Operating in a highly commoditized industry, banks have limited possibilities to gain new clients. Since the sources of banks’ organic growth are exhaustible, selling more products and services to existing customers makes a great business sense for banks. Indeed, selling to existing customers is estimated to be almost 50% easier than selling to brand new prospects. Bain&Company also states that keeping existing customers costs 6-7 times less than attracting new ones. These statistics distinctly prove that cross-selling can help banks to increase their revenue and indirectly improve customer retention, because customers with more products are less likely to switch.

In fact, cross-selling is beneficial not only for banks but for their customers as well. As for the latter, cross-selling makes it easier to keep track and manage financials by consolidating them at a single bank. Using this approach, customers will get better service and a more qualified consultancy, since their banks will see their aggregated financial status.

To cross-sell effectively, banks must always keep the balance between making proper offers to customers and merely trying to sell more, which may look like an aggressive tactic.

Cross-selling challenges

Though effective cross-selling have always been the holy grail for banks seeking higher profits, getting sizable results is not an easy task. In particular, A.T. Kearney underlines low cross-selling indicators showing that customers on average have only 2-3 products from the same provider.

To increase these numbers, some banks tried to introduce incentives for banks’ sales teams. But as the case of Wells Fargo showed earlier this year, using an aggressive bonus-driven system of remuneration for selling additional products can result in failure and fall apart like a house of cards ruining a bank’s reputation and making customers switch to another bank. That is why, to cross-sell effectively, banks should scorn the wide-spread ‘sell-sell-sell’ mantra and suggest only those services that will help customers manage their financial affairs.

How mobile banking helps to cross-sell

Mobile banking solutions give new opportunities for banks to reach their customers. Traditional channels such as e-mail or SMS usually lack personalization, as confirmed by the Gallup study. It shows that 66% of customers feel that incoming offers are general in nature, with 53% of customers already owning the product being promoted. With email, it usually takes more time to check the inbox, which makes it a poor choice for communicating with time-sensitive customers. Besides, banks even have no certainty that customer will open their e-mails.

By contrast, mobile banking allows showing the message any time the customer enters the app. The SMS channel shows better cross-selling results as it allows sending actionable information, but still it lacks the level of personalization achieved by using a mobile banking app. Yet, to leverage the mobile banking channel, a bank needs to go far beyond a standard delivery of promo messages.

The first step towards effective cross-selling starts with defining the actual needs of each customer. This can be achieved by analyzing customer buying behavior for financial products. This approach complements classic cross-selling practices that segment customers according to demographics, age and income. To be precise, banks can use customers’ current actions or recent transactions as triggers for creating an effective cross-selling message. Taking into account customers’ real-time behavior in a mobile app, a bank can bind a relevant marketing message exactly to the moment when a customer needs a product.

For example, a bank can put a promotional message in a personal financial management (PFM) tool, which usually includes the possibility to add customers’ personal goals (e.g. buying a house). Banks can analyze this data and benefit from it by promoting relevant products, such as a mortgage, in PFM. A bank can also suggest customers with volatile high balances on their debit cards to buy a deposit certificate by showing an advertisement with interest rates they’ll be receiving per month. Thus, a bank will get a chance to freeze a fixed amount of money on deposits. In case a bank has a network of partner merchants, it can use geo-fencing to show relevant offers or installments that can be bought locally using a credit card.

However, this process takes regular refining of promotional messages to cross-sell the most relevant product for this particular customer, with a certain sum, interest rate and duration. Potentially, banks can cross-sell almost any product or service, be it on the liability side (i.e. deposit, savings or checking accounts, etc.) or on the asset side (i.e. auto loans, student loans, mortgages, etc.), which makes cross-selling a versatile tool to increase a bank’s profits.

After creating an advertising message, banks can communicate their offerings via standard channels such as e-mail, SMS, promotional sections in bank statements, etc., and also display the message in the mobile banking app so that it looks encouraging without annoying. We prepared a number of tips that can help to keep this balance.

Tips for displaying cross-selling ads in a mobile banking app

- Mind the timing. Several studies by MailChimp, Experian, MailerMailer and others revealed that the best days for showing promotional messages are close to the midweek with the highest CTR on Thursdays and Tuesdays. As for the time priorities, surveys reveal that late morning (10 a.m.) and late evening (8 p.m.) are the best time during the day to display promos. Mobile CTR can also increase at dinner time when customers tend to perform most of their financial activities.

- Define frequency. Generally, push notifications in a bank mobile app are less intrusive than SMS, since they appear on the screen without interrupting users’ current activities. Still, they can be irritating when showed too frequently. That is why banks should work out an intelligent algorithm to communicate the offer without being annoying (for example, by setting the frequency to 1-2 times per day, by eliminating interruptions and showing the promo message only after completed transactions or by hiding ads when any app bugs or failures occur).

- Apply the call-to-action (CTA) button. When customers see an ad, they should have the possibility to tap on the button and apply for a loan directly from mobile banking without the need to leave the app. This demo shows how a client is offered to perform an one-click order of a new card right in their 'Cards' menu.

- Consider user experience and interface (UX and UI). Ensuring easy-to-read fonts, choosing effective images, keeping ads lightweight for fast loading as well as checking the appearance on a variety of mobile devices will all help to make cross-selling campaigns effective. With A/B testing, banks can test different elements to find which of them is better.

- Speak customers’ language. Since ordinary users have little understanding of banking terminology, the language in cross-selling messages should be adopted to customers.

Making the most of screen real estate

There is one limitation of advertising through a mobile app: as long as the mobile screen is relatively small, ad sizes are even smaller. That is why, when it comes to cross-selling via a mobile banking app, less means more. What does it practically mean? Striving for simplicity, banks should keep their promotional messages clear, simple and encouraging, which can be achieved only by monitoring customers’ behavioral cues and using this data to turn a default cross-selling message into a customized, valuable one.

Support cross-selling activities with CRM

To turn sales consultants into professional product and service advisors, banks need effective tools to go with motivation. This is where a CRM system comes into play. Based on our CRM consulting practice, we identified a number of ways in how sales consultants can use CRM to increase their share of customer wallet.

1. Deepen knowledge about customers.

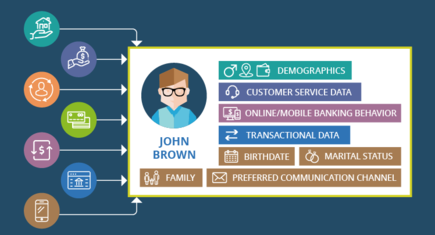

CRM in banking accommodates a unified customer database of individual profiles. These profiles include account information, customer profitability, purchase history, banking preferences, and behavior collected from a bank’s backend systems, a website, mobile banking and other sources. This database is the backbone for uncovering customers’ behavior patterns, revealing the most relevant cross-selling offers and devising further interactions.

2. Develop targeted cross-selling campaigns.

In combination with customer analytics, banking CRM can be used to segment customers by various parameters (for example, demographic characteristics, lifecycle stage, occupation, lifestyle, behavior, risk exposure, etc.) and assign the most suitable product offerings for them. In addition, bank sales consultants can detect the most value-generating customers to give them special attention as well as identify customers that are more likely to buy a particular product (find out how to do it in this demo).

A bank CRM system can help sales consultants revisit the traditional cross-selling process by tying products and services to customer relevancy. Since CRM can keep track of all previous customer interactions across various channels, sales consultants won’t ever send offers that do not answer customers’ personal needs. Instead of trying to cross-sell products and services that the customer does not desire, bank sales consultants can focus on delivering personalized financial advice. Consider this example of a message from a sales agent: “I see you regularly visit our branch to make a deposit from your rental property income. Have you considered our mobile banking app that allows you to deposit checks remotely?”

3. Manage scattered cross-selling activities.

With a bank CRM, sales representatives can simultaneously cope with various activities related to cross-selling, be it customer base management, sales activities planning or preparing analytics and reporting. For example, a bank with 7 million clients, 7,000 employees and 180 branches chose a CRM solution to optimize the workflows for corporate and individual profiles, as well as assigning tasks for sales consultants, which allowed users to plan calls and meetings with customers as well as report the results in the system. Banking executives also found it convenient for analysis of cross-selling results through comprehensive visualized reports.

N. B. Fill customer profiles with informative notes

Any CRM system requires a consistent teamwork and discipline in filling customer profiles. But apart from registering data about the cross-selling process itself, sales consultants should also focus on listening to customer sentiments and making respective notes. For example, instead of creating product-pitching records (e.g. “Discussed a mobile banking app” or “Offered a checking account, refused”), sales agents should rather mention valuable insights (e.g. “Has a teenager who is going to enter college in 2 years”).

4. Improve sales force performance.

Sales consultants can use CRM to centrally store their contacts, mark recent activities, and schedule calls, meetings in one place. Thus, CRM can help sales force optimize their daily activities, set individual goals, prioritize tasks and allocate time for each customer, which increases cross-selling possibilities.

How predictive analytics helps to cross-sell

Just a decade ago, predictive analytics was an exotic banking software tool used in just a few niches, such as credit risk evaluation or fraud detection. However, in the course of time, marketers realized it could be a competitive advantage to win and retain customers. Just look at how Facebook uses predictions to tailor the news feed to the user’s interests! Imagine how different your customer communications would be if you personalized your banking activities in the same way.

Due to an increased product commoditization, cross-selling has lately become a nightmare for most retail banks. In this regard, banks that want to sell extra products should cultivate deep knowledge of their customers. It means tailoring offers in a timely manner based on customers’ activities in their accounts, as well as their habits and lifestyle changes. To apply this in practice, banks should scrap “one-size-fits-all” campaigns and push-based selling, where sales representatives have to persuade existing customers to sign up for multiple products regardless of their needs. Instead, they can use predictive analysis to personalize communications with customers and offer them only relevant banking products and services.

To apply more advanced cross-selling techniques, it’s not necessary to buy standalone predictive solutions, because some banking CRM platforms go with built-in predictive analytics capabilities. For example, Salesforce offers its predictive tool Einstein that can significantly improve basic segmentation and standard marketing scripts with a “next best offer” (NBA) concept. Einstein takes into account all known information about customers and provides real-time product recommendations as well as optimal communication channels (e.g., e-mail, call center, mobile banking or even a banking chatbot). As a result, sales reps get a ranked and prioritized list of customers that tells them 1) whom to contact first, 2) what to sell to them and/or 3) what information they need.

Some banks have already taken advantage of predictive analytics software. For example, First Tennessee Bank managed to optimize its marketing strategy, which resulted in an impressive 600% ROI through more accurately targeted offers within high-value customer segments.

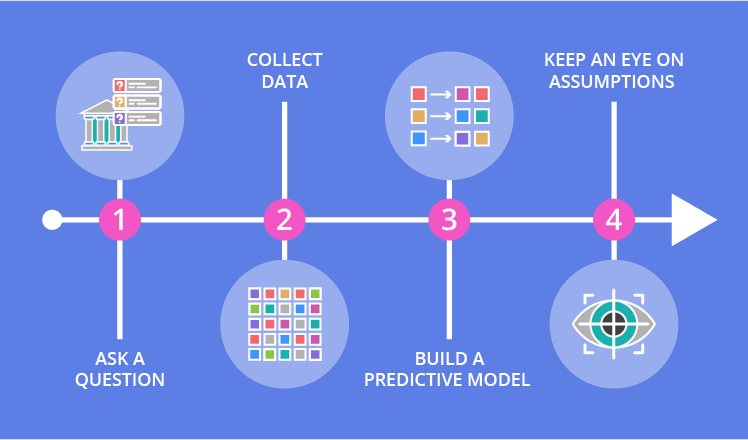

Checklist: 4 steps to apply predictive analytics

1. Ask a question

Unlike traditional BI tools (e.g., descriptive or diagnostic analytics) that are retrospective by nature, predictive analytics can give you insights about the future. Thus, instead of trying to understand the reasons for something that happened in the past, your bank can use predictive analytics to anticipate upcoming events and work out a plan in advance.

With analytics software, banks can answer various questions:

- How many leads will a new marketing campaign generate?

- What is the profit potential of a customer X over the next 2 years?

- Which customers are going to churn?

- What is the probability that a customer X will purchase a product A, if he or she purchases a product B?

2. Collect Data

Once a bank stated a question, the next step is to find the data that directly or indirectly reflects the answer. The confidence level of every prediction highly correlates with the quality of data presented for analysis. Only consistent data can provide trustable insights.

Still, according to our analytics consulting practice, data collection is usually the most time-consuming aspect of data analysis. The reason is that the majority of banks store inconsistent, outdated or incomplete information about customers in their banking CRM systems. Thus, to streamline the process of data collection, banks should timely update and review their customer profiles.

For some predictive models, customer information from a banking CRM is not enough. In this case, a bank will need to incorporate additional data sources in its model. In particular, Aite Group suggests the following data sources:

- Channel preferences

- Social media insights

- Consumer ratings and reviews

- Bill payment behavior

- Personal financial management (e.g., customers’ financial goals)

- Geolocation

- Current events

3. Build a predictive model

At this step, data analysts (or data scientists) create a model that will define the probability that a certain event will happen in the future. To do this, they employ machine learning (ML) methods of various complexity, from linear regression to deep learning. To illustrate the idea, let’s see how a ML algorithm based on regression analysis helps find the probability that a customer will close his or her account in 2-3 months.

First, a data analyst assumes that certain variables correlate with customers’ desire to churn. In this case, the analyst can use the last transaction date, the last external deposit, the number of monthly transactions, etc. Then, the analyst creates training and tests data sets containing real customer data: the values of the chosen variables and the binary (Y/N) values of customer churn. Both data sets should include the data of both loyal customers and those who left, so that the future model could learn to distinguish them based on their behavior (the chosen variables).

The next task is to find the correlation between the chosen variables and the customer churn probability. To do this, the data analyst creates a linear regression model that will calculate the weight of each variable, i.e., if and how much the variables influence the customer churn probability. But first the model should be trained on real data from the training data set (this is why the process is called machine learning).

After a number of training iterations (processing data entries), the analyst gets a predictive model that ‘explains’ customer attrition. Now, the test data set is used to assess the model’s predictive power. If it’s not enough, the model can be further elaborated to achieve a higher accuracy.

An accurate predictive model is a powerful tool. When fed with a customer’s data, it outputs the ‘churn score’, and if this score exceeds a certain threshold, a bank can take preventive measures for customer retention. Once created, the same predictive model can be applied to any customer’s data.

4. Keep an eye on assumptions

One major assumption in predictive analytics is that the future will be similar to the past. Indeed, as stated by Charles Duhigg in his book The Power of Habit, people establish strong patterns of behavior and follow them over time, which makes a predictive model rather reliable. However, sometimes people change their behavior patterns, so the model, once used to predict them, may become invalid.

Besides, time or changing market circumstances can also alter a predictive model’s assumptions. For example, models once used to predict mortgage repayment were based on the assumption that the housing prices would always rise, which resulted in the financial crisis of 2008. Thus, if a model contains a variable that changes over time, it will probably lose its predictive power eventually.

Overcoming skepticism

Despite sizable benefits, many skeptics still don’t believe in algorithms' abilities to predict the future. For example, Gary King, a professor from Harvard University and the director of the Institute for Quantitative Social Science, mentions that statistical predictions are valid only in sterile laboratory conditions, whereas in reality a bank cannot know for sure which variables influence a customer’s behavior. As he puts it, “Everything from the weather to [a customer’s] relationship with their mother can change the way people think and act. All of those variables are unpredictable. How they will impact a person is even less predictable. If put in the exact same situation tomorrow, they may make a completely different decision”.

Though these words make sense, we still believe that banks should strive to decrease the level of uncertainty and apply predictive analytics in their daily operations. Data-driven decision-making has its limitations, but it is much better than wild guesses.

Switch from selling to advising

To cross-sell effectively, banks should keep balance between pushing to sell more and making valuable, relevant offers to customers. For this purpose, banks should suggest only those services that will help customers manage their financial affairs.

Leave a request

Want to boost cross-selling?

We can help you get a solid CRM system, a quality mobile banking app or an elaborate analytical solution to get you there.

Leave a request