Artificial Intelligence (AI) Assistants for Insurance

Capabilities, Architecture, Costs

In AI engineering since 1989 and in insurance IT since 2012, ScienceSoft develops commercial insurance AI products and proprietary AI assistants tailored to the unique servicing workflows of each insurance firm.

Key Opportunities AI-Powered Assistants Unlock for Insurers

AI-powered assistants for insurance are used to automate data search and analytics workflows, support insurance teams’ underwriting and claims decisions, and handle routine customer interactions.

Insurers have already been using traditional AI and ML for decades, but modern assistants built on generative AI and large language model (LLM) technologies made it possible to also process unstructured documents and human speech and compile live responses, basically letting insurers and their customers “talk” to apps, data, and analytics.

Here’s how the adoption of AI assistants has reflected on the industry in recent years:

|

|

BCG reports that its work involving 20,000+ insurance service and operations employees has shown productivity gains of more than 30% from equipping these workers with AI-empowered tools. |

|

|

A specialty insurer Markel reached a 113% increase in productivity (GWP per FTE) for its underwriting team after employing AI assistants to automate pre-underwriting tasks and upfront risk evaluation. |

|

|

A multiline giant Allianz got over 65% of claims under its Allianz Travel Insurance programs handled automatically and cut the average claim lifecycle 5-fold by rolling out a claims AI assistant. |

|

|

A health & travel payer PassportCard reports that its AI copilot automatically pays more than $220M in annual claims, minimizing claimant friction and employee efforts and driving the insurer’s NPS high. |

|

|

Precedence Research, in its 2025 study, estimates that AI will reduce insurers’ operational costs by up to 40% by 2030, illustrating the impressive financial gains from applying AI assistants industry-wide. |

AI Assistants for Insurance: Market Snapshot

The global market of generative AI for insurance reached $1.1 billion in 2025 and is anticipated to grow 9x to $10.94 billion by 2034 at a CAGR of 29.11%. Employee and customer assistance is considered one of the largest use case segments for GenAI in insurance.

A recent study by BCG shows that insurance outpaces nearly all industries in adopting generative and agentic AI systems, including intelligent assistants. Key drivers of the popularity of AI-powered assistants among insurers are the need to enhance employee productivity, speed up servicing, improve risk assessment, and deliver a better customer experience. As of late 2025, 74% of insurers had already deployed or were piloting such solutions. However, only 7% move past pilots due to organization and accountability issues, employee resistance, siloed AI use cases, and large amounts of tech debt.

What AI Assistants Do for Insurance Firms

For customers and partner agents

Personalized policy recommendations

Customers and agents can use generative AI copilots to navigate insurance product portfolios and design tailored coverage packages. An AI assistant can analyze customer profiles, risks, behavior patterns, and historical claims and propose relevant products that match individual needs, explaining trade-offs between cost and coverage in simple language. It can suggest riders, bundles, and add-ons to bridge gaps in standard coverage and proactively surface personalized retention and cross-sell offers for policy renewals.

Value: Improved conversion, engagement, and retention rates, more effective upselling.

Guided insurance application filing

AI assistants can guide customers and agents through insurance questionnaires, explaining complex concepts in simple terms on the fly. An assistant can dynamically add or remove questions based on previous answers, prefill data from connected internal and third-party systems, and validate user inputs against underwriting rules. It requests missing data from the applicant in real time and holds the application until it’s complete, preventing gapped files and future time losses on the customer and underwriting side.

Value: Quick, frictionless application completion for insureds and front-line teams, streamlined risk profiling.

Conversational intake of claims

AI assistants can guide insureds through the step-by-step FNOL process without the need to fill out static forms. Claimants describe what happened in plain language via a chat or voice interface, and the assistant automatically composes the incident description, extracts essential details, and populates FNOL forms. It can suggest the right claim type, assist with evidence uploading, validate submissions in real time, and request additional information. Upon user request, the solution can check and explain reimbursement terms for specific loss scenarios.

Value: Shorter FNOL cycle, smoother claimant journeys, reduced adjuster workload.

Omnichannel support for policyholders

AI assistants can handle the bulk of typical customer requests across digital channels (website, portal, email, messengers) and call centers, supporting live chat and audio conversations. They can interpret free-form questions and deliver responses in plain language. Assistants can also authenticate customers to display their active policies and guide them through tasks like updating personal information, making payments, or renewing coverage. When an assistant doesn’t have an answer or isn’t certain enough, it routes the request to human support specialists based on preset handoff rules and confidence thresholds.

Value: Faster case handling, minimized manual support routines, improved policyholder experience.

For front-line and back-office insurance teams

For underwriters, AI assistants can generate concise risk narratives and triage applications by urgency. Relying on established risk appetites and approval thresholds, they can recommend whether a risk can go straight through, requires human review, or needs co-assessment with loss handling partners. Underwriters can ask the assistant to gather risk-relevant data from public sources and evaluate the severity and loss impact of specific conditions. Such tools can model alternative risk scenarios, compare applicants against peer segments, visualize potential losses, and suggest optimal underwriting decisions.

Value: Quicker underwriting of simple applications, more efficient and accurate handling of complex submissions.

Claims teams can rely on AI copilots to automatically process routine claims, compile case summaries, and reason on coverage applicability and optimal loss reserve utilization. AI assistants can analyze FNOL descriptions and multi-format evidence (damage photos, medical records, repair invoices, etc.) and determine key loss events, liability triggers, cost drivers, and urgency indicators. They can highlight discrepancies between submissions and policy terms with links to source passages. AI can also propose triage and settlement decisions and route claims to the right specialists for adjustment or reimbursement based on case complexity.

Value: Faster claim processing, improved quality of claims decisions, enhanced adjuster capacity.

AI assistants can analyze customer submissions (filed forms, documents, etc.), match the data against trusted sources, and identify suspicious patterns. They notify investigators about risks and provide summaries of fraud indicators with contextual explanations. Specialized GenAI assistants can spot known schemes like double-billing, complex cases like network collusion, and emerging types of fraud like deepfaked evidence. They can also capture subtle contradictions in insureds’ narratives during text and audio conversations and flag them for deeper review.

Value: Improved fraud detection rates without hampering customer experience; minimized fraud-associated losses.

Documentation and communication drafting

Intelligent assistants can draft tailored templates for insurance documents (policies, cover letters, adverse action notices, etc.) that adhere to regulatory and brand guidelines. They can also generate personalized messages about application and claim updates, payments, or policy changes, tailoring the tone to each customer’s risk profile, historical sentiment, and level of insurance literacy. Agentic AI assistants can also trigger automatic document and message distribution across the insurer’s systems and interaction channels.

Value: Simplified creation of tailored content compliant with the insurer’s policies and brand voice.

Call center support

Call center specialists can ask an AI assistant to retrieve specific information from internal policies, product sheets, past case archives, and regulatory guidelines, or just ask AI about particular accounts or service aspects. The assistant navigates insurance knowledge bases in real time, pulls up the insured’s policies, claims, payments, and previous interactions, and delivers relevant answers backed by source citations. It can explain complex terms and clauses, provide step-by-step process instructions, and suggest personalized offerings and loss handling options.

Value: Faster data search, more consistent communication and decision-making, improved productivity of the insurer’s call center teams.

Risk and optimization insights for management

Insurance managers can use AI-powered assistants with their business analytics systems to translate complex operational and financial data into clear, easy-to-understand insights. Tailored assistants can analyze KPIs across underwriting, claims, sales, customer service, and finance, predict future performance, and compile analytical summaries at the company, branch, region, or line-of-business level. They can highlight areas of underperformance and emerging risks, explain drivers behind these trends, and suggest actionable improvements and workflow optimization steps.

Value: Streamlined business oversight, faster and more confident management decisions.

Agentic automation of multi-step workflows

Agentic and multi-agent AI systems go beyond conversational assistance and can perform low-risk, high-volume actions independently. For example, when integrated with the insurer’s core automation systems and business-critical external tools, they can create and schedule tasks, update policy attributes, trigger auto-approvals, request reinsurance confirmation, and enforce fraud response. To maximize the degree of autonomy while retaining control over agentic workflows, we implement rule-based guardrails, “human-in-the-loop” oversight and approvals, audit trails, and line-of-business restrictions.

Value: An increase in efficiency across complex, multi-step insurance operations.

See an Insurance AI Assistant in Action

Watch Vadim Belski, ScienceSoft’s Head of AI, try to make a “fraudulent claim” for homeowners insurance and get caught by the AI agent. According to ScienceSoft’s consultants, the production solution can boost investigator capacity by 40% and drive 20%+ higher fraud detection rates through sentiment-based fraud indicators.

Generic, Specialized, or Custom-Built AI Assistants: What Do Insurers Pick?

In my experience, insurers adopt general-purpose AI assistants like Boost.ai or LivePerson only for high-volume, routine customer interactions. They can work well for FAQs, simple service requests, and linear workflows like address changes or claim status checks. Basically, these assistants can handle the bulk of first-line customer interactions, but it is hard to scale them to more complex functions without migrating to a different platform.

More advanced, insurance-focused GenAI assistants like those by Verisk or Insurity go way further. They can summarize submissions, gather and interpret risk data, and support underwriting and claims decisions, which is what most insurers are looking for. Still, these products are constrained by vendor data models, process logic, and integration patterns. In practice, this means they may struggle to support unique product structures and non-standard decision rules. But even for insurers with very traditional service lines, integration with legacy systems remains the biggest pain point. Software vendors can’t provide APIs for every kind of old or proprietary system out there, and without access to internal data, AI assistants can’t make adequate decisions.

That’s how insurers I work with end up adopting partially or fully custom AI assistants: to integrate the stack with their legacy software, add extra logic and rules, or make AI more “aware” of their internal policies and risk frameworks. Most of the time, this means taking a pretrained model or insurance AI platform and making tweaks or building custom infrastructure around it. Training a fully custom insurance AI model is only financially feasible for AI startups that are going to commercialize it later.

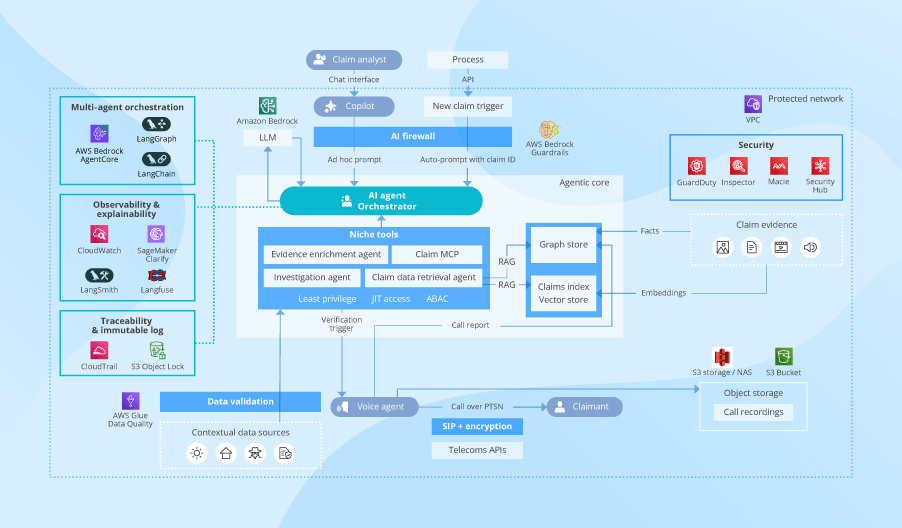

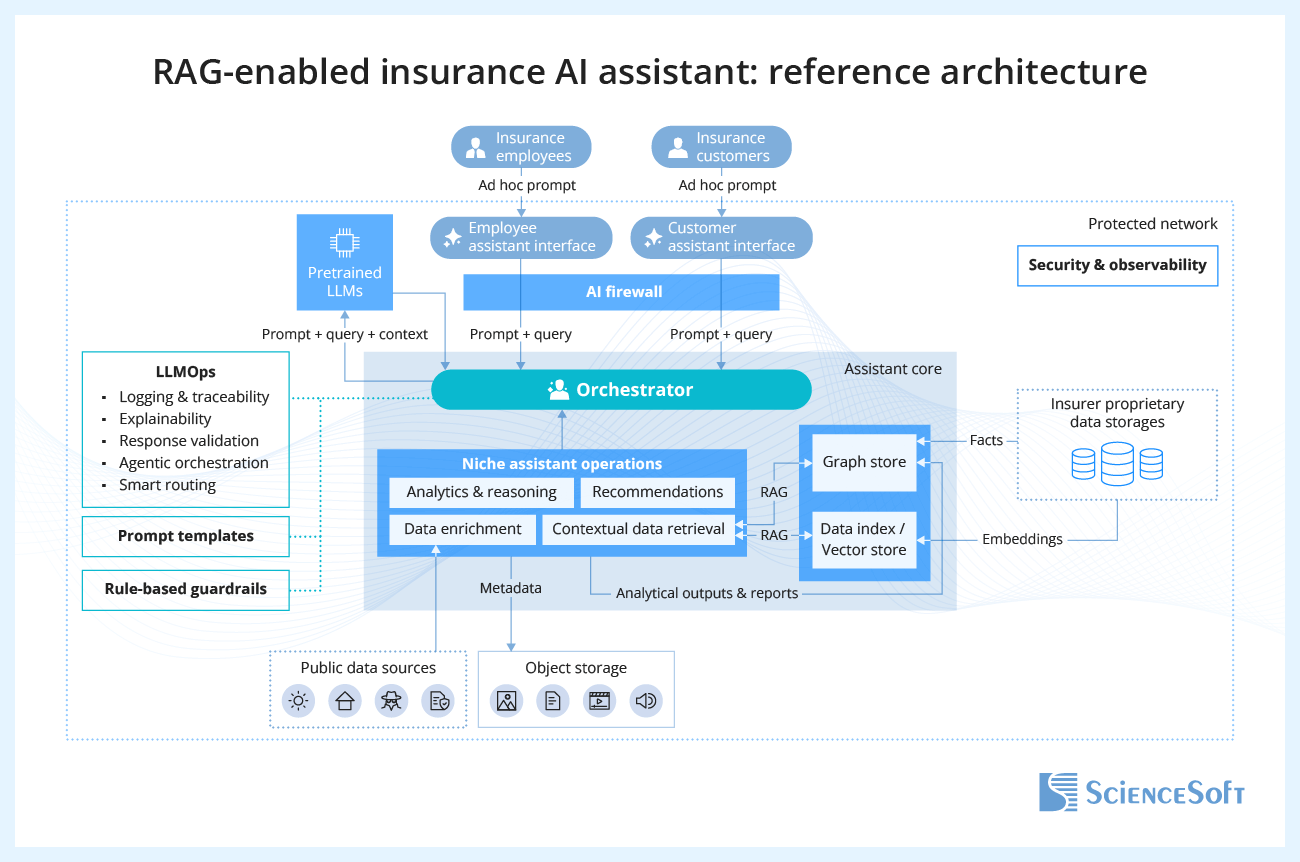

Sample Architecture of an Insurance AI Assistant Solution

In the reference architecture below, ScienceSoft’s architects show how a pretrained commercial LLM can be used as a core for a specialized insurance AI assistant, outlining the solution’s key components and data processing flows.

To adapt the LLM to the insurer’s specifics, we can use techniques like retrieval-augmented generation (RAG), which are faster and cheaper than model fine-tuning or retraining. See a full comparison of LLM enhancement techniques in our dedicated guide.

- Users interact with an AI assistant via role-based app interfaces (for insurance customers, underwriters, loss adjusters, etc.). Employees and customers can ask questions or submit tasks in text or voice mode, depending on the solution’s configurations. Adding support for live conversations usually means the need for a speech-to-speech model like Amazon Nova Sonic, which can support low-latency bidirectional voice streaming and function calling.

- The app routes the user request (prompt) to the AI firewall, which enforces security and compliance safeguards (authorization, PII redaction, content filtering, prompt-injection checks, policy-based routing, etc.).

- After validation, prompts are forwarded for processing to the orchestrator. The orchestrator serves as the integration and control layer that connects user interfaces, LLMs, and assistant-side enhancement components. It relies on a large language model operations (LLMOps) tool stack to provide event logging and traceability, explainability, model inference validation, and, when applicable, agentic orchestration for multi-step tasks. This component also hosts the insurer’s rule-based guardrails for AI assistant workflows.

- To ground the response in the insurer’s context, the orchestrator triggers niche assistant operations. First, it queries the insurer’s proprietary data storage (a centralized data warehouse or dedicated databases of specialized insurance systems) for structured data, such as policy details, deductibles, claim status, risk and fraud scores, and customer details. Before launching the assistant, ScienceSoft normalizes structured data in a graph store to represent relationships between disparate attributes and ensure reliable reasoning over dependencies.

- In parallel, the orchestrator activates the RAG embedding pipeline to retrieve unstructured and semi-structured data relevant to the request (e.g., claim media evidence, policy documents, underwriting guidelines, regulatory instructions, knowledge articles). To make such data semantically searchable for the RAG engine, you first need to classify it, cleanse, enrich with insurance metadata, chunk, convert to vectors, and store in the vector store. ScienceSoft uses automated metadata vectorization pipelines to streamline these processes.

- If necessary, the assistant can also perform contextual data search across public sources (open databases of local authorities, sentiment platforms, etc.) to enrich the insurer’s internal findings, e.g., when running KYC, profiling risks, or validating claims. The results of the hybrid search are merged into a single optimal set of outputs.

- The orchestrator combines the gathered contextual data with the original prompt and assembles an LLM-ready prompt using pre-engineered prompt templates. We create custom prompt templates considering frequent inquiry topics, insurer’s operational specifics, and prompt length limits and formatting defined by LLM providers. The ready prompt is routed to the integrated LLM. In multi-model setups, the orchestrator applies intelligent routing logic to select the best-performing LLM for the task.

- The pretrained LLM (GPT-5, LLaMA, Claude, etc.) analyzes the prompt and provides its response with links to source data and citations. The response is logged and validated in the orchestrator and, if accurate and relevant, submitted to the user.

- Structured passages produced by the assistant are submitted as auditable artifacts (summaries + citations + confidence scores) to human reviewers. The approved artifacts are written back to the graph store to be available for the insurer’s databases and operating systems. Non-structured files (e.g., AI-generated documents, tables, images) are directed for retention and reuse to the dedicated object storage.

Benefits of the proposed architecture

Flexible deployment options

The AI assistant app can be built as a standalone solution, implemented on top of existing software (e.g., an underwriting system, a claims management platform, an insurance portal, a customer-facing app), or launched as a browser extension.

Technology-agnostic design

The architecture works well with LLMs, AI engineering and orchestration frameworks, and cloud services from a variety of vendors, allowing a mix of best-performing technologies and alignment with the insurers’ existing software stacks.

Easy scaling and evolution

A modular orchestration core can flexibly accommodate new field-specific assistants and dedicated guardrails. The design is feasible for assistants of various classes, from conversational chatbots to autonomous agents.

Native assistant controls

The AI firewall and LLMOps components ensure that intelligent assistant operations are controllable, auditable, explainable, and secure. These controls can be configured to specifically match specific regulations or insurers’ internal policies.

How Insurance Market Leaders Benefit From AI Assistants

Allianz Cuts Claim Cycle by 5x With AI Claims Assistant

Allianz, one of the world's largest multiline insurers with 156K employees and 70 countries served, rolled out a proprietary AI assistant to automatically handle claims under its Allianz Travel Insurance programs, which protect 55 million travelers a year. The assistant launched on the insurer’s web portal guides its private customers through the digital claim submission process, asks routine questions, and automates back-office claim processing, evidence validation, routing, and payout tasks.

By switching to AI-assisted claim workflows, Allianz managed to cut the average claim lifecycle from 19 days to 4 days. More than 65% of claims are now handled automatically, with 71% of those processed within 12 hours and some payouts completed in as little as 6 hours. 75% of Allianz customers who used the AI-powered claims assistance reported higher satisfaction, largely due to faster settlements and always-on digital support.

PassportCard Relies on AI to Automate 95% of Global Claims

PassportCard, a health and travel insurer operating in 150+ countries, launched a tailored AI copilot to aid its claims teams in case processing and settlement. The copilot vets claims for accuracy and fraud, verifies losses, and concludes on case eligibility. It instantly pre-approves expenses and enforces payouts for valid cases, while routing complex and questionable claims for human review.

Today, PassportCard’s copilot automatically pays 95% of the insurer’s $250 million in annual claims. This straight-through processing enables just-in-time payouts for most insureds and minimizes manual efforts for adjusters and investigators. Independent CX studies attribute much of PassportCard’s high Net Promoter Score to the fast, low-friction claimant journeys.

Recently, PassportCard has expanded its AI stack with assistants for coverage personalization and notifications about emerging travel and safety risks.

Let’s Co-Plan an AI Assistant for Your Particular Case

AI assistant implementation for insurers

ScienceSoft’s experts will study your needs, help define high-ROI use cases for assistant AI across your insurance operations, and advise on cost-effective implementation paths, with further solution technical design and iterative development.

AI assistant product development

ScienceSoft’s team will help you sharpen your product vision, conceptualize the solution, and plan market entry. We can further aid in AI software design and project planning, deliver a PoC and an MVP, and handle incremental product expansion.

Tech stack that minimizes time-to-launch for tailored AI assistants

For an initial AI assistant deployment, I recommend using managed services wherever possible. For example, specialized frameworks like LangChain and LlamaIndex and cloud provider services (Microsoft’s Azure OpenAI, AWS’ Amazon Bedrock, and Google’s Vertex AI) let you quickly roll out proprietary AI assistants for specific insurance tasks. These services offer built-in toolkits for RAG pipeline setup, prompt templating, vector search, orchestration, observability, and AI guardrails, removing heavy infrastructure work and cutting time to value.

Another advantage of managed AI services is native access to multiple leading LLMs. This lets you choose the most suitable model per use case and switch models with minimal effort without maintaining multiple standalone integrations.

Challenges of Launching AI Assistants and How to Solve Them

Challenge 1. Poor quality of contextual data may degrade the accuracy of AI

An insurer’s proprietary data can be siloed, flawed, incomplete, or outdated. If AI assistants draw on such data, the resulting responses can be inaccurate, inconsistent, or irrelevant.

Solution

Challenge 2. Weak AI assistant security may compromise data privacy

AI can unintentionally expose sensitive insurance data to third parties and overlook malicious activity, violating data protection regulations, customer confidentiality principles, and customer trust.

Solution

Challenge 3. Third-party vendors may mishandle sensitive data

Inept AI and cloud providers may deliberately retain, reuse, or expose the insurer’s proprietary data (e.g., for model training or cross-customer inference), leading to data and compliance breaches.

Solution

Costs of Implementing an Insurance AI Assistant

Developing a tailored AI assistant solution for insurance may cost from $150,000 to $1,000,000+, depending on the software’s functional scope, the number and complexity of integrations, architectural and tech stack choices, and security and compliance requirements.

This is the estimate for the initial implementation, which doesn’t include ongoing cloud fees, component (model, AI service, etc.) license costs, and solution maintenance expenses.

For product development, expect +30–120% higher upfront investment for the same kind of AI assistant due to the additional cost factors, such as the need for multi-tenant isolation, tenant-specific RAG, SOC 2 and local compliance packaging, product distribution (marketplaces, multi-cloud), and go-to integration solutions (SSO, APIs, partner connectors).

Here are ScienceSoft’s sample estimates for three common scenarios:

$150,000–$250,000

An AI-powered chatbot that handles customer technical support and basic insured communication tasks (e.g., requesting missing application data, reporting claim statuses).

$300,000–$600,000

A generative AI copilot for insurance employees. The solution automates omnichannel data search and analytics tasks and provides intelligent suggestions on optimal servicing decisions.

$600,000–$1,000,000+

An agentic AI solution that autonomously handles data processing and reasoning operations, recommends the optimal actions for insurance teams, and can automatically enforce those actions across the connected systems (with human sign-off).

Get a tailored quote for your project

ScienceSoft is ready to provide tailored cost estimates for your specific case. It is free and non-binding.

Why Build Your AI Assistant With ScienceSoft

-

Since 1989 in AI consulting and implementation.

- Since 2005 in engineering custom software solutions for the insurance industry.

- Insurance IT and compliance consultants (NAIC, GDPR, IA, HIPAA, SOC 1/2, etc.) with 5–20 years of experience.

- 45+ certified project managers (PMP, PSM I, PSPO I, ICP-APM) who succeeded in large-scale projects for Fortune 500 firms.

- 9 principal architects with hands-on experience in designing complex insurance automation systems and driving secure implementation of emerging AI technologies.

- Established practices to ensure the high quality of insurance solutions and their delivery on the agreed timelines and budget, despite project constraints or uncertain requirements.

Our awards, certifications, and partnerships

Insights From ScienceSoft's Insurance IT Experts

Featured Expert Talk

AI Agents for Insurance Claims Fraud Detection | Presentation at ITS 2025

Presentation by Vadim Belski, Head of AI and Principal Architect at ScienceSoft, from the 2025 Insurance Transformation Summit in Boston. Vadim explores the potential of agentic AI in insurance and demonstrates how claims AI agents can enhance fraud detection through conversational claim verification.