Trade Execution Management Software for Buy-Side

Features, development steps, and costs

ScienceSoft’s clients get custom execution systems that address the common shortcomings of ready-made tools, such as rigid features, restricted integrations, and limited control over trade transparency and trader experience. We architect EMS solutions for accuracy, interoperability, minimized latency, and cost-effective adaptability to new market and regulatory demands.

Trade Execution Management Software: Key Aspects

Trade execution management software (EMS) is used by buy-side firms as a centralized platform for orchestrating high-touch and algorithmic trading workflows across diverse trade facilities and asset classes. It automates tasks like order routing to best execution, trade analytics, and risk control.

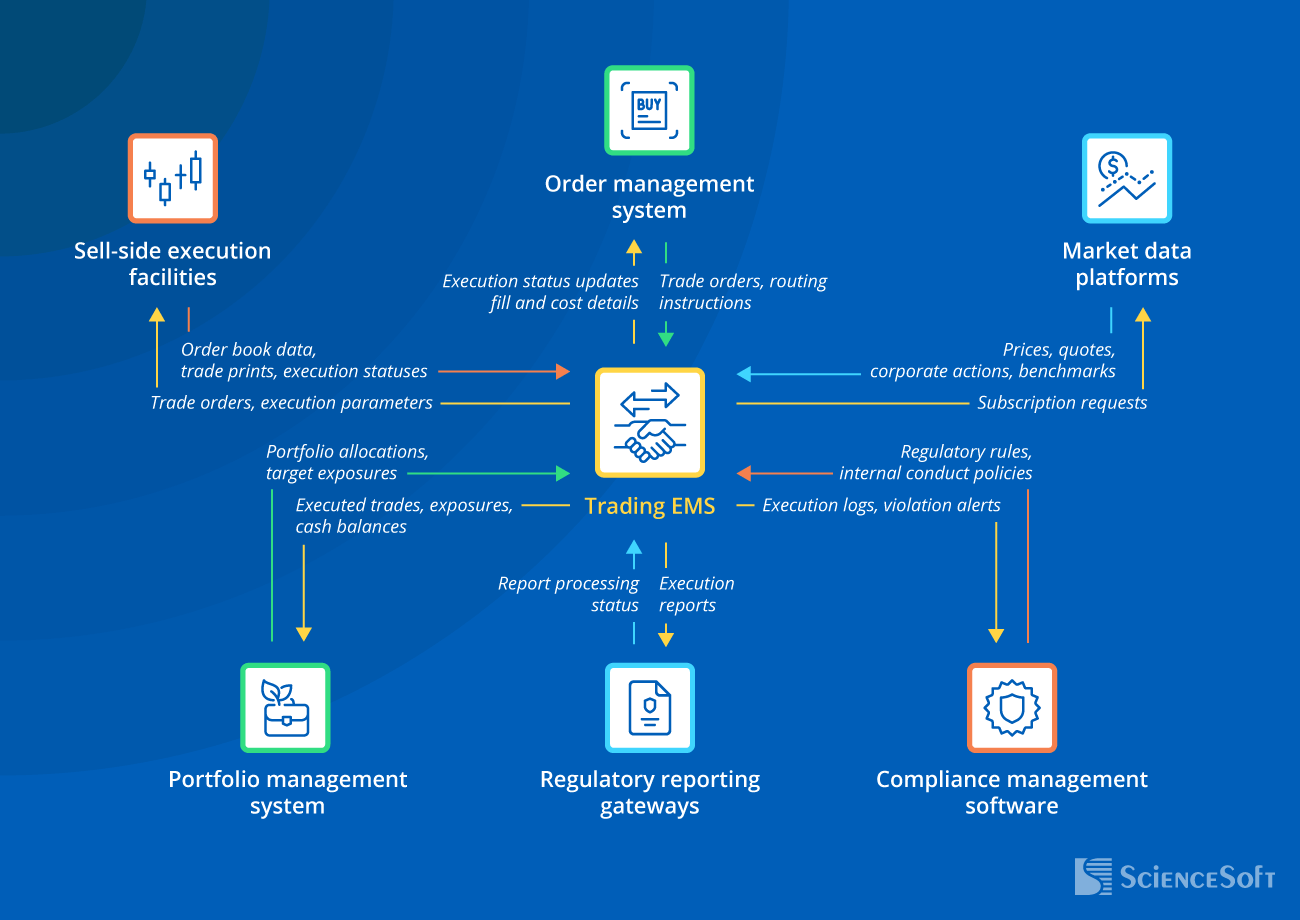

- Key integrations for a trade EMS: an order management system, trading venues, brokerages, compliance tools, and more.

- Implementation time: around 9–16 months for core EMS modules.

- Development costs: $400,000–$4,000,000+, depending on solution complexity. Use our free calculator to estimate the cost for your case.

Why Investment Firms Go for Custom Execution Systems

Custom execution management software is the preferred choice for investment firms that want to automate proprietary execution strategies and streamline complex, cross-asset trade workflows. Custom solutions give trading desks full ownership of execution logic and allow on-demand adjustment of instruction, algo selection, and routing rules. They can be built to support any required asset classes, including fixed income instruments, derivatives, and tokenized assets.

Custom EMS implementations also allow investment entities to gain an edge in trading speed. Custom solutions can be designed for ultra-low execution latency across the platforms of the company’s choice. Unlike off-the-shelf tools, custom systems offer interfaces precisely shaped around the firm’s unique trader workflows, driving faster manual execution and lower error rates.

Another advantage of custom software is that it can be integrated with any required systems, including legacy systems, local sell-side endpoints, and modern wealthtech tools. Equally important, custom solutions can be designed in compliance with any necessary trading regulations, including jurisdictional frameworks (e.g., SEC, FINRA for the US, MiFID II for the EU, CMA for the KSA) and asset-specific rules (e.g., CFTC’s rules for swap trade disclosure).

Increasingly, investment companies also go custom to leverage tailored features powered by artificial intelligence (AI). Custom EMS can include AI models designed to securely access the firm’s proprietary data, optimize execution strategies, and provide explainable and compliant insights. Such AI-powered systems let trading desks drive efficiency via intelligent automation while maintaining complete control over AI-supported operations.

Investment Entities That Benefit From Tailored Trade EMSs

ROI for an Automated Trade Execution Management System

According to a recent study by Coalition Greenwich, 100% of trade professionals believe execution management software gives them an edge while trading. Moreover, 90% note that EMS simplifies best execution and adherence to fiduciary duties. Automated execution handling, multi-venue connectivity, and advanced trade analytics are cited as the highest-return features.

Investment firms report the following gains with the tailored EMS that provides such capabilities:

Sources: Bloomberg, BNY, MarketAxess, SS&C.

Functionality of Trading Execution Management Software

Below, ScienceSoft’s consultants list the core and AI-supported features that lay the foundation for a robust trading EMS:

Pre-trade execution planning and market analytics

Strategy design

An intuitive rule builder lets traders construct proprietary execution strategies for diverse asset classes, markets, and venues. Each strategy can incorporate tailored instructions (timing, price thresholds, order slicing, etc.) and be stored as a reusable template. A custom EMS can include a library of production-ready algo strategies (TWAP, VWAP, Arbitrage, Program Trading, Iceberg, Sniper, Pegged, etc.) licensed from selected brokers. The software runs automated workflows for multi-party strategy approval.

Execution modeling

Traders can construct execution scenarios with tailored parameters like order size, trade window, venue mix, and transaction costs. The system calculates projected execution KPIs (profit & loss, fill ratios, implementation shortfall, slippage, etc.) based on sector-wide and custom formulas. The models can be stress-tested under configurable conditions, such as extreme demand, limited liquidity, or economic drawdowns. Model outcomes are visualized side by side for easier spotting of best-performing strategy configurations.

Price screening

EMS solutions aggregate live pricing data across target asset classes and display price streams in configurable watchlists. Traders can organize data views by tick, sector, region, venue, price range, and more. Custom systems can support template-based creation of quote requests, real-time processing of incoming quotes, and criteria-based comparison of quotes from multiple counterparties to automate RFQ workflows for complex instruments like OTC derivatives.

Liquidity monitoring

EMSs collect real-time liquidity data from multiple trading endpoints, consolidate the data into a unified view, and archive it for trade reconstruction and transaction cost validation. Traders can monitor venue-specific trade prints and order book data (bid and ask prices, volumes at each price level, spread dynamics, etc.). Configurable notifications alert traders about price movements, volume shifts, emerging depth imbalances, and other liquidity events.

Technical analysis

With a custom EMS, institutional traders can automatically calculate and track moving averages, OBV, ADX, RSI, MACD, MFI, Bollinger Bands, parabolic SAR, and any proprietary technical indicators. The software can present price dynamics via interactive charts (line, bar, candlestick, Renko) or other chosen visualization techniques. It instantly recognizes and highlights reversal, bilateral, and continuation patterns on live price feeds.

Venue analytics

A custom EMS can evaluate trading venues based on historical behavioral data (fill rates, response times, price improvement history, and more). To assess dark pool transparency and venue toxicity, the system applies rule-based scoring models with factors like fill size consistency, post-trade price drift, and adverse selection rates. Traders can define custom scoring rules and weights to reflect their own definitions of quality and toxicity.

Execution handling, monitoring, and analysis

Trade order processing

The EMS automatically captures trade orders from the connected order management system. It can direct orders for straight-through algorithmic execution or pass them to traders for manual handling, as defined by preset rules. Custom systems can process both traditional orders (market, limit, stop, etc.) and advanced order types, including conditional, basket, list, and multi-leg orders. Prior to routing, orders are checked against firm-specific constraints like instrument eligibility, position limits, and cash limits.

Algorithmic trading

Orders can be auto-executed based on pre-defined algorithmic strategies and triggers (e.g., when a buy/sell price or liquidity volume reaches a certain threshold). Built-in algo wheels continuously evaluate conditions across brokers and auto-adjust broker and algorithm choices to ensure best execution. With bespoke EMS, traders can set custom logic for algo wheel workflows, e.g., define broker and algorithm selection restrictions for hedging sensitive trades and minimizing settlement costs.

High-touch execution

Complex and large orders can be handled manually via interactive trading screens. Traders can stage and slice orders and apply distinct execution tactics for each slice across venues. An execution management panel displays live market data and order book activity across venues to support informed ad hoc decision-making. A custom EMS can incorporate fast keybindings, hotkeys, and drag-and-drop interface components for rapid manual executions.

Electronic order submission

Execution-related electronic messages between the EMS and venue/broker endpoints are processed via standardized protocols (FIX, ITCH, OUCH, etc.) for consistent communication. The software timestamps each message and provides a complete, microsecond-precision transaction log. Order state changes across venues (submissions, fills, cancels, rejections, etc.) are captured in real time and reflected in the execution desk’s control dashboards.

Live trade monitoring

Customizable trade blotters consolidate real-time and historical execution data by asset type into a single interface. Traders can track real-time order status and end-to-end order execution lifecycle with drill-down to unit price, quantity traded, and transaction timing. The system continuously updates P&L based on executed prices and positions and notifies traders about order status changes, exposure drifts, limit breaches, and execution delays.

EMS solutions can calculate metrics like fill rate, expectancy, drawdown, execution speed, slippage, and more (by venue, instrument, strategy, trader). Custom systems can handle detailed transaction cost analysis (TCA), performance attribution analytics, and trend-based forecasting of execution performance. Traders can replay executed strategies and model their outcomes with adjusted parameters using built-in backtesting tools.

Risk and compliance management

Execution risk monitoring and mitigation

EMS solutions run real-time execution risk controls, automatically detect errors and exposures, and enforce pre-defined risk mitigation steps. For example, they can spot fat-finger errors across high-touch trades and block compromised orders, auto-throttle submission rates in high-risk market conditions, and immediately halt trading on individual instruments or across the portfolio if preset risk thresholds are breached.

Trade surveillance and compliance check

Execution activities are automatically vetted for compliance with the firm’s internal policies (broker/venue restrictions, trader-specific limits, etc.) and regulators’ best execution mandates. EMS solutions can instantly recognize and flag market abuse (e.g., spoofing, layering) and escalate issues to the compliance team. They also analyze trader actions, detect signs of misconduct, and notify managers about violations.

Execution reporting

If you rely on direct market access, a custom system will let you automate electronic execution reporting in compliance with any jurisdiction-specific rules (e.g., SEC’s Reg NMS, FINRA’s CAT and TRACE, CFTC Parts 43, 45, 46 in the US; MiFID II RTS 28, MAR in the EU). Reports can be sent ad hoc or scheduled for automated distribution within compliant submission timelines (e.g., T+0 for intraday transactions, T+1 for settlement reporting).

Security

Execution data and the EMS are protected via role-based access control, multi-factor authentication, data encryption in transit and at rest, automated threat detection, and other security mechanisms. The system maintains a complete, audit-ready log of order details and trader activities; for an immutable audit trail, the data can be hashed and recorded on the blockchain. Custom solutions can provide compliance with GLBA, GDPR, SOX, SOC 2, ISO 27001, and more.

What AI Can Do for Trade Execution Management

ScienceSoft suggests extending EMS with the following AI capabilities to drive the efficiency of trade execution operations further:

ML-supported market and risk analytics

Diagnostic and predictive machine learning (ML) models can be employed to sense microstructure signals that cannot be quickly captured by human traders, such as minor liquidity and price fluctuations, short-term arbitrage opportunities, and temporary momentum shifts. An ML-powered EMS can forecast liquidity risks, transaction costs, slippage, and execution speed for specific instruments and order sizes across venues.

Intelligent trade optimization

AI-driven recommendation engines can analyze live market conditions, intraday liquidity and volatility, and venue-specific behavior and suggest optimal execution strategies, child order sizes, submission timings, and venues in the current context. AI can also be used to assess the performance of in-house algos and algo-wheels and suggest improvements to strategy design and algo selection logic.

Smart assistance and autonomous trading

The EMS can employ smart copilots powered by large language models (LLMs) to instantly process trader inquiries about the best next actions and communicate intelligent suggestions in regular human language. LLM- and ML-driven AI agents can autonomously enforce execution actions based on intelligent insights. For example, an agent can trigger time-sensitive trade placement or dynamic switching to the better-performing strategies proposed by copilots.

Post-trade intelligence

Custom EMSs can leverage regression and attribution ML models to compare actual execution prices against benchmarks (VWAP, arrival price, etc.) and quantify the impact of factors like venue latency, volatility spikes, and liquidity gaps on slippage. They can also apply clustering and attribution algorithms to group trades with similar execution patterns, spot non-apparent performance trends, and break market factors by impact on execution outcomes.

Important Integrations for a Trading EMS

- To instantly pull trade orders into execution workflows.

- To keep portfolio managers updated about execution progress, outcomes, and costs for timely and accurate settlement.

Sell-side execution facilities

Brokers’ execution platforms, exchanges, alternative trading systems (dark pools, crossing networks), etc.

- To automatically gather order book data.

- To quickly place and execute trade orders.

- To track execution progress and trade outcomes.

- (For broker integrations) To maintain a catalog of broker-provided algos within the EMS and track algo performance.

Market data platforms

E.g., by Bloomberg, ICE, Refinitiv

- To access current market data for accurate execution planning and optimization.

- To leverage third-party market datasets for execution model design, validation, and testing.

- To align executions with portfolio objectives and risk limits.

- To maintain accurate, up-to-date portfolio views.

- To vet execution compliance against up-to-date regulatory and firm-specific constraints.

- To directly report execution details and breach alerts to compliance teams.

Regulatory reporting gateways

E.g., FINRA Gateway, FINRA TRFs, TRACE (for direct market access)

To automatically submit direct execution reports to regulators and track report processing status.

If you’re only routing parent orders to broker-provided algos, you don’t need independent market data integration since brokers handle market feeds internally. But if you’re running proprietary strategies inside your EMS, then direct access to live market data is mission-critical — you just can’t run arbitrage, calculate VWAP/TWAP schedules, detect liquidity for Iceberg replenishment, and peg to NBBO without it.

Steps to Build a Reliable Trade Execution Management Solution

Below, ScienceSoft’s Project Management Office shares a roadmap and best practices for creating custom EMS without compromising quality or extending the expected timeline and budget.

1.

Software requirements engineering

Investment IT consultants analyze the company’s trade execution processes and business needs and elicit requirements for the new EMS. Based on the collected information, consultants compose a software requirements specification (SRS).

- Interviewing traders alongside the firm’s project stakeholders helps better grasp the trading desk’s daily operational needs and bottlenecks. As a result, you can prioritize implementing functionality that solves persisting troubles in the MVP, so that the company can reap efficiency gains as soon as the EMS is set live. Involving risk managers helps accurately define operational constraints (maximum order sizes, authorization workflows for algo parameter changes, etc.) that may require specialized guardrails for controlled and compliant executions.

- By defining compliance requirements for the trade EMS at this early stage, you ensure a compliant solution and infrastructure design from the outset. Consultants at ScienceSoft consider both the relevant security standards (e.g., SEC Reg SCI, GLBA, SOC 2) and trade operational regulations (SEC, FINRA, CMA, MiFID II, etc.) when designing a compliance matrix for the software.

- “Good EMS performance” means different things to different teams, so it is critical to specify benchmarks upfront. ScienceSoft’s teams stick to quantitative KPIs such as median order routing latency under 200 microseconds, EMS uptime of 99.99%, or recovery time under 2 minutes in case of failure. Such tangible numbers give architects clear guidelines for technical decisions and provide project stakeholders with unified, objective measures of software success.

2.

Technical design

During this stage, solution architects design the architecture of the trade execution management system, including its integrations and security components.

- A hybrid architecture is the pragmatic winner for most EMS systems. In such a model, latency-critical components (execution engines, gateways, risk check functions) are built into a small, tightly controlled monolithic core. Meanwhile, less time-sensitive components (consolidated tracking, analytics, reporting) are designed using SOA and microservices patterns. This approach preserves microsecond-level latency where it matters while giving you the flexibility to evolve auxiliary modules independently. In some cases, trade EMS may benefit from event-driven or tech-specific patterns. Here are the aspects our architects consider when choosing the optimal architecture for each specific solution.

- Hybrid architectures allow applying the most productive programming technologies for each EMS component. For example, you can write execution engines in C++ to minimize latency, analytics algorithms in Python to maximize throughput, and UI APIs in Node.js to maximize data accessibility. Tailoring programming stack to each component’s specific needs is one of ScienceSoft’s primary practices for building stable, high-performing apps. Another wise practice is to segment data storage for various data types, e.g., use an in-memory store for live trade data, a time-series store for tick data, and an OLTP database for historical execution snapshots. Doing this helps maximize the speed and efficiency of trading data retrieval while cutting storage-related expenses.

3.

UX/UI design

UX and UI designers map out user journeys and create EMS interfaces tailored to the needs of specific user roles (quants, high-touch traders, risk analysts, etc.).

- UX design for trade EMS must prioritize high interaction speed and low cognitive load while ensuring traders never miss critical risk alerts. To balance streamlined execution and visible safeguards, ScienceSoft’s designers use tiered notifications: subtle visual cues for routine events (partial fills, minor slippage), persistent banners for important but non-urgent issues, and modal interrupts for breaches like fat-finger errors. We also apply progressive content disclosure, showing only the most relevant controls during active trader workflows while keeping advanced functions quickly accessible. Vast interface customization options are a must to let each trader configure tailored views with their preferred toolkits.

- By shadowing live or replayed trade sessions in the investment firm’s current EMS, you can get insights into traders’ real behaviors and identify UX/UI optimization opportunities for faster trading. For example, designers can spot delays with the keystrokes traders use when volatility spikes and add hotkeys for order adjustment or one-click hedging in the new EMS interface to shave seconds off responses to market signals. We use shadowing as part of our UX research process.

4.

Project planning

Project managers scope the trade EMS engineering tasks, assemble the development team, and estimate the project time and budget.

- Evolving business needs and regulatory updates may entail new requirements mid-project. Agile development methodologies let you quickly adapt to changes, but, at the same time, they escalate the risk of scope creep and deadline breaches. One wise approach is to lock down the scope of non-negotiables (think core execution and compliance functions) and run a structured feasibility and priority assessment for every requested change. Agile teams at ScienceSoft apply this practice to prevent feature churn and skewed scope priorities and keep delivery timelines predictable.

- Budget overruns in EMS development projects usually come from underestimating complexity in engineering tasks, disregarding potential changes, and overlooking external risks like regulatory and market shifts. ScienceSoft’s practical safeguard for accurate cost estimation is to combine bottom-up estimation (by EMS functional module, based on our past project data) with a top-down contingency reserve of 15–30% for risks. Tracking planned vs. actual cost and progress throughout the project gives you early signals if budget burn rate diverges from expectations. Check our dedicated page for tactics and tools to get a realistic picture of budget health.

5.

Development and testing

This is the stage where developers code the back end of an execution management system (including specialized components like algo wheels and ML models for trade performance forecasting), create user interfaces, and set up scalable data storage.

- Clean code contributes to higher accuracy of the execution system’s logic, accelerates testing, and minimizes regression risks during future feature extensions. Following language-specific conventions and secure coding guidelines, consistently documenting new code pieces, and running static code analysis and peer reviews are what ScienceSoft’s engineers do to secure code quality and maintainability.

- By running testing activities in parallel with coding, you can detect potential issues quickly and avoid their costly resolution at later stages. Manual testing, while necessary, is inefficient for many functional and performance testing tasks; you need a dedicated test automation environment to verify EMS-critical metrics like microsecond-level latency and throughput. QA consultants at ScienceSoft suggest that for complex systems requiring exceptional reliability, such as trade EMS, it may be reasonable to consider test-driven development (TDD), which assumes comprehensive coverage of intended use and edge cases. If you’d like to learn how we select the optimal QA tactics for each particular case, visit our dedicated page.

Whenever you use AI in trade execution, regulators and risk officers will demand evidence that models comply with best execution standards and market rules. The most reliable way to provide this proof is through explainable AI (xAI) methods. Techniques like SHAP and LIME help dissect and interpret AI’s logic, showing exactly what factors drove a routing or sizing decision. This transparency gives traders confidence in the tool, helps risk teams validate outcomes, and equips compliance staff with clear evidence under regulatory scrutiny.

6.

Integration and data migration

Back-end developers integrate the EMS with corporate and third-party systems. During this stage, you may also need to migrate execution data, configurations, and surveillance logs from your existing system to the new software.

- Integration testing is key to ensuring smooth and secure data flows between the connected systems. The tests should replicate real market data streams, multi-venue routing paths, risk checks, load, and timing. This way, you can uncover functional and performance issues that only appear when systems interact at scale. Check how we applied this practice in ScienceSoft’s early trading automation software project to ensure the solution would operate reliably in live trades on NASDAQ and NYSE American.

- Migrating trading data in small fractions and outside the market’s standard hours will let you quickly roll back the changes if something goes wrong without a major impact on traders’ workflows. At ScienceSoft, data engineers establish automated migration pipelines with testing checkpoints across data extraction, transformation, and transfer stages. This prevents manual migration errors and helps validate the integrity, accuracy, and completeness of data during transition.

Most brokers and venues mandate FIX conformance testing before live integration to make sure an EMS works seamlessly with their systems. For this, you need certified FIX engines and simulators that can mimic venue behavior. With such tools, you run “cush” tests that verify message sequencing, field mapping, session recovery, and routing under stress. These checks often take a lot of time, so I recommend setting a FIX test environment at the coding stage. This way, you can test as soon as the integrations are ready and avoid idle time near launch.

7.

Deployment and post-launch support

Development teams configure execution management software infrastructure, set up redundancy and failover mechanisms, finalize the necessary testing activities, and deploy the solution to production.

- EMS infrastructure must embed security mechanisms at every layer. Apply network segmentation to isolate execution engines, gateways, and back-office services, use encrypted channels for data exchange (TLS for external feeds, RPC/REST encryption for internal data), and implement network protection tools like SIEM, IDS/IDP, firewalls, and intelligent UEBA. These measures protect trading data and the integrity of the execution path while ensuring compliance with data protection standards.

- User acceptance testing (UAT) validates the EMS solution’s usability and alignment with the trading desk’s needs. It allows the development team to fix any previously unnoticed issues before the software goes live. You can further deploy the solution for a pilot run across a limited number of traders to make sure it performs well in live settings. Check how ScienceSoft applied this in a recent bond investing software project.

- Once your EMS goes live, you need to implement continuous observability tools, organize tiered issue handling, and define clear escalation procedures to maintain control over system operations and ensure quick response to troubles. Check out ScienceSoft’s dedicated page for ways to establish efficient support and maintenance operations for both outsourced and in-house scenarios.

Costs of a Trading Execution Management Solution

Developing custom software for trade execution management may cost from $400,000 to $4,000,000+, depending on the solution’s functional scope, the number and complexity of integrations, as well as performance, scalability, security, and compliance requirements.

Here are ScienceSoft’s sample cost ranges:

Wondering how much your EMS project will cost?

Use our online calculator to describe your needs, and we'll get back to you shortly with a tailored estimate. It’s free and non-binding.

Why Trust Trade EMS Development to ScienceSoft

- Since 2007 in engineering custom solutions for the investment industry.

- Investment IT and compliance (SEC, FINRA, GLBA, SOC 2, etc.) consultants with 5–20 years of experience.

- 45+ certified project managers (PMP, PSM I, PSPO I, ICP-APM) with experience in large-scale projects for Fortune 500 companies.

- Principal architects with hands-on experience in designing complex investment management systems and driving secure implementation of advanced technologies.

- 350+ software engineers, 50% of whom are seniors or leads.

- Among ScienceSoft’s clients is one of the top 3 global asset managers with $5T+ in AUM.