Investment Software Product Development Services

ScienceSoft helps investment software product companies create reliable and secure solutions loved by users worldwide, driving project success for our clients no matter what.

Our investment software consultants — senior product people who speak the language of user value — will shape your high-level solution vision into a buildable concept, ensuring the product’s technical excellence, sleek design, and regulatory compliance.

Investment software product development services are focused on creating commercial solutions for the investment industry, either unique to the market or having solid competitive advantages. Such services may span the design, engineering, evolution, support, and revamp of go-to investment tools.

The market for investment software products is projected to grow steadily, and its emerging technology niches are offering lucrative opportunities for newcomers and established firms. But to create a truly successful product, businesses need to address a range of challenges specific to the investment space, such as picking secure, flawless techs, meeting sectoral regulations, and earning the trust of demanding investment professionals.

Why Build Your Investment Software Product With ScienceSoft

- Since 2007 in engineering custom solutions for investment and wealth management.

- Investment IT and compliance (SEC, GLBA, NYDFS, GDPR, SOC 2, etc.) consultants with 5–20 years of experience.

- Principal architects with hands-on experience in designing complex investment systems and driving secure implementation of advanced techs.

- 45+ certified project managers (PMP, PSM I, PSPO I, ICP-APM) with experience in large-scale projects for Fortune 500 companies.

- 350+ software developers, 50% of whom are seniors or leads.

- Established practices to ensure the high quality of investment solutions and their delivery on the agreed timelines and budget despite constraints and risks.

- Our investment software product development company served one of the top 3 global asset managers with $5T+ in AUM.

Investment Solutions We Specialize In

ScienceSoft engineers specialized software for particular investment operations and multi-functional suites that transform the entire investment management process. Here are some of the solutions we deliver:

Core investment management solutions

An all-in-one software suite meant to support the investment firm’s core functions, such as investor life cycle management, portfolio management, trading, risk management, accounting, and reporting.

Value-driving features: AI-supported workflow automation, advanced analytics powered by machine learning (ML).

Software that automates the construction, allocation, monitoring, and optimization of multi-asset portfolios. It covers toolsets for portfolio modeling, portfolio performance and attribution analysis, and risk hedging.

Value-driving features: data-driven portfolio performance forecasting, AI-assisted portfolio composition and rebalancing.

Software designed to orchestrate and automate trade ordering workflows across investment accounts. It offers template-based order creation, automated order submission to trading venues, and real-time order tracking.

Value-driving features: AI-supported validation of order accuracy and compliance, smart order routing.

Software that streamlines trade enforcement, monitoring, and analysis. It offers direct market connectivity for real-time trading, supports ad hoc and algorithmic executions, and automates post-trade strategy analytics.

Value-driving features: intelligent suggestions on high-yield, low-risk execution strategies, AI-powered arbitrage.

Such software automatically gathers disparate data (fundamentals, technicals, sentiment, etc.) relevant to investment decision-making from multiple sources and structures the data according to researchers’ rules.

Value-driving features: automated content parsing, smart data tagging and lineage, auto-generation of research summaries using large language models (LLM).

Trading tools

Traders use such software to design, simulate, deploy, and backtest trading strategies. Live trading tools comprise real-time technical analytics, trade execution interfaces, and trade performance monitoring dashboards.

Value-driving features: AI-powered trading strategy design and optimization, ML-supported trade signal capturing, autonomous trade execution.

Deal flow management software

Software used for managing the full lifecycle of investment deals, from origination to closing. It automates multi-step workflows across opportunity data processing, deal pipeline tracking, and due diligence.

Value-driving features: LLM-supported lead profile enrichment, AI-powered deal scoring, smart alerts for priority opportunities.

Software that lets investment firms automate lot- and portfolio-level accounting operations, including asset valuation, transaction recordkeeping, fee accruals, tax calculation and filing, and reconciliation.

Value-driving features: AI-supported reconciliation, immutable investment books of record (IBOR) held on the blockchain.

Administrative solutions

Centralized platforms for investment firms to plan and track interactions with their clients. The software automates investor data processing, onboarding, commitment and goal tracking, and follow-ups.

Value-driving features: intelligent investor analytics and suggestions on personalized engagement tactics, automated investor communication enabled by generative AI.

Software that enables automated generation of investment performance and financial reports and their distribution to investors. It can be integrated with investor portals for real-time reporting.

Value-driving features: AI-supported report localization, generating non-standard reports using LLMs, investor-side dashboards with dynamic account reports.

White-label web and mobile platforms that provide investment management clients with self-service options across portfolio design, fund subscription, investment ordering, and investment performance tracking.

Value-driving features: AI-driven content personalization, support for natural language data querying.

Using such software, investment firms can control the compliance of their servicing operations with internal policies and regulatory rules. Compliance breaches are automatically flagged and reported to investigators.

Value-driving features: intelligent trade surveillance, ML-powered detection of non-compliant actions.

Data and analytics solutions

Software that automates the integration, validation, enrichment, and maintenance of multi-purpose data (market, investor, portfolio, etc.) used for the investment firm’s analytical and reporting needs.

Value-driving features: straight-through processing of unstructured data, intelligent data mapping, natural language search.

Document management software

Software meant to process, store, and organize the investment company’s operational documents. It automates document generation, indexing, access control, and version tracking.

Value-driving features: automated document processing using intelligent image analysis and machine learning, smart indexing.

Investment pros employ such software to create, test, and run statistical models for financial forecasting, asset valuation, and strategy analysis. It offers automated calculations and visual modeling.

Value-driving features: AI-supported model evaluation and calibration.

Solutions that allow investment firms to automate the calculation, forecasting, and reporting of chosen metrics across sales, finance, client experience, investment, and risk management areas.

Value-driving features: ML-powered diagnostic and predictive analytics.

Advisory and assisting solutions

Algorithmic tools that suggest high-yield portfolio design and investment strategies based on investor risk profiles, goals, and financial capacities. They can automate portfolio allocation and rebalancing.

Value-driving features: AI-powered, hyperpersonalized investment advisory.

Smart chatbots

Conversational tools that offer automated support for investment employees and investors across digital channels. They can respond to simple queries about accounts, portfolios, documents, and market insights.

Value-driving features: human-like textual and voice assistance enabled by generative AI.

Specialized components

Pre-trained machine and deep learning models of a selected type, used to support diagnostic, predictive, prescriptive, and optimization tasks within investment workflows.

Blockchain protocols that automate operations like asset tokenization, trade ordering and settlement, IBOR maintenance, capital calls, and compliance checks based on pre-set rules.

Ready-made integration solutions designed for quick and secure connection of investment software products with the internal systems of corporate users.

SDKs for investment firms

Go-to toolkits that make it easier for investment firms’ development teams to deploy, customize, and integrate the chosen investment software product.

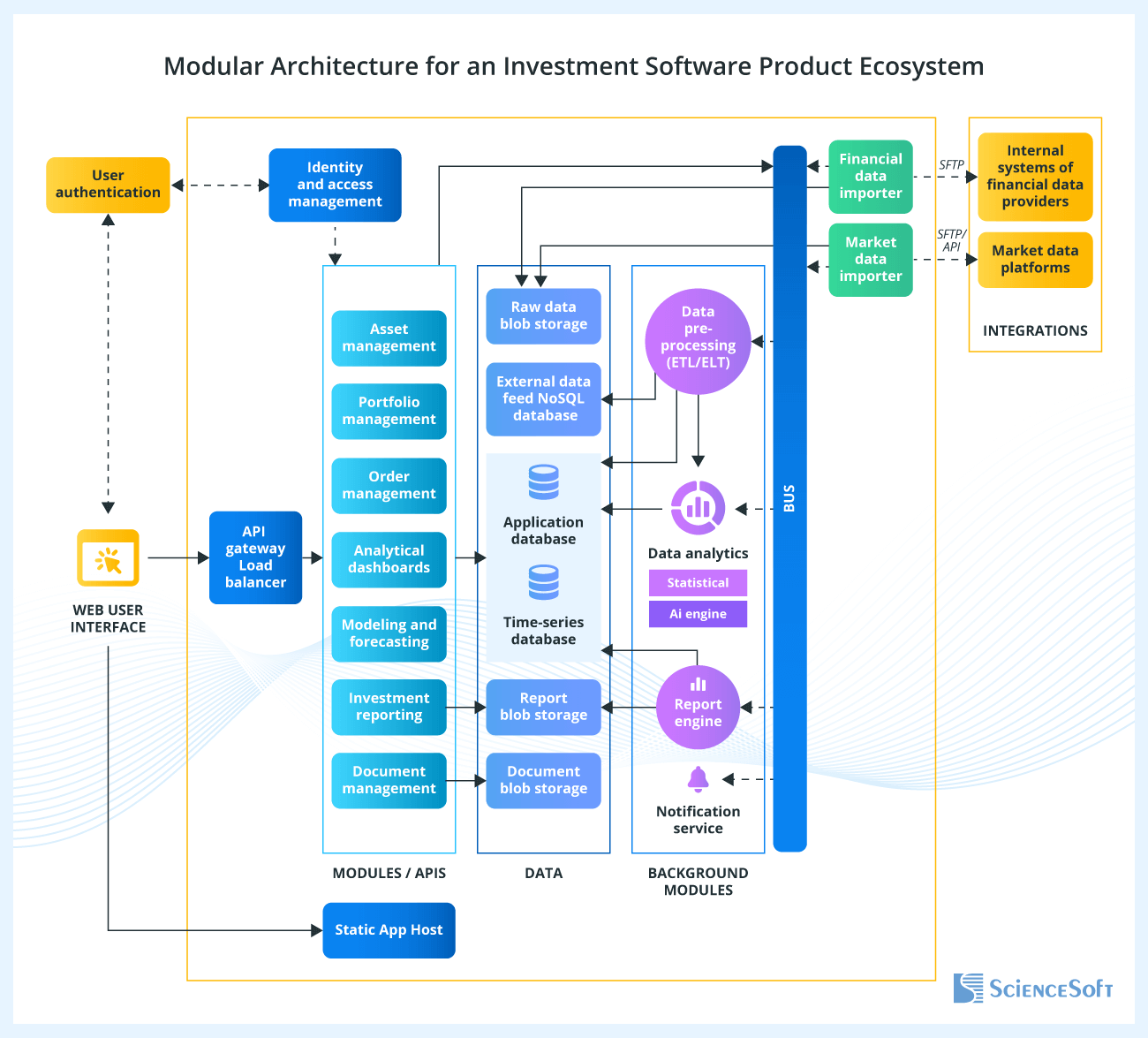

Architecture for an Investment Software Product Ecosystem

Below, ScienceSoft’s consultants share a sample architecture that can be used as a robust foundation for investment software products.

Key architectural components and data flows

In the proposed architecture, the solution is designed as a modular monolith, where task-specific features (portfolio management, modeling, reporting, etc.) are separated into distinct functional modules. Logic separation is enforced at both the application and data layers to enhance data privacy and accommodate jurisdiction-specific regulatory requirements.

The solution is hosted in the cloud and embraces a cloud-native, multi-tenant architecture. Multi-tenancy allows product users — investment firms — to operate in securely isolated cloud environments within a single storage cluster without the need to manage the underlying infrastructure. Application components are packaged as portable containers with environment-specific deployment and configuration overlays.

The architecture reflects integrations with market data platforms and financial data providers (established via APIs and SFTP). Integration flows are abstracted via the connector framework (messaging bus) that supports multiple protocol adapters for easy onboarding of new data sources and entities. The scope of pre-built integrations can be readily expanded to meet your specific needs.

Data storage is organized by data type. Any raw data entering the system is stored in the scalable blob storage (the data lake) to be available for reprocessing if analytical logic changes. Structured application data and time-series feeds like portfolio performance metrics are stored as is in the relational (SQL) databases optimized for time-series queries and analytical operations. Semi-structured data like market and custodian feeds passes through pre-processing (validation, cleansing, enrichment, etc.) in the dedicated module. It is then stored in the non-relational (NoSQL) database in an analysis-ready format. Documents and reports are stored in the dedicated blob storages optimized for search and navigation.

The analytics module computes the necessary investment metrics (on scheduled intervals or event triggers) and feeds them into investment dashboards and reports. Report generation is handled via the report engine that offers a low-code report template designer. The notification service handles alerts for user-defined and system events.

Investment professionals interact with the solution using customizable web interfaces. Identity and access management controls define distinct user experiences and privileges, ensuring operational security, segregation of duties, and adherence to compliance rules.

Hide

Some investment firms may want to retain their data in-house due to strict data sovereignty and regulatory policies, so cloud-only deployment options are insufficient. At ScienceSoft, we address this by designing investment software products to support full on-premises installations as well as hybrid deployments where critical data remains on-site and software runs in the cloud for scalability and performance.

Benefits of the proposed architecture

- The modular monolith approach removes technical and operational complexity often associated with microservices architectures. It streamlines development and maintenance while still allowing easy independent evolution of investment software product modules and ensuring flexibility to add new SaaS features in the future.

- The cloud-native product design lets you leverage native cloud services (storage, integration, DevOps, etc.), driving quicker product launch and development cost savings. It also supports autoscaling of computing and storage resources, which is critical for accommodating steady growth and periodic spikes in user activity without performance degradation.

- The architecture is cloud-agnostic, meaning you can apply it for deployments on Microsoft Azure, AWS, or any other cloud of your choice with minimal changes.

- Containerization of investment software product components facilitates deployment and ensures its consistent performance across diverse infrastructures.

- Data storage segmentation cuts infrastructure expenses, improves data accessibility, and enhances storage performance and manageability. This approach also allows for tiered storage, where costly high-speed storage is kept only for frequently accessed investment information, while infrequently used and archival data is offloaded to cheaper storage layers.

- The architecture is AI-ready, meaning you can introduce intelligent investment features in the first product version or add them later. Major cloud providers offer ready AI frameworks and services — with such a plug-in architecture, you can easily employ them for faster development of AI-supported components.

Choose a Service Option That Best Matches Your Needs

ScienceSoft provides full-range product consulting, engineering, and support services for startups and mature investment software companies. Our services are tailored to the client’s needs and can be related to:

Investment software product consulting

ScienceSoft’s consultants sharpen your product vision, deliver a clear solution concept, and assist with market entry planning. We can further design the architecture, UX and UI, and tech stack for your software and advise on security and compliance. You also get a detailed project plan with time and cost estimates and risk mitigation steps.

PoC and MVP delivery for investment solutions

ScienceSoft’s team can create a minimal viable product (MVP) for your investment solution to keep pace with your Agile development plans and speed up product release. You obtain an MVP in 3–7 months, depending on software complexity. We can start with a proof of concept (PoC) to verify solution feasibility and avoid unnecessary risks.

End-to-end investment software product development

Our team handles the entire development process, including solution design, engineering, integration with the necessary systems, and testing. Depending on your needs, we can develop the software from scratch or build it on a low-code platform like Microsoft Power Apps. We can also take over after-launch product support and evolution.

Modernization of legacy investment products

ScienceSoft can redesign the architecture, UX/UI, and tech stack of your existing product and revamp its legacy codebase. We can also upgrade the solution with value-adding features to strengthen its positions in the target market — a fast and cost-effective way to get modern commercial software with a solid competitive edge.

How to Ensure the Success of Investment Software Products

Drawing on decades of experience in investment software development, ScienceSoft’s consultants suggest that the following steps have a major impact on the success of commercial investment tools:

Focus on the actual needs of intended users

A mismatch between what the investment software product offers and what the users actually need may result in low adoption. At ScienceSoft, we help our clients mitigate this risk by starting the product design process with target audience discovery. We map the needs and goals of each intended user segment (advisors, traders, investors, etc.) and translate the insights into user personas and use case models that inform product requirements. This way, we prevent feature bloat and ensure the product vision is grounded in real user demands, not assumptions. Rapid prototyping and early usability testing with representative users help reveal feature and user experience gaps and improve product design before coding.

Investment firms won’t take chances on non-compliant software — it puts their entire operation at risk. To make your product viable in the investment sector, design for compliance from day one. That means mapping regulatory requirements (SEC, FINRA, CMA, SOC 2, and so on) early, embedding them into your technical and functional design, and building with enough flexibility to adapt as regulatory rules evolve. Investing in a pre-launch compliance audit is a smart move to ensure your product is ready for market and regulatory scrutiny.

Differentiate the product in a crowded market

There are hundreds of ready-made investment tools competing for user attention. To set your product apart, you need to define and market its unique value proposition (UVP). For this, consultants at ScienceSoft analyze the competitive landscape and pinpoint underserved needs within the target user segments, whether it’s richer portfolio visualization, faster trade execution, or easier research. These insights guide us in shaping differentiating product features that resonate with real user pain points. A winning step is to highlight the UVP through UI design, for instance, by adding contextual tooltips describing the value of signature features. This will make the product’s unique edge visible to users from the first interaction.

Make sure your product performs accurately

Flawed automation, inaccurate calculations, and delayed data access can severely damage user trust and derail the success of your investment software product. A stark cautionary tale is the 2012 Knight Capital incident, where a trading algorithm bug cost the firm $460 million in about 45 minutes. ScienceSoft achieves investment software accuracy through early validation of automation logic against real-world investment rules and applying the architectural patterns and programming techs that minimize risks to logic integrity. Our teams conduct thorough unit, integration, and security testing, targeting 95%+ test coverage to ensure consistent software accuracy across complex scenarios and edge cases. We also add mechanisms for input and output validation and instant error flagging to quickly locate data-associated accuracy issues in live products.

Establish robust security of investment data

Investment tools handle high-stake transactions and sensitive financial data, which makes them prime targets for cyberattacks. To meet user demands for data protection, you need to bake multi-layer security into your investment software product from the ground up. Applying secure architecting and coding practices, role-based access controls, multi-factor authentication for users, authorization controls for APIs, multi-level data encryption, and network protection tools is a must to safeguard your product and user data from cyber threats. ScienceSoft’s engineers also help investment software providers implement technology-specific defensive mechanisms, like asymmetric encryption for blockchain-based investment tools and prompt injection detection for LLM-powered apps.

Start small and evolve your product incrementally

It’s not just about accelerating the investment software product’s time-to-market. By starting with an MVP, you get actionable user feedback early and can further refine and grow the software in closer alignment with user needs, with minimal waste. Prioritize features that solve the most pressing user hurdles across critical workflows like portfolio and market tracking — these will bring quick, tangible benefits to your customers and secure retention. At ScienceSoft, we vet each investment software feature in terms of its value for users and build the MVP’s scope around the highest-value capabilities. And here are some of the techniques we apply for value-driven feature triaging in Agile product development projects.