Lending IT Blog

Welcome to our Lending blog, focused on the digital transformation of loan and credit operations.

Here, we dive into how modern technology solutions reshape the entire lending cycle from origination to servicing to collections. In lending IT since 2005, our experts focus on lenders’ real challenges across operational efficiency, risk control, regulatory compliance, and customer experience, explaining the value of technology from a practical, business-first angle.

Follow along to learn how lenders can grow confidently in a digital, data-driven economy.

Dimitry Senko

Lending IT Consultant and Senior Business Analyst, ScienceSoft

Lending IT

Banking IT

Finance IT

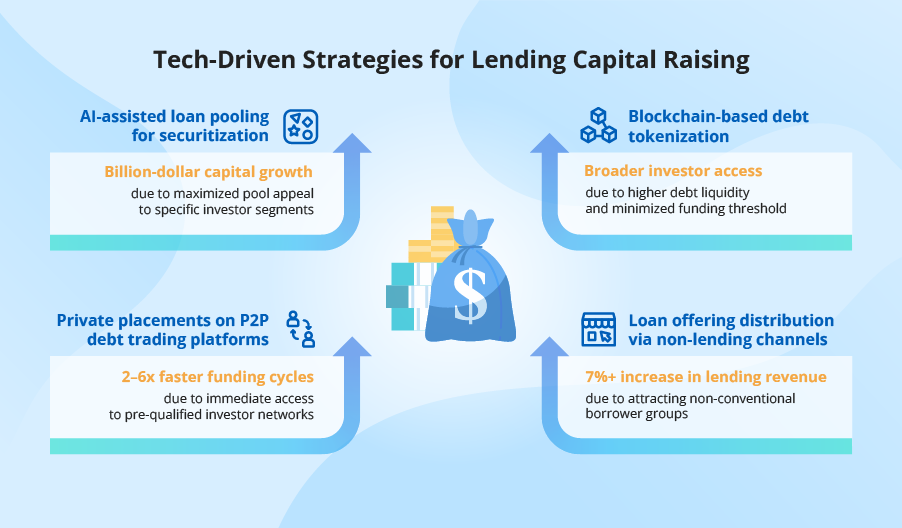

4 Tech-Driven Strategies Lenders Are Using to Attract More Capital

Dimitry Senko

Lending IT Consultant and Senior Business Analyst, ScienceSoft

Lending IT

Banking IT

Finance IT

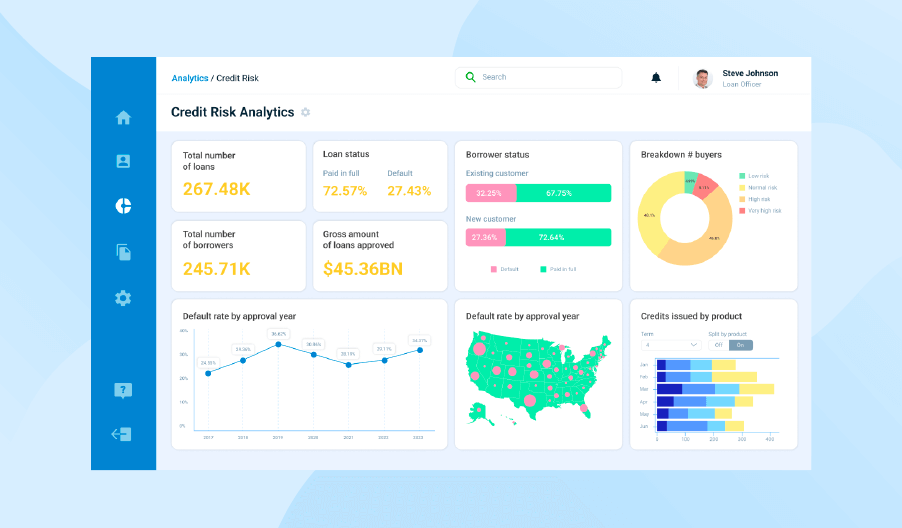

Legacy Analytics Tools Hamper Tactical Capital Allocation in Lending. Here’s How to Upgrade Them

Dimitry Senko

Lending IT Consultant and Senior Business Analyst, ScienceSoft

Lending IT

Banking IT

Finance IT

Four Digital Credit Underwriting Strategies to Expand Borrower Base Without Added Risks

Natallia Babrovich

Financial and Banking IT Consultant, Lead Business Analyst

Banking IT

CRM

Finance IT

Lending IT

CRM for Community Banks: a Game-Changer in the Digital Age

Andrew Repin

Business Analyst and CRM Expert

CRM

Finance IT

Lending IT

Mortgage CRM: The Future of Loan Management

Natallia Babrovich

Financial and Banking IT Consultant, Lead Business Analyst

Banking IT

Finance IT

Investment IT

Lending IT