Investment Compliance Monitoring Software

Features, Development Best Practices, Costs

ScienceSoft engineers custom investment compliance systems that address the common drawbacks of off-the-shelf tools, such as a limited panel of assets, jurisdictions, and risks, rigid features, and pre-defined integrations. We deliver secure, interoperable solutions that can quickly accommodate market and regulatory change while keeping TCO under control.

Investment Compliance Monitoring Software: Key Aspects

Investment compliance monitoring software serves as a centralized platform for enforcing investment restrictions, detecting breaches, and documenting oversight activities across regulated investment areas. It provides a unified view of the firm’s adherence to internal mandates and regulatory rules.

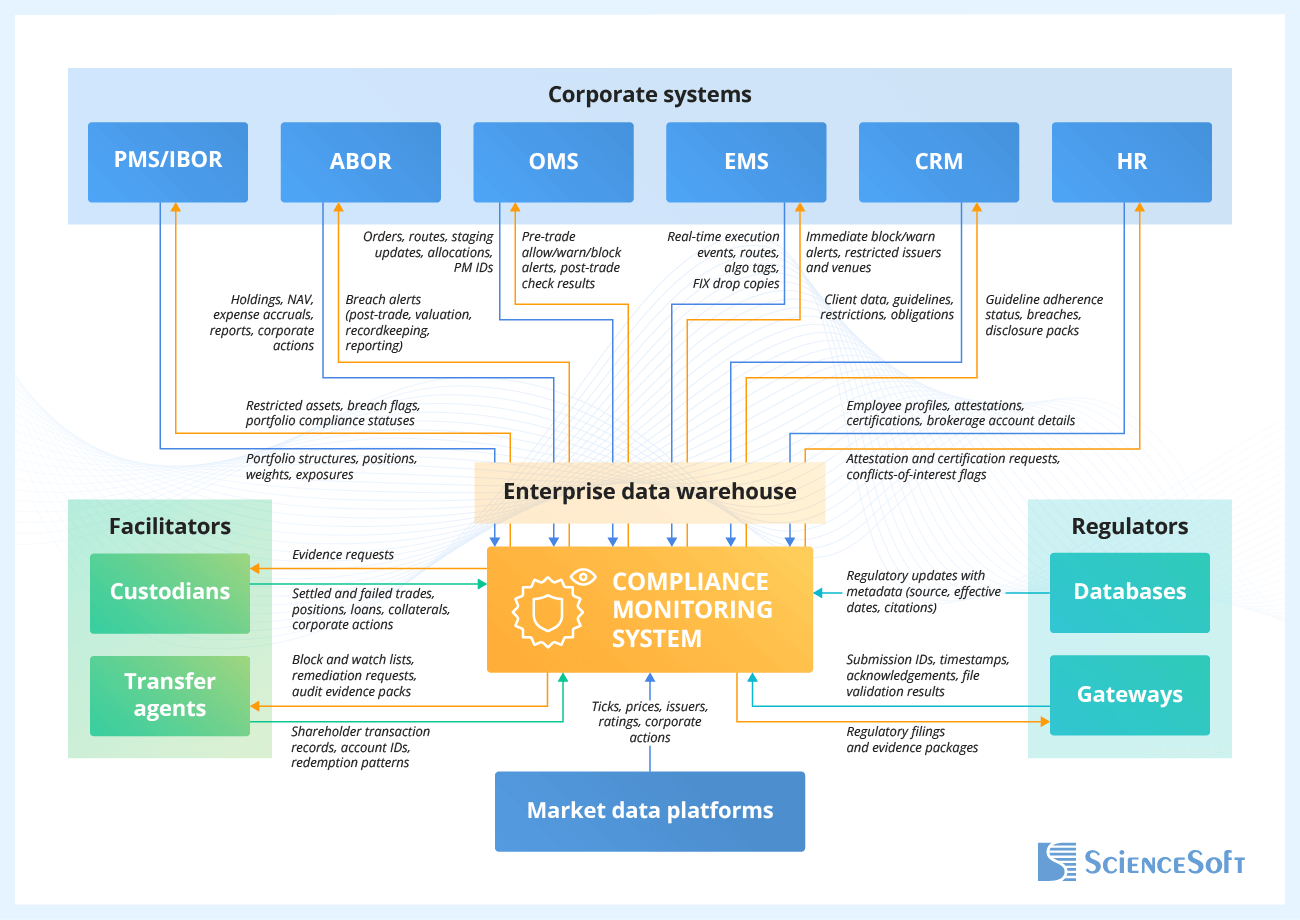

- Key integrations for a compliance monitoring system: portfolio management software, an order management system, an accounting system, regulatory databases and reporting gateways, and more.

- Implementation time: around 7–15 months for the first release (core software modules).

- Development costs: $250,000–$2,500,000+, depending on solution complexity. Use our free calculator to estimate the cost for your case.

- ROI: Up to 330% over three years.

Why Investment Firms Opt for Custom Compliance Monitoring Solutions

Investment firms go for custom compliance monitoring software when off-the-shelf platforms fail to support their cross-border, cross-asset compliance workflows, non-standard governance frameworks, or strict data residency requirements.

|

|

Custom solutions give compliance teams complete ownership of the validation logic, data flows, and resolution paths, allowing them to automate firm-specific controls without vendor constraints. |

|

|

Custom compliance systems can be built to accommodate diverse asset classes and natively support regulations relevant to the firm’s activity, including local frameworks (e.g., SEC and FINRA for the US, MiFID II for the EU, CMA for the KSA) and domain-specific rules (e.g., CFTC’s CEA for the US commodity trading advisors, AIFMD directive for the EU alternative funds). |

|

|

Unlike off-the-shelf systems, custom investment compliance solutions can be integrated with any necessary software, including legacy tools, modern fintech services, and local regulatory platforms. |

|

|

When new business rules, asset classes, or regulatory mandates emerge, custom software can be extended or tweaked quickly without re-architecting, unlike vendor platforms that typically take time to catch up or don’t accommodate changes at all. |

|

|

Investment managers increasingly favor custom software to leverage tailored automation features powered by artificial intelligence (AI). In custom setups, traditional AI models can be trained on the firm’s proprietary data to maximize the relevance of intelligent insights. Generative AI models can be built into tailored RAG solutions to securely access the company’s internal databases for contextual feeds. Such components can be deployed on premises or in a virtual private cloud to avoid data passing to third parties. |

Investment Compliance Areas to Monitor With Custom Software

ScienceSoft can build a comprehensive compliance system integrated with your other tools or add custom modules for compliance checks across specific investment tasks. Here are some of the compliance areas our solutions help automate:

Governance and organizational conduct

- Compliance governance and program management.

- Employee conduct, attestations, and personal trading.

- Vendor risk and compliance management.

- Counterparty onboarding and certifications.

- Fund administration.

Investment and trading controls

- Fiduciary duty and suitability.

- Adherence to pre-, in-, and post-trade mandates.

- Investment limits (concentration, liquidity, leverage, derivatives).

- Trading governance (best execution, fair allocation).

- Trade surveillance and market abuse.

Data, operations, ESG, and reporting

- Asset valuation and pricing.

- Fee and expense calculation and disclosure.

- Proxy voting, stewardship, and corporate actions.

- ESG and sustainability.

- Regulatory reporting.

- Data recordkeeping, retention, and protection.

ROI for Investment Compliance Monitoring Solutions

According to ScienceSoft’s consultants’ estimations based on industry reports and proprietary research, an intelligent compliance management system tailored to the needs of investment and asset managers can bring up to 327% ROI over three years.

The ROI is driven by the following major operational and financial benefits:

Functionality of Investment Compliance Management Software

This is a comprehensive map of modules that can be included in investment compliance monitoring solutions. The final architecture depends on each firm’s needs and existing tech stack.

Internal compliance program management

Compliance management solutions provide a centralized, versioned repository for the investment firm’s compliance policies. They can automate the company’s unique change review, approval, lineage, and traceability workflows to prevent “shadow” compliance setups and policy drifts. Users can add compliance rules (by jurisdiction, entity, employee role, strategy, asset class, client mandate, etc.) and link them to the related policies. Built-in role-based access controls ensure only authorized employees can create, approve, and enforce control policies and rules.

Regulatory requirements onboarding

Compliance teams can set up jurisdiction-specific regulatory rules for pre-trade, in-trade, and post-trade compliance via customizable templates. The software automatically links each obligation to user-defined data elements from the firm’s internal and connected external systems. Custom systems can accommodate any necessary regulatory mandates, including rules for compliance programs (SEC Rule 206(4)-7), recordkeeping (SEC Rule 204-2/31a-2), liquidity (SEC Rule 22e-4), valuation (SEC Rule 2a-5), best execution (FINRA 5310, MiFID II), and sanctions screening (OFAC).

Compliance automation workflow design

A drag-and-drop modeling interface allows compliance experts to design multi-step checks with tailored composite logic for simultaneous data matching against internal and regulatory restrictions. Users can configure custom checkup sequences, automation triggers, and exception-handling and backup-control rules. Custom solutions can include policy-as-code export, scenario modeling, and what-if analysis tools so users can test and refine compliance automation workflows before go-live.

Compliant report template library

Compliance systems host compliant templates for regulatory filings (Form ADV, Form PF, Form 13F, Schedules 13D/13G, Form CRS, N-PORT, N-CEN, N-CSR, N-MFP, N-PX, EMIR, MiFIR, and more). They maintain template version control and hard field lineage to the original regulatory mandates. Custom systems can automate report template auto-population with data from pre-defined sources and pre-submission report vetting for content accuracy, completeness, and format schema matching.

Automated compliance monitoring

Custom solutions continuously aggregate trade, portfolio, benchmark, pricing, corporate action, issuer, and investment teams’ activity data. They automatically match the data against active compliance rules and log validity decisions, adhering to regulators’ recordkeeping requirements and WORM-compliant retention policies. A monitoring engine applies trend-based analytics to diagnose compliance-sensitive aspects (desk error rates, portfolio concentration, market timing, etc.) and identify potential issues early so teams can prevent violations.

Compliance risk alerts

Compliance teams, risk owners, legal officers, and managers can view risk alerts on role-specific dashboards or receive them via email, messaging apps, and integrated SOAR/SIEM systems. Each alert provides links to the risk-relevant investment activities, compliance rules, and risk/breach evidence, enabling one-click issue investigation and escalation. Custom tools can be designed to automatically enforce temporary hard stops, e.g., blocking trades or freezing accounts until the issue is reviewed.

Breach diagnostic analytics

A diagnostics engine reconstructs the causal chain across investment manager behaviors, data feeds, and operational controls to determine the root cause of the breach. The software segments issues by configurable criteria (portfolio, asset type, manager, strategy, counterparty, etc.) and scores their materiality, severity, urgency, and financial impact using custom formulas. It automatically triages issues for handling and generates issue summaries and evidence trails for investigation boards.

Incident response

Custom solutions automatically convert breach alerts into trackable issue tickets and assign task owners, resolution deadlines, and evidence requirements, as defined in preset compliance SLAs. Compliance specialists can update the task status as it progresses through investigation, corrective, and preventive action stages. The software can automate resolution activities under the firm’s proprietary compliance playbook, e.g., block trades across problematic venues, add non-compliant issuers to a restricted list, or trigger employee re-attestation requests.

Regulatory change management

Using the software, compliance teams can automatically aggregate and monitor regulatory rule updates, new guidelines, enforcement actions, and consultation papers across domain-relevant authorities (e.g., SEC, FINRA, CMA, ESMA). The solution identifies which investment workflows, reports, and control mechanisms are affected and assigns change management owners and deadlines based on each regulation’s effective and compliance dates. It records updates in a traceable ledger so teams can easily track what’s changing.

Compliance systems calculate and track metrics like the number of compliance breaches, average investigation time, percentage of issues resolved on time, recurrence of violations, and control effectiveness scores. Drill-down and drill-up dashboards can display metrics across any selected dimensions, from separate assets and operations to the enterprise level for compliance and C-level teams. Custom solutions can auto-generate reports on chosen KPIs and auto-compose compliant disclosure packs for regulators and investors.

Compliance workflow testing and optimization

Compliance platforms automate periodic and ad hoc assessments of compliance management processes based on established testing frameworks (e.g., RCA, RCSA) and the investment firm’s proprietary test scenarios and sampling models. They analyze period-bound metrics (control coverage, breach rates, resolution cycle time, etc.), compare them against historical KPIs and sectoral compliance benchmarks, and flag areas of inefficiency and superior performance, giving the firm insights for continuous optimization of compliance workflows.

Software security and compliance

Custom compliance management solutions can be designed with built-in controls and documentation that meet enterprise security standards like SOC 2 Type II, ISO 27001, ISO 20022, NIST 800-53, NIST CSF, and CIS. They can be powered by field-level data encryption, personal data tokenization, multi-factor user authentication, and other security mechanisms. The solutions can include privacy-by-design features (configurable data residency, consent logging, etc.) supporting GLBA, GDPR, and CCPA compliance, as well as incorporate data-loss prevention safeguards that satisfy SEC’s mandates.

Adding blockchain to prove regulatory compliance with stronger evidence

Blockchain isn’t a mainstream compliance technology, but it can give investment firms something they’ve long needed: verifiable proof of strong governance. A traditional audit trail can be complemented by a permissioned blockchain ledger — effectively providing a second record that reconciles how the firm meets books-and-records obligations. In the blockchain setup, every compliance-relevant event is automatically timestamped, encrypted into hash values, and protected against tampering. Regulators can be granted read-only access to the blockchain registry for audits. This dual-ledger approach reduces disputes over data accuracy, accelerates audits, and ensures data traceability without exposing sensitive details to auditors.

How AI Can Reinforce Investment Compliance Management

Intelligent compliance automation is gaining traction among investment and asset management firms, with 75% of domain players projecting AI to be their biggest tech investment in the near term.

ScienceSoft suggests extending investment compliance software with the following capabilities to drive operational efficiency further:

LLM-supported regulatory data parsing

Compliance systems can employ large language models (LLMs) to automatically parse multi-format regulatory documents (investment rule releases, no-action letters, guidance notes, etc.), extract details like obligations, effective dates, and enforcement deadlines, and summarize the insights into structured change reports. LLMs can provide concise, natural-language explanations of new regulatory requirements and their impact on investment operations. They can also help compliance teams plan targeted updates to internal control and automation rules.

ML-powered compliance risk analytics

Tailored machine learning (ML) models can be applied to analyze investor interactions, portfolio management, trading, reporting, market, and counterparty risk patterns and capture latent compliance risk signals that cannot be recognized by statistical tools. ML-produced predictions can trigger preemptive checks and user-defined blocking actions. Compliance solutions should incorporate model drift monitoring, bias detection, and explainability mechanisms (e.g., SHAP, LIME) to meet regulatory requirements for model risk management.

AI-assisted document drafting and process optimization

Upon a textual or voice request from compliance specialists, smart copilots powered by generative AI can quickly find task-relevant data, prepare investigation materials with linked evidence, and draft compliance reports. They can also suggest tailored compliance checklists for new assets, service lines, and geographies, and map optimal, context-aware steps for resolving compliance issues. Explainable AI techniques ensure transparency of the logic behind intelligent suggestions, reinforcing model risk governance and accountability.

Agentic automation of compliance monitoring tasks

Custom solutions can incorporate agentic AI components to enable intelligent automation of end-to-end compliance workflows. For example, in trade ordering, an AI agent can detect a potential breach, double-check it against regulatory and internal rules, notify operational and compliance teams, instantly block a non-compliant order, and generate an audit-ready report. Such agents can independently search task-relevant data sources and trigger actions across connected systems. Rule-based guardrails and human-in-the-loop oversight are applied for agent control.

Important Integrations for an Investment Compliance Monitoring System

To monitor portfolio compliance against investor mandates, target weights, asset class restrictions, and risk limits.

To verify account recordkeeping, valuation, post-trade, and financial reporting compliance.

To access order details required for automated pre-trade and post-trade compliance checks.

Investment CRM

To align investment compliance rules with client-specific mandates and track adherence to servicing obligations.

To control investment team member attestations, certifications, and adherence to the firm’s code of conduct.

Custodian systems

To reconcile internal settlement, position, financing, and corporate action data against custodians’ data and quickly detect breaches.

Market data sources

Financial data platforms (e.g., Bloomberg, ICE), ESG databases, asset-specific databases (real estate databases for REITs, startup registries for VC firms, etc.).

To check limit and valuation compliance against certified reference data.

Regulatory databases

Of regulatory bodies (SEC, FINRA, FCA, etc.) and curated providers

To automatically intake global and jurisdictional regulatory rules, updates, and enforcement actions.

Regulatory reporting gateways

E.g., SEC’s EDGAR, FINRA gateway, Adenza

For electronic submission of regulatory filings and automated tracking of report processing statuses.

Case-specific integrations

For buy-side firms with separate execution platforms or low-latency trading desks.

For latency-sensitive pre-trade compliance checks, in-trade surveillance, and immediate enforcement of trading restrictions.

For registered investment funds or advisors acting as fund administrators.

To monitor the market-timing compliance of shareholder-level trading activity across mutual funds, ETFs, CEFs, and UITs.

Best Practices for Compliance Monitoring Software Development

Below, ScienceSoft’s experts share their best practices for engineering reliable and cost-effective compliance management software for investment firms.

Low-code should be used selectively for where it saves costs and adds flexibility

A pragmatic approach is to use low-code/no-code solutions for workflow configuration modules that will be managed by non-IT employees. This enables flexible compliance rule adjustments without involving IT teams, which optimizes IT efforts and contributes to software longevity. However, the core compliance logic responsible for compliance analytics, breach detection, and impact scoring should be fully coded to ensure predictable system performance and low latency.

From ScienceSoft’s experience, most investment firms don’t need to build custom low-code engines. Applying enterprise platforms like Microsoft Power Platform, ServiceNow, or Appian accelerates delivery and reduces development costs by up to 4x.

Software quality assurance should run on representative data

Basing functional, integration, performance, and security tests on the investment firm’s real datasets help confirm that the solution operates smoothly in real settings. The test data must match the structure, edge cases, and volume of live compliance feeds so the system behaves as it would in production. Removing direct identifiers and masking sensitive attributes prevents unintended data exposure while still preserving data relationships. For compliance software products, you can use synthetic data by verified providers like Hazy or Gretel.ai.

Data quality tools are brought for accurate automation

To prevent silent drifts in the solution’s accuracy, you need to ensure that the data that enters the software is clean and reliable. For that, you’ll need to incorporate tailored pipelines and tools for automated data validation, refining, and enrichment. Check how ScienceSoft handled that in the compliance analytics system for a capital market regulator for deeper insight.

Low-latency design supports sub-second risk detection

In trade management, compliance latency directly impacts short-term opportunity capturing, timely executions, and traders’ productivity. We typically apply event-driven, asynchronous processing models, implement low-latency messaging platforms and in-memory data stores, and optimize risk scanning queries to speed up trading compliance software operations. From my experience, such mechanisms help establish sub-second pre-trade compliance checks.

Costs of Investment Compliance Management Solutions

Developing investment compliance monitoring software may cost from $250,000 to $2,500,000+, depending on the solution’s functionality, the scope of supported assets and jurisdictions, the number and complexity of integrations, as well as performance, scalability, latency, and security requirements.

An area-specific compliance module built on top of the investment firm’s existing compliance management system would cost around $150,000–$300,000, depending on the degree and complexity of task automation.

Here are ScienceSoft’s sample cost ranges for full-scale solutions:

$250,000–$500,000

A platform-based compliance solution (e.g., built on Microsoft Power Platform) with low-code policy and rule configuration engines.

- Rule-based automation of core monitoring workflows (pre-trade and post-trade checks, exception escalation, attestation capture).

- Single-jurisdiction regulatory compliance (e.g., US SEC and FINRA).

- Support for 1–3 traditional asset classes and instruments (e.g., equities, bonds, mutual funds).

- 3–6 core integrations (internal investment systems and a market data provider).

- Batch statistical analytics and forecasting.

$600,000–$1,000,000

A custom compliance platform blending platform-based and proprietary automation components.

- Rule-based and analytics-driven automation of compliance risk monitoring and investigation tasks.

- Multi-jurisdiction oversight (e.g., regulatory compliance in the US and 1–2 additional regions, such as the EU and KSA).

- Support for 3–8 traditional and alternative asset classes, including derivatives, ETFs, and private funds.

- 5–15 integrations via ready APIs (internal systems, market data platforms, regulatory gateways across jurisdictions).

- ML-powered stream analytics for compliance trend detection, breach triaging, risk prediction, and response effectiveness forecasting.

$1,200,000–$2,500,000+

A fully custom, enterprise-grade compliance system powered by advanced analytics and intelligent automation.

- Rule-based, GenAI-supported, and agentic orchestration and automation of compliance workflows across global portfolios.

- Multi-jurisdiction compliance (US, EU, GCC, APAC, offshore regimes) with dynamic rule libraries covering SEC, CFTC, CMA, ESMA, and other frameworks.

- Support for all major asset classes, including structured products, alternatives, and digital assets.

- 15–30+ integrations across business lines and regions (investment, trade, and administrative tools, specialized data platforms, regulatory gateways, blockchain systems).

- AI-powered diagnostic and predictive analytics and real-time optimization suggestions.

Wondering how much your compliance software project will cost?

Use our online calculator to describe your needs, and we'll get back to you shortly with a tailored estimate. It’s free and non-binding.

Why Develop Investment Compliance Software With ScienceSoft

- Since 2005 in engineering custom solutions for investment and wealth management.

- ScienceSoft served one of the top 3 global asset managers with $5T+ in AUM.

- Investment IT and compliance (SEC, FINRA, GLBA, etc.) consultants with 5–20 years of experience.

- 45+ certified project managers (PMP, PSM I, PSPO I, ICP-APM) with experience in large-scale projects for Fortune 500 companies.

- Principal architects with hands-on experience in designing complex investment systems and driving secure implementation of advanced technologies.

- 350+ software engineers, 50% of whom are seniors or leads.