Investment Client Lifecycle Management (CLM) Software

Features, Development Best Practices, Costs

ScienceSoft engineers tailored investment client lifecycle management systems that address the common drawbacks of off-the-shelf tools, such as rigid automation features, limited regulatory matrices, and pre-defined integrations. For each CLM solution, we work with our clients to engineer a secure, interoperable software architecture that will bring lasting value and optimized TCO.

Investment Client Lifecycle Management Software: Key Aspects

Investment client lifecycle management (CLM) software is used to orchestrate and automate an investment firm’s cross-functional workflows across investor onboarding, initial and perpetual due diligence, account maintenance, client data management, risk and compliance controls, and offboarding.

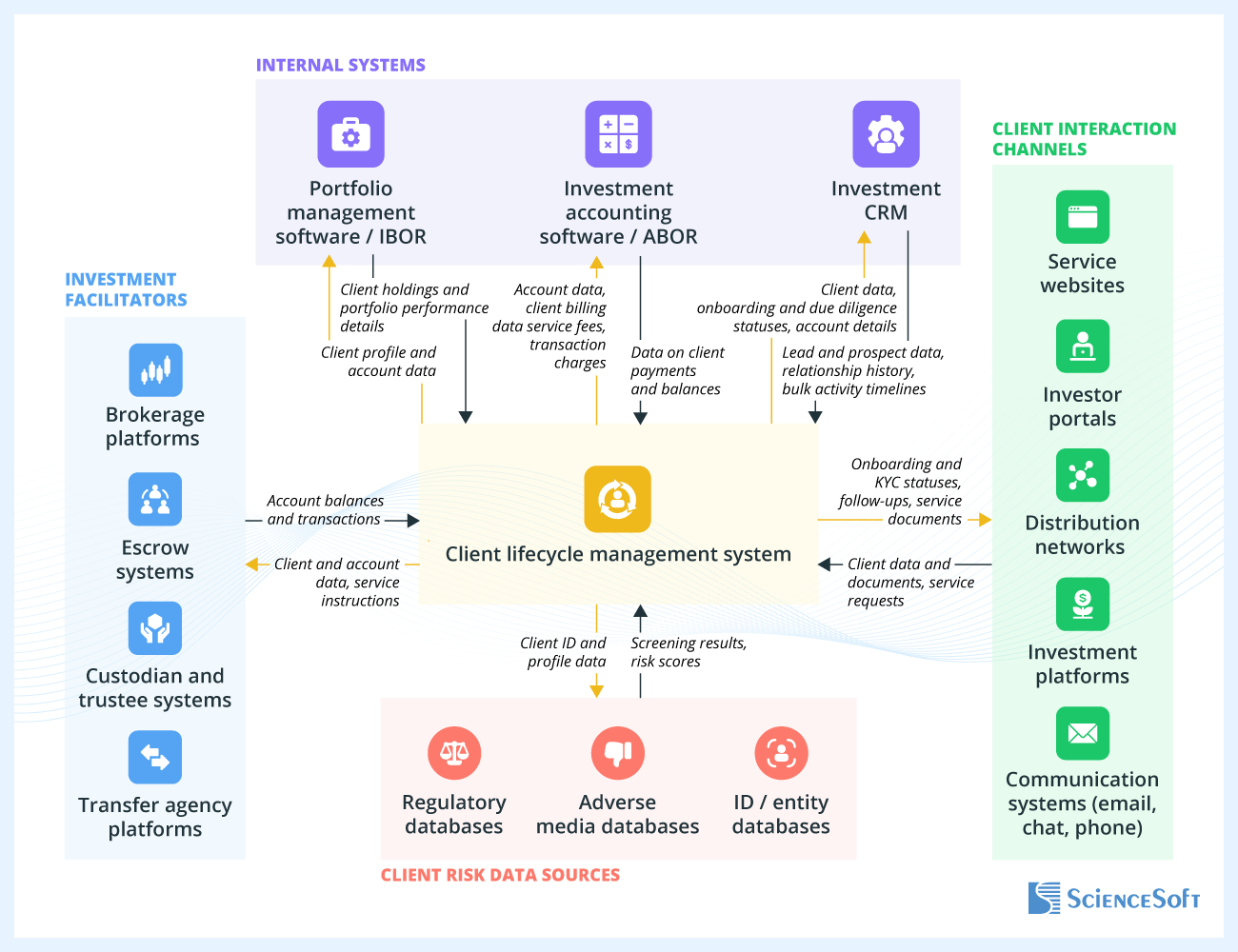

- Key integrations for CLM software: client interaction channels, CRM, investment management software, risk data sources, and more.

- Implementation time: around 7–15 months for core software modules.

- Development costs: $100,000–$1,000,000+, depending on solution complexity. Use our free calculator to estimate the cost for your case.

- Solution ROI: 150–450%+ in four years after launch.

Why Investment Firms Choose to Build Tailored Client Lifecycle Management Solutions

Investment entities go for proprietary CLM solutions when off-the-shelf software products fail to support their non-conventional operations, orchestrate complex workflows, and reliably integrate data across disparate systems.

- Tailored CLM solutions can support complex entity structures (e.g., layered models like trusts and funds-of-funds) and accommodate diverse asset classes, including special-purpose vehicles, structured instruments, or digital assets (if needed).

- Custom solutions can be integrated with any necessary software, including legacy tools, modern fintech services, and local data platforms. CLM’s access to task-critical data and tools removes semi-automated routines and enables straight-through onboarding for global clients, which is often constrained by gapped integrations.

- Tailored CLM software can provide an orchestration layer for fragmented CLM ecosystems spanning a patchwork of data platforms and task-specific tools, allowing investment firms to unify data models and digital workflows at scale.

- Proprietary systems can be built to support regulations relevant to the firm’s activities, including local frameworks (e.g., SEC and FINRA in the US, MiFID II in the EU, CMA in the KSA) and domain-specific directives (e.g., AIFMD for the EU alternative funds).

- Tailored CLM software gives the firm complete ownership over eligibility and risk scoring logic, automation rules, and data models, meaning you can tailor digital workflows by investor segment and add new features without waiting for vendor releases.

- Investment companies increasingly turn to proprietary tools to leverage tailored deal automation algorithms powered by artificial intelligence (AI). For example, you can deploy proprietary AI models for high-precision client risk scoring or incorporate custom agentic components for autonomous automation — something that vendor software can only offer through costly customization and access to sensitive data.

In most cases, you don’t need to go fully custom

As a consultant, I increasingly see investment clients, especially in the midsize range, go for custom layers on top of their existing CLM suites. This approach lets you close functional, integration, and orchestration gaps without investing millions in a fully custom CLM.

Building a CLM from scratch is justified only if you deal with something uniquely complex and specific, for example, need to upgrade a deeply rooted legacy tech stack, centralize data across heavily dispersed global operations, or automate CLM across FoF schemes or niche assets like SPVs and digital securities. Even in this case, a hybrid path, where you combine a ready-made CLM core with custom components for specific tasks, can often be more financially feasible.

ROI for Investment CLM Solutions

A recent study by Chartis Research and Fenergo found out that market-leading CLM software suites can bring investment and asset management firms up to 309% ROI over four years, with 195% ROI realized in the first year. Consultants at ScienceSoft estimate that tailored investment CLM systems can deliver, on average, 1.5x higher payoff.

The ROI is driven by the following major operational and financial benefits:

Sources: Deloitte, nCino, Fenergo, S&P Global.

Entities That Can Benefit From Tailored Investment CLM Software

Functionality of Client Lifecycle Management Software

Below, ScienceSoft’s consultants list the core building blocks that investment firms seek most often in their CLM solutions. We can implement any combo of them as a standalone system or build a custom module on top of your existing CLM suite:

CLM workflow setup

Operational and IT teams can configure multi-step digital workflows for client onboarding, suitability checks, account creation, servicing, and other CLM functions through a no-code interface. The software lets users set up tailored automation rules (including RPA), triggers, decision logic, and exception paths (by client segment, investment product, jurisdiction, etc.). A drag-and-drop modeling panel allows visually constructing, sequencing, and branching complex CLM processes, such as conditional KYC and hierarchical account opening for FoF entity structures.

Client onboarding

CLM solutions can capture investor data and documents from omnichannel self-registration forms and internal CRM records in batches or in real time. They can apply optical character recognition and image analysis to extract and structure onboarding-relevant details (ID, TIN/EIN, LEI, selected product(s), goals, risk tier, etc.). The software then validates the data for accuracy, flags gapped points for manual review, segments clean submissions according to predefined criteria (investor risk tolerance, expertise, objectives, etc.), and passes them for due diligence.

Due diligence and risk checks

Tailored CLM software automatically matches investor details against firm-specific qualification criteria (entity legal form, investor age, residency, tax status, etc.). It runs KYC/AML checks against global and local regulatory mandates and screens investors against OFAC, PEP, and adverse media databases. When onboarding data indicates complex ownership structures, the platform automatically enforces entity and ultimate beneficial owner (UBO) verification. For eligible clients, it immediately triggers account creation across connected portfolio and custody systems.

Document management

CLM solutions automatically generate investment policy statements, subscription and redemption packages, account agreements, KYC questionnaires, termination letters, and other service documents. They automate document tagging, timestamping, linking to CLM stages, metadata assignment, and version control. Users can design custom document templates and configure mandatory document sets by product type and investor segment. In addition, customized platforms can handle document localization, multi-party distribution, and e-signature workflows.

Client data and documents are stored in a centralized, secure repository. CML solutions normalize data formats, validate accuracy, and maintain golden copy records and audit-ready lineage for source and reference data. CLM teams can search investor records by tags, metadata, client identifiers, and workflow status and navigate them through customizable displays (by client, structure, period, etc.). Access permissions can be enforced at the profile, entity, region, document, and field levels and tailored to internal and counterparty user roles and firm-specific data governance models (data ownership, stewardship, survivorship, etc.).

Client profile maintenance

CLM solutions track expiry dates for client IDs, corporate registrations, Forms W-8/W-9, CRS declarations, and proofs of address. They notify operations teams when updates or renewals are required and can send personalized requests for up-to-date documents and information to investors. Customized systems can continually scan the connected external sources and collect evidence of non-declared changes, e.g., beneficial ownership updates or residency shifts. They can synchronize new client data across integrated systems to ensure consistent servicing.

Account activity monitoring

CLM solutions consolidate account and transactional data from the connected portfolio, trade, and custodian systems to provide a unified view of client activity and its compliance for CLM teams. They can automatically detect suitability drifts, concentration breaches, leverage leakage, liquidity constraints, and restricted-list contacts, and trigger risk responses, investor outreach, and disclosures. Interactive dashboards showcase the suitability of investment positions, orders, executions, subscriptions, and redemptions, with drill-down to investor-level intraday activity.

Perpetual risk reviews

Tailored CLM platforms continuously monitor client risk data, spot regulatory and internal risk signals (jurisdiction changes, abnormal transaction volumes, new adverse media findings, etc.), and compile exposure summaries with supporting sources for enhanced due diligence (EDD). They can automate KYC rechecks, EDD by risk tier, re-screening, and client risk re-scoring based on preset review schedules and detected events. Users can review risk summaries and initiate follow-up actions directly from flagged alerts within the client record.

Client offboarding

Upon a client exit request, relationship termination, or deceased client notification, CLM solutions initiate the investor offboarding process. They can reconcile accounts, settle fees, generate termination notices and final attestations, and distribute custodian and broker instructions. The software also revokes data sharing consents, locks client records for statutory retention, and deletes archival data in accordance with regulatory rules and the firm’s policies. Users receive closure approval notifications when financial and document checks pass.

Collaborative CLM

Built-in collaboration and communication tools let relationship managers, compliance officers, and investment operations specialists securely cooperate across the client lifecycle. Users can share and discuss client updates in thematic threads, assign role-specific workflow tasks, trace voice and video call records, and leave in-record comments with references to documents, checks, and decisions. Customized CLM platforms can incorporate email and messaging integrations to allow traceable, task-associated interaction with clients directly from the CLM interface.

Tailored solutions can monitor CLM workflow compliance against the investment firm’s code of conduct and jurisdiction-specific regulations, e.g., SEC and FINRA in the US, MiFID II and GDPR in the EU, CMA in the KSA. They automatically detect breaches across key compliance checkpoints (suitability validation, risk disclosures, periodic KYC reviews, etc.), record evidence, and initiate investigation and remediation procedures. The evidence audit trail can be aligned with SEC 17a-4, FINRA 4512, MiFID II recordkeeping rules, and other applicable regulatory standards.

Data and platform security

CLM data and the software are protected via role-based access control, multi-factor authentication, field-level data encryption and tokenization, and other security mechanisms. Customized platforms can be designed to meet enterprise security standards like SOC 2 Type II, ISO 27001, NIST 800-53, NIST CSF, and CIS. They can include privacy-by-design features (configurable data residency, consent logging, etc.) supporting GLBA, GDPR, and CCPA compliance and data-loss prevention safeguards that satisfy SEC’s mandates.

Here’s how you can add no-code capabilities for cheap

A low-code/no-code CLM core is a natural fit for investment firms, who need frequent digital workflow adapting to new products, geographies, and regulatory rules. If you want to extend your current CLM with a no-code process builder, consider reusing the baseline from enterprise automation platforms like Microsoft Power Platform or Pega. Such platforms have go-to no-code configuration engines and dedicated user interfaces in their stack, meaning you don’t need to build anything like a bank-grade BPM system from scratch. From my experience, the platform path comes up to 70% cheaper compared to from-scratch development.

How AI Can Reinforce Investment Client Lifecycle Management

Investment companies are increasingly deploying artificial intelligence in their service operations, with 93% of private equity firms anticipating moderate to substantial benefits from AI launch. According to McKinsey, AI-powered automation of client onboarding, KYC, and risk operations alone can cut investment firms’ total operating costs by a total of 14%, which is equivalent to million-dollar savings for a midsize entity.

ScienceSoft suggests extending your CLM software with the following AI features for comparable gains:

LLM-supported client risk research

CLM solutions can incorporate large language models (LLMs) to automate the collection of client risk data from filings, corporate registries, court records, sanctions lists, PEP databases, and other credible sources. LLMs identify risk signals, extract related data points, and compile due diligence summaries and investigation reports. They can provide citations, ownership charts, related-party links, and timeline views and flag gaps that require human review. Users then check summaries inline, accept or reject findings, and publish verified insights to the client record.

AI-powered predictive risk analytics

Tailored machine learning (ML) models can be applied to analyze client behaviors, portfolio movements, and transactional trends and forecast potential risks. ML algorithms can correlate historical client activity with market and geopolitical data and spot early indicators of heightened risk exposure, such as potential sanctions or suspicious ownership transfers. Advanced ML-supported systems can project the likelihood of EDD and proactively propose risk minimization steps, e.g., earlier re-screening or requests for specific eligibility documents.

Agentic CLM automation

Customized platforms can employ AI agents to orchestrate and automate end-to-end CLM operations. Smart agents can reason on the necessary steps and execute them sequentially based on predefined scripts tailored to the firm’s servicing policies, e.g., opening a due diligence case, cross-referencing KYC data across sources, scheduling follow-ups, assembling approval packs, and updating account records. Voice and chat AI agents can engage with clients directly to confirm identity data and request missing details. Supervisors can set tailored guardrails and approval limits so agents never act autonomously on sensitive cases.

Intelligent CLM optimization

AI-powered engines can analyze CLM workflow metrics (onboarding and review cycle times, risk false-positive rates, investigation outcomes, etc.), identify inefficiencies, and map pragmatic optimization steps. For example, an AI-powered system can propose rule tuning for screening thresholds, jurisdiction-specific checklist adjustments, KYC refreshes by risk cohort, question updates for onboarding packs, and approval path refinements for complex investment structures. One-click approval lets users quickly apply feasible suggestions to digital workflows.

3 things we do to deploy LLMs and agentic AI in CLM safely

- Make sure AI can access your business data — securely. Without access to accurate, timely data, AI can’t provide output grounded in your firm’s reality. Use zero-trust architectures, data encryption, and secure RAG paths to ensure AI accesses only what it needs, when it needs it.

- Make sure you understand the AI’s logic. Transparency in how AI arrives at conclusions is a must to build trust in intelligent CLM decisions and prove their compliance. Use explainable AI frameworks (e.g., LIME, SHAP), interpretability dashboards, and audit trails to trace model reasoning and outputs.

- Make sure humans are the ultimate decision-makers. Ethical, regulatory, and reputational accountability must always remain with people, not algorithms. Embed rule-based guardrails, human-in-the-loop oversight, and approval checkpoints in every AI-driven process.

Important Integrations for a Client Lifecycle Management System

- Client interaction channels (e.g., the investment firm’s website, investor portal, and communication systems (email, chat, phone); third-party distribution networks and investment platforms) – for fast client onboarding, service request processing, workflow-related communication, and document sharing.

- Investment CRM – to maintain a single source of truth for client relations, sync updates across teams, and inform the firm’s investor interaction and marketing strategies.

- Client risk data sources (e.g., ID, registered entity, AML/KYC, sanctions, and adverse media databases of local regulators and authorized providers) – to automate client risk and compliance checks according to the current regulatory requirements.

- Portfolio management software – to initiate portfolio activities from the CLM and provide CLM teams and clients with up-to-date portfolio performance details.

- Transaction facilitators’ systems (e.g., custodian, brokerage, trustee, escrow, transfer agents’ systems) – to speed up client account creation across facilitator platforms, track and reconcile transaction progress and positions.

- Accounting software – for consistent recordkeeping and fast reconciliation between client lifecycle events and the firm’s financial records.

How to Customize Your Investment CLM Solution

There are two main approaches to building customized investor lifecycle software, each having its benefits and limitations. Below, ScienceSoft provides a high-level comparison of the two.

|

|

Platform-based development |

Engineering from scratch |

|---|---|---|

|

Best for

|

Investment firms that already have a CLM foundation (a specialized or enterprise suite) and only need small-scale, tailored automation modules or an orchestration layer for scattered workflows. |

Companies with large-scale or unique CLM operations that require highly specific automation features, need unified CLM workflows across multiple jurisdictions, or are transitioning from legacy, home-grown CLM suites. |

|

Pros

|

|

|

|

Cons

|

|

High upfront costs and longer development. |

|

Tech stack we use

|

|

A vendor-agnostic toolkit composed with an investment firm’s business priorities in mind. |

Best Practices for Custom CLM Software Development

Below, ScienceSoft’s consultants share best practices for creating reliable client lifecycle management software for investment firms while reducing development costs and timelines. These apply regardless of your chosen development approach.

UX and UI should be designed around distinct CLM user roles

Discovering role-specific UX preferences at early project stages and tailoring user journeys, layouts, and data density for each persona fosters the speed and accuracy of CLM workflows. For example, onboarding analysts value clean drill-down views of client document packs, compliance experts prefer laconic screens with clear risk signals, and relationship specialists benefit from well-structured communication dashboards. By applying adaptable layouts (context-aware interfaces, configurable modal windows, customizable workspaces, etc.), you can address the needs of diverse CLM teams within a single platform without inflating design efforts.

Manual checks, test automation, and UAT ensure holistic QA

ScienceSoft’s QA engineers recommend applying automation in performance, integration, and regression tests for efficient continuous checks. Replicating live integrations with internal and external systems in a QA environment helps verify how system connectivity and data syncing go in realistic conditions. Manual QA is a must for validating the accuracy of complex CLM logic, e.g., conditional KYC escalation rules and branching workflows for multi-jurisdiction client structures. User acceptance testing (UAT) is valuable before launch to confirm that the final CLM solution meets the investment firm’s current business and regulatory needs.

Explore our dedicated pages for niche QA best practices: picking workable software quality metrics, steps to organize efficient security testing, and ways to ensure the compliance of regulated financial tools like investment CLM.

Well-planned data migration prevents rollbacks and disruptions

The process should begin during CLM solution design by defining data ownership, mapping data structures between legacy and new systems, and establishing cleansing and validation rules for transitioned data. Engineers at ScienceSoft organize migration into phases (data extraction, transformation, validation, and reconciliation) and implement automated quality check scripts and rollback checkpoints at each step. This approach speeds up data movement and lets teams fix any arising issues without massive rollbacks. Migrating data during low-activity time windows (ideally during non-reporting periods and outside advisory hours) minimizes the risk of operational and client service disruptions.

Costs of Investment Client Lifecycle Management Solutions

Building investment client lifecycle management software may cost from $100,000 to $1,000,000+, depending on the solution’s functional scope, the number and complexity of integrations, non-functional (performance, scalability, security, compliance) requirements, and the chosen development approach.

Sample cost ranges

Here are ScienceSoft’s estimates for CLM solutions commonly requested by our investment clients:

$100,000–$400,000

A CLM data consolidation layer that aggregates data in batches from 3–15 sources (CRM, portfolio management, KYC databases, client interaction tools, etc.). It automatically processes structured and semi-structured data, maps all data into a unified format, and prepares it for analytics and data-driven automation. The solution comprises a data warehouse and can include basic BI capabilities.

$150,000–$400,000+

A custom module built on top of an existing CLM/CRM product suite. The solution automates 2–3 CLM workflows (e.g., KYC, dynamic risk scoring, periodic compliance reviews) using rule-based engines, with possible extensions to advanced analytics and AI assists. It includes a no-code rule builder for non-IT teams, brought via a platform setup (e.g., Microsoft Power Platform, Dynamics 365).

$400,000–$1,000,000+

A full-scale CLM system engineered for the investment firm’s unique processes. It automates client onboarding, compliance, and risk operations using pre-built, low-code workflows, custom rules, and, if needed, tailored AI components. The solution supports the necessary asset classes, entity structures, jurisdictions, and integrations with corporate and external systems.

Wondering how much your CLM software project will cost?

Use our online calculator to describe your needs, and we'll get back to you shortly with a tailored estimate. It’s free and non-binding.

Why Develop Investment CLM Software With ScienceSoft

- Since 2005 in engineering tailored solutions for investment and wealth management.

- ScienceSoft’s client portfolio includes one of the top 3 global asset managers with $5T+ in AUM.

- Investment IT and compliance (SEC, FINRA, GLBA, SOC, etc.) consultants with 5–20 years of experience.

- 45+ certified project managers (PMP, PSM I, PSPO I, ICP-APM) with experience in large-scale projects for Fortune 500 companies.

- Principal architects with hands-on experience in designing complex investment systems and driving secure implementation of advanced technologies.

- 350+ software engineers, 50% of whom are seniors or leads.