Robo-Advisory Software Development Services

ScienceSoft creates secure robo-advisory tools for smooth investor experiences and compliant wealth management automation. Our principal architects and consultants engineer strategic solutions that combine high accuracy with cost-efficiency, scalability, and strong data governance.

Robo-advisory software development services are meant to create digital platforms that deliver personalized, algorithm-driven wealth planning and investment management services at scale. These services may span the design, engineering, support, and modernization of robo-advisory tools.

- For wealth management firms, creating a custom robo-advisor is a way to offer affordable investment advisory options for individuals who aren’t ready to pay for full-scale expert guidance.

- For fintech companies and startups, building a robo-advisory software product is a way to enter the rapidly growing digital advisory market with a brand-new technology solution.

Sources: Fortune Business Insights, Deloitte, Statista

Why Develop Robo-Advisory Software With ScienceSoft

- Since 2007 in software engineering for the investment industry.

- Financial IT and compliance consultants with 5–20 years of experience.

- Principal architects proficient in designing complex investment automation systems and driving secure implementation of advanced technologies.

- 45+ certified project managers (PMP, PSM I, PSPO I, ICP-APM) with experience in large-scale projects for Fortune 500 companies.

- Established practices for financial software accuracy and transparent, predictable development processes.

Winning Features for Web and Mobile Robo-Advisory Platforms

ScienceSoft engineers robo-advisory solutions with functionality tailored to the specific needs of each client. Below, we list the core robo-advisor features and value-adding capabilities that can further enhance profitability and investor experience.

Core features

Value-adding capabilities (post-MVP stage)

Secure and Scalable Architecture for Robo-Advisory Software

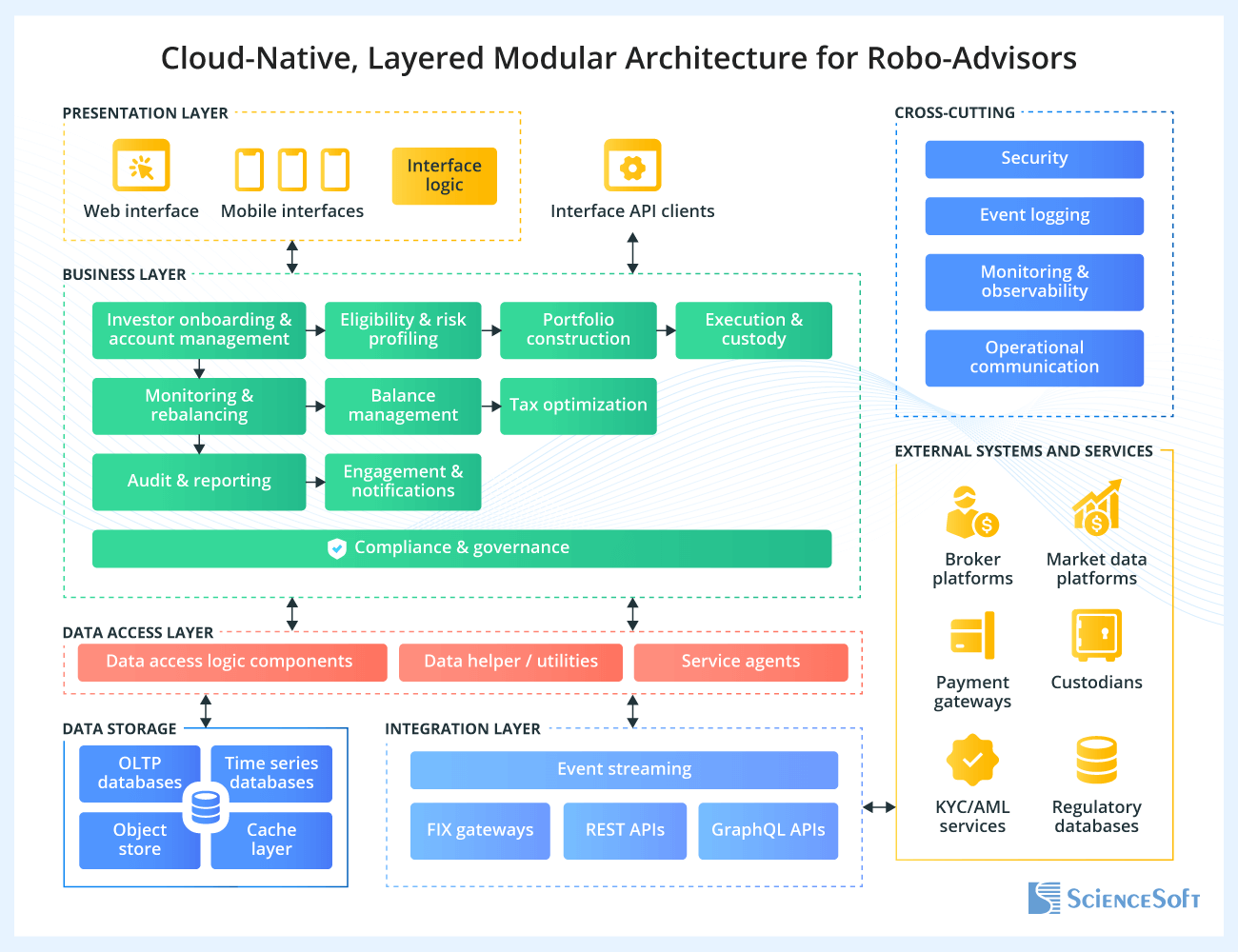

Below, ScienceSoft’s principal architects share a sample architecture we use to create robo-advisory solutions. The concept applies to scalable (1M+ accounts), commercial robo-advisors that offer rule-based and AI-supported personalized investment advice to retail investors while meeting institutional regulations (SEC, CMA, MiFID II, etc.).

Component-level flexibility and fast development

In the proposed cloud-native, modular architecture, the robo-advisory solution is divided into distinct layers, each responsible for a specific operational aspect. The layers are further broken down into separate components that can be built, deployed, reused, and scaled independently, without cross-impact. This design contributes to quicker delivery and supports incremental solution growth from a lean core to a feature-rich product.

Scalability, low latency, and reduced coding costs

Business logic components are presented as distinct functions (investor risk profiling, portfolio construction, trading, etc.). Each function is deployed as a scalable microservice, with the ability to build custom logic or employ third-party services (e.g., AWS’s Step Functions for user onboarding, Entrust’s Onfido for eKYC, Kavout’s Kai Score for intelligent asset picking) to optimize development costs. Architects at ScienceSoft suggest that event-driven microservices setups work best to minimize latency for algorithmic advisory operations that draw on rapidly changing data.

App-agnostic user interface

The proposed architecture allows the robo-advisor to be packed as a standalone web or mobile app or an embedded module within your existing software product via interface APIs. You will need the same APIs if you plan to sell your robo-advisor as a white-label product to investment and fintech firms, so that your partners can quickly add the features from your solution to their own apps.

Integrations for standardized, clean data exchange

The robo-advisory solution integrates with third-party systems (broker platforms, market data platforms, payment gateways, regulatory databases, custodians/clearing, and more) to exchange data. We apply integration components like FIX gateways, REST APIs, GraphQL APIs, and event‑based messaging to exchange data in near-real time and ensure consistent, standardized communication between the connected systems.

Data accessibility and cost-effective storage

Data storage is organized based on data types. Our architects typically employ online transactional processing (OLTP) databases for structured data on positions, orders, and trade details, time series databases for time-framed tick and reference data, scalable object stores for trade algos and unstructured data (raw market feeds, user documents, reports, etc.), and low-latency cache datastores for live session data. Such segmented storage ensures quick and efficient data retrieval and balanced storage expenses.

Secure data access boundaries

ScienceSoft’s architects typically host integration components in the integration layer and separate data access logic and related components (data utilities, service agents, etc.) into a dedicated data access layer. This separation ensures that internal data models and data storage are never directly exposed to external systems, limiting privacy risks.

Controllable, compliant performance

Governance, security, and compliance mechanisms underpin multiple robo-advisor components, enforcing auditability, data protection, and regulatory compliance. Here, we use monitoring and observability tools, event logging engines, and security mechanisms like SIEM, identity and access management, key management, data encryption, and data residency controls.

Robo-advisor performance metrics you can hit with the proposed architecture

Robo-Advisory Software Development Services by ScienceSoft

Robo-advisory software consulting

Our consultants can define a winning niche for your solution and assist with market entry planning. We will design the optimal feature set, architecture, UX and UI, and tech stack for the system and advise on security and compliance. You will also get a detailed project plan with time and cost estimates and risk mitigation steps.

End-to-end development of robo-advisory solutions

ScienceSoft’s software engineers can handle the entire process, including solution design, coding, integration, and testing. You get a lean MVP of your app in 4–6 months and can release it right away; we stay with you to iteratively evolve the robo-advisor with new features. We can also take over solution maintenance and support.

Modernization of legacy robo-advisory tools

ScienceSoft can redesign the architecture, UX/UI, and tech stack of your existing robo-advisory tool, revamp legacy codebase, and establish new integrations. In addition, we can upgrade your solution with the required features to boost its value for investors. Compared to development from scratch, you get a modern solution faster and at a lower cost.

Costs of Robo-Advisory Software Development

Based on ScienceSoft’s experience, developing custom robo-advisory software may cost from $150,000 to $1,200,000+, depending on the solution’s functional scope, the number and complexity of integrations, as well as performance, scalability, security, and compliance requirements.

The sourcing model your company chooses — build in-house, outsource entirely, or hire dedicated developers — is another factor that impacts the project cost. For example, it can be up to 3x cheaper to outsource the development to a managed nearshore or offshore team than hire, train, and maintain in-house robo-advisor experts.

Sample cost ranges

$150,000–$300,000

A lean version of a robo-advisory solution with core features.

- A web or mobile app with basic dashboards.

- Rule-based automation of core robo-advisory workflows (goal-based portfolio construction, asset rebalancing, trade execution).

- Support for 1–2 traditional asset classes (e.g., ETFs, equities).

- 1–2 mainstream investing strategies (e.g., passive indexing, buy & hold).

- Single-jurisdiction regulatory compliance (e.g., US- or KSA-only).

- 2–5 core integrations (a single brokerage/custodian, one market data provider, basic payment gateways).

- Batch statistical analytics and forecasting.

$500,000–$1,200,000+

A fully-featured robo-advisor with advanced capabilities.

- Web and mobile interfaces; responsive, segment-specific UX.

- AI/ML-driven and rule-based automation of investor onboarding, portfolio management, and trading operations.

- Support for 4–6+ asset classes (ETFs, equities, bonds, mutual funds, alternatives, crypto).

- 4–6+ investing strategies, including advanced types like factor-based, ESG, thematic, and tax-aware.

- Multi-jurisdiction compliance (e.g., US, EU, UK) with localized onboarding, KYC/AML, and tax logic.

- 5–10+ integrations, including multiple custodians and brokerages, several data vendors, and local regulatory databases.

- ML-powered predictive analytics and intelligent optimization suggestions.

Learn the Cost of Your Robo-Advisory Solution

Please answer a few simple questions prepared by ScienceSoft's consultants.

Within 24 hours, our team will carefully review your project details and prepare a tailored estimate. We'll send it to your email free of charge.

Thank you for your request!

We will analyze your case and get back to you within a business day to share a ballpark estimate.

In the meantime, would you like to learn more about ScienceSoft?

- Project success no matter what: learn how we make good on our mission.

- Since 2005 in investment IT services: check what we do.

- 4,200+ successful projects: explore our portfolio.

- 1,400+ incredible clients: read what they say.

Challenges of Building Robo-Advisory Software — And How to Tackle Them

Challenge #1. Achieving and maintaining regulatory compliance

In the US, robo-advisors hold the same legal status as human investment advisors. This means your software must comply with the SEC, FINRA, and other relevant regulations and remain adaptable to regulatory changes.

Check the solution

AI-powered robo-advisors require specific architecture and logic arrangements to have the explainability that regulators want. Traceable storage for model inputs and outputs, rule‑based logic overrides, interpretability mechanisms (SHAP, LIME, ICE plots), and bias check tools (we recently used Clarify for AWS-based rollouts) are a minimal stack of components to ensure transparent and auditable intelligent operations.

Challenge #2. Ensuring the accuracy of algorithmic advisory logic

If robo-advisory algorithms fail to capture the nuances of financial data or investment goals, the platform risks offering inconsistent advice that may lead to poor investment outcomes and, as a result, loss of client trust.

Check the solution

Challenge #3. Incorporating high-quality market data feeds

Robo-advisory algorithms are only as good as the data they use to evaluate the market and predict yield and risks. Inconsistent, gapped, delayed, and tampered inputs can distort the relevance and reliability of advice.

Check the solution

Challenge #4. Delivering smooth experiences for diverse investor segments

A robo-advisory platform should accommodate users with varying needs and experience levels, from beginners to seasoned investors. Failure to meet these diverse needs can lead to user frustration and low adoption rates.

Check the solution

Early usability testing with representative user personas allows you to validate whether the UX/UI design choices for the robo-advisory solution resonate with target investor segments. With the gathered insights, you can swiftly refine the content, navigation, and interaction patterns, avoiding costly fixes during coding. Another smart move is to implement user feedback loops with the live robo-advisor. This will let you promptly uncover real-life pain points and agilely improve the solution.

Challenge #5. Accelerating the solution’s time-to-market

Complex investment software products like robo-advisors often get stuck in development as new hurdles and concerns keep surfacing during the project, delaying the planned release date and inflating the budget.