenization.

2

Define the fitting token type

Depending on the type of asset to tokenize, we can issue utility tokens, security tokens, governance tokens, or NFTs.

3

Determine compliance requirements

Our in-house compliance experts analyze global, country- and industry-specific legal regulations relevant for the asset (e.g., SEC regulations for financial securities, HIPAA for healthcare assets).

4

Create tokenomics

We deliver a tokenomics model for the tokenized asset, which defines token supply and demand characteristics, outlines token value, describes the rights associated with assets.

5

Choose the optimal blockchain platform for the tokenization of assets

With your unique requirements in mind, we choose an optimal blockchain platform to tokenize your assets on. We can also build an asset tokenization platform on top of your existing blockchain network.

6

Develop smart contracts

We design and build smart contracts to tokenize an asset, program the asset's behavior, and automate compliance check with relevant legal regulations.

7

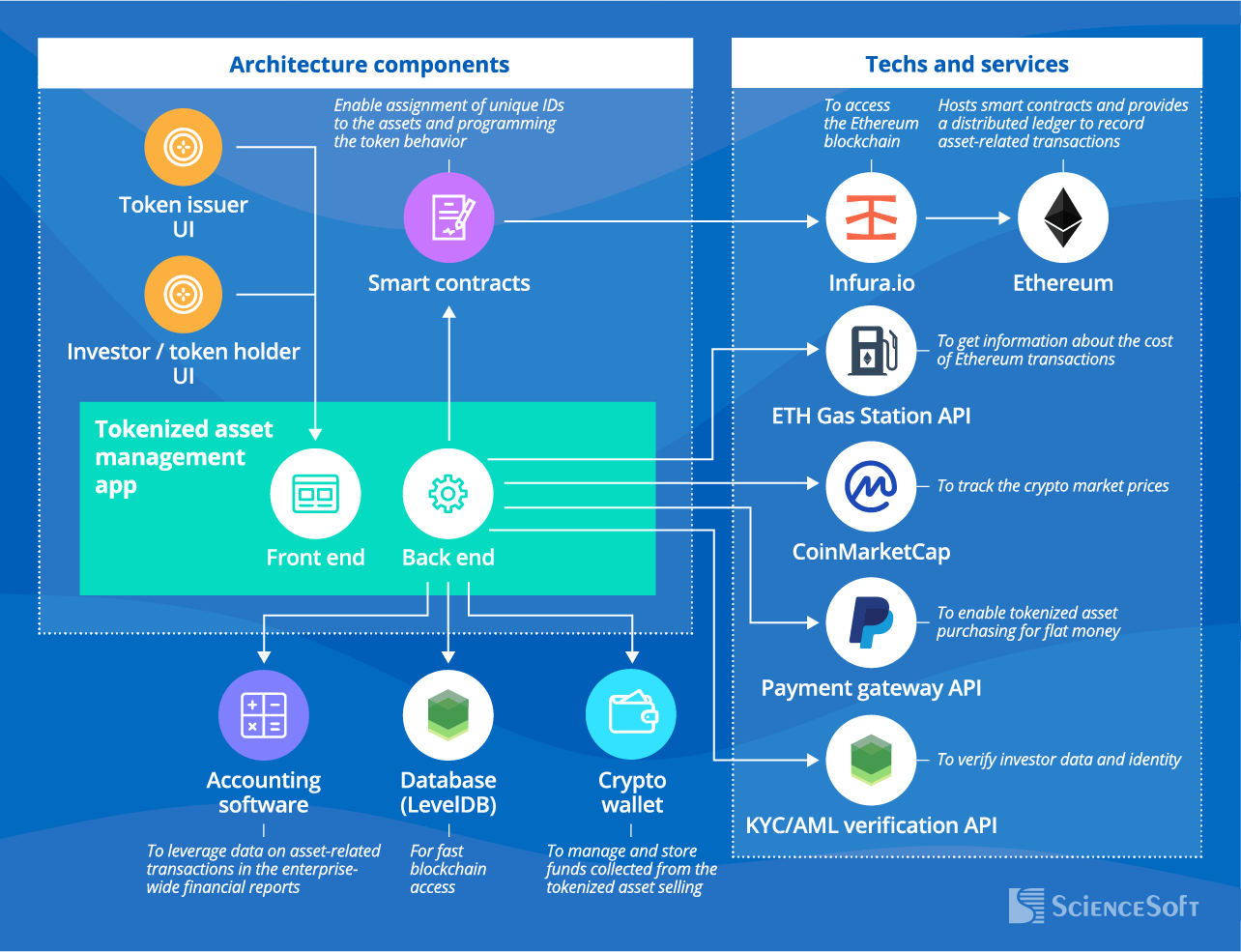

Implement a solution for tokenized asset management

We can develop a custom blockchain-based asset management application for token issuers and investors/token holders or establish the integration with a selected third-party crypto wallet.

8

Integrate the tokenized asset management solution with the required systems

We connect the solution to accounting software, payment gateways, KYC/AML verification services, trading platforms, and other relevant systems.

9

Issue the tokens

We run token issuance in the form of ITO, STO, IDO, etc. on your own or third-party blockchain platform to enable token distribution or primary purchasing of the tokenized asset by investors.

10

Release the tokens on third-party trading platforms

(optional) We list your tokens on selected token exchanges to enable tokenized asset trading on a secondary market.

An illustrated example of Ethereum-based tokenization of assets by ScienceSoft

Hide

Asset Tokenization Costs

The cost and duration of asset tokenization vary greatly depending on:

- The type of assets to tokenize.

- The required type of a token.

- The chosen blockchain platform for the tokenization of assets.

- The number and complexity of smart contracts.

- Cross-chain interoperability requirements for digital tokens.

- The number and complexity of applications (web, mobile, desktop) for token issuers and investors to manage their assets.

- The type of an asset management solution (a custom or a third-party crypto wallet).

According to ScienceSoft’s experience, an asset tokenization project of average complexity lasts 3–6 months and may cost around $100,000–$300,000.

Want to know the cost of your asset tokenization project?

Benefits You Get from Tokenizing Assets

Increase in revenue

due to enhanced liquidity of a company’s assets, which drives their growth in value and reduces barriers to investment.

Reduction in costs

of transfer of asset ownership rights and settlement due to peer-to-peer asset trading and no need for third-party services.

Minimized risk

of financial losses associated with fraud and penalties for non-compliance due to token development, issuance and trading in accordance with relevant standards and regulations.

Eliminated human involvement

with token-related transactions processing due to smart contract-based automation, which provides an opportunity to optimize employee workload and cut labor costs.

Factors that drive high ROI for asset tokenization

ScienceSoft keeps to the following practices to increase the chances of asset tokenization success:

- Thorough analysis of the available blockchain platforms for asset tokenization to choose the one that provides optimal transaction prices and ensure economic feasibility.

- Cross-chain interoperability of tokenized assets to ensure their smooth performance across different blockchain systems, trading platforms, and crypto wallets.

- Maximized automation across issuing, managing and trading tokenized assets to eliminate manual processing of asset transactions, increase their speed and accuracy.

- Seamless integration of the tokenized asset solution with relevant corporate software to eliminate double data entry on asset transactions.

- Focus on security to ensure protection of tokenized assets and sensitive financial and business data stored in the blockchain.

- 100% compliance with all required global, region- and industry-specific standards and regulations to avoid legal penalties.

Hide

Blockchain Platforms We Use to Build Asset Tokenization Solutions

Asset tokenization on a third-party open-source blockchain platform is a fast and cost-effective way to issue asset-backed tokens for companies that don’t have an enterprise blockchain network in place. Below, we list the popular decentralized platforms we rely on in ScienceSoft’s asset tokenization projects.

Ethereum

Description

The most popular blockchain to tokenize assets. Ethereum offers a range of established standards and frameworks to easily design and launch various types of tokens. However, Ethereum’s popularity results in low transaction processing speed and drives high transaction costs, which makes the platform economically unfeasible for smaller businesses.

Best for

Large enterprises looking to tokenize physical assets.

Stellar

Description

Enables fast transaction processing and instant platform scalability while charging significantly lower cost per transaction, compared to Ethereum. Stellar employs the provably safe and fault-tolerant Federated Byzantine Agreement (FBA) consensus protocol and offers the proprietary compliance protocol to ensure tokenized asset transactions meet AML/KYC requirements.

Best for

Midsize and large companies that need to tokenize highly regulated assets.

Tezos

Description

Relies on the Proof-of-Stake consensus protocol, which provides low transaction fees. Michelson, a Tezos’s domain-specific language for writing smart contracts, is designed to facilitate formal verification of smart contracts to assure their high-level security.

Best for

Midsize businesses that need cost-saving physical and digital asset tokenization.

About ScienceSoft

ScienceSoft is a global IT consulting and software development company headquartered in McKinney, Texas. We help businesses tokenize various types of assets and build crypto asset management solutions. In our asset tokenization projects, we employ robust quality management and data security management systems supported by ISO 9001 and ISO 27001 certificates.