Custom Cash Management System

Features, Integrations, Costs

ScienceSoft applies 18 years of experience in financial software development and practical knowledge of 30+ industries to help businesses implement effective cash management systems.

Cash Management System: The Essence

A cash management system is used to forecast, track, and report corporate cash flows. Custom cash management software is especially helpful to manage cash flows (including in various currencies) across multiple, including international, company branches and across complex bank account structures.

- Main integrations: ERP, accounting software, payment gateways, bank accounts, etc.

- Implementation time: 6–12 months for a custom cash management system of average complexity, 1+ year for a high-end solution.

- Development costs: $150,000–400,000+, depending on the solution's complexity. Use our cost calculator to estimate the cost for your case.

- Annual ROI: Up to 230%.

- Payback period: 6 months on average.

NB! Banks and financial services companies involved in performing cash management operations on behalf of their corporate clients may need to build a specialized banking cash management system.

Cash Management System: Key Features

ScienceSoft creates corporate cash management systems with unique functionality closely bound to our clients’ objectives. Here, we have summarized the features commonly requested by our clients:

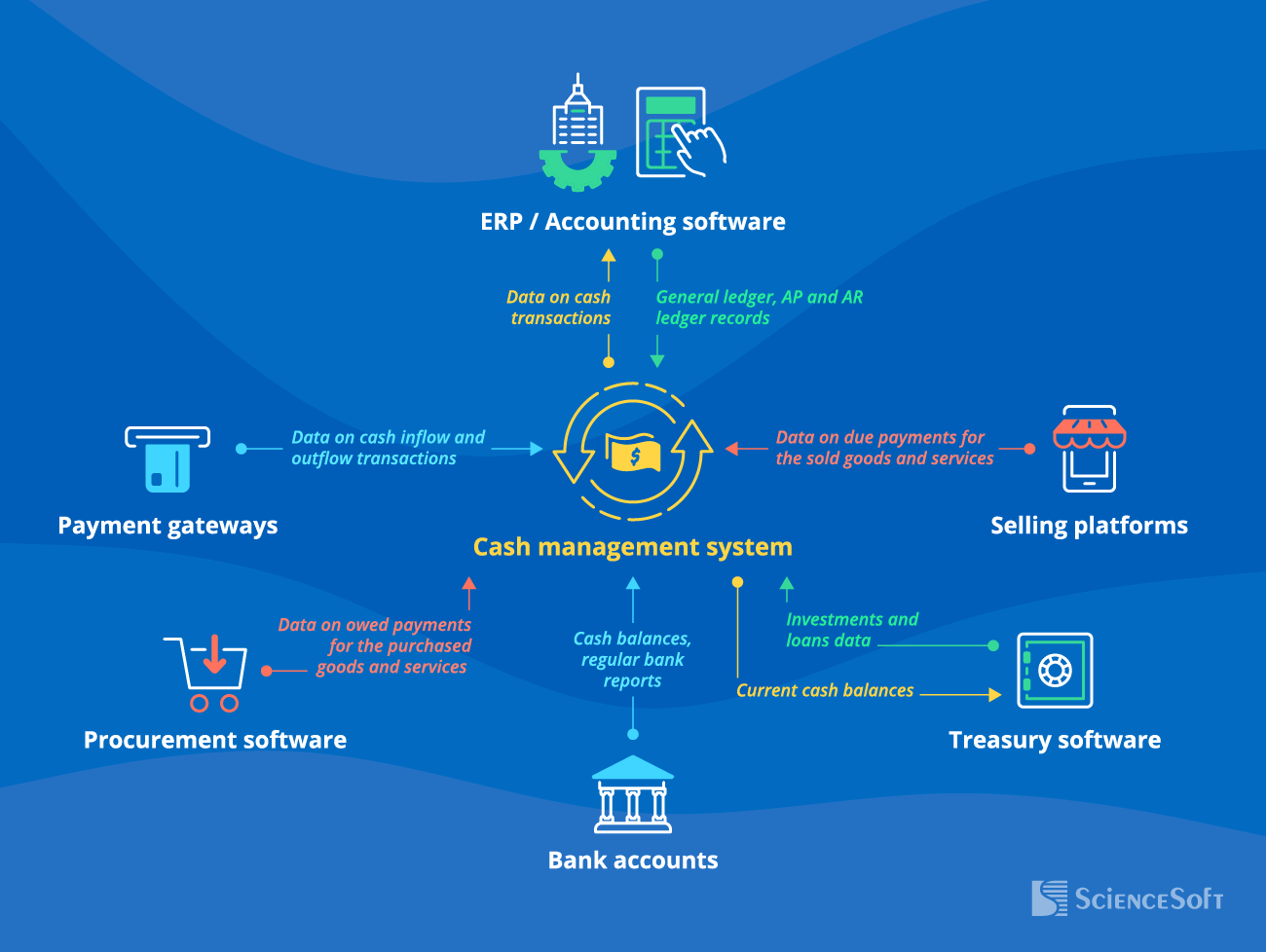

Essential Integrations for the Cash Flow Management System

To enhance cash visibility, streamline reconciliation and ensure accurate and timely cash flow reporting, ScienceSoft recommends setting up the following integrations:

- Payment gateways – for real-time cash flow monitoring.

- Selling platforms (e.g., a company’s ecommerce website, a customer portal) – for data-driven cash inflow forecasting.

- Procurement software – for accurate cash outflow forecasting.

- ERP/accounting software – for the automated creation of entries in the general ledger, accounts payable and accounts receivable ledgers.

- Treasury software – to timely initiate investment and borrowing activities for cash optimization.

- Bank accounts – for overall cash visibility and faster reconciliation – for real-time cash flow monitoring.

Off-the-Shelf vs. Custom Cash Management Software

There is a wide range of market-available cash management solutions that differ in the scope and complexity of capabilities, customization options, security level, and pricing. None of them is a “one-size-fits-all” solution, and the choice in favor of a particular tool should be made based on your specific needs. In some cases, custom development can be a more feasible option.

|

|

Oracle Cash Management |

SAP Cash Management |

Trovata |

A custom cash management system ScienceSoft’s choice |

|---|---|---|---|---|

|

Basic cash management capabilities

?

Real-time tracking of cash flow and cash balances across accounts. Automated cash positioning, reconciliation, and reporting. Trend-based cash analysis and forecasting. |

|

|

|

|

|

Advanced analytics

?

Comprehensive, ML-powered cash analytics and forecasting and AI-based insights on optimal time for cash transfer between the intercompany accounts to support the required liquidity level. |

|

|

|

|

|

Business-specific functionality

?

The ability to expand the solution’s core capabilities to meet a company’s unique business needs. |

Restricted to OOTB Oracle plugins and extensions. |

Restricted to third-party add-ons available in SAP Store. |

|

Non-restricted and can be introduced on demand. |

|

Customization

?

The ability to adjust the solution’s existing capabilities and remove unnecessary features. |

Limited capabilities. |

Limited capabilities. |

|

Unlimited capabilities. |

|

Integrations

?

The ability to connect the solution to other business-critical systems to leverage instant data sharing with no manual involvement. |

Native: with Oracle products. Via API: with popular financial tools and major bank. |

Native: with SAP products. Via API: with popular software products and major banks. |

Via API: with most major US banks and popular corporate finance products. |

Seamless connection to all required business solutions (including legacy software) and third-party systems. |

|

Security

?

Based on ScienceSoft’s expert assessment. Main criteria: type of software deployment and the type of cloud – public, private, or hybrid (for cloud deployment); basic cybersecurity mechanisms (data encryption, role-based access control, user authentication); advanced data protection capabilities (e.g., AI-powered fraud detection, immutable recordkeeping of cash data); compliance with global security standards. |

|

|

|

|

|

Regulatory compliance

?

Ability to meet the relevant local, industry-specific, and corporate data protection standards and regulations. |

Compliance with global data security standards. |

Compliance with global data security standards. |

Compliance with major US data protection standards. |

Compliance with all required global, regional, and industry-specific regulations. |

|

Ease of use

?

Based on ScienceSoft’s expert assessment. Main criteria: UX and UI complexity, convenience, and customization options; learning curve. |

|

|

|

|

|

Pricing (for 4 users/3 years)

|

$115,180 (for integrated Oracle Cash and Treasury Management)

Additional fees: initial setup costs + customization and integration costs. |

Upon request to the vendor. Expect to pay initial setup fees + configuration, customization and integration fees + licensing fees that depend on the number of software users. |

From $24,000 (for a basic feature set) to $168,000 (for an advanced toolkit)

Additional fees: initial setup costs + integration costs. |

Upfront investments in custom development around $150,000–$400,000. Unlimited number of users. No additional fees. |

Which Cash Management System Approach Is Right for You?

Answer a few simple questions to find out whether a custom-built or ready-made solution best fits your needs.

Do you need a cash management system with specific features, e.g., custom liquidity calculations or cash flow forecasting based on user-defined parameters?

Do you need to integrate cash management software with multiple back-office systems or legacy tools?

Do you need a cash management solution providing compliance with the local regulations in the regions your company operates?

Do you operate in a strictly regulated industry (e.g., healthcare, public sector) and need a solution providing advanced financial data security?

Do you have large teams involved in cash management processes and look to avoid the software fees associated with the per-user subscription model?

Do you need a cash management solution with various interfaces for different roles in the finance team?

Do you plan to evolve the solution with new functional and non-functional capabilities in order to adjust it to changing business and legal requirements?

Please tell us a bit more about your needs

Answer at least 3 questions to get results.

You can go with off-the-shelf cash management software

Looks like market-available solutions are a viable option to meet your cash management needs. Turn to ScienceSoft if you need help with choosing the optimal ready-made tool, its implementation, customization, or integration with your corporate systems.

You definitely should consider custom development

Tailor-made cash management software will help you reap the unique benefits that market-available tools cannot offer. Turn to ScienceSoft to get the detailed assessment of a custom cash management system’s feasibility for your business situation.

A custom cash management system is your best choice

Looks like market-available tools don’t fit your specific requirements and won’t be able to provide the expected operational and economic feasibility. Turn to ScienceSoft to get consulting on custom development and receive a free cost estimate.

Factors that Drive High ROI for the Cash Management System

In cash management software development projects, ScienceSoft always seeks to cover the following important factors to maximize the value and cost-efficiency of the cash management solution:

|

|

End-to-end automation. To eliminate time-consuming manual tasks across all cash management processes, from cash positioning and reconciliation to cash flow analysis and reporting. |

|

|

Robust security. To ensure protection of sensitive cash flow data by employing multi-factor authentication, AI-based fraud detection, and other advanced cybersecurity mechanisms. |

|

|

Powerful data visualization capabilities. To enhance overall cash transparency and streamline control of the cash flow transactions. |

|

|

ML-based cash flow forecasting. To get accurate predictions on future cash flow for improved liquidity planning. |

How to Develop Cash Management Software

Cash management software development is a way for companies to leverage tailored capabilities for efficient digitalization of their unique cash monitoring, reconciliation, and forecasting workflows. Below, ScienceSoft outlines key steps to build a custom cash management system:

1

Business needs analysis and requirements engineering for the custom cash management system.

2

Designing the functionality, architecture, and tech stack for cash management software.

3

Project planning: deliverables, scope of work, duration, budget, etc.

4

Custom cash management software development.

5

Quality assurance.

6

Cash flow data migration (from spreadsheets or a previously used cash control tool).

7

Establishing integrations with the required internal and third-party systems.

8

User training.

9

Continuous support and evolution of the cash management solution (optional).

Cash Management System Implementation Costs

Based on ScienceSoft's experience, the costs of building a custom automated cash management solution of average complexity vary between $150,000 and $350,000, while the development of large-scale cash and liquidity management software powered with advanced analytics may require $400,000+ in investments.

Want to know the cost of your cash management solution?

Benefits of a Cash Flow Management System

Annual ROI for a custom cash management system may reach up to 230%. An average payback period for the solution is around 6 months.

Implement Your Cash Management System With ScienceSoft

In financial software development since 2007, ScienceSoft helps companies engineer effective cash management solutions.

About ScienceSoft

ScienceSoft is a global IT consulting and software development company headquartered in McKinney, Texas. Since 2007, we've been helping businesses build robust cash management systems tailored to their cash tracking and forecasting needs. Being ISO 9001- and ISO 27001-certified, we apply a mature quality management system and guarantee cooperation with us does not pose any risks to our clients’ data security. If you are interested in developing an effective cash management system, feel free to turn to ScienceSoft’s team.